On September 15, 2022, Ethereum developers pulled off a massive upgrade to its blockchain protocol known as “the Merge” — switching from the blockchain’s Proof-of-Work (PoW) mining model to a Proof-of-Stake (PoS) consensus mechanism. The overhaul brought an end to the blockchain’s reliance on the energy-intensive process of cryptocurrency mining, ushering in a myriad of improvements theorised for years.

Staking is often considered a passive source of income and a long-term investment strategy for traders. By lowering the entry barrier, investors can begin low-risk staking with a small investment. But consider the risks before taking a dive into staking.

Staking Ethereum could offer attractive returns on investments depending on where and how much Ethereum is staked.

Reliance on the energy-intensive process of cryptocurrency mining, ushering in a myriad of improvements theorised for years.

Ethereum co-founder Vitalik Buterin “merge” announcement on Twitter

As a result of the transition from the PoW to the PoS consensus mechanism, validators rather than miners are now responsible for approving blocks to be added to the blockchain and ensuring the security of the Ethereum network. With PoS protocol, crypto miners competed to write transactions to its ledger by solving cryptographic puzzles which required using tremendous computing power and enormous energy.

Now that the Merge is complete, bringing changes to the crypto world, it’s important to take a dive into Ethereum 2.0 staking for the benefit of crypto enthusiasts and traders who want to get started with ETH staking. In this article, you’ll learn about what it means to stake Ethereum, where to stake, how to stake, if you should stake, and how much you can make from staking Ethereum.

Things to learn:

- What does it mean to stake your Ethereum?

- Where to stake Ethereum

- How to stake Ethereum

1. Select a staking method

2. Select an exchange

3. Send Ethereum to your account

4. Set up the contract

- Should you stake your Ethereum?

- How much do you make staking Ethereum?

- Ethereum 2.0 Staking

What does it mean to stake your Ethereum?

According to Ethereum, staking ETH means “depositing 32 ETH to activate validator software. As a validator, you’ll store data, process transactions, and add new blocks to the blockchain”. In return for locking up some of your ETH tokens to help validate blocks and secure the Ethereum network, you’ll receive staking rewards as ETH. Think of ETH staking as a fixed-term deposit at a traditional banking institution where a person deposits funds for some time to earn interest.

Staking is a relatively new concept in cryptocurrency. It uses the PoS consensus mechanism for validating transactions on Ethereum protocol, creating a new block and distributing newly minted coins as staking rewards. Before the adoption of PoS, miners solely depended on PoW. However, it had its shortcomings, such as transaction security, scalability challenges, slow performance, expensive transaction fees, and high electricity consumption.

For instance, one bitcoin transaction takes 1,207.17 kilowatts, equivalent to the power consumption of an average U.S. household over 41.38 days and around 144.90 terawatt-hours hour (TWh) of electricity annually, as at the time of writing. This is comparable to the energy used in the Netherlands, a nation of about 17.53 million people. Also, the energy consumption of Ethereum via PoW protocol ranged between 46.31 to 93.98 TWh per year.

