The US Securities and Exchange Commission (SEC) has declared war on crypto in the United States. Led by chairperson Gary Gensler the SEC has come under fire for its unpredictable litigation against crypto businesses.

The crypto world was tossed into the deep end of a potential crisis yesterday as Gary Gensler’s SEC decided to go after two of the biggest crypto platforms in the world in Binance and Coinbase.

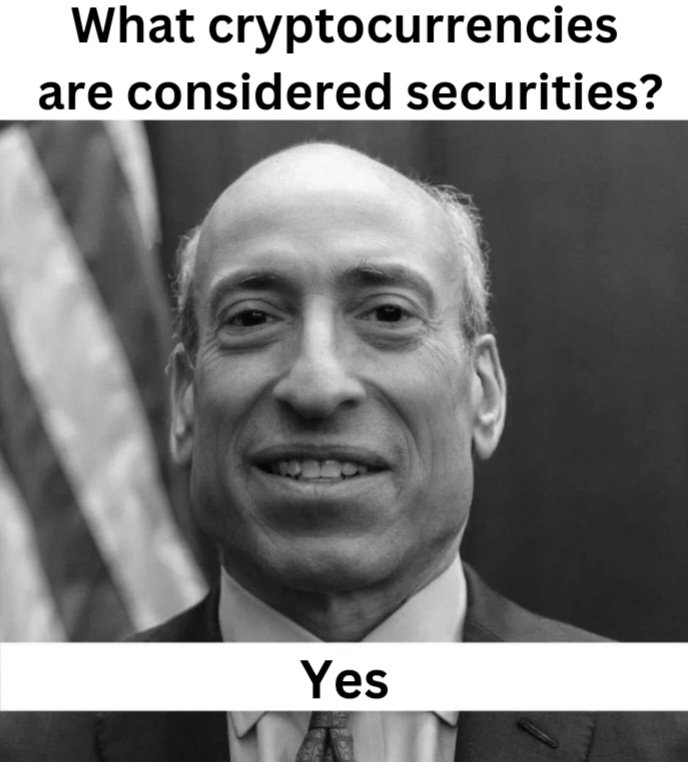

Gary Gensler is hugely unpopular amongst the crypto community, who view him as being hellbent on driving the crypto industry out of the US.

SEC: What it is supposed to do

The SEC has a mission of protecting the average American investor. However under his watch, major US-based crypto projects have imploded, including Terra Luna, Celsius, and FTX, taking investor funds with them.

Gensler is even famous for getting cosy with the now-shamed FTX overlord Sam Bankman-Fried (SBF) while the exchange conned people out of billions.

Meanwhile, the SEC is legally pummeling companies like Ripple, Coinbase and Binance, who have made attempts to be compliant but can’t align with laws that don’t yet exist.

Gensler’s reputation is so bad that crypto figures and fans alike have made a sport out of railing against him on social media in increasingly hilarious ways.

Gensler has faced a slew of political opposition during his tenure, and navigated Republican calls to have him removed from office.

Reaction of Coinbase and Binance

Amid the recent drama, the SEC fired shots at Coinbase, saying they are operating as an unregistered broker. The exchange has 108 million users, which makes it the largest cryptocurrency exchange based in the US, according to the SEC lawsuit.

Binance is also under fire from the SEC, counting over 100m customers worldwide, and 687,000 in the US alone. The founder of Binance, Changpeng Zhao (CZ), made the famous point that FTX was never in the firing line of the SEC prior to its collapse, implying hypocritical positions from Gensler.

Coinbase, in the face of these lawsuits, has gone so far as to dare the SEC to sue them harder.

Coinbase chief legal officer Paul Grewal said in a statement: “The SEC’s reliance on an enforcement-only approach in the absence of clear rules for the digital asset industry is hurting America’s economic competitiveness and companies like Coinbase that have a demonstrated commitment to compliance. The solution is legislation that allows fair rules for the road to be developed transparently and applied equally, not litigation. In the meantime, we’ll continue to operate our business as usual.”

No one is scared of the floppy SEC

The reaction from major crypto figures to this latest round of lawsuits seems to be one of ambivalence.

Twitter owner Elon Musk has also made his thoughts on the SEC abundantly, clear — a stance which was pointed out by Twitter users today.

And as at the time of writing, the Bitcoin price is now higher than before the SEC moved in to sue Coinbase and Binance, indicating a fairly defiant market response.

The reactions across social media have been thick, fast, and fairly funny.

Protest NFTs are even being minted.

A memecoin named after Gensler’s shenanigans has just gone to the moon, which is the most crypto thing that we will see in this whole saga.

Whether this has any effect on Ginsler’s tenure as SEC chair, or his tenacious pursuit of cryptocurrency platforms in the US, remains to be seen.