The Chainsaw Weekly wrap covers more madness from the FTX collapse among other craziness. Yes, another eventful week has passed in the world of crypto and Web3. Here’s everything that happened in Web3 over the last seven days, condensed into an easily digestible wrap up for your reading pleasure in this edition of The Chainsaw Weekly Wrap.

The Chainsaw Weekly Wrap: This week in Web3

This week started off with a wave of excitement, as crypto asset prices surged. While investors celebrated the double digit surge in prices of cryptocurrencies across the market, some of crypto’s most notorious actors, Zhu Su and Kyle Davies, took advantage of the temporary euphoria to announce the launch of a new exchange called ‘GTX’.

According to a leaked pitch deck that did the rounds on Twitter, GTX was named in a humorous jab at collapsed exchange FTX, with ‘G’ being the next letter in the alphabet after ‘F’. After some vicious backlash, the disgraced founders and their equally questionable new partner CoinFLEX clarified that the name was simply a placeholder until a better option appeared.

Bitzlato? What the f*ck is Bitzlato?

The crypto community was left open-mouthed after the US Department of Justice teased a “major international cryptocurrency action”.

Investors whipped themselves into frenzy fearing that another FTX-like collapse was imminent and the price of both Bitcoin (BTC) and Ethereum (ETH) plunged more than 5% in the following hours.

However, in a wildly disappointing revelation, the Justice Department announced that this “major action” was actually just taking down a tiny Hong Kong-based crypto exchange called #Bitzlato, which had never held more than $6 million on its books.

Hilarity and memes ensued, as the crypto community struggled to come to grips with what is arguably once of the most underwhelming announcements from the Justice Department ever.

Twitter adds to its ‘Cashtags’ feature & SHIB teases new network

Twitter first launched the ‘$Cashtags’ feature — which allows Twitter users to see detailed price information on stocks and cryptocurrencies — on December 22 last year.

Recently however, the social media platform has quietly added more than 30 new cryptocurrencies to the feature, with ‘Cashtags’ now available for crypto assets including Dogecoin (DOGE), Solana (SOL) Cardano (ADA) and Avalanche (AVAX).

Still, the new, quietly-released additions to the ‘Cashtag’ feature was overshadowed by the news of Twitter’s revenue falling more than 35% from this time last year, as the social media platform’s new owner Elon Musk, struggles to keep advertisers paying for partnerships. This might have something to do with his erratic tweeting, which have seen him direct attacks at advertisers themselves, but hey, who knows right?

Despite the news, a number of the more notable crypto communities on Twitter were overjoyed with the new ‘Cashtag’ additions, particularly the outspoken fans of popular meme token Dogecoin.

While we’re on the subject of dog-themed tokens, the developers behind the wildly popular Shiba Inu (SHIB) token teased the launch of a new upgrade called ‘Shibarium’.

According to the announcement posted to Shiba Inu’s official blog, the Shibarium network, which is marketed as an entirely new Layer-2 network built on Ethereum will reduce costs, and speed up transactions on the SHIB blockchain.

Metaverse tokens pumped on Apple news

The metaverse craze — which overtook the crypto space for much of last year — has been temporarily reignited in the wake of news that the tech colossus Apple would be releasing a new headset that combines Augmented Reality (AR) and VR technology.

While almost every cryptocurrency has been enjoying some much-needed green over the first few weeks of the new year, the Apple news seemed to have to sparked a renewed interest in the metaverse from crypto investors. MANA, the native token of Decentraland, along with SAND, the token used by players in the Sandbox, both surged, growing 75% and 40% respectively.

It ain’t just crypto, Big Tech scales back

While the crypto industry has undeniably been suffering from a case of the “massive layoffs” in recent weeks — with Coinbase, Crypto.com & Swyftx all engaging in some good old-fashioned firing — it seems as though the broader financial crunch across traditional markets has affected the land of tech as well.

This week, Microsoft CEO Satya Nadella announced that the tech giant would be scaling back its workforce by 10,000 employees by the third quarter of this year. Nadella, who was appointed as only Microsoft’s third CEO in its history in February 2014, outlined that the reduction — which accounts for approximately 5% of their global workforce — would be conducted in a “thoughtful and transparent” manner.

