It’s been said that a day in crypto is like a month in any other space. And it’s hard to argue with that, particularly in light of all that has happened over the past month or so. Enter this edition of The Chainsaw Weekly Wrap.

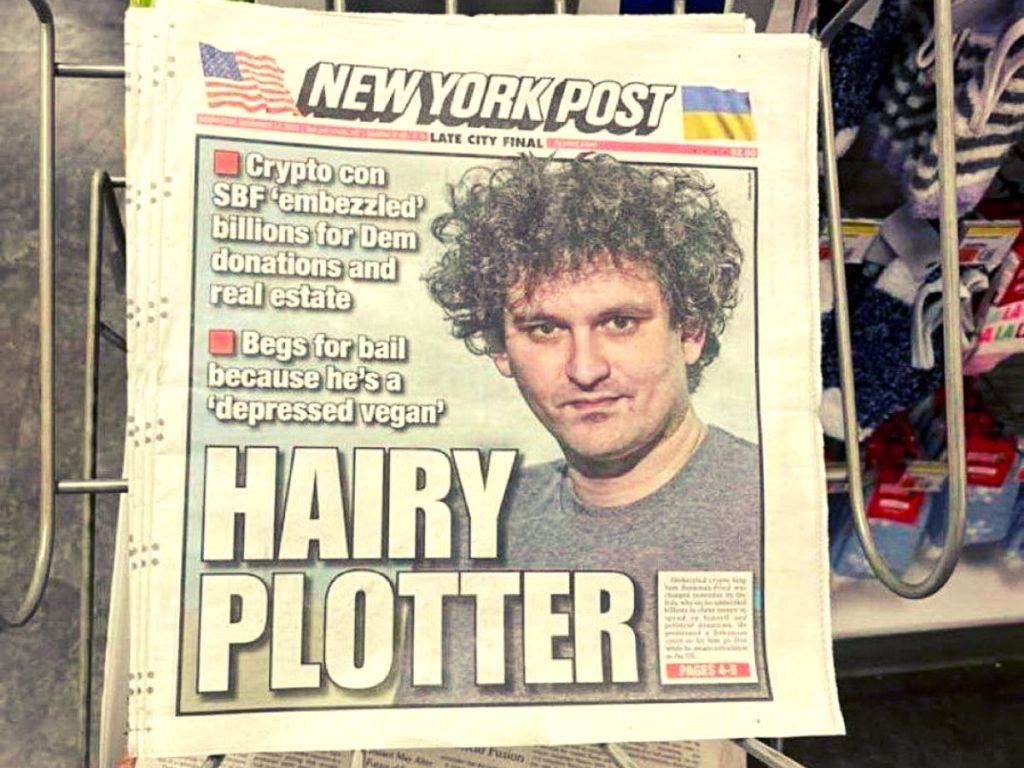

By now, almost everyone knows about the FTX scandal and the former poster child of crypto, one Sam Bankman-Fried (SBF), taking user deposits and gambling them away.

Against the backdrop of chaos, there’s still a ton going on and that’s what we’ll be digging into today, in this edition of The Chainsaw Weekly Wrap (and some FTX stuff, sorry).

FTX debacle reaches new heights

Let’s start off with FTX, because it’s the car crash that we just can’t keep our eyes away from. People have been wondering for some time what the hold up was, but finally, SBF was arrested for an array of charges linked to wire fraud, money laundering and other financial crimes. At a hearing he was denied bail on the basis that he posed a flight risk and is currently locked up in Fox Hill, a pretty awful-looking prison that is reportedly filled with rats and maggots. Quite the downfall, from a penthouse to prison in a matter of days.

This all happened the day before his scheduled appearance before the US Congress where an enquiry was to be held into how the entire saga unfolded. Of course SBF could no longer appear with the FTX new CEO, John J Ray, confirming SBF’s involvement would be “zero”.

Day one of the hearing was pretty interesting, with the new CEO describing what took place as “old-fashioned embezzlement”.

Congress heard about the amateur operations at work at FTX, which at one point drew a few audible gasps from the gallery. One senator was utterly shocked that the business used Quickbooks, “a very nice tool, but not for a billion dollar company”.

The Chainsaw Weekly Wrap: Shambles

In describing the utter shambles of company operations, Ray declared:

“Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information as occurred here.”

Day 2 of the FTX hearing proved as interesting as the day before, with a host of senators adding their two cents worth, both pro or anti-crypto. One of the standout moments of the day was Senator Pat Toomey’s take that the problem wasn’t the technology, but its use that proved to be the problem.

Others such as Hillary Allen, a law professor said, ““In many ways, relying on the crypto industry to improve access to financial services is like adopting a policy to open more casinos in underserved communities.”

The most truly surprising moment of the day was surely when Kevin O’ Leary, a paid spokesman for FTX who received US$15 million plus US$3 million to cover tax, blamed Binance on FTX’s downfall. Somehow SBF’s fraud managed to slip O’ Leary’s mind.

The following day, US lawmakers Elizabeth Warren and Roger Marshall introduced a bill to crack down on money laundering and financing terrorists and rogue nations through crypto. If it becomes law, the Digital Asset Anti-Money Laundering Act will bring know-your-customer (KYC) rules to wallet providers and miners. It will also prohibit financial institutions from transacting with crypto mixers.

Coincidence? We think not.

Elsewhere in Web3

That’s all pretty depressing stuff. So what else is happening in crypto?

Global investment banking giant Goldman Sachs came out this week with an OpEd in the Wall Street Journal entitled, “Blockchain Is Much More Than Crypto”. While the bank is still somewhat sceptical about crypto, David Soloman the CEO said he was bullish on blockchain, describing how the bank used a private blockchain to arrange a 100 million euro two-year digital bond for the European Investment Bank that was settled in 60 seconds .

