Invest in Bitcoin: Bitcoin (BTC) is unique. It’s not only the first virtual currency; it’s also the only scarce digital currency. Since launching in 2009, Bitcoin’s decentralization principles threaten the supremacy of financial institutions, causing central banks and financial regulators not to back cryptocurrency. Despite the undecidedness, many individuals and corporations like PayPal and Microsoft are investing in Bitcoin — in 2020, Bitcoin’s on-chain transaction volume hit $1 trillion, 64 billion more than PayPal’s transaction sum in the same year.

Like every traditional asset, investing in Bitcoin isn’t a walk in the park: you need to understand the market to make informed investment decisions. This primer is your window to understanding how to invest in Bitcoin.

What is Bitcoin?

Bitcoin is a virtual currency. Like stocks, you can invest in bitcoin for greater yields because of its limited supply — only 21 million BTC are available. BTC profits typically favour long-term investors who HODL (“hold on for dear life”) BTC.

Ben Gagnon, Chief Mining Officer at Bitfarms, explains that HODL is a mentality approach that helps investors navigate the volatile crypto market. “To HODL is an acknowledgment that while a lot of money can be made trading short-term volatility, a lot of money can be easily lost.” The difference, Ben stresses, is that HODL encourages investors not to “throw in the towel” when crypto prices fall or cash out when crypto prices rise.

Given BTC is in its price discovery era, its price continues to fluctuate. Since the HODL forum launched in 2013, BTC prices have increased by 2,500%, according to Forbes. Notwithstanding the price surge, it has suffered price dips in recent years. For example, BTC prices fell from $29,000 to $4,000 in March 2020. Now at $16,000, Bitcoin has lost over 50% of the record-high $69,000 it reached in November 2021.

How does Bitcoin work?

Although the identity of bitcoin creator Satoshi Nakamoto remains a mystery, its working principles aren’t as murky. Fundamentally, bitcoin isn’t tied to any central source — it’s based on a decentralised virtual network where users can conduct peer-to-peer (P2P) transactions on a “block.” Every block contains a unique fingerprint (also called a “hash”) for security. Blockchain, like the name, is a distributed chain of blocks containing records and data of every transaction. It’s like recording transactions on a ledger system, but with the blockchain, every data you enter is encrypted to prevent alteration and it’s visible to everyone.

In 2016, Williams Mougayar — the author of The Business Blockchain — likened bitcoin’s decentralised system to using Google Docs. Similar to Google Docs, the blockchain has public-visibility-but-private-inspection characteristics where anyone can contribute, but nobody owns it. The blockchain has single entries for every transaction you conduct, and only authorised users can validate blocks through a proof-of-work consensus.

In this instance, the blockchain is like revealing your home address publicly — no one will know what your home looks like unless you give them the private keys.

How to buy Bitcoin

You need third-party platforms to buy or invest in bitcoin (or any cryptocurrency). Brokers and crypto exchanges are intermediate platforms for trading BTC. Brokers are middle-persons that set the price for BTC transactions. They also provide user-friendly interfaces and low or free transaction fees. This is why brokers are suited for newbie BTC holders and small-scale investors. Coinbase and Kraken are popular broker platforms for Bitcoin trading.

Contrary, crypto exchanges connect buyers and sellers for bitcoin transactions at the market rate. It’s suitable for experienced crypto users and large-scale bitcoin investments. Coinbase and Bybit are examples.

How to invest in Bitcoin: Alternative methods

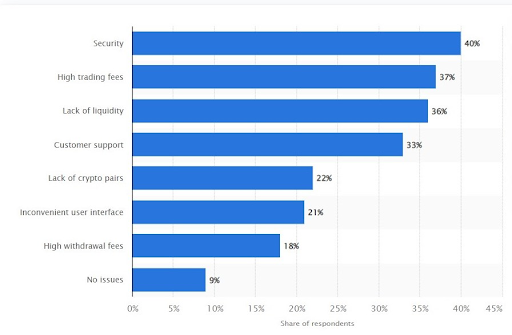

Using brokers and crypto exchanges come with security risks. For example, since 2018, over $1860 is stolen every minute from crypto platforms. Besides, you’re also likely to have complicated user interfaces, high trading fees, and withdrawal fee issues with crypto platforms, according to Statista.

If the challenges make you skeptical about using online trading platforms, consider Crypto Exchange-Traded Funds (or Crypto ETFs). Crypto ETFs allow you to invest in Bitcoin through diverse digital assets, such as decentralized apps (dApps) and Non-fungible tokens (NFTs). Unlike intermediary platforms, you can invest in digital assets across several industries without ownership costs to edge out volatile markets.

ETFs are suitable for novice Bitcoin investors because they don’t need to know the technical details about cryptocurrency exchange investments — ETFs provide analysts that handle the investment aspect. They also face tight regulatory policies to prevent security breaches — external companies verify every ETF investment.