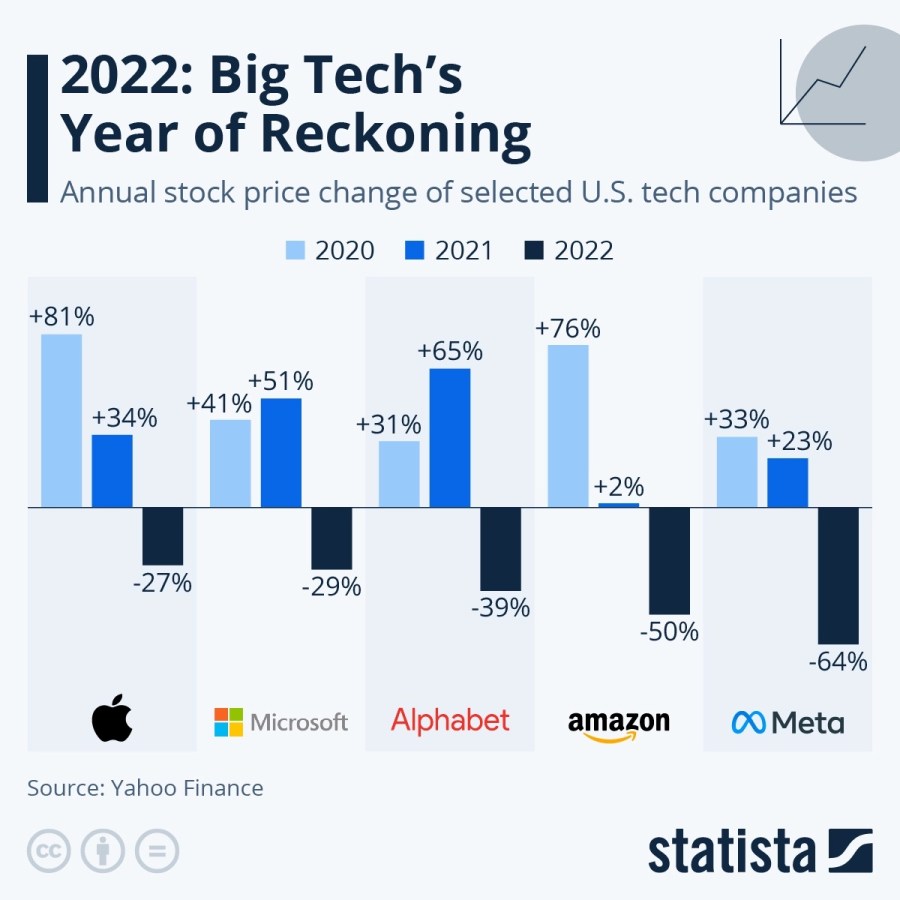

Still, Big Tech remains ‘down bad’ with the share prices of Apple, Microsoft, Google, Amazon and Meta all slumping considerably over the course of last year.

FTX: all the latest

The drama surrounding FTX and its founders have dominated headlines ever since the crypto exchange collapsed in November last year. This week was no different. On Wednesday, CoinDesk dropped a bombshell revelation that more than 1 in 3 members of US Congress as received some form of political donation from the FTX’s former CEO Sam Bankman-Fried or other senior executives at the exchange.

This means that a total of 196 members of the US Congress across both the House of Representative and the Senate are carrying some form of financial baggage related to the exchange.

The most noteworthy recipients of FTX cash include the new Speaker of the House, Kevin McCarthy (R-CA) and Senate Majority Leader Chuck Schumer (D-NY), as well as congresswoman Nancy Pelosi (D-CA), Senator Mitt Romney (R-UT), Marco Rubio (R-FL) and Joe Manchin (D-WV).

Just when you thought that things would finally start winding down, it turns out that FTX’s new CEO, John Ray III — the man in charge of cleaning up the whole mess — said in a report this morning that fully restarting the exchange might be a good way to get funds back in the hands of the one million investors who still have their assets stuck on the platform.

The Chainsaw Weekly Wrap: This week’s funding & venture capital roundup

It seemed as though venture capital interest in crypto had all but dried up a few short weeks ago, but the lest seven days have seen a renewed interest from investors.

Here’s all of the latest funding news for Web3:

- Hong Kong-based Hashkey Capital raised US$500 million aimed at crypto and blockchain development.

- US-based capital market advisory firm Deal Box launched a US$125 million Web3 venture fund aimed at supporting blockchain and Web3 startups.

- Latin American Web3 infrastructure provider Parfin raised US$15 million in a seed investment round.

- The =nil; Foundation raised US$22 million to build a ‘proof-based’ marketplace.

- Another ZK proof-focused startup Ulvetanna raised US$15 million in a seed round.

- Obol Labs raised US $12.5 million in a Series A round.

- Metahood raised US$3 million to build a metaverse-based real estate portal.

- Sleepagotchi raised US$3.5 million to reward people for sleeping.

Crypto markets took a breather after a two-week-long run

The hype from cooling inflation data and a more relaxed approach to interest rate hikes from the US Federal Reserve calmed down this week, with the price of major crypto assets levelling out. For the first two weeks of this year, a renewed wave of capital surged into crypto investments, with Bitcoin (BTC) and Ethereum (ETH) and a number of other digital assets witnessing their most prolonged rally since February last year.

On Monday however, things chilled out, and the price of Bitcoin has hovered consistently around the US$21,000 mark ever since. At the time of writing Bitcoin is changing hands for US$20,989 dollars, as the market takes a breather after its two-week-long run.

The Chainsaw Weekly Wrap: Winners and losers

The biggest gainer of this week was the native token of the fractional-algorithmic stablecoin protocol known as Frax Protcol. The FRAX token grew a touch over 54% for the week, rocketing from a price US$6.40 to US$10.10 over the last seven days. Other notable gainers were Decentraland’s MANA token which grew 38% and one of the tokens from the early days of crypto Enjin Coin (ENJ) which posted a gain of 34% for the week.

In good news, there were very few losses over the course of the last seven days, with the biggest loser of the week being the native token of Binance’s self-custday app Trust Wallet. The TWT token only fell 3.26% for the week as the craze around self custody, brought on by the collapse of FTX dwindles.

Following TWT into second place, was the native token of the crypto exchange Huobi, which goes by the two-letter ticker ‘HT’. HT fell a mere 2.98% over the course of this week.

And that’s it for this edition of The Chainsaw Weekly Wrap.

As always, here’s this week’s hottest memes.