An extremely suspicious transfer of funds has come to light after Crypto.com CEO Kris Maszalek publicly admitted that the Singapore-based Crypto.com exchange “accidentally” transferred 320,000 ETH (approximately US$400 million at the time) to a wallet address associated with a competitor exchange.

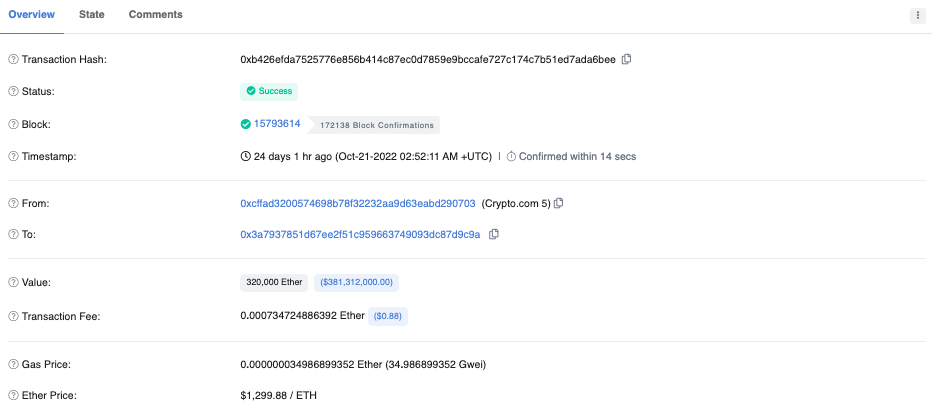

Transaction records from blockchain search tool Etherscan, show that Crypto.com sent the 320,000 ETH to a rival exchange Gate.io on October 21 just one week before it published its proof of reserves documents.

‘Proof of reserves’ are a public statement from an exchange that shows what amount of digital currency it holds on its books. The fallout from FTX has put centralised exchanges under a microscope, leading to calls from all corners for exchanges to publish proof of reserves..

What makes this even more insidious is that Gate.io then returned 285,000 ETH, (roughly US$450 million) eight days later on October 29. Just two days ago, on November 12, Crypto.com released its own proof of reserves.

Crypto.com accident

Strangely, Maszalek tried to claim that the transfer was actually a “mistake”, explaining that the funds had accidentally been sent to their rival’s account instead of Crypto.com’s own cold storage.

“It was supposed to be a move to a new cold storage address, but was sent to a whitelisted external exchange address,” Marszalek explained in a response to Crypto personality, ‘Ledger’.

Apart from wondering what would have happened if the money was transferred to someone who didn’t willingly give it back, it seems unlikely that a “mistake” of this size could happen with such an enormous sum of money.

Then again, it wouldn’t be the first time Crypto.com sent the wrong person a ridiculous amount of money. In May 2021, Crypto.com accidentally sent a Melbourne woman US$10 million instead of US$100 in a refund gone wrong. It took the exchange nearly eight months to realise the money was actually missing.

Are exchanges faking ‘proof of reserves’?

Put quite simply, this transaction data appears to suggest that major exchanges seem to be rotating large sums of capital between each other to bolster their ‘proof of Reserves’ documentation. If true, the implication is that the real amount of money on the Crypto.com or Gate.io exchange may be far lower than once thought.

Understandably this transaction data combined with Marszalek’s unconvincing explanation has spooked Crypto.com users, who at the time of writing, are rushing in droves to withdraw their funds from the Crypto.com platform.

In the last few hours more than 89,000 unique transactions have been processed with regards to wallets associated with the Crypto.com exchange.

Parallels are being drawn between FTX, which saw a mass of customer withdrawals drive it into bankruptcy within a few days. Now, many critics and commentators are sharing the same concerns for Crypto.com. The crypto.com accident is food for thought.

At the time of writing the platform’s native token CRO is changing hands for just US$0.05, down more than 50% from US$0.12 a few days ago.