Crypto tax in Australia: Confused about how it applies to you? This is your must-read guide to all things cryptocurrency and taxation. While some crypto holders think that using crypto means you don’t pay capital gains tax on your gains, this isn’t necessarily the case. With tax time fast approaching, here’s what you need to know.

Nearly half a billion people in the world own crypto. According to a recent survey, 4.2 million Australians (21%) have invested in cryptocurrency, with a further million expected to enter the fray in the coming 12 months. Despite being viewed by some as the digital Wild West, the reality is that Web3 remains very much tethered to the current financial system. Which brings us to the matter at hand – tax.

Admittedly, most people find tax a snoozy affair and understandably so, it’s not exactly riveting stuff designed to keep you on the edge of your seat. But get it wrong and the consequences are potentially severe. For that reason alone, it’s worth spending the time to get on top of your crypto tax situation, because there are simply some things in life that are unavoidable.

“Nothing is certain except death and taxes.”

Benjamin Franklin, founding father of the United States in 1789

With that said, this piece aims to provide some broad principles and guidance to some of the most pressing issues when it comes to tax and cryptocurrency. However it goes without saying that what follows isn’t advice, it’s just a roadmap to provide a foundational knowledge based on publicly available information.

In reality, the application of taxation laws to individuals varies based on personal circumstances, which is why it is always advisable to speak with a registered tax professional about your particular situation. Now with that out of the way, let’s dig in.

How much tax do you pay on crypto in Australia?

The Australian Tax Office (ATO) has put out extensive guidance on crypto and digital assets, particularly over the last few years as the space exploded. According to the ATO, “the way you use or transact with crypto assets will determine how you treat them for tax purposes”.

The ATO says that in general, crypto assets are taxed as capital gains tax (CGT) assets. However, there are circumstances the ATO highlights where transacting in digital assets is accounted for as ‘trading stock’ and in that case, gains are treated as ‘ordinary income’. Similarly, mining tokens and rewards for staking crypto are also considered ordinary income for tax purposes. And then to further complicate matters, there are some limited circumstances where crypto assets are not kept mainly for investment but for ‘personal use’, in which case they are not subject to capital gains tax at all. If this sounds like gibberish, don’t fret, we’ve got your covered.

Even though it sounds super complex, the vast majority of cases are relatively simple. According to the ATO, most commonly, people hold crypto as investments with a view to making a profit from holding or selling them. In that case, if one then chooses to sell a crypto asset, it creates what’s known as a capital gains tax (CGT) event meaning you need to pay tax on your crypto capital gains. This isn’t different to the tax you’d pay on capital gains on an investment property sold. The ATO offers a useful calculator to help establish your capital gains, but how does this actually work?