Elsewhere, gaming blockchain Oasys’ SEGA and Ubisoft-validated mainnet went after completing the final phase of its mainnet. This marked a significant milestone of major traditional gaming companies, both SEGA and Ubisoft, integrating into the Web3 ecosystem. Oasys is one of several blockchain ecosystems that have developed over the last year specifically targeting Web3 gaming, and this news is truly a game-changer for the budding blockchain gaming community.

Turning now to mystery men, one Do Kwon from the failed Luna experiment is still somehow missing. No one knows where he is, despite his regular appearances on podcasts and Twitter. This week, Coindesk reported that the Seoul Southern District Prosecutor’s office had said that Kwon was in Serbia, and that they were in the process of working with Serbian authorities to assist in their investigation. His South Korean passport has been invalidated but he has someone slipped through the cracks, heading to Singapore, then Dubai and now Serbia, apparently. When will this one draw to a close?

Binance

In other news, Binance has had a rather tough week, after seeing some of the highest levels of withdrawals from its exchange in its history. Some of the biggest players in the institutional capital space including Jump Capital and Wintermute also got in on the act, whipping their investments off the platform at a record pace.

Audits

This was no doubt partially inspired by the news that Binance’s “audit” was not an audit in a the strictest sense of the word, despite what CZ said on Twitter. Turns out it is anything but a true audit and the market is calling Binance’s bluff.

Simultaneously, the US Department of Justice is weighing up a move to launch proceedings against Binance and its executives for money laundering and ignoring sanctions.

So all in all, a rough week for Binance and it does not look like it’s getting much better in the near term, as Binance Australia just got fined over $2 million for email spamming its Aussie customers. Ouch.

Speaking of Australia, Aussies have put together a petition to “enshrine the use of cash” and to reject central bank digital currencies. Since last week’s article, the number of signatures has risen from 13,500 to just under 96,000. The Chainsaw’s magic at work? Probably not. But clearly, Aussies want to be heard, especially given the fact that most of the petitions struggle to get more than 100 signatures.

Meanwhile, Tether truthers will be pleased to hear that the stablecoin operator has vowed to reduce secured loans in its reserves to zero in 2023. The company told the Wall Street Journal that its loans reached US$6.1 billion, or 9% of Tether’s total assets, as of September 30.

“Tether is professionally and conservatively managed, and this will be demonstrated once again by successfully winding down the lending business without losses — since all loans are over-collateralized by liquid assets,” the company said in a statement.

Oh, and Donald Trump launched his own NFT collection. Enjoy.

The Chainsaw Weekly Wrap: Money money money!

Things have slowed a tad, but the crypto winter is still demonstrating that investor confidence is high. Repeat, confidence is high.

These are the big moves that made the cut for The Chainsaw Weekly Wrap:

- Blocknative, a Web3 infrastructure company, raised US$15 million in a Series A-1 round. “With this new financing round, Blocknative is ideally positioned to vigorously pursue the block building opportunity and help drive equitable value recirculation throughout the entire Web3 transaction supply chain” Blocknative CEO and co-founder Matt Cutler said.

- Aztec Network, a firm that aims to encrypt the Ethereum blockchain, raised a whopping US$100 million in Series B funding led by a16z. The firm will use the funds to build out its encryption architecture and double its team of 40 people.

- Decent, an NFT infrastructure protocol that helps artists monetise their work, raised US$3.5 million in a seed funding round. Decent plans to expand its team with the funds raised.

- Spaceport, a Web3 intellectual property protocol, raised US$3.6 million in a pre-seed round. Spaceport is designed to help creators, brands and agencies monetise their intellectual property through Web3.

- Sooho.io, a provider of decentralised finance (DeFi) services, has raised US$4.5 million to help forge links between separate blockchains in its native South Korea.

- The company aims to build infrastructure to facilitate interoperability between different networks.

- Web3 game Dogami, which lets players adopt and raise virtual dogs, raised US$7 million to further expand development of the game. “Dogami are not normal dogs, they come from outer space, and they come to earth with a purpose,” Dogami CEO and co-founder Max Stoeckl said in an interview.

- Bitcoin Group SE has agreed to purchase German bank Bankhaus von der Heydt for 14 million euro (US$14.75 million), as part of its plans to diversify its investments.

- Evertas, the cryptocurrency insurance firm, raised US$14 million in funding, to provide further support to companies struggling in the crypto winter.

And that wraps it all up on the funding side of things. Not too shabby, if we don’t say.

The Chainsaw Weekly Wrap Markets Update

Is anyone even paying attention to crypto markets these days? They’re just so damn depressing. Aren’t things supposed to only go up? Of course not. Here’s what happened in crypto markets this week.

Crypto markets were somewhat buoyed by fresh inflation data coming out of the US, which coupled with comments from the Fed, suggested that the current bout of quantitative tightening may be slowing down faster than expected.

On the back of this news, Bitcoin was up 0.9% on the week exchanging hands at US$17,392.45 at the time of publication, and up 3% for the month.

By contrast, Ethereum was down 0.9% trading at US$1,269.55, up 1.3% for the month.

It proved to be a cracking week for a crypto ranked #22 called Toncoin (TON), up an astounding 24.55%. Meanwhile, on the other end of the spectrum, a not-so-stable-stablecoin Neutrino USD (USDN) depegged as is down 36% for the week.

The bear has been long and it’s likely that in the long run, only the strong will survive. Much like in the wild.

That’s it for today’s edition of The Chainsaw Weekly Wrap. Have yourself a very merry weekend, and we’ll see you on the other side.