Following the incredible collapse of FTX — which saw the world’s fourth-largest crypto exchange capitulate from US$32 billion to zero in just five days — concerns over the safety of funds held on centralised exchanges (CEX) have become the focal point of commentary in the crypto space.

The Chainsaw conducted some research and launched a deep dive into which crypto exchanges seem most likely to tread a similar path to FTX. Each breakdown finishes up with a ‘Dumpster Fire Rating’ where the shadiness of each exchange earns a score ranked out of 5 (with 5 being the worst).

Crypto Exchanges: Likely to fail

Lets dig in to which crypto exchanges

Crypto.com has some questions to answer

Despite the CEO of Crypto.com CEO Kris Marszalek saying that anyone criticising the financial wellbeing of the platform is “spreading FUD” (fear, uncertainty and doubt) there may be good reason to think that the numbers at Crypto.com aren’t quite right …

The most recent cause for concern comes from a suspicious $400M transaction being brought to light. Strangely, Marszalek claimed that the transfer, which saw 320,000 ETH transferred to rival exchange Gate.io, was an “accident”.

Even if Marszalek is being completely truthful and the transfer wasn’t an attempt of bolstering the books for a subsequent “proof of reserves” attestation, it’s worrying to think that one of the world’s largest cryptocurrency exchanges would make any kind of mistake where 320,000 ETH goes to the wrong address.

Many critics have made the case that it’s far more likely that Crypto.com intentionally transferred the $400M worth of ETH to Gate.io so that the exchange could bolster its proof of reserves before releasing its attestation.

Long story short, this suspicious activity has led to a mass of withdrawals from the Crypto.com exchange, suggesting that people are scrambling to remove their funds from the platform. While Marszalek has tempered fears by tweeting that: “withdrawals are still processing”, simply being able to process transactions isn’t the most comforting metric to be using to claim that Crypto.com is actually alright.

Crypto Exchanges: Crypto.com’s fall from grace

Outside of Crypto.com’s unfortunate series of accounting mistakes, things at the Singapore-based crypto exchange have been going from bad to worse for some time now. In August, Crypto.com got caught out lying about the number of employees it laid off. Initially the exchange claimed just 265 employees would be fired, however sources discovered that more than 1,000 employees were fired in the following weeks.

More recently, Crypto.com has notably withdrawn from multiple major sponsorship deals. In early-September, the exchange pulled the plug on a US$495 million deal with the UEFA Champions League. In October, Crypto.com backed out of a series of major multi-million-dollar deals with Angel City Football Club, the 2022 FIFA World Cup and Twitch Rivals.

All of this is to say that many of the notable people, including Ben ‘BitBoy’ Armstrong, who have shared their concerns about Crypto.com, seem to have a host of good reasons behind their sceptical treatment of the exchange.

DUMPSTER FIRE RATING: 🔥🔥🔥🔥🔥

Gate.io tells their side of the story

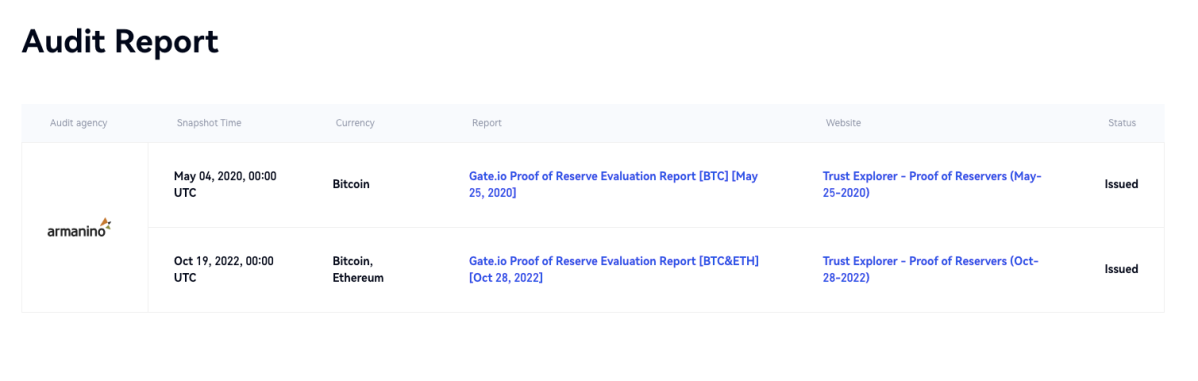

Gate.io has since released their Proof of Reserves statement, which was technically unveiled more than one week after Crypto.com’s mistake sent them $400M.

