What are the top 20 cryptocurrencies? And what are they used for? Here is the explainer for the crypto curious amongst us!

How do we judge what the top 20 cryptocurrencies are? There are many ways to judge this, but the most common way is by “market cap.”

Market cap is a measure of the total value of a cryptocurrency. It is calculated by multiplying the current price of a cryptocurrency by the total number of coins or tokens in circulation.

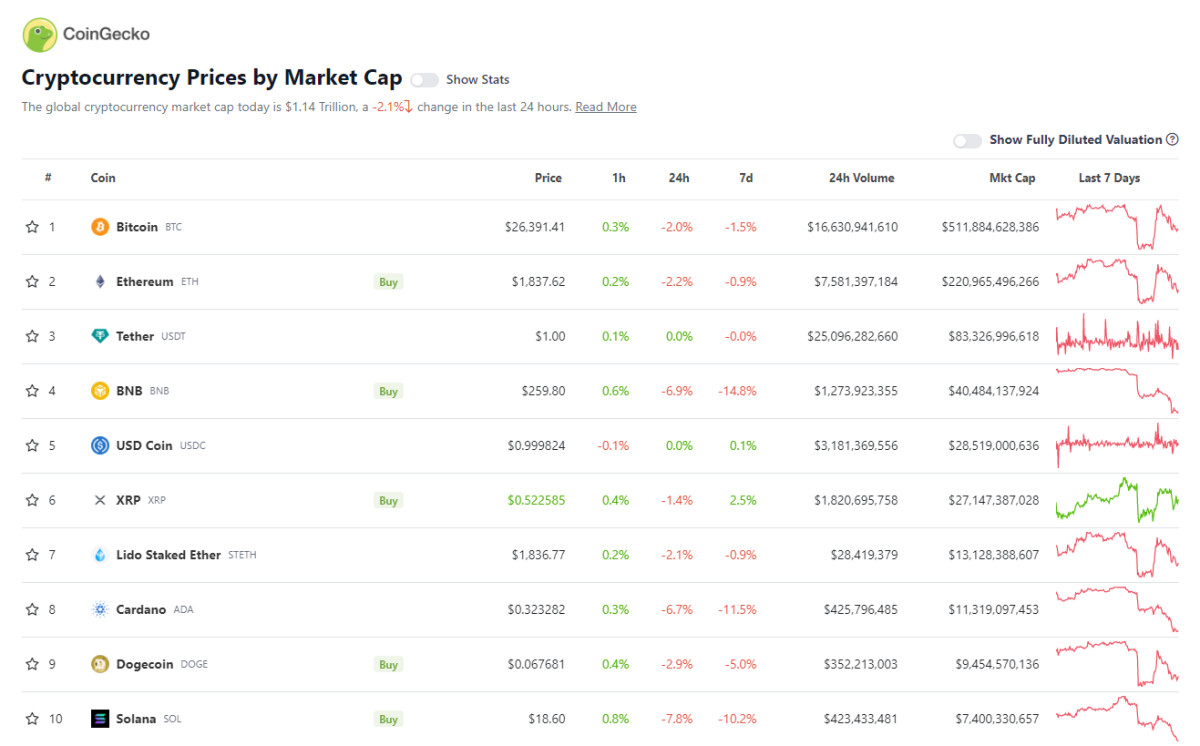

A list of the top cryptocurrencies by market cap can be found on websites like CoinGecko or CoinMarketCap.

Cryptocurrencies with higher market caps are considered more established and more widely adopted. Those with lower market caps may be new or have a smaller user base.

How to calculate the market cap of Bitcoin

Step 1: Find out the most current price of Bitcoin

Bitcoin at the time of writing is US$26,393.10. This is the price of one Bitcoin unit.

Step 2: Find the total number of Bitcoin units

You need to know the total number of Bitcoin units that exist. There are around 19,394,868.75 Bitcoins in circulation at the time of writing.

Step 3: Multiply the price by the total number of units

Now, we’ll multiply the price of one Bitcoin ($26,393.10) by the total number of Bitcoins (19,394,868.75) to calculate the market cap. Let’s do the maths:

Market Cap = Price per Bitcoin x Total Number of Bitcoins

Market Cap = $26,393.10 x 19,394,868.75

Step 4: Calculate the market cap

Market Cap ≈ US$511.9 billion

So, as of today with the given price, the market capitalisation of Bitcoin is approximately US$511.9 billion. This means that Bitcoin takes the crown as the number one cryptocurrency.