Crypto Tax

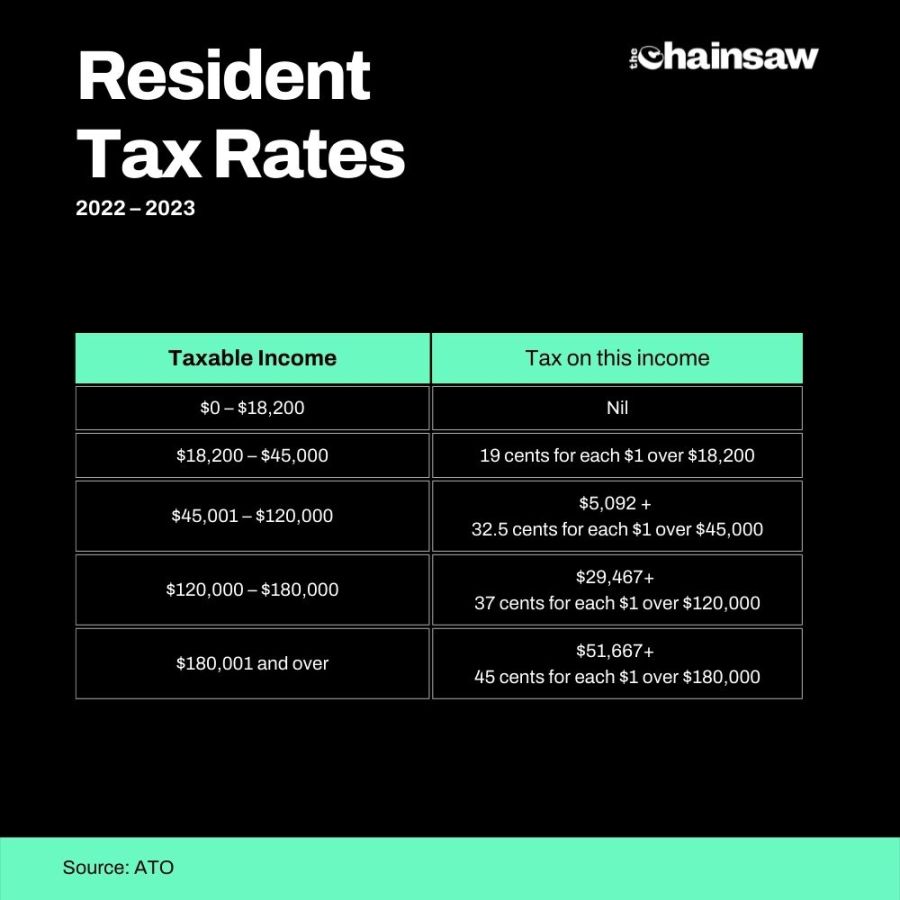

Let’s assume that you’ve made $5,000 profit, how will you be taxed? The answer is at your marginal tax rate. In Australia, there is a progressive tax system – meaning the tax rate progresses from low to high, depending on how much you earn. The marginal tax rate can also be considered as the highest percentage tax you pay based on your income – reflected as an amount of cents tax imposed for every dollar earned. The table below highlights this point.

To illustrate, if you earned $60,000 pre-tax on your salary and an additional $20,000 from crypto trading, your total income would be $80,000 per annum. Based on the table above, how would your $20,000 crypto gain be taxed? You would pay 32.5% tax (32.5 cents on the dollar) on $20,000, equal to $6400 if you held for less than 12 months. But it’s not necessarily that simple…

If you held for more than 12 months prior to selling, a 50% CGT discount applies, meaning you would only pay 32.5% on $10,000 (and not $20,000). Confused? Don’t worry, we’ll dig deeper into that later.

What everybody needs to know about crypto tax

As hinted at earlier, some people mistakenly believe that crypto is immune from tax. This is not true in Australia and certainly not in almost all countries. For better or worse, in most cases, tax is payable on your crypto gains subject to a handful of limited exceptions.

From the ATO’s perspective, ignorance is no excuse. The penalties for non-compliance are severe, so it’s best to get your tax affairs in order. There are guidelines and general rules, as well as exceptions, but it is always recommended to engage a professional to establish how the law relates to your personal circumstances.

Remember – you’re perfectly entitled to take steps to proactively reduce your tax liability, but you are not permitted to evade it altogether.

Can the ATO track crypto?

The short answer is absolutely yes. Since public blockchains such as Ethereum and Bitcoin are transparent distributed ledgers, all transactions are visible to anyone…forever. In that sense, crypto isn’t generally suitable as a tool for criminals (unlike the often repeated narrative) as everything can be traced on-chain. Koinly Head of Tax Danny Talwar stressed this point in a conversation with The Chainsaw:

“Blockchains are inherently traceable, so it’s important to be upfront with your crypto tax. The ATO has access to information from banks, cryptocurrency exchanges, and financial institutions, tracking where crypto transactions interact with fiat offramps and flow back into the ‘real world’ to trace funds back to the taxpayer.”

How is crypto tracked in Australia?

If you have an account with an Australian cryptocurrency exchange, then it’s highly likely that the ATO already has your data since they have data matching programs with exchanges and access to all the know-your-customer (KYC) information provided when you signed up.

In 2020 and 2021, hundreds of thousands of Australian crypto investors were sent a letter by the ATO warning them to declare their crypto gains, giving them 28 days to do so. There’s no reason to believe that 2022 will be any different. If anything, chances are that they will ramp up.

Crypto investor vs. trader

What’s the difference between an investor or a trader? When it comes to the common understanding of the difference, there really isn’t a bright red line that allows us to draw a neat distinction between the two.

But in general, investors have a longer term horizon than traders and don’t do it ‘professionally’. However, when it comes to tax, there is an important distinction the ATO draws.

Crypto Investor

The ATO says that if you hold crypto as an investor, your crypto is an asset and subject to CGT when you sell. In that case, your costs are taken into account at the time you sell and if you have a capital loss (i.e. lose money on the investment) you can use it to offset capital gains but not to offset income.

Crypto Trader

However, if you are trading, crypto is treated as ‘trading stock in a business’ which means gains are treated as ‘ordinary income’, and losses and costs are deductible expenses – much like you can deduct the costs of your internet when you work from home.

If you change from an investor to a trader, or vice versa, the treatment of your profits or losses will also change.