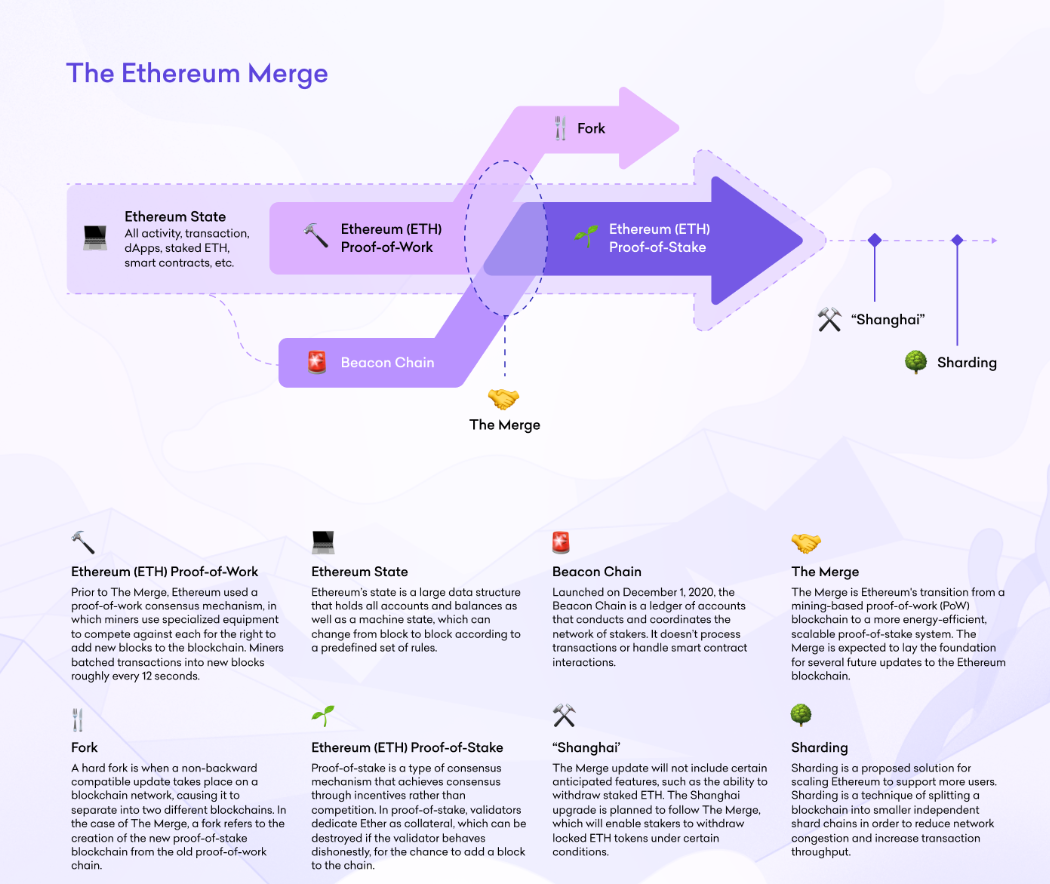

To combat the climate impact of high energy consumption and for other benefits, Ethereum embraced a more environmentally friendlier consensus mechanism to build blockchains and generate crypto coins: staking or “Proof of Stake.” In December 2020, the Ethereum blockchain began work on its multi-phased upgrade by launching a PoS network called the Beacon Chain. The Beacon Chain launch was a testing ground for proof-of-stake consensus that ran alongside Ethereum’s mainnet (short for “main network”). Then the Merge in early December brought these networks together, and PoS replaced PoW permanently.

Justin Drake, a researcher at the non-profit Ethereum Foundation, described the upgrade as “switching out an engine from a running car. I like to think of it like the switch from gasoline to electric.” PoS coin owners create blocks rather than miners using power-hungry machines for operation. The energy consumption of PoS is now negligible compared to PoW. A recent study shows that Ethereum has reduced its electrical energy requirement by at least 99.84% since the Merge, only using approximately 0.0026 TWh/yr across the entire global network.

Also, the upgrade attempts to improve the Ethereum network’s scalability, network maintenance incentives, energy efficiency, and security by making infrastructure modifications. You can’t transact with staked ETH. A validator processes transactions and earns a portion of the fees that are paid by entities that submit transactions to the blockchain. Staking yields are about 3% to 15%, depending the staking method.

Following Ethereum’s shift to PoS, blockchain analytics platform Nansen revealed that staking solutions have been in high demand, with over 15.4 million ETH locked in Ethereum’s staking contract as of early December.

Where to stake Ethereum

You can either stake your Ethereum through solo staking, Staking-as-a-Service (SaaS), in a staking pool, or in centralised exchanges. Your choice depends on how much you want to invest and risks you can take.

