Okay, so you’ve done your research and you’ve decided that Ethereum is going to play a role in the future. Now that you want a piece of the network, how do you actually go about buying it? For the digitally native, buying Ethereum is actually pretty simple. But just in case this is your first exploration into the world of digital assets, in this step-by-step guide, we’ll walk you through exactly how to buy Ethereum.

What Is Ethereum?

First, let’s understand what we’re talking about. What is Ethereum?

With a total market capitalisation of US$181 million, Ethereum is the second largest cryptocurrency in the world. It was launched in 2015 and according to its website:

“Ethereum is a technology for building apps and organisations, holding assets, transacting and communicating without being controlled by a central authority. There is no need to hand over all your personal details to use Ethereum – you keep control of your own data and what is being shared. Ethereum has its own cryptocurrency, Ether, which is used to pay for certain activities on the Ethereum network.”

Ethereum’s key value proposition is that it is programmable, allowing developers to build and deploy decentralised applications on the network. As the Ethereum Foundation notes on their website, “Ethereum being programmable means that you can build apps that use the blockchain to store data or control what your app can do. This results in a general purpose blockchain that can be programmed to do anything”.

Consensys describes Ethereum as “the World Computer” since it is a “decentralised, open source, and distributed computing platform that enables the creation of smart contracts and decentralised applications (‘DApps)”.

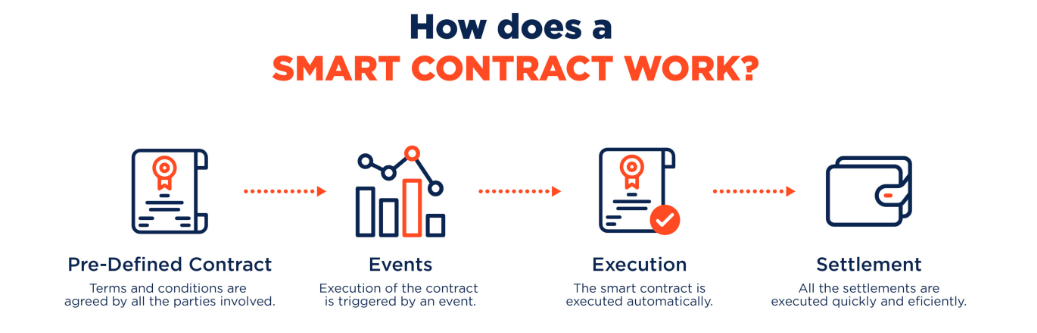

As a refresher, smart contracts are computer protocols that facilitate, verify, or enforce the negotiation and performance of some sort of agreement. They operate based upon an if, then logic, so that if x action happens, then y action occurs.

Bottomline is that Ethereum is fundamentally different from Bitcoin, as the Ethereum Foundation itself suggests. It says that Bitcoin is only a payment network but Ethereum is more like a “marketplace of financial services, games, social networks and other apps that respect your privacy and cannot censor you”.

What is Ethereum worth?

Much like any other cryptocurrency, Ethereum trades 24/7 across hundreds of crypto exchanges around the world. The price therefore fluctuates based on market conditions, which lately have been challenging to say the least.

At the time of writing, the current price for Ethereum is US$1,490, well over 70% down from its all-time high of just under US$5,000 apiece.

When buying Ethereum, it’s of course advisable to bear in mind that the price volatility is such that it could easily be significantly more or less valuable within days, or even hours, of purchase.

At the end of the day, Ethereum is worth what the market is prepared to pay. It’s much lower than it once was, but today, Ethereum’s total network value is around US$180 million and 1 ETH will set you back just under US$1,500.

How to buy Ethereum

The steps to buying Ethereum are the same for most other cryptocurrencies, except those that trade only on decentralised exchanges, as opposed to centralised regulated ones such as Binance, Coinbase, Coinspot, Swyftx (in Australia) and FTX (before it went belly-up).