Keep in mind that the price of Bitcoin and the number of Bitcoins can change over time, so the market cap can also change.

Top Cryptocurrencies by Market Cap

1. Bitcoin (BTC)

Bitcoin was created in 2009 by an anonymous person or group of people using the name Satoshi Nakamoto. New Bitcoins are created through a process called mining, where powerful computers solve complex mathematical problems to keep the network in working order. Miners are rewarded with newly created Bitcoins for their work. There is a limited supply of Bitcoins that can ever be created, and it’s set at 21 million, so it’s considered scarce, like gold. In fact, it is often referred to as “digital gold.”

People use Bitcoin for various reasons. In some countries like El Salvador, it is legal tender and has just as much legitimacy as the US Dollar. Some people use Bitcoin as a way to store their money and protect it from inflation. Others use it for online purchases or as an investment.

2. Ethereum (ETH)

The Ethereum network was created in 2015 by Vitalik Buterin. Ethereum works in a slightly different way compared to Bitcoin. Bitcoin’s main purpose is to be used as money, but Ethereum is a platform that is used to build different types of applications. Developers can use the network to create smart contracts and decentralised applications, which are often referred to as “dApps.”

Smart contracts are computer programs that automatically execute certain actions when specific conditions are met. For example, imagine you want to sell a digital item, like a piece of artwork, and you want to make sure you get paid before sending it. With Ethereum’s smart contracts, you can set up a contract that automatically transfers ownership of the artwork to the buyer once the payment is confirmed. It removes the need for a middleman, like a bank or a lawyer, to handle the transaction.

People use Ether (ETH) to pay for services and transactions on the Ethereum network. It can also be used as an investment, just like Bitcoin. So even though a lot of people refer to Ethereum as a cryptocurrency, in fact Ethereum is the network, and Ether is the cryptocurrency.

3. Tether (USDT)

Tether is a bit different from other cryptocurrencies like Bitcoin or Ethereum. It is known as a “stablecoin.”

Stablecoins are designed to have a stable value, unlike other cryptocurrencies whose prices can go up and down wildly. The idea is to provide some stability and make them more reliable for everyday use.

Tether is a”fiat-backed” stablecoin. What that means is that each Tether is supposed to be backed by a real-world currency, like the US dollar. The idea is that for every Tether in circulation, there should be a dollar in a bank account somewhere to support it.

The purpose of Tether is to give people an easy way to use digital currencies that have a value similar to traditional money. It allows you to hold and send money electronically, just like using digital dollars. Some people find it helpful because it can be used on certain cryptocurrency exchanges to trade and move money quickly without having to go through regular banks.

However, it’s important to keep in mind that there has been some controversy and concerns around Tether. Some people have raised questions about whether Tether really has enough dollars to back up all the Tethers in circulation. So as always, do your own research.

4. BNB (BNB)

BNB, also known as Binance Coin, is a cryptocurrency that was created by crypto exchange Binance. It’s a little different from other cryptocurrencies like Bitcoin or Ethereum because it has a specific purpose within the Binance cryptocurrency exchange.

Binance is a popular platform where people can trade different cryptocurrencies, kind of like a digital marketplace. One of the main uses of BNB is to pay for trading fees on Binance. When you buy or sell cryptocurrencies on the platform, you usually have to pay a small fee. If you have some BNB, you can use it to pay for those fees, and sometimes you might even get a discount when you use BNB instead of other cryptocurrencies.

While BNB was initially created for use on the Binance platform, it can also be traded on other cryptocurrency exchanges, just like other cryptocurrencies.

5. USD Coin (USDC)

USD Coin (USDC) is a type of cryptocurrency that is designed to have a value equal to one United States dollar. It is another example of a stablecoin, and it aims to maintain a stable value, just like the dollar itself.

USDC was created to make it easier for people to use digital currencies in a way that is similar to using regular money. The idea is that for every USDC coin in existence, there should be a real US dollar held in a bank account to back it up.

The purpose of USDC is to allow people to quickly and easily move money between different platforms and exchanges without relying on traditional banks.

While USDC is designed to have a stable value, just like the dollar, its price can still fluctuate slightly. This is because the value of the dollar itself can change a little bit over time.

6. XRP (XRP)

XRP is a cryptocurrency that was created by a company called Ripple. It’s a little different from other cryptocurrencies like Bitcoin or Ethereum because it was designed with a specific purpose in mind.

Ripple, the company behind XRP, aims to make it easier and faster for people and institutions to send money across borders. XRP is used as a digital asset that helps facilitate these transactions. It acts as a bridge currency, which means it can be used to convert one type of currency into another during the transfer process.