Capital gains on crypto

To stress a point made earlier, in the vast majority of cases, the ATO will treat crypto gains similar to the manner it treats any other CGT asset – you have to pay CGT on profits of any crypto assets sold. There are limited exceptions – if you qualify as a ‘trader’ or disposed of crypto as a ‘personal use asset’ – but critically, these are not generally applicable to the average crypto investor.

Speak to a licensed professional to see which camp you fall into. Notwithstanding, our focus will be on crypto gains impacting the ordinary investor (i.e. when CGT applies).

How much tax do I pay on crypto gains?

As highlighted earlier, whenever you dispose of your crypto (which involves selling or even swapping for another token), it creates a CGT event. The CGT event establishes liability to pay capital gains tax at the investor’s marginal tax rate. Danny Talwar, Koinly’s Head of Tax clarified that “marginal tax rates represent the amount of tax you’ll need to pay on every dollar you earn over the course of a financial year”.

Sounds complex, but it’s pretty simple. If you look at the tax table above, it’s basically the tax rate applicable to your earnings (including capital gains) since not all dollars are taxed at the same rate – the less you earn, the lower the rate.

How to calculate crypto capital gains?

This is how the ATO would treat crypto gains in most circumstances, but for the reasons outlined above, not always. Assuming you’re just an ordinary investor, what would your tax liability look like in the following scenario?

- Your salary is $180,000 per annum pre-tax; and

- During the financial year, you sold $30,000 worth of BTC and made a profit of $10,000.

First, you calculate your capital gain by taking the sales price and deducting it from the ‘base cost’ (how much you paid for it). In this case, you bought it for $20,000 (base cost) and sold it for $30,000 (proceeds), leaving you with a profit of $10,000 (capital gain).

Importantly, it doesn’t matter if you sold the asset, swapped it for another token (such as a stablecoin) or gave it away, the ATO will regard all instances as a ‘disposal’ at the market value. Switching between wallets isn’t a disposal, nor is transferring between your wallet and exchange. If it sounds bewildering, you’re not alone – we’ll touch on those topics later. But roughly speaking, if you still control the asset, chances are that it won’t be regarded as a disposal.

In the earlier example, the capital gain is $10,000 and the investor’s marginal tax rate is 45%. This means that 45 cents on the dollar is payable on crypto gains. However, the one caveat is if the investor held the asset for more than 12 months. In that case, a 50% discount is applied to the capital gain and the investor is liable to pay 45% on $5,000 ($10,000 x 50%) and not the original $10,000.

To summarise:

- If the investor held for less than 12 months, the CGT liability = $10,000 x 45% = $4500

- If the investor held for more than 12 months, the CGT liability = ($10,000 x 50%) x 45% = $2250

Easy peasy, it’s just maths.

Can you claim crypto losses on taxes in Australia?

If you’ve spent any time in the Web3 or crypto space, you’ll know it’s not all about the gains. Losses are inevitable if you dabble and perhaps even more so in the current bear market. So the question many investors have is: what about my crypto losses?

Luckily, the ATO has addressed this. It depends (again!) on whether you are an investor or trader as to how the losses are calculated. Let’s assume, as we have in other examples, that you are an ordinary investor and that losses and gains are subject to CGT.

Going back to an earlier example, if your salary is $180,000 pre-tax but instead of making a $10,000 gain, you sold at a $10,000 loss – what would that look like?

Unfortunately, you can’t just deduct the loss from your taxable income (salary of $180,000) as if it were any other operating expense (such as your home internet). Losses from one crypto asset sale can however be used to offset gains in another (such as if you made a profit on one transaction and a loss on another). In addition, the capital loss can be taken into account and/or carried over into the next financial year.

One of the sneaky things people have employed to reduce their liability is ‘wash sales’, which involves deliberately selling at a loss and buying back in order to reduce the tax bill. There is no time period specified in order for an action to be seen as wash selling, but the intent is ultimately what it comes down to.

“Don’t hang yourself out to dry by engaging in a wash sale. We want you to count your losses, not have them removed by the ATO.”

Tim Loh, ATO, assistant commissioner

Crypto tax breaks

Tax free threshold

To reiterate an earlier point, Australia has a progressive tax system meaning you don’t pay a flat rate. Instead, the percentage tax paid depends on how much you earn. The more you earn, the higher the tax rate.

On that basis, given the current tax table, the first $18,200 is tax-free. Yup, no matter what you do not pay tax on the first $18,200 of income (or capital gains in the case of crypto). It’s only once your crypto gains exceed $18,200 that you start paying tax.

50% long-term capital gains discount

This is one of the most important things to know when it comes to crypto gains. If you hold the digital asset for more than a year before selling, you are generally entitled to a 50% CGT discount. This was briefly touched on earlier, but what does this actually mean?