1. Solo staking

This means taking part in the network consensus directly as an individual by running an Ethereum node that’s connected to the internet 24/7 and depositing 32 ETH to activate a validator software. Solo staking provides full participation rewards, improves the decentralisation of the Ethereum network, and never requires trusting anyone else with your funds. Some technical know-how is necessary, but easy-to-use tools now exist to help. As a solo staker, you can receive up to 15% Annual Percentage Yield (APY) on staked ETH.

2. Staking pool

The staking pool is like a crowdfunding service that allows many with smaller amounts of ETH to join forces to get the 32 ETH required to activate a set of validator keys. Few people can boast of owning 32 ETH (over $40,000 at the time of writing). Therefore, skip the hard part, pool funds together with other ETH holders for staking, and entrust validator operation to a third party. Many staking pools provide a token that represents your staked ETH and the rewards it generates.

3. Staking-as-as-Service (SaaS)

SaaS is a great option for anyone who doesn’t feel comfortable dealing with the technical complexity of running a node but still wants to stake 32 ETH. You can delegate the hard part to a third-party operator by uploading your own signing credentials, allowing them to run a validator on your behalf, but for a small cost, while you earn native block rewards. However, a certain level of trust in the SaaS provider is required. To limit counterparty risk, you are in custody of the keys to withdraw your ETH.

For example, Lido is an Ethereum-based liquid staking solution for ETH 2.0, which allows its users to pool Ethereum together without locking assets or maintaining infrastructure. Lido also operates as a decentralised autonomous organisation (DAO) and you can stake any amount of Ethereum. Stake your ETH and receive stETH which represents your staked ETH on a 1:1 ratio basis. Just like regular ETH, you can use your stETH balances to earn yields or to lend funds. Currently, Lido offers an annual ETH staking returns rate of 3.7% and charges a 10% fee, which is taken out of your earning.

4. Exchanges

Not all exchanges support coin staking to earn rewards. But, there are some major cryptocurrency exchanges where you can stake ETH, with varying payouts and terms. If you are a beginner with little technical knowledge, some platforms below support 1-click staking options with minimal effort required:

- Binance: While Binance mandates the 32 ETH requirement, the exchange allows users to stake as low as 0.1ETH! Binance also offers a “Flexible Lock” option, meaning you can redeem your assets instead of locking them for a fixed period. Binance promotes an Annual Percentage Rate (APR) as high as 11.20%. To stake, convert the ETH tokens into BETH, which represents the staked ETH at a 1:1 ratio. Users of Binance ETH 2.0 staking get daily payments, and the reward return is determined by your BETH holdings.

- Coinbase: Coinbase users can earn up to 5% APY with their staked ETH. A few days after your first stake, you receive your first rewards payment. Following this, regular payouts of the ETH 2.0 rewards take place every 3 days. You can’t trade, send, or sell the amount you have staked (both the originally staked amount and any received rewards). Unlike Binance, there is no minimum ETH to stake. Also, Coinbase will take a 25% commission fee off the staking profits.

- Kraken: Kraken is reputable for ease of use, safety, and competitive pricing suited for experienced crypto investors. On the exchange platform, you can stake up to 12 digital assets, including on-chain Ethereum 2.0 staking, and earn between 4-7% yearly rewards. Kraken gives users who stake their ETH a trading pair ETH2.S/ETH. Your staked ETH will start earning rewards after a 20-day bonding period or less depending on network conditions. Kraken has an administration fee of 15% on all rewards earned.

- Bitfinex: With Bitfinex, your staking reward is up to 3.5% APY but there are no guarantees regarding the amount of any staking rewards. There’s also no minimum requirement for the amount of ETH to be held on the exchange, but upholds the 32 ETH rule if you want to become an official validator. Bitfinex does not take any fee for staking, but will take a small undisclosed amount from the staking reward, which is paid weekly. ETH2 and ETH 2.0 reward balances cannot be withdrawn.

