Remember the NFT mania that took the world by storm during lockdown in 2021? That one Late Night episode where Paris Hilton and Jimmy Fallon less-than-enthusiastically fawned over their Bored Ape Yacht Club NFT?

It all seems like a fever dream now, and FTX’s stunning collapse in November last year certainly didn’t help the market. A report by crypto betting platform dappGambl found that 95% of people who hold an NFT are now “holding on to worthless investments”.

dappGambl analysed 73,257 NFT collections, and identified the key trends, and the health and success of the projects. It found that of the 73,257 NFT collections, “an eye-watering 69,795 of them had a market cap of zero ETH”.

In other words, 95% of them – or an estimated 23 million NFTs – were judged as being worthless. Which leaves only 5% of NFTs as being worth … something. We don’t know exactly how much, though.

“This daunting reality should serve as a sobering check on the euphoria that has often surrounded the NFT space. Amid stories of digital art pieces selling for millions and overnight success stories, it is easy to overlook the fact that the market is fraught with potential losses,” wrote dappGambl.

Are NFTs dead?

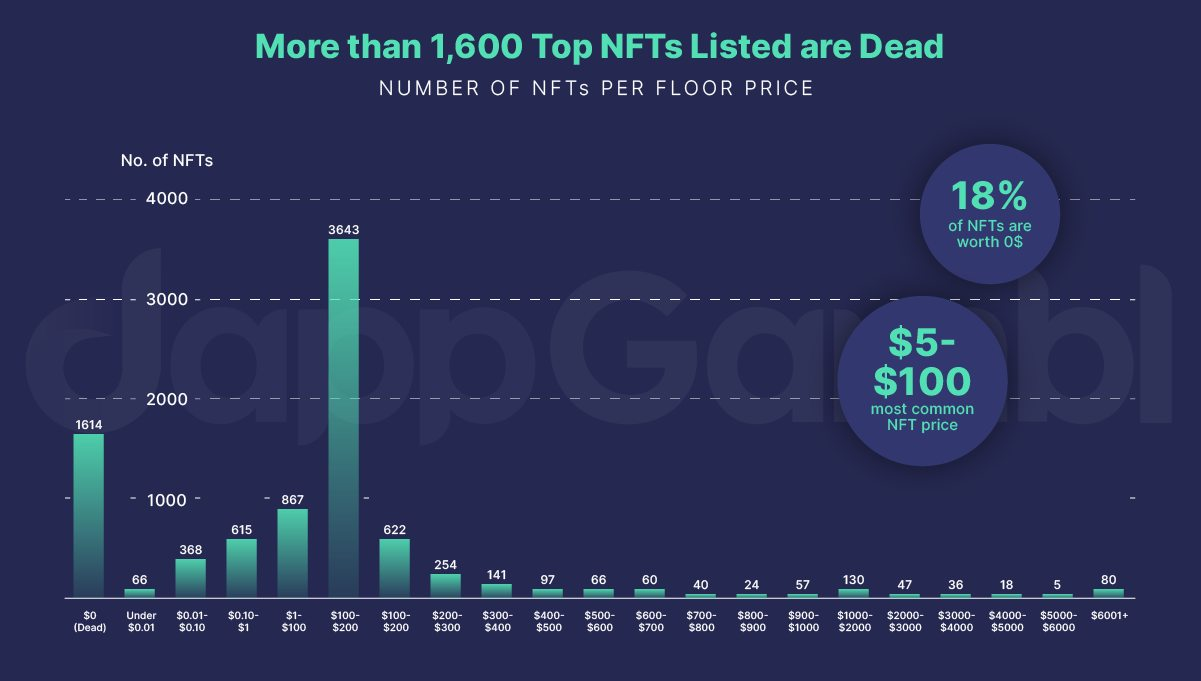

The report zoomed in on the top 8,850 NFT collections to assess the current state of NFTs. Of the total supposedly white-hot NFT collections, they found that 1,614 of them, or 18%, are “dead”, with a floor price of US$0 (AU$0, duh).

In the NFT market, a collection’s “floor price” refers to the cheapest price of one single NFT in a particular collection. The floor price is often viewed as an indicator of a collection’s overall health and success – the higher the floor price, the more successful it is.