Then, Gate.io founder Lin Han took to Twitter to brush the dirt from Gate.io’s name. Han provided a screenshot from the Gate.io website, which clearly shows that the “snapshot” used to audit the crypto exchange was taken two days before Crypto.com’s accidental transfer of 320,000 ETH ever hit their books.

Gate.io has since released a public statement on the matter, but with post-FTX paranoia at all time highs, many users remain unconvinced of Gate.io’s legitimacy.

“It doesn’t matter how hard you try to explain, this smells fishy and the people lost the trust of mostly all exchanges. This will be the rise of self-custodial wallets,” wrote one user in the comments section.

DUMPSTER FIRE RATING: 🔥🔥

Huobi gets put under the microscope

It isn’t just Crypto.com and Gate.io that have been linked with some shady “accidents” when it comes to moving funds around. Hong-Kong based cryptocurrency exchange Huobi was recently called out for manipulating their own Proof of Reserves.

Popular blockchain analyst Wu Blockchain reported that after Huobi released the snapshots of its asset reserve, 10,000 ETH was transferred from Huobi’s wallet to addresses associated with Binance and OKX.

Crypto Exchanges: Borderline

A further risk that Huobi users face is that the exchange recently admitted that roughly US$18.1 million of its funds are currently stuck on the FTX exchange and cannot be withdrawn. According to Huobi, US$13.2 million consists of clients’ deposits and US$4.9 million are assets belonging to Hbit, a subsidiary company of Huobi.

Huobi, the 20th largest crypto exchange in the world, has since announced that it will take out a loan of US$14 million to cover customer funds. Regardless, the fact that Huobi has multiple discrepancies on their books in regards to Proof of Reserves and still currently-unresolved exposure to FTX should be a warning signal to all Huobi users and crypto investors.

DUMPSTER FIRE RATING: 🔥🔥🔥🔥

AAX shuts down for 10 days of “maintenance”

Another giant exchange that makes the cut for this list is Hong Kong-based AAX. While many crypto users may not be aware of AAX, the platform claims to have 2 million users across 100 different countries.

Now the exchange has suspended all withdrawals from its platform for up to 10 days, claiming that it’s due to a “scheduled system upgrade”. In a statement on Twitter, AAX’s vice president Ben Caselin said that the upgrade came at a “bad time” but was being undertaken to address “serious vulnerabilities” in the AAX security system.

What makes this suspicious is that there was reportedly no notice given to users before the maintenance went through, nor did AAX attempt to explain the “serious vulnerabilities” the upgrade was being implemented to fix.

In a further statement to Bloomberg, Caselin added that the FTX situation has put immense pressure on exchanges everywhere with users “nervous about exchange holdings”. He added, “It’s my observation this can be resolved in a few days, although rebuilding market confidence may take months”.

Ultimately, AAX’s move here is unquestionably strange and sceptics would be right in questioning the legitimacy of the statements made by AAX. There was no notice provided to users and healthy platforms do not need to shut down operations for more than a week to implement security upgrades.

DUMPSTER FIRE RATING: 🔥🔥🔥

Final verdict

Understandably, the idea that multiple exchanges may be sharing funds, manipulating the numbers on their books, and shutting down operations to hide unsavoury financial information has made many crypto investors wary of centralised exchanges.

While there’s no guarantee that any of these exchanges will go belly up in the coming days like FTX did, it’s worth approaching any institution that’s “accidentally” moving hundreds of millions of dollars or shutting down for weeks with no explanation with a healthy dose of scepticism.

To sum it all up, Binance CEO Changpeng Zhao said it best:

“If an exchange [has] to move large amounts of crypto before or after they demonstrate their wallet addresses, it is a clear sign of problems. Stay away. Stay SAFU”.

Binance CEO, Changpeng Zhao