If you’re still a devoted crypto bag holder, you might want to double-check the coins that you own. The latest report by AlphaQuest revealed 72 percent of crypto projects that were ‘born’ during the crypto bull run from 2020–2021 have met their demise.

AlphaQuest combed through 12,000 crypto projects listed on crypto price tracking site, CoinMarketCap. Throughout the 2020–2021 bull run, 4,834 crypto projects were born. Among that number, an overwhelming 3,473 of them have died.

‘Died’, as defined by AlphaQuest here, is when a crypto project meets four of the below criteria:

- Trading volume of less than US$1,000 (AU$1,500) in 24 hours;

- Delisted from CoinMarketCap;

- X account deleted;

- No updates on X for over three months, which signals a lack of “social engagement or operational presence”.

65% of crypto projects died last year

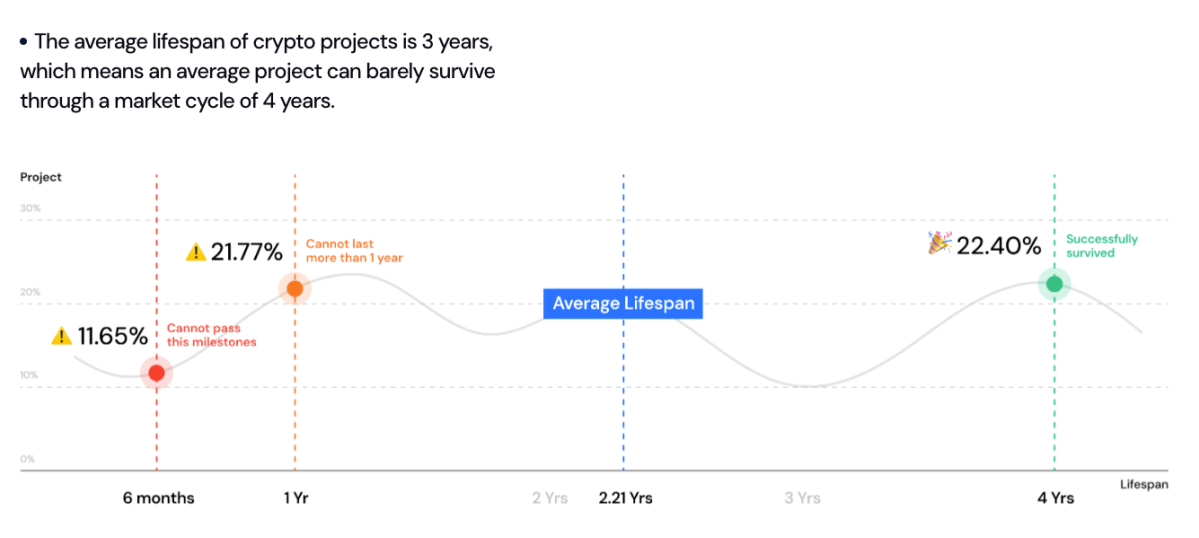

In 2023 alone, 65 percent of crypto projects were declared by AlphaQuest as dead. The average ‘lifespan’ of a crypto project is also no longer than a pet rat: three years. This means many can barely survive a four-year market cycle.

Only 22.4 percent of crypto projects successfully made it through four years. Someone give a medal to Bitcoin and Ethereum developers!

Which crypto categories saw the most tumbleweeds? Crypto projects that are involved with video and music saw a 75 percent ‘death rate’. This “[showcased] a pattern where crypto projects targeting specific niches struggle to maintain sustainability,” wrote AlphaQuest. Yeah, that Rihanna music NFT you were thinking of buying? Might as well just stream it on Spotify.

Metaverse projects that distribute native crypto tokens also recorded a 51 percent ‘death rate’.

Crypto investors in Australia

The global crypto market may look depressing, but Aussies still appear to be optimistic about its prospects.

Independent Reserve’s 2024 report on Australian attitudes on crypto found that Aussies remain “confident” about the state of crypto. We can thank the historic Bitcoin ETF approval early this year that lifted investors’ spirits.

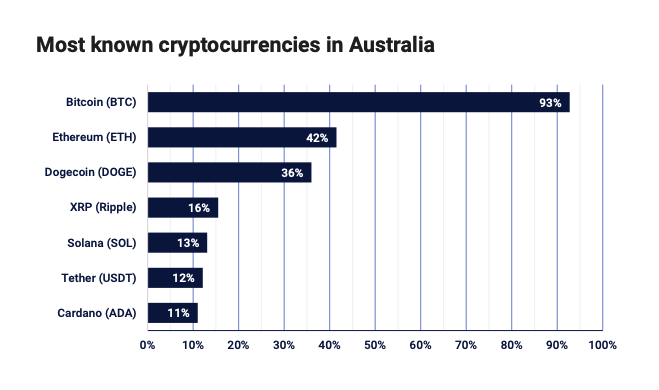

According to the report which surveyed 2,100 Aussies, an overwhelming 95 percent of them own at least one crypto. Within this number, 63 percent of them own Bitcoin. 69 percent of them also consider Bitcoin to be money and thus a legitimate store of value.

Overall, Bitcoin remains ‘king’ among fellow Aussies.

Aussies slowly seeing profit

Moving away from Bitcoin, more Aussie investors also report seeing climbing profits from their crypto investments.

“Year on year, the number of Australians reporting to make a profit on their crypto investments has increased from 29 percent to 37 percent. 36 percent reported that they’re breaking even, up 6 percent points,” wrote Independent Reserve.

“However, profitability is still 13 percent lower than during the bull market of 2021, where 60% reported making a profit and only 11 percent making a loss.”

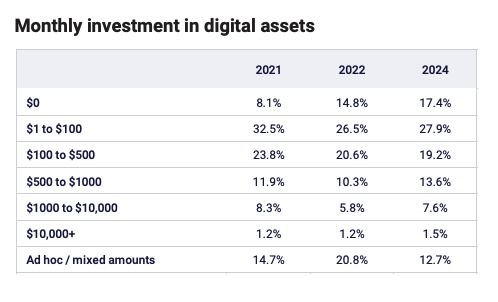

Gen Z, who are perceived as more risk-tolerant investors, have also “significantly increased” their crypto investments. The number of Gen Zs who dump AU$500 to AU$1,000 per month in crypto investing increased from 5 percent to 21 percent in 2024.

Gen Z, who are perceived as more risk-tolerant investors, have also “significantly increased” their crypto investments. The number of Gen Zs who dump AU$500 to AU$1,000 per month in crypto investing increased from 5 percent to 21 percent in 2024.

“Investors need to conduct extensive research and due diligence. This involves evaluating the project’s whitepaper for viability, the credibility of the development team, the level of community engagement, and their communication transparency,” AlphaQuest tells The Chainsaw.

“Additionally, it is important to keep track of the project’s advancements, partnerships, and technological developments. By understanding market trends and the potential for practical uses, investors can effectively minimize risks in the highly unpredictable crypto market.”