Cash services like Paypal, Venmo, and Cash App also offer P2P for buying, selling, and holding bitcoin. Unlike traditional exchanges, cash services are easier to navigate, especially for new Bitcoin traders. But cash services don’t give you full control over Bitcoin like traditional crypto platforms. For example, you can’t transfer the crypto in your PayPal to another account or wallet.

What do you need to invest in Bitcoin?

Before investing in bitcoin, you must cross the checklists listed below.

Select the exchange or broker platform that suits you

Security, transaction fees, platform liquidity, and technology (i.e., user-friendliness of the app) are factors you should consider before selecting the trading platform. After selecting your preferred trading platform, the registration process usually involves filling in your personal details (e.g., name, email, and contact) and account details before you start trading.

Select your storage options

Trading platforms often provide custodial wallets for BTC storage. But if you’re uncomfortable with storing your digital currency online, consider using hardware wallets. They’re physical devices (usually Bluetooth or USB devices) that keep your BTC in “cold” storage.

Technically, hardware wallets don’t store your BTC. Instead, it saves the keys — the long, alphanumeric code — you need to access your BTC. Unlike software-based or hot wallets, which connect permanently to the internet, hardware wallets connect to the internet when you need to conduct a transaction. As a result, they’re highly secure for BTC storage. Trezor One, the first maker of BTC hardware wallets, Ledger, and Metamask are prominent BTC digital wallets that provide cold storage.

How to invest in bitcoin in Australia

Currently, BTC isn’t a legal tender in Australia. However, while you can’t use it to meet financial obligations like tax payments, you can invest in Bitcoin or use it as a form of payment. For instance, the online travel agency CheapAir allows customers to book flights using BTC. Likewise, the online electronics store Zumi accepts BTC payments. If you’re looking to invest in Australia, the following steps will guide you.

Select the platform

Every crypto investment starts with choosing the right platform. The platform allows you to exchange BTC for other cryptocurrencies or fiat currencies (like the Australian Dollar).

Apart from platform efficiency, the key metric you should consider before your trading platform is regulation. Platforms regulated by the Australian Securities & Investments Commission (ASIC) offer more security. eToro and Coinspot are popular Australian exchanges that comply with ASIC regulations.

Create an account

After choosing your preferred platform, create an account to invest in BTC.

Deposit cash

Wallet funding is the next step after account verification. Generally, you can fund your wallet through a credit or debit card, bank transfer, or PayPal (the specifics of account funding depend on trading platforms). But if you’re paying with your card, consider credit card security policies before releasing your details to avoid security breaches. Start transacting BTC once you’ve funded your account.

Select where to store your BTC

Many brokers and exchanges offer storage options. But only a few exchange platforms are regulated in Australia. Unless you have secure out-of-exchange storage like hot wallets, you’re one hack or theft away from losing your BTC.

Hot wallets are online vaults for storing digital assets. You can access them from any location with an internet connection. Like hardware wallets, they provide convenient and secure access to your BTC. But hot wallets are usually free or less expensive compared with hardware wallets, which typically cost $50-$250. Coinbase, which is regulated in the US and operates in Australia, provides hot wallet storage.

Where to invest BTC

Nakamoto’s original Bitcoin idea was about improving P2P e-commerce outside the monitoring eyes of financial institutions. But the growth of Web3 and blockchain have opened more Bitcoin investment possibilities. This section will address other ways you can invest in BTC.

The metaverse

At its core, the metaverse is a blockchain-powered system that connects Web3 technologies. As such, crypto and BTC are “natural legal tender” of the metaverse economy. In essence, BTC is to the metaverse what fiat currencies are to the traditional market. Crypto coins and metaverse tokens are used to conduct transactions and invest in metaverse projects.

Crypto metaverse investments are already popular in the gaming industry where selected companies (e.g., Decentraland and The Sandbox) allow gamers to use platform-specific tokens for digital transactions.

DAO investment

Decentralized Autonomous Organizations (DAOs) are the blockchain’s answer to decentralised decision-making (governance) and community. Built on the altars of decentralisation and cryptocurrency, DAOs allow investors to execute shared goals. In the DAO sphere, crypto enables investors to buy governance tokens for voting and policy contributions.

For instance, MODA DAO — a music DAO — claims their MODA token ($MODA) allows holders to “interact with Music3 technology, apply for grants, back artists, back songs, and generate income.” Similarly, in 2021, US-based record label Leaving Records (LR) launched the Genre DAO token ($GENRE), which anyone with a crypto wallet can purchase for free on LR’s public Discord server. According to LR, the token is a “symbol of LR growth … a governance token, currency to buy NFT, [and] a utility to unlock token-gated experiences.”