How to stake Ethereum

- Select a staking method: There are non-custodial or custodial staking methods. Non-custodial staking is decentralised, users have full control over validator selection and their wallets, and is often grouped in the decentralised finance (DeFi) category. Examples are TrustWallet, MetaMask, Guarda Wallet, Myetherwallet, Exodus, etc. Meanwhile, custodial staking is a centralised and hands-off method where staking responsibilities are delegated to an exchange like Binance, Coinbase, and others listed above.

- Select an exchange: You entrust your tokens to exchanges, relinquishing ownership in exchange for taking care of your staked ETH from their end and sharing the earned rewards with you. Review the platforms before making a choice.

- Send Ethereum to your account: After creating an account on a reputable platform like Binance, purchase or transfer ETH tokens to your Binance wallet. Navigate to “Binance Earn” and select ETH 2.0 staking. Click on “Stake Now”, choose the ETH amount to stake and convert the ETH into BETH.

- Set up the contract: A smart contract is a program that runs on the Ethereum blockchain, which empowers you to define a set of rules to be fulfilled before any transaction like Ethereum staking is made between parties.

Should you stake your Ethereum?

Staking Ethereum has many benefits, but it also comes with potential risks. As previously mentioned, staking yields passive income while contributing to network validation and security.

However, it’s essential to consider certain risks at the early stage before investing. The biggest risks with staking crypto are malicious actions, slashing, offline nodes, and failure to validate transactions and market crashes.

The crypto market is highly volatile and you can suffer substantial financial losses if prices suddenly drop because of a market correction or a bear market. This means staked ETH might be worth less than its market value at the beginning of the staking term.

Staking is often considered a passive source of income and a long-term investment strategy for traders. By lowering the entry barrier, investors can begin low-risk staking with a small investment. But consider the risks before taking a dive into staking.

How much do you make staking Ethereum?

Staking Ethereum could offer attractive returns on investments depending on where and how much Ethereum is staked. If the total staked ETH decreases, the annual percentage rate (APR) increases, and vice versa. The rewards are tied to the overall amount of ETH staked in the network which can range between 4.9% to 21.6%.

For those solo staking on the Ethereum blockchain, more validators translate to a lower base reward per validator. The APR varies between 6% to 15%. Meanwhile, SaaS or pooled staking offers similar rewards, minus third-party operation and maintenance fees. Centralised exchange rewards depend on the platform and are typically around 4% to 6%.

Ethereum 2.0 Staking

ETH staking is the backbone of Ethereum 2.0. Following the Merge, research has shown that Ethereum has reduced its electrical energy consumption by at least 99.84%, using only about 0.0026 TWh/yr across the entire global network. There are also expectations about processing speed, network security, and scalability.

As it stands, ETH staking is an exciting opportunity to contribute to the future of the network while earning rewards. Analysts predict that the multi-phased upgrade will usher in new possibilities.

It’s key to note that the Merge is only one step in a series of planned upgrades to the Ethereum blockchain. The next upgrade is the Shanghai upgrade, followed by “Surge,” “Verge,” and the “Purge.”

Source: Kraken

Ethereum developer Marius van der Wijden tweeted that while he could not give a specific date for the Shanghai upgrade, he confirmed that stakers would be able to unstake their ETH. “The only thing I can say is almost certain is that Shanghai will enable withdrawals.”

Also, many in the Ethereum community project that the next upgrade would be implemented over the next nine months.

What’s next for ETH staking?

A recent report from Nansen revealed that the value of staked ETH alone would be the equivalent of a top-six crypto by market cap in its own right. This shows that there are endless possibilities in ETH staking. While some Ethereum miners have refused to join the Merge and there are still pockets of skepticism about the result of the upgrades, you should watch out for what’s coming and jump on any opportunities that exist in the Ethereum 2.0 staking ecosystem — after doing proper research, of course.