The goal of XRP is to provide a way for banks and other financial institutions to make international money transfers more efficient and cost-effective. Ripple’s technology, called the RippleNet, enables these transactions to happen quickly and securely using XRP.

One of the main advantages of XRP is its speed. Traditional bank transfers can sometimes take several days, but using XRP, these transfers can happen in a matter of seconds. This could be particularly useful for cross-border payments or remittances, where people send money to their families in different countries.

It’s important to note that XRP is not just a cryptocurrency for individuals to buy and sell. Its main purpose is to be used within the Ripple network by banks and financial institutions. However, individuals can still buy and trade XRP on cryptocurrency exchanges if they want to.

7. Lido Staked Ether (STETH)

Lido Staked Ether (STETH) is a type of cryptocurrency that represents a special form of Ethereum called “staked Ether.”

When people stake Ether, it means they lock it up in a special process called “staking.” By doing this, they contribute their Ether to the Ethereum network to help secure and validate transactions. In return for staking Ether, they can earn rewards, like earning interest.

Lido Finance is a company that has created a service called Lido. Lido allows people to stake their Ether without needing to do it themselves. Instead, they can send their Ether to Lido, and Lido will stake it on their behalf. In exchange, Lido issues a token called Lido Staked Ether (STETH) to represent the staked Ether.

So, STETH is a cryptocurrency that represents the value of the Ether that users have staked through the Lido service. It’s like a digital token that shows you have staked Ether and can be used as a tradable asset.

The benefit of staking Ether and holding STETH is that you can earn rewards while contributing to the Ethereum network’s security. These rewards are typically in the form of additional Ether that you receive over time.

It’s important to note that staking comes with risks, as the value of staked Ether and STETH can still fluctuate.

8. Cardano (ADA)

The Cardano network was created with the goal of providing a more secure and sustainable platform for the development of decentralised applications (dApps) and smart contracts. It was designed to address the shortcomings of existing blockchain platforms, such as scalability, sustainability, and interoperability. It is a direct competitor to the Ethereum network. The Cardano (ADA) cryptocurrency is the native token of the Cardano network.

The project was founded by Charles Hoskinson, one of the co-founders of Ethereum, and his team at IOHK (Input Output Hong Kong). They recognised the need for a more scientifically driven approach to blockchain development and sought to create a platform that could support a wide range of applications while maintaining high security standards.

9. Dogecoin (DOGE)

Dogecoin (DOGE) is a cryptocurrency that started as a fun project. It was created in 2013 based on an internet meme featuring a Shiba Inu dog. Dogecoin quickly gained popularity and became one of the most well-known cryptocurrencies.

While Dogecoin initially started as a parody of other cryptocurrencies, but it gained a loyal following and community. People liked the idea of a cryptocurrency that didn’t take itself too seriously.

Similar to other cryptocurrencies, Dogecoin operates on a decentralised network called the blockchain. It allows people to send and receive Dogecoin as a form of digital currency. Some people use Dogecoin for online tipping, donations to charitable causes, or simply as a way to have fun and engage with the community.

10. Solana (SOL)

Solana is a blockchain platform and cryptocurrency that aims to provide fast and efficient solutions for decentralised applications (dApps) and financial transactions. It is another competitor for the Ethereum network.

Solana was created to address some of the limitations faced by other blockchain platforms, such as scalability and transaction speed. It focuses on achieving high performance to support a wide range of applications and transactions on its network.

One of Solana’s key features is its ability to process a large number of transactions quickly. It uses a unique technology called Proof of History (PoH) that helps order and validate transactions in a fast and efficient way. This enables Solana to handle thousands of transactions per second, which is significantly higher compared to some other blockchain networks.

But not all is well in paradise… the Solana has gone down several times recently, which lead to a price fall for the Solana cryptocurrency.

11. Polygon (MATIC)

Polygon is a blockchain platform that aims to enhance the scalability and usability of the Ethereum network. MATIC is the native cryptocurrency, and it is used to pay for gas fees on the network. Holders can also stake the MATIC for rewards. MATIC can also be used outside of the Polygon network.

Polygon is designed to address some of the challenges faced by Ethereum, such as high fees and slow transaction times. It provides a framework for building and connecting multiple blockchain networks, theoretically offering developers and users an improved experience.

One of the key features of Polygon is its ability to scale Ethereum. It achieves this by creating a network of interconnected sidechains, also known as “Polygon chains,” that can handle transactions faster and with lower fees compared to the Ethereum mainnet. This scalability allows for a more efficient and user-friendly experience for decentralised applications (dApps) and users.

