Binance Withdrawals: Binance, the world’s largest crypto exchange by daily trading volume, has experienced an abnormally high level of withdrawals from its platform after a number of market participants shared their concerns relating to a string of recent issues.

Withdrawals coming in thick and fast

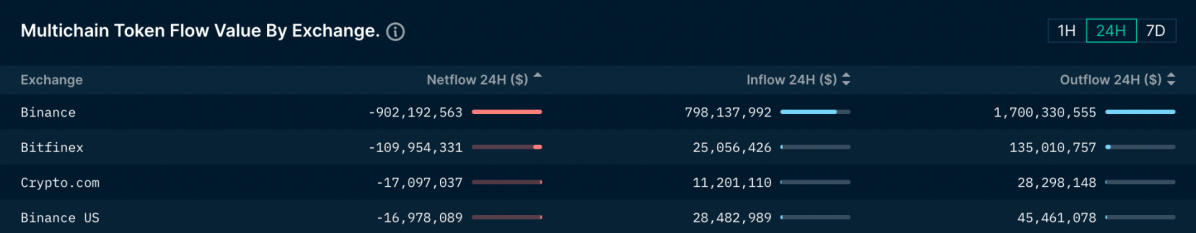

According to data from blockchain analytics firm Nansen, a little more than US$900 million has been withdrawn from the crypto exchange in the last 24 hours.

Worryingly, this marks the highest total amount of outflows for Binance since mid-November when the collapse of FTX sent crypto investors into a withdrawal frenzy.

The reason for the recent slew of withdrawals from Binance can be traced back to a growing number of concerns around Binance’s management of customer funds. Ever since the rapid implosion of FTX, crypto investors have become increasingly wary of security on centralised exchanges.

What’s most concerning about these outflows is that two of the larger ‘market makers’ in the crypto industry, Jump Trading and Wintermute, were both on the list of entities withdrawing a significant amount of funds from the exchange.

According to a tweet from Nansen analyst Andrew Thurman, Jump Trading has been the largest with the market maker removing more than US$146 million worth of cryptocurrencies over the last week.

Binance Withdrawals: Binance’s proof of reserves report sound alarms

Last week, auditing firm Mazars released a report on the state of Binance’s reserves.

According to financial experts at the Wall Street Journal, the report raised a number of issues around the exchange’s total liabilities.

The proof-of-reserves report declared that Binance is 97% collateralised, excluding a number of assets lended to users of the exchange via loans and margin accounts. This means that Binance’s claims of being backed 1:1 aren’t entirely accurate. Mazars addressed this inconsistency and added that it “performed its work using ‘agreed-upon procedures’ … we make no representation regarding the appropriateness of the procedures”. So in short, it wasn’t an audit at all.

John Reed Stark, the former head of the Internet Enforcement at the Securities and Exchange Commission said that Binance’s report failed to address the “effectiveness of internal financial controls” and doesn’t adequately vouch for the numbers. “This is how I define a red flag,” he concluded.

In the days following the FTX collapse Binance released a Proof Reserves (PoR) system that allowed users to individually check their own assets using a ‘Merkle tree’ which works by taking a detailed cryptographic snapshot of existing digital assets. The move however was flayed by experts including Kraken CEO Jesse Powell, who called it “pointless… hand wavey bullshit” as the system fails to account for liabilities on the exchange.

Binance refutes allegations of money laundering

Things only got worse for Binance as a Monday report from Reuters claimed that that prosecutors from the US Department of Justice (DoJ) are debating whether to charge Binance with violating US anti-money laundering laws.

“Reuters has it wrong again,” wrote the official Binance twitter account in protest.

The report, which cited four anonymous people “familiar with the matter”, said the DoJ investigation into Binance began in 2018. Bloomberg also reported that Binance was being investigated by the Justice Department in 2021.

Binance’s rejection of Reuter’s claims points to their efforts in mitigating money laundering in the crypto space, however it’s worth noting that it remains unclear specifically which parts of the Reuter’s report Binance is refuting.