Simply put, altcoins are defined as any cryptocurrency other than Bitcoin.

According to Coinmarketcap, there are over 21,000 crypto tokens in existence, all of which are altcoins, except for one. Some are attempts to replicate Bitcoin or Ethereum, except for minor alterations. Many have little to no utility or are obvious scams. Others yet however have expanded into multi-billion dollar ecosystems. For those new to the cryptocurrency space, it can be somewhat overwhelming given the sheer amount of tokens in existence – how does one go about understanding what appears to be the Wild West of finance?

In this overview, we’ll get back to basics and explain what it is all about from the ground up.

What are altcoins?

An altcoin, short for ‘alternate coin’, is the name given to any cryptocurrency other than Bitcoin. Bitcoin is the original cryptocurrency created in 2009 and all other tokens or ‘altcoins’ either aim to compete with it or do something completely different.

When it comes to those who have attempted to replicate a cryptocurrency save for some key differences, that is known as a ‘hard fork’. It’s akin to disagreeing on the fundamental rules of the game and creating a new different one. For example, Bitcoin Cash and Litecoin are two examples of hard forks of Bitcoin because they both wanted to make changes to Bitcoin’s fundamental code.

Now for a little bit of blockchain design 101, which will provide the technical underpinning for an introductory understanding of altcoin architecture.

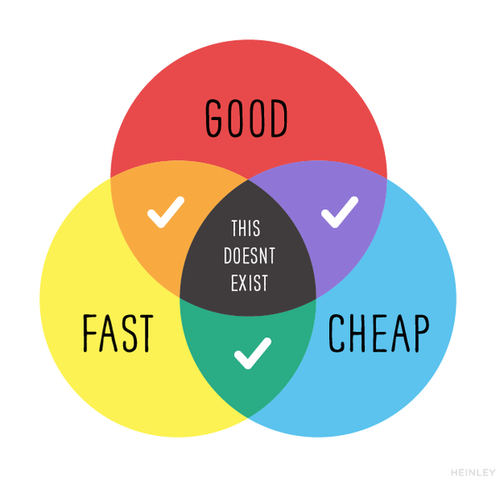

Blockchains technology – the backbone of all cryptocurrencies – necessarily requires developers to engage with a phenomenon known as the ‘Blockchain Trilemma’. It’s not as difficult a concept to grasp as it sounds. It goes like this – a blockchain can only optimise for two of the following three characteristics:

- speed;

- decentralisation; and

- security.

Bitcoin is optimised for decentralisation and security, and that comes at the cost of speed. By contrast, Solana optimises for speed and security, however this makes it inherently more centralised. To draw an analogy, let’s say you’re in the software business and you build solutions for customers. While they want everything at the cheapest cost ready tomorrow, there are innate compromises between the quality, speed and cost. You can only optimise for two of the three.

Altcoin – consensus mechanism

In addition, each blockchain has a ‘consensus mechanism’, which is the manner in which the network reaches agreement on the state of the blockchain. In other words, how do validators who run a copy of the distributed ledger agree on the transaction history and future state? Proof-of-Work (PoW) and Proof-of-Stake (PoS) are the most well-known consensus mechanisms.

Importantly, every cryptocurrency (and by extension, altcoin) is designed with these parameters in mind – each has different trade-offs relating to the Blockchain Trilemma and its consensus mechanism. This forms the main basis upon which tokens seek to distinguish and market themselves.

Altcoin projects cover a diverse range of blockchain products – from decentralised finance (DeFi) and gaming to NFTs and the metaverse. Some have created entirely new blockchains, whilst others have built on existing blockchains to provide new financial products (as is the case with DeFi).

With a little technical knowledge and a plethora of white label products, those with enough time and energy could create their own altcoin – which says nothing of its chances of having any value. In true crypto Wild West fashion, there are some altcoins that were literally created as a joke.

As public blockchains and cryptocurrencies are open-source, anyone can view and copy the code of an existing project. The trick to being successful is the network effect – a phenomenon whereby increased numbers of people or participants improve the value of the protocol. If nobody uses a blockchain it has little value, but the more development activity and people using it, the more likely it is to succeed.

Types of altcoins

As we’ve already discussed, there are plenty of altcoins. And no doubt, there are even more on the horizon. Each claims to solve a different problem or provide a new financial product or innovation using blockchain technology. Or some are created just for a laugh, without purpose.

It would be nice if there was an agreed upon classification for altcoins, but there isn’t. However, for simplicity’s sake, altcoins can be grouped into four main categories – blockchain tokens, stablecoins, DeFi tokens and meme coins.

Blockchain tokens

Blockchain tokens are altcoins that are native to their own blockchain.