Polygon also provides a range of tools and infrastructure to support developers in building dApps. It offers smart contract functionality, security features, and compatibility with existing Ethereum-based applications. This makes it easier for developers to create and deploy their projects on the Polygon network.

Polygon also focuses on interoperability, allowing for seamless communication and transfers of assets between different blockchain networks, including Ethereum. This opens up opportunities for cross-chain transactions and collaborations, enabling users to access a broader ecosystem of applications and services.

Polygon has gained popularity due to its ability to offer a faster and more cost-effective user experience compared to the Ethereum network. Many dApps and projects have migrated or expanded to Polygon to benefit from its scalability features.

12. TRON (TRX)

Tron (TRX) is a blockchain platform and cryptocurrency that aims to create a decentralised entertainment ecosystem. It was created by Justin Sun, a young entrepreneur, with the vision of revolutionising the way we consume and interact with digital content.

Tron focuses on providing a platform for content creators, such as musicians, artists, and video creators, to connect directly with their audience without intermediaries. It aims to remove the middlemen, like streaming services or app stores, and allow creators to have more control over their content and earn fair rewards for their work.

Tron has its native cryptocurrency called TRX, which is used for transactions within the Tron ecosystem. TRX can be used to support content creators by tipping them, purchasing digital goods, or accessing exclusive content.

13. Litecoin (LTC)

Litecoin (LTC) is a cryptocurrency that was created in 2011 by a computer scientist named Charlie Lee. It was designed to be a digital currency that is similar to Bitcoin but with some differences.

Litecoin operates on a decentralised network, similar to Bitcoin. One of the key differences between Litecoin and Bitcoin is the transaction confirmation time. Litecoin’s network is structured to process transactions faster than Bitcoin. This means that transactions can be confirmed and completed more quickly, making it more convenient for everyday use.

Litecoin also uses a different hashing algorithm than Bitcoin, called Scrypt. This algorithm makes it more accessible for individuals to mine Litecoin using regular computer hardware, compared to the specialised and more expensive equipment required for Bitcoin mining.

The goal of Litecoin, similar to other cryptocurrencies, is to be a digital form of money that can be used for various transactions.

Users appreciate Litecoin for its fast transaction times and lower fees compared to Bitcoin. It is also considered one of the well-established cryptocurrencies in the industry, having been around for more than a decade.

14. Polkadot (DOT)

Polkadot is a blockchain platform and cryptocurrency that aims to enable the interoperability and connectivity of multiple blockchain networks. It was created by Gavin Wood, one of the co-founders of the Ethereum blockchain.

Polkadot is designed to address one of the challenges faced by the blockchain industry: the lack of seamless communication and cooperation between different blockchains. It provides a framework for connecting various blockchains, allowing them to interact and share information securely.

In the Polkadot network, different blockchains are referred to as “parachains.” Each parachain can have its own unique features, governance rules, and functionality. These parachains can communicate and exchange data with each other through the Polkadot network, creating a connected ecosystem of blockchains.

By enabling multiple parachains to run in parallel, Polkadot can process a higher number of transactions compared to a single blockchain network. This scalability feature makes Polkadot attractive for developers and users who require a high-performance blockchain platform.

Polkadot allows token holders to participate in the decision-making process of the network. This means that people who hold the native cryptocurrency of Polkadot, called DOT, can have a say in network upgrades, protocol changes, and other governance matters.

15. Binance USD (BUSD)

Binance USD (BUSD) is a stablecoin, and is pegged to the value of the US dollar on a 1:1 basis. This means that for every BUSD token in circulation, there should be an equivalent amount of US dollars held in reserve.

BUSD is primarily used on the Binance exchange, one of the largest cryptocurrency exchanges globally. It serves as a means of facilitating trading and transactions within the Binance ecosystem. By using BUSD, users can quickly and securely move funds between different cryptocurrencies using its stable value.

One of the benefits of using a stablecoin like BUSD is that it offers a level of stability compared to other cryptocurrencies that can experience significant price volatility. This stability can make it more suitable for everyday transactions and as a store of value.

Stablecoins like BUSD are not entirely risk-free. The stability relies on the trustworthiness and transparency of the entity managing the stablecoin and the reserves backing it.

16. Avalanche (AVAX)

Avalanche (AVAX) is a blockchain platform and cryptocurrency that aims to provide a fast, secure, and highly scalable infrastructure for decentralised applications (dApps) and financial transactions. It is yet another competitor of Ethereum.

