A crypto trader has become the top spender of gas fees on the Ethereum blockchain, taking up 5% of traffic on the network.

Jaredfromsubway.eth has spent over US$70 million (AU$109 million) on Ethereum gas fees over the past six months. They don’t operate alone, though: they’re assisted by a crypto trading bot that’s known for executing transactions that are perceived by some as “bullying” other traders.

Who is ‘Jared From subway’?

Jaredfromsubway.eth is an anonymous crypto trader who claims to be the “founder of the most advanced MEV bot” in the crypto space.

An MEV bot is a type of crypto trading bot that monitors profitable trade opportunities on the blockchain and executes them on behalf of their owners. MEV is short for “maximum extractable value”, which gives you an idea of how the bot works. It calculates the maximum profit that it could potentially obtain from a possible trade, and performs said trade – and, of course, it’s usually faster than a human.

So, jaredfromsubway.eth owns such a bot. Back to the story.

Jared from subway’s sandwich attacks

Jaredfromsubway.eth’s MEV bot is notorious for performing what’s called a “sandwich attack” on other users. In the crypto world, a sandwich attack is a tactic where an unsuspecting user becomes the target of two simultaneous trades executed by the same MEV bot.

In this scenario, an MEV bot would first place one trade order right before the victim’s transaction and one trade right after. The goal is to front-run and back-run the victim at the same time, so the victim’s transaction is “sandwiched” in between.

The price of a crypto asset would typically be manipulated as a result of a sandwich attack. The outcome of this is that the victim wouldn’t be able to make as much profit as they’d hoped. So, you could say that old mate Jared here is the final boss of crypto trading.

Ethereum gas fees

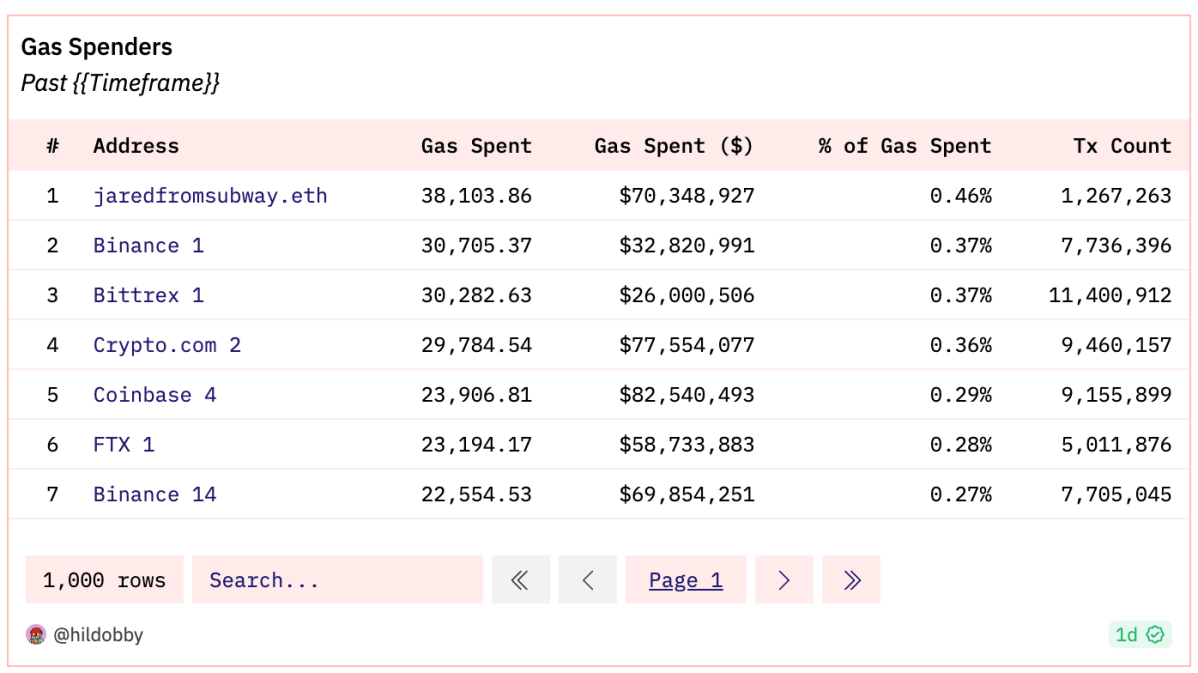

According to blockchain analytics tracker Dune, jaredfromsubway.eth has performed over 1.267 million crypto transactions. They’ve spent over 38,000 ETH, worth over US$70.3 million (AU$110 million) on gas fees on the Ethereum blockchain for their MEV bot to execute trades.

Jaredfromsubway.eth’s gas guzzling also places them ahead of wallets held by the world’s largest crypto exchanges Binance and Coinbase.

Etherscan data also shows that in the past nine days, jaredfromsubway.eth has made over 1,100 ETH in gross profit. This is equivalent to US$1.768 million (AU$2.76 million) – all thanks to the MEV bot.

Crypto trader: Gas fees, transaction fees…

Believe it or not, it is not uncommon for users to pay a crazy amount of money to speed up crypto transactions. Less than 24 hours ago, a user paid US$500,000 (AU$782,000) worth of fees to speed up their Bitcoin transactions. They overpaid 481,299 times the average amount, which was around 17 satoshis/vB.

Nobody knows if jaredfromsubway.eth is a sole crypto trader who operates alone, or if it is run by a company. At the time of writing, Jaredfromsubway holds 147 ETH in their crypto wallet. This is equivalent to US$238,000 (AU$372,000).