For example, the poster child of the NFT world, the Bored Ape Yacht Club, has a floor price of 26 ETH, equivalent to US$42,180 (AU$65,500) at the time of writing. This means that the cheapest monkey JPEG you can get costs that much – that’s several luxury designer bags.

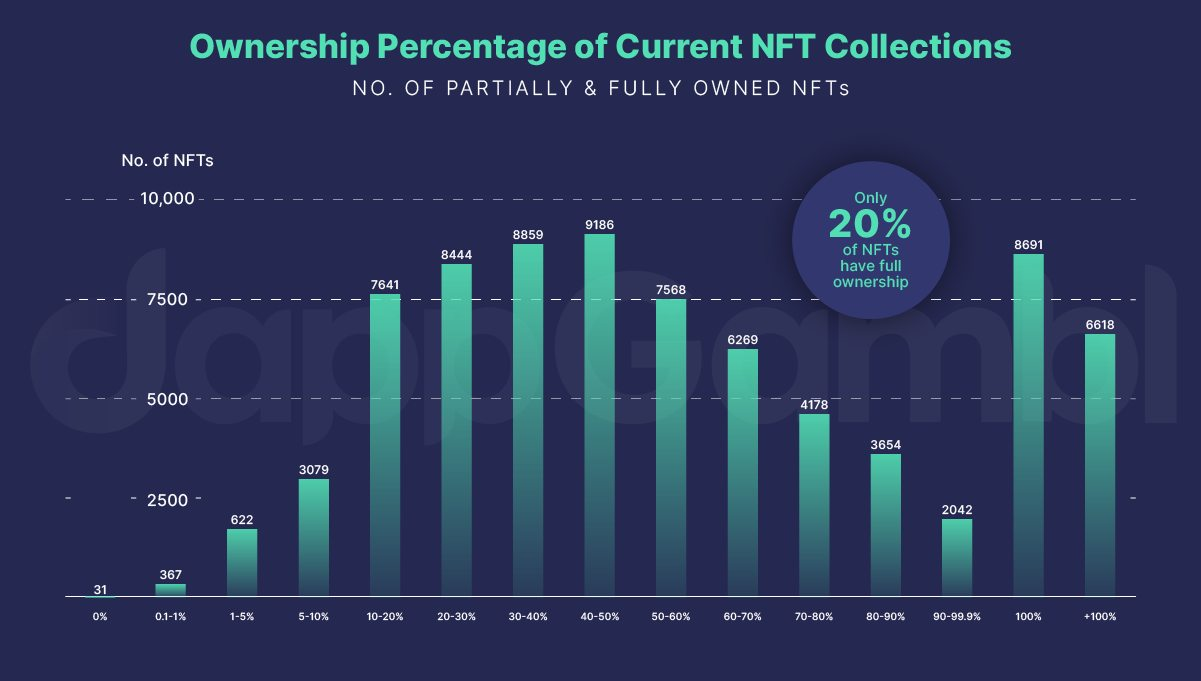

In dappGambl’s report, it was also found that 867, or 41% of NFT collections of the 8,850 total have a modest price tag of US$5 (AU$7.80) to US$100 (AU$155). Only 80 of the 8,850 NFT collections have a floor price of over US$6,000 (AU$9,320) – that’s less than one percent of the total.

These depressing numbers are a far cry from the hundreds of millions of dollars in NFT sales in 2021-22. “These statistics not only underline the disparity within the top echelons of the NFT world but also serve as a stark reminder that, despite all the glitter and allure, genuine value in this market can be elusive,” said dappGambl.

The number could be higher

The report suggests that due to the possibility that many NFT collections do not present a viable real-life use case, “the situation may even be bleaker than these numbers suggest”.

At this point, blockchain technology that powers NFTs is the only feature that the NFT market can rely on to prove that they are able to serve real-life utility. NFTs that represent ownership of a real-life asset that’s been collateralised is one example of a potential use case for NFTs.

dappGambl said: “It becomes clear that a significant portion of the NFT market is characterised by speculative and hopeful pricing strategies that are far removed from the actual trading history of these assets.

“The key question arises: How many of these NFTs lacked a genuine use case and are now redundant? Without utility, they may be considered ‘dead’.”