How to sell Bitcoin: For whatever reason, you’ve decided that now is the time to cash in. You’ve made the decision and now you want to know how to sell Bitcoin. Is it through a crypto exchange or can it be done in cash? Converting your Bitcoin back into your local currency is relatively simple, but it’s worth taking the time to understand it to reduce the prospects of things going wrong.

What is Bitcoin?

First we need to get on the same page. What is Bitcoin?

The Chainsaw put together a comprehensive explainer on the topic which is well worth a read to get fully up to speed. But if you’re instead looking for a quick overview, here it is.

Bitcoin inventor, Satoshi Nakamoto, explained Bitcoin’s purpose in the original 2009 whitepaper saying it was: “A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution.”

You can think of Bitcoin as digital money. The money we use everyday is known as a ‘fiat currency’ and this includes the US dollar, Australian dollar, Argentine peso and close to 200 others.

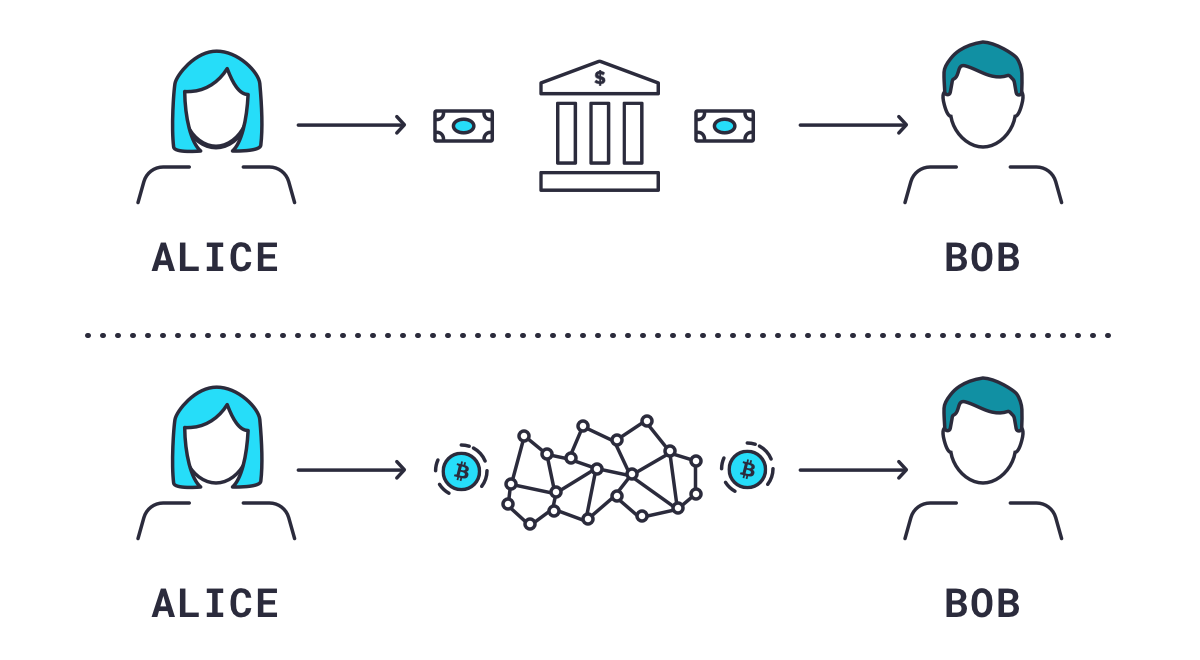

What makes Bitcoin different is that it isn’t issued or controlled by any centralised entity or authority. It is regulated by a set of rules that are enforced by a network of decentralised participants comprising nodes and miners. Nobody owns or controls Bitcoin and anyone can participate.

The other part that is important to understand is how Bitcoin works. Bitcoin transactions are peer-to-peer, which means they go directly from the sender to the receiver without a third party in the middle.

In practice, Bitcoins are sent to a Bitcoin address — a string of numbers and letters — so in that sense it is pseudonymous and not anonymous. Bitcoin uses the decentralised peer-to-peer network to distribute blocks and transactions.

How is a Bitcoin created? By miners who compete to solve a hashed algorithm using specialised hardware for the block reward and fees. Presently the block reward is 6.25 Bitcoins and that figure halves around every four years.

Finally, the critical piece with Bitcoin is that there are only ever going to be 21 million issued. As seen in the graph below, within 10 years, 99% of all Bitcoins that will ever be mined will have already been issued.

Where can I sell Bitcoin?

