FTX hearing: Yesterday’s FTX hearing in Congress didn’t provide us with any bombshell revelations, probably due to the empty hot seat that one Sam Bankman-Fried was intending to sit in before his arrest in the Bahamas on Monday.

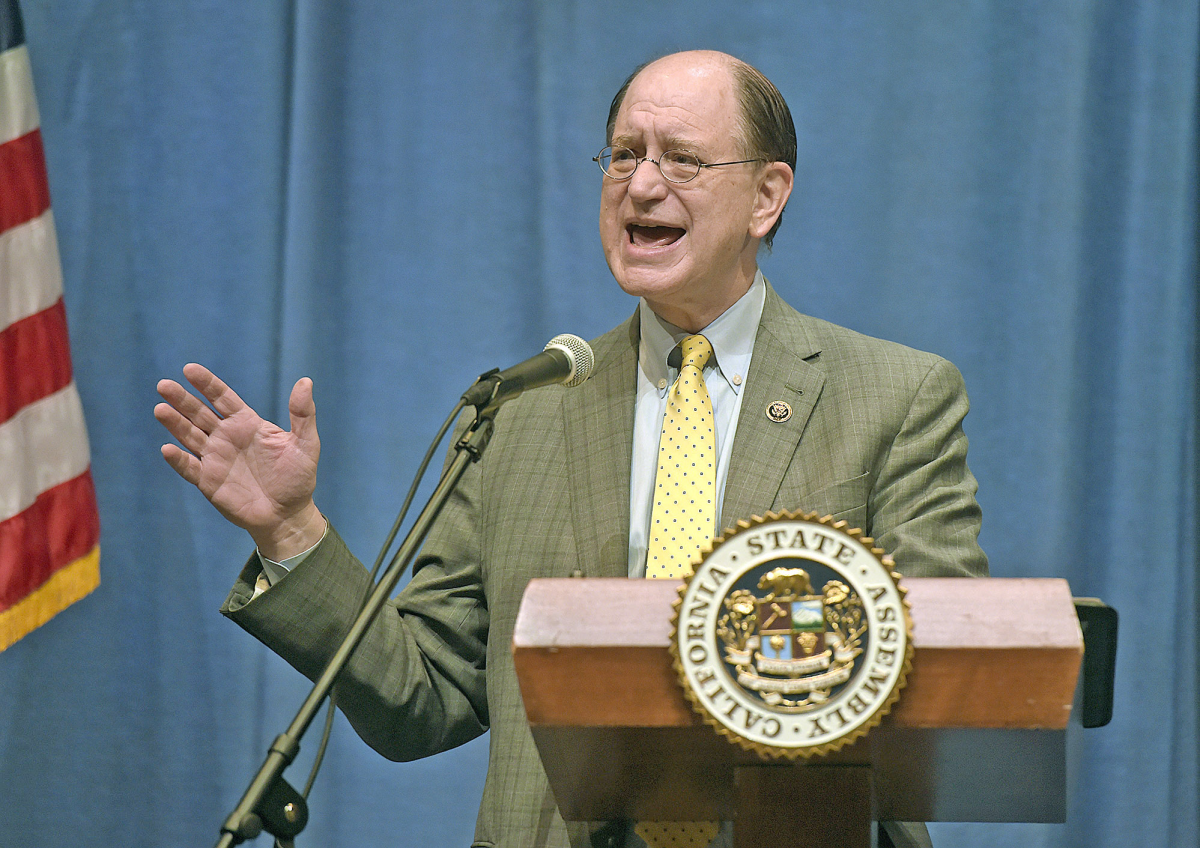

So, that just left the new chief in FTX town, John J. Ray III who sincerely answered the questions of congressmen and women – some of whom enquired with scrupulous attention to detail in pursuit of indemnifying the one million victimised investors. Others however opted for a more theatrical, melodramatic approach. California congressman Brad Sherman comes to mind.