Avalanche was created to address the limitations of existing blockchain platforms, such as high fees, slow transaction times, and scalability challenges.

Avalanche can process transactions quickly, making it well-suited for applications that require fast and responsive transactions.

The native cryptocurrency of Avalanche is called AVAX. AVAX is used for various purposes within the network, including paying for transaction fees, participating in network governance, and securing the network through staking.

17. Shiba Inu (SHIB)

Shiba Inu (SHIB) is a cryptocurrency that is named after the Shiba Inu dog breed, which is a popular dog breed in Japan. It is one of the most famous memecoins in the crypto world, after Dogecoin and Pepe Coin.

Shiba Inu aims to create a community-driven ecosystem where people can participate in activities like trading, holding, and interacting with the SHIB token. Some people are attracted to Shiba Inu because they find the project fun and enjoy being part of an enthusiastic community.

Shiba Inu and other similar meme-inspired cryptocurrencies can be highly speculative and come with significant risks. Their prices can be very volatile.

18. Dai (DAI)

Dai is another stablecoin; it is Ethereum-based and aims to provide stability and decentralised control within the cryptocurrency ecosystem. Unlike other stablecoins that rely on a centralised entity to maintain the pegged value, Dai uses smart contracts and algorithms to ensure stability.

The value of Dai is pegged to the US dollar, aiming to maintain a 1:1 ratio. This means that for every Dai token in circulation, there should be an equivalent amount of collateral held in the form of other cryptocurrencies or digital assets. The smart contracts ensure that the value of Dai remains stable by automatically adjusting the supply based on market demand.

Dai is often used as a medium of exchange in decentralised applications (dApps) and platforms within the Ethereum ecosystem. It enables users to transact and hold a cryptocurrency with a stable value, making it more suitable for everyday use and reducing exposure to price volatility.

One of the key features of Dai is its decentralised nature. It is not controlled by any central authority or company, which means that no single entity has complete control over its supply or value. This decentralisation provides transparency and removes the need to rely on a centralised entity for stability.

19. Wrapped Bitcoin (WBTC)

Wrapped Bitcoin (WBTC) is a type of cryptocurrency that represents Bitcoin (BTC) on the Ethereum blockchain.

Bitcoin operates on its own blockchain network and is widely accepted as a digital store of value and a medium of exchange. However, the Ethereum blockchain has its own ecosystem of decentralised applications (dApps) and smart contracts.

Wrapped Bitcoin was created to bring the value and utility of Bitcoin to the Ethereum network. It allows Bitcoin to be used within the Ethereum ecosystem by “wrapping” it. When Bitcoin is wrapped, it is locked in a smart contract, and an equivalent amount of Wrapped Bitcoin (WBTC) tokens are minted on the Ethereum blockchain.

The purpose of Wrapped Bitcoin is to enable users to access the benefits of Bitcoin while taking advantage of the functionalities and applications available on the Ethereum blockchain. For example, WBTC can be used as collateral for borrowing or lending in decentralised finance (DeFi) applications, traded on decentralised exchanges, or integrated into other Ethereum-based dApps.

20. Uniswap (UNI)

Uniswap (UNI) is a decentralised cryptocurrency exchange built on the Ethereum blockchain. It allows users to trade various cryptocurrencies directly from their digital wallets without the need for a traditional intermediary like a centralised exchange.

Uniswap operates on the concept of automated market making (AMM). Instead of relying on order books and matching buyers with sellers, Uniswap uses liquidity pools and smart contracts to facilitate trading. These liquidity pools consist of pairs of tokens, and users can trade between these token pairs.

For example, if you want to trade Ethereum (ETH) for another cryptocurrency like DAI, you can find the ETH-DAI liquidity pool on Uniswap. The liquidity pool holds a certain amount of ETH and DAI provided by users who want to earn fees by contributing to the pool.

When you make a trade, the smart contract automatically calculates the exchange rate based on the available tokens in the pool.

Uniswap also introduced its own governance token called UNI. UNI holders can participate in the decision-making process of the Uniswap protocol, including proposing and voting on protocol upgrades, fee changes, and other governance matters. UNI tokens are earned by users who have interacted with the Uniswap platform, such as trading or providing liquidity.

Uniswap has gained popularity due to its decentralised and user-friendly nature. It enables peer-to-peer trading, offers a wide range of cryptocurrency pairs, and provides access to liquidity for various tokens. Additionally, it allows anyone to create liquidity pools for new tokens, increasing the availability of trading options.