Crypto futures and spot trading

If you’re big on predicting the future, crypto futures are an investment option you should consider. It allows investors to bet on future Bitcoin prices at a pre-agreed date without holding the asset. Moreover, futures allow BTC holders to sell their assets at or before the contract due date. For instance, a trader can decide to sell BTC on 25 January 2023 at a set price. Suppose the current BTC price is $20,000, and any buyer pre-agrees with the future price at $45,000; the owner of the contract will make a profit if the price of BTC increases.

Crypto futures is a speculative investment method that often uses fundamental analysis — internal and external factors that affect the price of assets — and technical analysis, mathematical indicators predicting the crypto markets, to determine crypto prices.

In contrast, spot trading is transacting crypto assets at the current (or spot) market price. In spot trading, the goal is to buy crypto assets (usually at a low market price) and sell at a higher price for profit at a later stage. Neither crypto futures nor spot trading guarantees profits, but spot trading allows you to invest in assets for long periods to generate profits.

The pros of bitcoin investment

Borderless transactions

Unlike traditional payment systems, Bitcoin transactions are free from centralised interference. It’s accessible to everyone using the blockchain. Blockchain also offers better transparency because it records every transaction you conduct.

Potential longer-term rewards

Bitcoin rewards follow the “when it rains, it pours” principle. Bitcoin prices inherently depend on blockchain infrastructure, rather than any specific currency, and the supply-demand value per time. In recent years, Bitcoin prices have been growing steadily (like the growth seen in Feb-July 2019 in the Statista graph below), which is good news for investors.

Invest in Bitcoin: Investment opportunities

Bitcoin investment opportunities continue to grow as technology grows. A few years ago, metaverse commerce was as good as fiction. But that’s no longer the case — besides trading on exchanges, you can invest in company stocks, creators’ economies and DAOs, or crypto ETFs. The investment possibilities aren’t slowing down.

Cons of investing in Bitcoin

Investing in bitcoin has downsides too. Here are a few you should know.

Security

Hackers often target crypto-related platforms. In October 2022, Chainalysis reported that crypto hacking will set new hacking records.

Lack of regulatory bodies

There’s an argument that decentralisation is bitcoin’s greatest strength and undoing. While decentralisation makes transactions seamless, a lack of regulatory bodies means if (and when) transactions go south, it’ll go really south. The recent FTX fiasco is a case in point.

Price volatility

BTC is a scarce currency — only 19 million BTC are in circulation as of June 2022. BTC scarcity and lack of central regulation make its prices vulnerable to external market events. For instance, in May 2021, BTC prices fell by 5% shortly after Tesla suspended BTC payments.

Invest in Bitcoin: Tips for investing in BTC

Bitcoin investments come with risks and rewards. But understanding the crypto trading market will help you make more profits than losses. Therefore, we compiled tips to consider before investing in bitcoin.

Do your homework

“If you fail to plan, then you’re planning to fail” holds in crypto trading. Before investing in Bitcoin or altcoins, analyse the investment strategy that fits your objectives. This includes understanding the exchange platforms and their shortcomings and market conditions. Doing your research (DYOR) doesn’t guarantee profits, but it will help prepare you for the risks.

Think long-term

Many crypto holders have unrealistic expectations about BTC returns because of their “get rich quick” approach. While Bitcoin is over a decade old, its price depends on market conditions, demand-supply rate, and external events like China’s recent riot. But long-term investments could likely give better returns because it’ll give you time to edge the market instabilities.

Prioritise value

Warren Buffet’s financial counsels are worth their weight in Bitcoin. In his 2008 op-ed for the New York Times, he explained that his investment tactic rests on the sentiment “Be fearful when others are greedy, and be greedy when others are fearful.”

Bitcoin investors can take a leaf out of Warren’s playbook: prioritise value investments.

Invest in Bitcoin: Is investing in Bitcoin worth it?

The simple answer is “it depends.” Bitcoin prices are as unstable as water. Between May 2016 ($500) and May 2022 ($38,000), 1 BTC price increased by almost 600%. However, the price surge doesn’t tell the complete story. In November 2021, BTC reached a record-breaking $69,000 before dropping below $20,000 in November 2022, shortly after the recent FTX debacle, which proves the effect of external market conditions on BTC prices.

Strictly judging from the price data, bitcoin investments are volatile. This is why Tori Dunlap, the founder of Her First $100K, argued that investors “should maybe be OK losing … money” because “these [Bitcoin investments] are still speculative.”

You’re better off with long-term investments because they’ll help you withstand the fluctuations. The unwritten rule of thumb is to invest less than 5% of your crypto portfolio or less than 2% of your worth. Vrishin Subramaniam (CapitalWe founder) believes “2 to 3% is usually what we see for most clients who are not tracking crypto markets more than once a week.” The consensus is that little investments, at least for a start, provide room to navigate unstable market prices.