For example, ETH is native to the Ethereum blockchain. As Ethereum is the largest ‘programmable’ blockchain, many blockchains are forks of the ‘Go Ethereum’ protocol (‘Geth’) used by nodes on the Ethereum blockchain. Hence, they may share similar characteristics with Ethereum and have their native token work similar to ETH.

For most blockchains, the native token is used to pay transaction fees and is issued to miners (in the case of PoW) or stakers (in the case of PoS) as a reward for adding a new block of validated transactions to the blockchain.

Stablecoins

Stablecoins are not strictly speaking altcoins, but for current purposes it is best to include them in our discussion. These stablecoins are designed to have a stable value by being pegged to another asset, such as a fiat currency like the US dollar. There are two main types of stablecoins: asset-backed and algorithmic.

Asset-backed stablecoins are issued by either a centralised issuer, such as Circle for USDC, or decentralised issuer, such as MakerDAO for DAI. In the case of the centralised stablecoins, they are backed by fiat assets (such as cash and treasury notes), whereas decentralised stablecoins are backed by crypto assets. They employ different mechanisms in order to retain the 1:1 peg, however both are designed to be redeemable at any time for the fiat equivalent.

By contrast, algorithmic stablecoins such as USDD on the Tron blockchain and USDN on Near Protocol are maintained using other methods. This often requires complex algorithms in conjunction with constant arbitrage in order to maintain their peg. They are deemed more risky as the Terra Luna (UST) collapse of 2022 illustrated.

While cryptocurrencies are inherently volatile, these assets are designed to remain stable. Many investors hold them as cash equivalents within their digital asset portfolio. Due to their nature, many crypto users also find value in stablecoins as a mechanism for savings and reliable payments on the blockchain.

DeFi tokens

DeFi tokens cover a wide range of different altcoins. These cryptocurrencies are designed for a specific DeFi project or protocol.

The projects that employ these tokens use them in various ways – such as raising funds or attracting users and liquidity to the platform. The tokens often come with platform-specific utility, such as voting rights, revenue sharing, yield-generation and other features. It’s all context driven so hard and fast rules are difficult to come by.

These altcoins are often some of the most volatile, with their value being quite heavily correlated with the platform’s use, volume and benefits to token holders. Examples include Uniswap, Aave and Maker.

Meme coins

Crypto culture is built on memes. Due to the ease of creating an altcoin, meme coins are quick to appear as the financial embodiment of the latest joke or trend online. These tokens usually serve very little to no purpose but have a funny name or logo based on a trending meme at the time.

They tend to have low levels of liquidity, creating explosive price action on the way up and down. They also tend to be promoted by celebrities (such as Elon Musk), which often sees their values inflate, only to capitulate on the other side. Investments in these tokens are highly speculative in nature, akin to a gamble – make a lot of money or lose it all. For the vast majority, it is the latter.

The most popular altcoins

The top 10 most popular altcoins include US dollar stablecoins. However, we’ve excluded stablecoins and relied on market capitalisation (total value of tokens in circulation) as a proxy for popularity for the rest.

As of October 2022, these are the top 10 most popular altcoins:

- Ethereum

- Tether

- USD Coin

- BNB

- XRP

- Binance USD

- Cardano

- Solana

- Dogecoin

- Polkadot

Honourable mentions to Polygon, Dai, Shiba Inu and Tron who rank 11 to 15 respectively.

Best altcoins in Australia

Technically, there is no ‘best altcoin in Australia’ – it’s a matter of opinion. The borderless nature of cryptocurrencies means that altcoins are generally accessible to anyone with an internet connection worldwide, not to mention access to a cryptocurrency exchange.

Due to this, most altcoin projects have shed a location-specific brand and have opted to portray themselves as global. In crypto, most projects chase the best talent they can find, which naturally results in globally distributed teams.

That said, there are many altcoin projects that are Australian-founded intended to solve both local and international problems. Below we’ve included two Australian altcoin projects that we’re keeping an eye on.

Immutable X

This one is for the gamers out there.

Immutable X is a project focused on blockchain gaming and NFTs. This project has created a new blockchain that is optimised for blockchain gaming, allowing for extremely high transaction throughput, cheap transaction fees and a low barrier for entry for gamebuilders to create games on-chain.

The project’s token IMX is required to pay transaction fees for the chain and can also be staked to earn a share of the chain’s fee revenue. Holding the token also gives governance rights so that holders can influence the direction of the project.

RocketPool

Interested in Ethereum and keen to stake? RocketPool may be for you.

RocketPool is a decentralised staking protocol for Ethereum. Currently, staking Ethereum by yourself requires a minimum of 32 ETH, staking hardware and an in-depth understanding of Ethereum to run the validator software. For most, this is simply a bridge too far.

