Any time a crypto holder buys or sells a cryptocurrency in a financial year, or even swaps one crypto for another, this must be reported to the Australian Tax Office (ATO). The same goes for non-fungible tokens (NFTs).

This means that we crypto people need to start keeping records, ready to be handed to the ATO at the end of every financial year.

Not everyone in Australia even understands that crypto holders are supposed to report their crypto trades and swaps to the ATO. In fact, according to a new survey by crypto tax software company Koinly, 15% (or almost 1 in 7) people surveyed who held crypto were clueless that it was even a thing to report their activities to the ATO.

Another interesting info nugget was that even though many crypto holders know that they are required to report their crypto activity to the ATO, they simply just don’t do it.

The ATO emphasises record-keeping as being important but it’s not always easy to produce the extensive evidence required for crypto when it comes to tax.

Crypto tax software

Koinly recently did a deal with Australian crypto exchange Swyftx so Swyftx users can keep records automatically. The deal means that Swyftx users will get access to Koinly’s crypto tax reporting platform. Users can then generate tax reports directly from Swyftx accounts. This will be free for up to 500 transactions.

The Treasury will be happy too. COO at Swyftx, Jason Titman, said that Bitcoin’s price jump in the 2022-2023 financial year will lead to the Treasury scoring a crypto tax windfall. “A significant proportion of crypto traders make hundreds of investments over the financial year and a lot of our active traders since January will have realised capital gains. Keeping track of multiple trades can be daunting, but it’s enormously important crypto users don’t bury their heads in the sand.”

Women and crypto

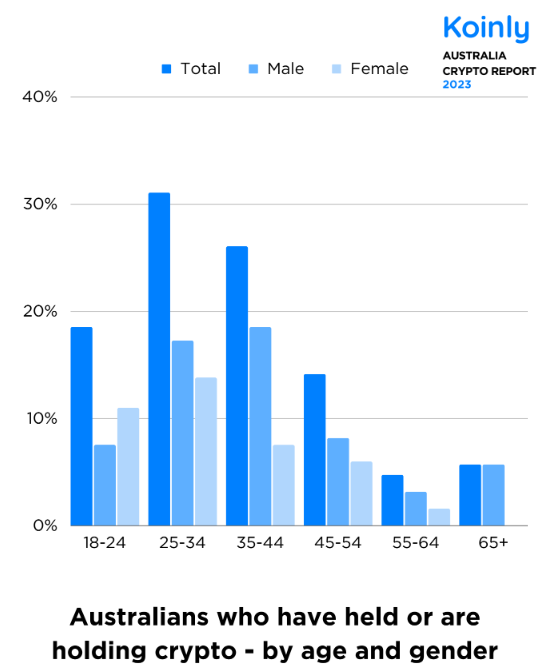

Lads, catch up. Australian women aged 18-24 own more crypto than you. The survey mentioned above has also shown that Australian women aged between 18 and 24 are more likely to be holding cryptocurrencies than Aussie men.

While the women don’t dominate in the same way across the rest of the demographic categories, it is an interesting statistical breakout.

The survey also showed that cryptocurrency is a lot more popular than most people would think. In fact, 31.6% of Australians currency hold crypto or have held cryptocurrencies in the past some time. That is nearly one in three of us. So if you are in a throuple, then chances are good that one of you can pay for snacks on your Bitcoin Island holiday.

Tax and crypto holders

Who in Australia is most likely to hold cryptocurrency? Millennials (aged 25-44). 57% of them hold crypto, more than any other demographic. This is probably because they love to spend their disposable income, being the biggest spending generation. They value experiences and lifestyle, so the crypto culture is apparently in!

NFTs and investor sentiment

According to a separate survey by Koinly, Australians who bought NFTs owned an average of 97 non-fungible tokens. 97 seems like a lot!

The rise and fall of non-fungible tokens (NFTs) have gotten a lot of coverage in the media recently. These unique digital assets have sparked excitement and controversy. Many people lost money on NFTs when the market crashed in 2021, and according to the survey, 100% of people who sold their NFTs did so at a loss for tax reasons.

‘Tax loss harvesting’ is a strategy used by investors to reduce their tax liabilities. That is, NFT buyers sold their NFTs at a loss, and used these losses to reduce the amount of taxes they have to pay on their overall investment profits.

Of those Australians still holding their NFTs, they said they don’t plan on selling them any time soon. And, half of these people plan to buy more NFTs in the future. The main driver of this purchasing decision is around how useful an NFT is to them. For example, some NFT tickets to concerts also have ‘extra benefits’ like access to VIP areas.