Whichever way, Mr. Ray was calm and composed, and in no way naive to the years-long task ahead, having worked on over a dozen large-scale bankruptcies throughout his career, including the infamous Enron Corporation.

And what will Bankman-Fried’s role be in all this? Well, the very question was put to Mr Ray by Texan congressman Roger Williams. Ray’s response? “The role he’s currently playing. Zero.”

If you missed the events of yesterday, you can get up to speed here, before returning to this article and reading what went down during today’s Senate Banking Committee discussion.

FTX hearing: Day two

Sherrod Brown, a senior US senator from Ohio, chaired the discussion on the subject of “Crypto Crash: Why the FTX Bubble Burst and the Harm to Consumers” and his opening statement established strong opinions on the nature of the cryptocurrency space.

“Hacks and complex crypto transactions make it easy to steal billions of dollars of investors’ money. That’s what we saw with FTX and that’s what will continue as long as we allow crypto firms to write their own rules.”

Junior US senator for Pennsylvania, Pat Toomey, spoke next and offered a more optimistic tone on the potential of the crypto industry. And this juxtaposition of opinion, or balance of agenda, was evident throughout the entire discussion.

One thing evident at the FTX hearing was the fact that the rhetoric of expert witnesses varied at either end of the spectrum from the US should “create a sensible regulatory framework for digital stablecoins” to “the cryptocurrency industry represents the largest Ponzi scheme in history.”

Anyhow, Toomey, whose cordial voice sounds like Principal Skinner from the Simpsons, shared some insightful points. “There’s nothing intrinsically good or evil about software”, he said, “it’s about what people do with it … code committed no crime. FTX was opaque, centralised and dishonest, cryptocurrencies usually are open-source, decentralised and transparent.”

The US didn’t ban mortgages in the wake of the 2008 financial crisis, or the US dollar when former governor of New Jersey Jon Corzine’s commodity brokerage firm MF Global collapsed after mishandling consumer funds, Toomey argued.

“With FTX, the problem is not the instruments that were used, the problem was the misuse of consumer funds, gross mismanagement, and likely illegal behavior.”

Senator Toomey

In his view, Congress should seek to pass legislation to support the cryptocurrency ecosystem, cultivating the growth of US-based exchanges and projects, as well as protecting consumers on the risks.

Experts who testified

Hilary Allen, Professor of Law at the American University Washington College of Law and author of the book ‘Driverless Finance’, voiced a strong anti-crypto view, claiming that “blockchain technology is fundamentally not fit for purpose”, before remarking:

“In many ways, relying on the crypto industry to improve access to financial services is like adopting a policy to open more casinos in underserved communities.”

In her opinion, the US should withdraw from the race to lead innovation in this field because it’s “little benefit to society and multitude of harms.”

Canadian businessman and former FTX spokesperson Kevin O’Leary appeared at the FTX hearing and proposed a unique view that “the recent collapse of crypto companies is a silver lining” with this nascent industry “culling its herd” in the likes of Terraform Labs, Celsius Network, Voyager Digital, Three Arrows Capital, BlockFi and FTX, among others.

On the subject of regulation, O’Leary stated “Congress should start by passing bi-partisan legislation that creates a sensible regulatory framework for digital stablecoins backed by the US dollar”, arguing that this asset could become the “global default payments system over time.”

Jennifer Schulp, Director of financial regulation studies at the Cato Institute, advised the committee that centralised exchanges should be treated with a different level of regulatory scrutiny than their decentralised counterparts.

“For exchanges to provide rules that are narrowly targeted to relevant risks, Congress should provide for centralised marketplaces to register with the CFTC for crypto commodities and the SEC for crypto securities.”

Jennifer Schult, director of financial regulation studies at Cato Institute

Adding further, she argued that “Decentralised exchanges should be permitted to voluntarily register which recognises their capacity to address intermediary risks through technology.”