Let’s assume you made $20,000 profit from a crypto trade – if you held it for more than 12 months and sold, you would only pay CGT on $10,000 (representing 50% of the capital gain or profit). By contrast, if you decided to sell before having held onto it for a year, you would pay tax on the full $20,000.

The takeaway then is simple: in general, it is more tax efficient to sell only after having held onto an investment for more than 12 months. In some cases, it pays to HODL.

Personal use asset

Lastly, you may be exempt from CGT if you hold crypto as a ‘personal use asset’, as defined by the ATO. Note that this is indeed an exception to the rule and applies in very limited circumstances.

The idea here is to cater for situations where you specifically buy crypto, not as an investment, but as a medium of exchange. Speaking with The Chainsaw, when asked whether there were rough guidelines relating to ‘personal use assets’ (except from CGT), Danny Talwar, Head of Tax at crypto tax software company Koinly, responded, “Yes, but it’s not great news for investors”.

He added that: the “personal use asset rule can exempt capital gains for assets purchased under $10,000 if they were used for personal use. However, they must have been intended to be purchased for personal use at the outset, and therefore it is rare that this rule applies”.

To illustrate, he said that if you have crypto on an exchange linked to a crypto spending card, the personal use asset rule would probably not apply because the underlying crypto in your account was held as an investment over a period of time.

What’s the takeaway? This is a complex topic and specialist advice should be sought if you believe that this exemption may apply.

Tax on lost or stolen crypto

2022 has been the worst on record for losses due to hacks or scams. Australians alone have lost $292 million to an array of different crypto investment scams. And that doesn’t include folks who simply lost access to their crypto. If you’re keen to up your security game, be sure to check out our piece on the risks of leaving your crypto on an exchange.

Now when it comes to losing access to your crypto, unlike in the traditional financial sector, there is little you can do to recover your assets if they are lost or stolen. If you lose access to your private keys without backing your wallet up, sadly you also lose access to your crypto – that’s the name of the game. However from a tax perspective, the ATO may provide some welcome relief to the devastation of losing your crypto.

Provided you have enough proof, the ATO may (no certainties here) let you claim a capital loss. The potential claim is based on whether or not the amount lost can be replaced.

In the case of losing a private key whether through sheer negligence or via a scam, you’re more likely to be able to claim a capital loss. If however your crypto was on an exchange and it got hacked, you’d be more likely to claim a capital loss to offset other gains. The key here is that you must have lost access to your crypto – a rug-pull (however unfortunate) does not qualify, nor does a situation where an exchange freezes your funds due to liquidity problems.

Crypto Tax

Ultimately, it comes down to the facts and your ability to provide proof that you have indeed lost access to your crypto. Some of the evidence may include:

- When you acquired and lost your private key;

- The wallet address that the private key relates to;

- What it cost you to acquire the lost or stolen crypto;

- The amount of crypto in the wallet at the time of the loss of your private key;

- That the wallet was controlled by you;

- That you are in possession of the hardware that stores the wallet; and

- Transaction records to the wallet from an exchange you have an account with.

Do I have to pay if I transfer crypto from one ‘wallet’ to another?

According to the ATO, moving crypto between your wallets does not constitute a disposal meaning that you do not need to report it or otherwise pay CGT. Of course, you will still pay transaction fees, most often in the crypto that you are transferring. However, it does get a little more complicated.

Technically, the transfer isn’t a disposal but the fees payable in order to transfer are regarded as a disposal, which creates a taxable event. Basically, transfers are tax-free but transfer fees aren’t. For that reason, in determining your tax liability, you need to establish the cost basis of your crypto and the capital gain or loss at the time of the transfer.

Sounds tricky? It is, which is why many people rely on crypto tax software to do the calculation for them.

What do you need to do to file a cryptocurrency tax return?

While there are no doubt some complications, the process of completing a tax return for your crypto is not unlike the process you would normally go through with your accountant each year. The difference perhaps is that there are so many variables that make things a little different due to the vast array of uniquely crypto concepts including staking, airdrops, ICOs and the like.

In order to file your tax return, the ATO (and by extension your accountant) will generally want to know the following:

- Date of transaction;

- Prices in AUD;

- Software costs for tax tracking;

- Receipts and proof of transactions;

- Exchange and wallet records;

- Agent, accountant and legal costs; and

- Reason for transactions.