Choose a cryptocurrency exchange to buy Ethereum

The first step towards buying Ethereum is to select a cryptocurrency exchange. In recent years, plenty have come and gone, while others have stood the test of time. Finding a credible exchange that provides all necessary services while also maintaining a high level of security requires careful research.

However it is well worth the time spent as one’s selection might be the difference between keeping your digital assets safe or losing them forever. Google is your friend. What are you looking for? Trust.

Factors

These are some of the most important factors to consider in determining the credibility (and by extension, the security) of an exchange:

- The information regarding the exchange’s security practices is easy to find, clear and comprehensive.

- It has a large number of good reviews on reputable review platforms spanning several years.

- The exchange has a valid HTTPS certificate in the URL address bar (a little lock image).

- It has a legitimate business address and the company is easy to contact.

- It conducts security audits (for example a SOC 2 compliance certificate).

- It prompts best practices when setting up an account – a strong password, 2FA, whitelist withdrawal addresses or whitelist IP address (nice to have).

- It utilises cold storage for the majority of funds.

- It provides a live attestation of reserves.

- It has insurance for user funds.

- It does not have any of the following:

- Questionably high yields for simply depositing;

- Promises of wealth or high returns;

- Poorly laid out website interface; or

- Agents who contact you to sell a trading program or provide investment advice.

If you find an exchange that ticks most of the boxes chances are it is reputable and secure. The more research you do, the better. Read reviews, speak to people in the industry and to stress the point, there isn’t such a thing as too much research.

Fund your account

Once you’ve decided which crypto exchange you want to buy your Ethereum from, the next step is to fund your account.

What that means in practice is that you need to deposit fiat currency — your local national currency — with the cryptocurrency exchange. Depending on the crypto exchange, you may be able to do so through a bank deposit, debit or credit card transaction, or even in some cases, through services such as PayPal.

Check with your crypto exchange how you can fund your account as each option tends to have different costs.

From there, the exchange will credit your account balance, which in turn will be used to buy Ethereum.

Place an order for Ethereum

Now that you have funded your account, it is now time to buy Ethereum.

For the purposes of this explanation, we’ll deliberately keep things simple and assume you are only interested in buying the market price, namely the current spot price for Ethereum.

There are other more complex ways to buy Ethereum — such as market orders where you place a bid at a specific price — but for beginners, it’s best to keep things simple and just hit ‘buy ETH’.

In the background, the crypto exchange is matching buyers and sellers of Ethereum and within a few moments of placing your bid to buy Ethereum, funds will be deducted from your currency account and you will be credited with the equivalent value in Ethereum.

Store your Ethereum

The next step to buying Ethereum is deciding how you wish to store it. There are essentially two main approaches you can take, each of which has its own pros and cons.

You are either going to custody the Ethereum yourself or you are going to trust a third party to do so on your behalf. Let’s start with the approach that many people take, storing their Ethereum on a crypto exchange, like a bank.

Before we do, it’s important to remember the philosophy that underlies cryptocurrency: “not your keys, not your coins”. This is another way of saying that if you don’t custody your own Ethereum, you don’t actually own it. Instead, it is an IOU for ETH.

The simplest and most convenient way to store your Ethereum is on a crypto exchange. You buy Ethereum and then you just leave it there. The risk is that if the exchange gets hacked or goes insolvent, chances are that your coins will disappear in the process. The advantage of course however is that it is very user-friendly and convenient. Check out our useful guide on the risks of leaving your crypto on an exchange.

If you only had a relatively small amount of cryptocurrency relative to your net worth, leaving your crypto on an exchange may be, on balance, the appropriate thing to do. Only you get to decide that though.

The other option for storing your Ethereum is self-custody – looking after your own ETH and ‘becoming your own bank’. Within that category, you get more secure options than others. Mobile crypto wallets (Exodus, Coinbase etc) and web browser extensions (MetaMask) are connected to the internet and do run the risk of being hacked.

