Su Zhu and Kyle Davies, the founders of Three Arrow Capital (3AC) — a once 10-billion-dollar hedge fund that collapsed spectacularly in March last year — are currently looking to raise US$25 million for a new crypto exchange called ‘GTX’.

The disgraced founders are teaming up with Mark Lamb and Sudhu Arumugam, the co-founders of cryptocurrency exchange CoinFLEX.

It’s worth noting that the CoinFLEX halted withdrawals from its exchange in June last year, but began processing ‘limited withdrawals’ in July. At the time of writing, CoinFLEX is currently in the process of being restructured.

Even though the Zhu and Davies are currently being hunted by Interpol and numerous other authorities from around the world, they seem entirely unencumbered by the wave of criminal allegations levied against them.

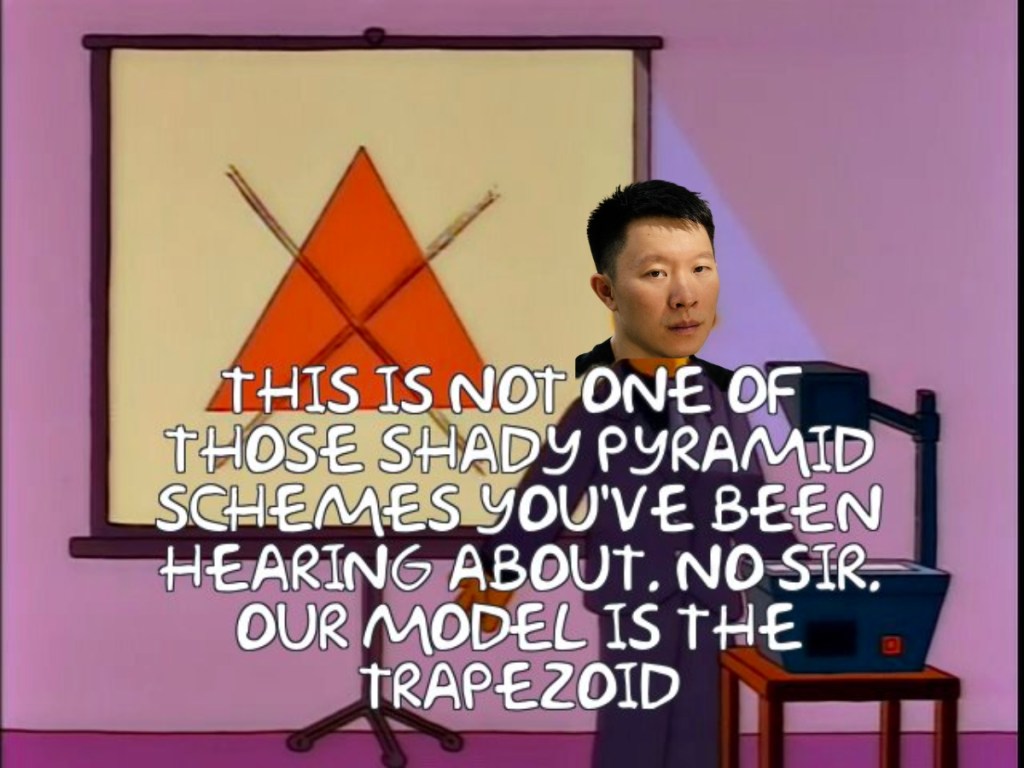

GTX: The crypto might be ridiculous

In revelation that can only be described as ‘absolutely ridiculous’, the new GTX exchange will apparently specialise in trading crypto bankruptcy claims, something that the team from Three Arrows Capital have plenty of experience in avoiding.

“FTX users are selling claims at ~10% face value for immediate liquidity or waiting 10+ years for the bankruptcy to process disbursements,” the leaked pitch deck claims.

Our legal team will streamline and automate claims onboarding to GTX and make it the dominant marketplace for FTX and other bankrupt companies’ claims.

GTX pitch deck

After taking a look at a pitch deck from the founders that was surfaced by Chinese crypto journalist Wu Blockchain, it turns out that the name ‘GTX’ stems from a not-so-humorous play on words. The pitch decks confirms that “G comes after F,” a clear nod to the failed crypto exchange FTX.

However, in response to wide-spread criticism of its new name across social media, the crypto investment firm CoinFLEX has attempted to clarify its plans to build a new crypto exchange with Three Arrows Capital (3AC).

In a blog post, CoinFLEX said it won’t be using the name ‘GTX’ which was outlined in the leaked pitch decks, claiming that it only serves as a placeholder title for the time being.

A brief history of Su Zhu, Kyle Davis and Three Arrows Capital

In case your new to this whole crypto thing, Su Zhu and Kyle Davies are some of the most notorious figures in the world of cryptocurrency.

The pair have refused to cooperate with ongoing requests from investigators and currently owe their former investors a staggering sum of US$3 billion. The pair landed themselves in hot water following the collapse of their hedge fund Three Arrows Capital in May last year.

It was later revealed that 3AC made enormous, risky bets on the potential success of Do Kwon’s Terra Money ecosystem, which was comprised of the algorithmic stablecoin UST, and its sister token LUNA, both of which have now collapsed in heap.

Not only did the duo burn through billions of borrowed money, but afterwards they went on the run, fleeing Singapore, the country their hedge fund was headquartered in. To this day their whereabouts remain completely unknown to authorities, and as such, Teneo, the liquidation firm handling the 3AC case was forced to serve them with subpoenas via Twitter.

Zhu and Davies also used their temporary earnings to purchase a 52-metre-long superyacht they named the ‘Much Wow’, a not-so-subtle nod to the meme token Dogecoin (DOGE).

The stunning implosion of 3AC has been described by commentators as the most rapid loss of ten billion dollars in human history.

A GTX exchange? I think not.