How to file crypto taxes

Whatever you are engaged in, the ATO requires you to keep detailed records of crypto transactions for five years after submitting your tax return or completing the transaction(s). Since there are often many moving parts, the ATO recommends using Australian tax-compliant applications for record keeping. These are software solutions that integrate with wallets and exchanges, and are designed to vastly simplify your tax affairs.

Whether you choose to keep manual records or rely on software to do the heavy lifting (such as Koinly or Crypto Tax Calculator), your accountant or tax professional will rely on that data when submitting your annual tax return.

Tips for choosing a crypto tax calculator

Speaking with The Chainsaw, Koinly Head of Tax Danny Talwar said that it was important, as per the ATO recommendation to utilise a reputable Australian crypto tax calculator for proper record-keeping. He added that it was also critical to “ensure that whatever solution you choose, that it can generate a tax report that is built to comply with ATO guidance”, and that further, “it integrates with whatever wallets, exchanges and applications you utilise”. He also noted that it was important for users to ensure that the chosen software solution properly tags transactions as airdrops, yield-farming and staking all have different tax treatment.

How to report your crypto taxes

It shouldn’t be surprising to know that the ATO is keen to know what you’ve been up to when it comes to your crypto activities in a given financial year. Specifically, the ATO wants to know about your crypto income (such as things like mining) and capital gains or losses, all of which need to be declared in your annual tax return.

In the same way that you report your salary and the gains on any share trading, the same applies to crypto – you need to disclose crypto income as well as capital gains or losses. Once you have established the extent of crypto capital gains or losses, that data can be included in your annual tax return which your tax professional submits on your behalf (unless of course you’re brave enough to do it on your own).

When to report crypto taxes

The Australian tax year runs from 1 July – 30 June the following year. Our current financial year started July 1, 2022 and ends June 30, 2023.

If you are lodging your own tax return for 1 July, 2021 – 30 June 2022, the tax deadline is 31 October 2022. However if you are lodging through an accountant, you have until May, 15 2023 to file.

This year, tax season began on 1 July 2023. The tax deadline for this year is also 31 October, 2023. Evidently, if you’re doing things on your own like calculating your own crypto tax, the deadline is fast approaching.

How to avoid tax on cryptocurrency Australia

There is no legal way to avoid paying tax altogether, but there are ways in which you can optimise your tax affairs by playing it smart such that you pay less tax overall. Here are some of the more common ways to reduce crypto taxes:

- Deducting crypto trading fees;

- Utilising the personal use asset exemption;

- Buying a local Australian crypto ETF;

- Holding onto an asset for more than 12 months;

- Offsetting capital gains with capital losses; and

- Donating crypto to charity.

There are nuances and specific requirements that apply to each of these examples as laid out by the ATO. It’s complicated and to some folks, it looks like legal mumbo jumbo. For that reason, most rely on tax professionals who provide tailored advice based on the individual’s circumstances – and frankly, that seems to be the most sensible route given the severe consequences for getting things wrong.

Ready to lodge your tax return and get that refund?

Initially, get all your information together about your wallets, transactions and investments in the space. Consider specialised crypto tax software as a relatively cost-effective solution to streamline the process and save you a lot of time. The more complicated your transaction history and activities, the stronger the case for a crypto tax calculator solution.

Once you have your proverbial ducks in a row, get in touch with a licensed tax professional who understands the space and who can provide guidance based on your specific circumstances. Everyone’s position is unique and there is no one-size-fits-all solution when it comes to tax.

As for the refund, that’s in your accountant’s hands. Depending on your past and current activities, there’s no guarantee of a fat refund from the ATO once you’ve submitted your tax return.

Irrespective though of whether you obtain a refund or not, the peace of mind of knowing that your tax affairs are in order is worth its weight in gold.

Tips from a pro

Before closing, we thought we’d share some juicy insights from our conversation with Danny Talwar of Koinly. When asked about some of the most common mistakes in the world of crypto tax, he highlighted the complexities, noting that:

“A lot of people don’t realise that their staking rewards are taxed as income when received even if they haven’t sold the underlying asset. Things such as interacting with DeFi and blockchain-based games can also create numerous taxable events. For example, the ATO guidance suggests wrapping a token such as ETH to wETH is a taxable event – although the underlying asset is the same.”

Discussing the bear market that has been in full force for some time, Talwar recognised that given many investors are firmly in the red, there were “steps investors [could] take to manage their tax bill” through “tax loss harvesting” (capital losses used to offset gains in subsequent years).

Well, that about wraps it all up for The Chainsaw’s comprehensive guide to all things crypto tax in Australia. If there’s one thing we can leave you with it’s this – the sooner you get on top of your tax affairs, the better. There’s nothing quite like peace of mind.