Cold Wallets

By contrast, so-called ‘cold wallets’ (such as Ledger) are not tied to the internet and are inherently more secure. This in itself comes with the main risk that if you lose access to your private keys, you can lose access to your cryptocurrency.

The more secure the storage, the more complex it is likely to be. Only you know what is best given your experience, knowledge and risk appetite. There’s no perfect solution, and in the end, there are no solutions, only trade-offs.

How to sell Ethereum

Selling Ethereum is the inverse to buying Ethereum and can be done through your crypto exchange of choice. Once again, we’ll keep things simple and assume you are only interested in selling at a market price — not something fancy like a stop order which sells when you hit a specific price, something best left to traders.

Whereas buying Ethereum requires you to deposit fiat currency onto an exchange, selling Ethereum requires you to deposit the Ethereum on the exchange so that it is credited to your account.

This of course assumes you have withdrawn the ETH into your own self-custody. In that case, you will need to identify your ETH wallet address at the crypto exchange and transfer it to that specific address.

If however you have left your ETH on the exchange and now want to sell, the process is even simpler. Head over to the asset section of your dashboard and depending on the specific exchange, you’ll click the ‘sell ETH’ button after deciding how much to sell.

Once you have clicked on the ‘sell ETH’ (or a variation thereof) button, the exchange will match you with a buyer and within moments, your ETH balance will reduce and your fiat currency balance will increase by the value of the ETH sold, less fees.

Should you invest in Ethereum?

We don’t give financial advice, so we’re not in a position to say whether Ethereum is a good investment or not. Only you can decide that based on your knowledge, experience and personal circumstances.

People invest in different assets for different reasons, but as a general rule, it’s rarely advisable to invest significant amounts into something you don’t understand.

Pros to buying Ethereum

There is no exhaustive list of the benefits to investing in Ethereum. As highlighted above, everyone is different, but these are the main reasons you may wish to consider investing in Ethereum:

- It could be a world computer — take things like homes, artwork and luxury cars, Ethereum’s smart contracts can secure and democratise ownership of these items.

- It offers tokenisation — it’s been estimated that over 10% of GDP will eventually transact on blockchains, and the vast majority of it will likely be on Ethereum.

- It can run uncensorable applications —we’ve seen in the last few years that censorship is a real issue and Ethereum offers the ability for the creation of decentralised applications (DApps).

- It offers diversification — if Bitcoin is a bet on a digital asset being a store of value, Ethereum is the ‘smart contract play’ that offers exposure to the world of DApps, tokenisation, smart contracts and more.

Cons to buying Ethereum

Once again, there is no definite list of cons as it ultimately is determined by personal circumstances, preferences and appetite for risk. Anyway, here are some of the cons you may want to know about:

- Volatility – this is hardly news to most people as Ethereum has a much higher rate of volatility than other asset classes such as shares, real estate or bonds. Volatility works both ways — both up and down – and for many people, that is too stressful and doesn’t match their risk appetite. If you’ve got a low risk tolerance you may want to consider whether Ethereum makes sense for you.

- Complexity – Linked to the first issue, if you don’t understand Ethereum then chances are that downside volatility is going to shake you from your position and make you want to sell. If you’re not keen to invest the time to understand Ethereum, perhaps reconsider whether it makes sense to invest.

- Security – Ethereum has experienced security breaches in the past and smart contracts are routinely exploited. Interacting with the related decentralised finance ecosystem has its own set of risks that are tied to Ethereum.

- Competition — Ethereum has a number of other protocols that are working hard to take away market share by being faster, better and stronger. This includes protocols such as Solana and Tron, which have attracted a fair bit of attention in the NFT and stablecoin markets respectively.

As stressed from the outset, everyone is different and there’s no ‘right answer’. You’ve got to decide what is ultimately best for you given your knowledge, experience, conviction and personal circumstances.