Generally speaking, you need third-party platforms, like crypto exchanges, to sell Bitcoin, or any cryptocurrency for that matter.

In doing so, you need to first deposit the Bitcoin onto the exchange if it is not already there. And from there, you can click “sell BTC” after which your currency balance will increase by the same amount that your Bitcoin holdings decrease.

How can I sell Bitcoin for cash in Australia

Some users prefer to sell Bitcoin for cash, while other users like to buy non-KYC Bitcoin – that is, Bitcoin that is not associated with a specific person’s name and physical address. In those circumstances, people like to trade Bitcoin for cash.

One person scans a QR code and deposits the Bitcoin, and in exchange, the cash is handed over. Easy enough. However, there are inherent risks of going this route.

Institutions or companies are not going to be able to participate in cash Bitcoin transactions, so you’re limited to individuals. And therein lies the risk. You need to trust the person as you will need to meet in person. Generally speaking, nobody is going to do a transfer remotely unless you specifically know them.

There’s the risk of violence, of ‘doxxing’ yourself and the possibility that the deal goes bad. It’s difficult to do and generally not possible to sell Bitcoin for cash unless it’s between trusted parties.

How to sell Bitcoin in Australia

The process of selling Bitcoin is similar to buying Bitcoin, but in reverse. It’s really as simple as a six step process that we outline below.

Step 1: Compare crypto exchanges

Choose a cryptocurrency exchange to buy Ethereum

The first step towards selling Bitcoin is to select a cryptocurrency exchange. In recent years, plenty have come and gone, while others have stood the test of time. Finding a credible exchange that provides all necessary services while also maintaining a high level of security requires careful research.

However it is well worth the time spent as one’s selection might be the difference between keeping your digital assets safe or losing them forever. Google is your friend. What are you looking for? Trust.

Credibility

These are some of the most important factors to consider in determining the credibility (and by extension, the security) of an exchange:

- The information regarding the exchange’s security practices is easy to find, clear and comprehensive.

- It has a large number of good reviews on reputable review platforms spanning several years.

- The exchange has a valid HTTPS certificate in the URL address bar (a little lock image).

- It has a legitimate business address and the company is easy to contact.

- It conducts security audits (for example a SOC 2 compliance certificate).

- It prompts best practices when setting up an account – a strong password, 2FA, whitelist withdrawal addresses or whitelist IP address (nice to have).

- It utilises cold storage for the majority of funds.

- It provides a live attestation of reserves.

- It has insurance for user funds.

It does not have any of the following:

- Questionably high yields for simply depositing;

- Promises of wealth or high returns;

- Poorly laid out website interface; or

- Agents who contact you to sell a trading program or provide investment advice.

If you find an exchange that ticks most of the boxes chances are it is reputable and secure. The more research you do, the better. Read reviews, speak to people in the industry and to stress the point, there isn’t such a thing as too much research.

Best crypto exchanges

There is no list of ‘best crypto exchanges’ in principle. Each may be best for a certain type of person with certain needs based on functionality, features, user-experience and other factors.

That said, globally, the most well-known names in the space include Coinbase, Kraken and Binance. These companies likely serve the needs of most people.

In Australia, you have companies like Coinspot, Kraken and CoinJar and Luno.

Step 2: Create an account

Realistically, if you are selling Bitcoin, chances are you already have an account with a crypto exchange.

If you’re happy with that service, stick with them. If you are planning to sell Bitcoin on a different exchange where you haven’t previously been onboarded, you will need to create an account.

Step 3: Verify your account

Once you have created an account, you will be asked to verify your personal information. This is part of the obligations imposed on regulated crypto exchanges, namely the KYC (know your customer) requirements.

This means that you will need to provide evidence of your identity and address. Each exchange is different in terms of how that process actually works, but the principle remains that all regulated exchanges must collect this data.

Step 4: Send Bitcoin into your account

Once you have an account, you can log in and head over to your wallet which may or may not be holding your Bitcoin. If you already decided to leave your Bitcoin on the exchange, ignore this step and go to Step 5.

Assuming you have previously withdrawn your Bitcoin and self-custody, you will need to deposit it onto the exchange so that you can sell Bitcoin. Your crypto exchange account will have a wallet with a specific Bitcoin address. You’ll need to send Bitcoin to that address and depending on the exchange, it can take ten minutes to 24 hours to reflect.

Step 5: Sell Bitcoin

Once the Bitcoin is reflected in your crypto exchange account, you’re now ready to sell.