The protocol is helping users to stake their Ethereum by allowing them to become ‘RocketPool’ validators using only 16 ETH and some of the RPL token. The remaining 16 ETH (which would normally be required by the validator) come from others who wish to stake their Ethereum.

In return for staking their ETH with RocketPool, staker’s receive a staked ETH derivative ‘rETH’ which accrues the staking rewards and can be sold at any time. This project has a native token ‘RPL’ which is used for governance, rewards and to unlock the ability to become a RocketPool validator.

Should you invest in altcoins?

We do not give financial advice and strongly suggest that you talk to your financial advisor before making an investment in any financial product. And remember, always do your own research (DYOR) when it comes to cryptocurrencies.

However with that said, as with any investment, investing in altcoins comes with certain risks. All cryptocurrencies are highly volatile and altcoins tend to be considerably more so than Bitcoin. Unsurprisingly, the less established projects tend to be the most speculative and prone to wild swings in price.

Aside from investing in the altcoin itself, there are also several other considerations to take into account. One of them is storage – how are you going to store your altcoins? Are you going to trust an exchange or do it yourself? Each comes with its own risks and benefits. There are also other general security practices that need to be employed when investing in crypto. This would include ensuring your device is free of malware, avoiding untrusted links, and having strong passwords and two-factor authentication.

Despite the risks, altcoins can produce exceptional returns. Since some have very low volumes, you can sometimes see gains that run into the hundreds, if not thousands of percent. But there is a big but coming…these returns are anything but ordinary and it is therefore critical for users to do their own research before making an investment.

If you consider that real estate and stock market returns over very long periods generally experience single digit compounded growth per annum, the sheer amount of risk involved in investing in altcoins becomes obvious.

Altcoins vs Bitcoin

For investors beginning the journey into cryptocurrency investing, one of the most common questions is, “Should I invest in Bitcoin or should I invest in altcoins?”

This depends entirely on the investor’s objectives, risk tolerance, time horizon, knowledge and skill, but to name a few. What is the token’s why? Ideally, you want to be able to describe it in simple terms to someone not familiar with crypto. Of course, many tokens are great at marketing but have no real-world utility. Your job is to do the work and to figure out what makes sense for you.

Investors also need to consider how much of their portfolio they want to allocate to crypto, and taking it one step further, establish whether they are trading or investing. Trading is short-term profiteering and investing is about thinking long-term.

Bitcoin and Ethereum have cemented themselves as so-called “blue-chip” digital assets in the crypto markets, holding the number 1 and 2 spots in ranking for years. This generally makes them less volatile than other cryptocurrencies. Generally, the greater the risk, the greater the potential upside (and downside). Better yet, you should be on the look-out for asymmetric opportunities – where the token is ‘cheap’ relative to the risk.

How to buy altcoins

Now that cryptocurrencies have become more popular, getting access to them is very easy. These simple steps will get you up and running in no time:

1. Sign up for a trusted exchange compliant with your local jurisdiction. It is crucial to ensure you use a reputable exchange as there have been cases of fraudulent crypto exchanges. Do your own research. Google is your friend.

2. Once you have signed up for the exchange, you will need to complete a know-your-customer (KYC) process. KYC usually involves providing a full name, an image of a government-issued ID and answering some security questions.

3. After the sign-up and KYC are complete, you should now be able to deposit funds onto the exchange. Different exchanges offer different deposit methods, from card to bank transfer, so choose what option is right for you.

4. Once you have deposited the funds you wish to invest, you can now buy crypto on the exchange. Many exchanges offer a range of cryptocurrencies; however, some provide more variety than others. Many altcoins can only be accessed through decentralised exchanges.

5. Once purchased, you need to decide whether to keep your assets on the exchange or withdraw them into your own custody. Best practice is to self-custody but there are risks involved. It comes down to who you trust more – yourself or the exchange?

What altcoins are here to stay?

Since the birth of Bitcoin, many altcoins have come and gone. There are now thousands of different altcoins, many of which are blatant scams or cash grabs without an active user base, development and functional product in the market.

As the crypto market has matured, investors have leaned towards more established projects that have product market fit, network effects and an active team and user base. However given the low barriers to creating a token, it’s likely we will see even more tokens come on stream in the years to come.

With that mind – it isn’t clear which altcoins will retain their value in the long run or which will go to zero. It’s truly impossible to say which are here to stay. We can, however, make educated guesses about which are more likely to survive, and that is probably all an investor can do.

These were the top coins in 2017. If you don’t recognise some, it wouldn’t be surprising, as some ended up going to zero.

With that in mind, it’s clear that it is worth spending a lot of time researching before you invest to reduce the prospects that your chosen token is relegated to the ashes of crypto history.