For the purposes of this explanation, we’ll deliberately keep things simple and assume you are only interested in selling at the market price, namely the current spot price for Ethereum.

There are other more complex ways to sell Bitcoin— such as limit orders where you place a bid to only sell at a specific price — but for beginners, it’s best to keep things simple and just hit ‘sell BTC’.

In the background, the crypto exchange is matching buyers and sellers of BTC and within a few moments of placing your bid to buy Bitcoin, funds will be deducted from your Bitcoin balance and you will be credited with the equivalent value in your local currency balance.

Step 6: Send your AUD into your bank account

Once you have the local currency (in this case Australian dollars) balance reflected in your account, you can withdraw into your bank account.

Your bank account details ought to be saved with the crypto exchange, so the process should be as simple as clicking “withdraw funds” (or something similar).

Advantages of selling Bitcoin using P2P exchange

Regulated crypto exchanges are best seen as on-ramps and off-ramps for converting fiat currency to crypto. In some regions of the world, such as Nigeria, there are heavy restrictions placed on centralised exchanges. This has led to the proliferation of peer-to-peer (P2P) exchanges, which serve a specific purpose in those types of markets.

While the downside is that they can be more complex to use since you cannot withdraw/deposit funds to or from a bank account, not to mention the lack the regulation that some users want, the upsides include:

- No intermediaries (useful where the intermediaries are censored)

- Anonymous/no-KYC

- Order books tend to be more transparent (good for traders)

- Can be cheaper (less fees)

How to sell Bitcoin using P2P marketplace?

Selling via a P2P marketplace is the same as through a centralised crypto exchange. You first need to deposit your Bitcoin into your Bitcoin wallet address on the platform.

You then decide how much you want to sell and click “sell BTC”

It’s really as simple as that, no frills.

Is selling Bitcoin in Australia safe?

This is a loaded question as it depends entirely on which platform you are using. For all registered and credible crypto exchanges in Australia, yes, it is safe to sell Bitcoin.

Of course, this changes significantly if you’re dealing with a dodgy exchange. There have been instances where people have bought what they think is Bitcoin and left it on an exchange, only to have it go bust and realise there was never any Bitcoin at all.

Is it legal to sell Bitcoin in Australia

Yes, it is legal to sell Bitcoin in Australia.

Do I have to pay tax when I sell Bitcoin?

Now this one is a difficult question as it really depends on where you live and the applicable tax regime. Virtually all countries treat Bitcoin (and other digital assets) differently, to some or other degree.

While there are exceptions, most countries (like Australia) will require you to pay tax on on any gains when you sell Bitcoin.

The Chainsaw has a useful explainer for Australian readers that is certainly worth digging into. However, for those elsewhere there are some rough guidelines:

- If Bitcoin is treated as legal tender (such as in El Salvador), there are no taxes applicable when you spend or cash out.

- In most regions including the US, Australia and UK, you pay capital gains tax on Bitcoin gains.

- Some countries (such as the US and Australia) offer a 50% discount on capital gains if you held the Bitcoin for more than 12 months. For example, if you bought a Bitcoin for US$20,000 and then sold it a year later for US$60,000, the gain would be US$40,000, however you’d only pay tax on US$20,000 (half the gain).

Tax is complicated and varies from country to country. While we can say that most countries require you to pay tax when you sell Bitcoin, it really depends on your personal circumstances.

In short, to get a definitive answer, speak to a professional.

When should I sell my Bitcoin?

Even though some would say “never”, the reality is that people are going to want to exchange their Bitcoin for their local currency. The question then is one of timing, when is a good time?

The answer is simple enough to understand, but difficult to implement. There is no ‘right time’ to sell. It depends entirely on your own personal circumstances, goals, knowledge and experience.

Generally, investors suggest that investment success isn’t about timing the market, as much as it is about ‘time in the market’. The same applies to Bitcoin.

Are there people who time the market perfectly and sold at the top? Sure, but they’re the exception. If you plan to sell Bitcoin, realise that the chances of predicting the top are marginal. A better approach in that case may be to dollar cost average (DCA) in reverse – sell little bits of Bitcoin irrespective of price over a period of time to reduce the volatility and prospect of selling at the bottom.

Since it really comes down to personal circumstances, perhaps the better question is when not to sell. You never want to be a forced seller, that is one who has borrowed money and has to sell the collateral which is declining rapidly in value.

Beyond that, there is no single period of time ideally suited for selling Bitcoin. Sometimes it’s overbought and sometimes oversold (overpriced versus undervalued). People are trading 24/7 at all prices and it can go up or down at a moment’s notice.