Last year was the year of crypto supervillains, and that’s not even counting the estimated US$3.8 billion stolen. As crypto investors pray for calmer waters, we reflect on the top five supervillains in crypto who likely ushered in the crypto winter that has everyone positively freezing.

Crypto supervillains

Sam Bankman-Fried (SBF) aka Scam Bankster-Fraud

In November, when SBF quit and his company FTX filed for bankruptcy, it marked the beginning of what turned out to be a scandal for the ages.

As the days went on, sordid details of the global exchange’s implosion were slowly unravelled, along with his carefully cultivated benevolent crypto wunderkind persona.

While SBF claimed to be an advocate of ‘effective altruism’ – a philosophy ostensibly about ‘doing good’ – it turns out he was more interested in taking US$10 billion worth of user funds and gambling them away through his hedge fund, Alameda Research.

The evidence suggests he knew what he was doing the whole time, as he said in a later interview:

“…we woke Westerners play a game where we say all the right shibboleths and so everyone likes us”.

Remarkably, it’s not even the theft of US$10 billion that has captured the public’s imagination. It’s all the details in the background that make this story quite unbelievable and an inevitable Netflix series.

While pretending to be the awkward, somewhat scrappy-looking kid making millions doing good, he bought luxury properties aplenty, abused amphetamines and apparently enjoyed orgies at his home in the Bahamas. Oh, and he donated millions to political figures, although there are efforts afoot trying to claw those back. Good luck with that.

Meanwhile, SBF continued to enjoy incredibly kind publicity, even being called the ‘next Warren Buffet’.

Was SBF the greatest crypto supervillain in the crypto sector’s history? Probably.

Whether he thinks so or not is an entirely different question as he plead ‘not guilty’ ahead of his trial. Nic Carter offered some insights as to how SBF may be thinking about his defence.

Crypto supervillains: Do Kwon

But for SBF’s shenanigans, Do Kwon, the infamous founder of the Terra ecosystem, would comfortably have taken the number one slot for top crypto supervillains. The spectacular collapse of his “stablecoin” UST, and LUNA will go down as one of the most rapid capitulations in crypto history.

His story is somewhat similar to SBF in that he was this absolute “whizz kid” who got a little too big for his boots. He was known for being lippy on Twitter, calling his critics ‘poor’ and in a now ironic interview, said that 95% of crypto was “going to die”, but there was “entertainment in watching companies fail”.

While he certainly had the makings of a crypto supervillain, Do Kwon failed to foresee his so-called stablecoin (UST) depegging from the US dollar and erasing almost US$40 billion in value within a short few days. At the time, Do Kwon said he was ‘heart broken’, but his actions since haven’t exactly reflected as much.

Legal authorities in South Korea and Singapore are now on the hunt for Kwon who has since made it onto Interpol’s red list. While he continues to self-promote on Twitter, the prominent crypto supervillain insists he is not ‘on the run’, despite reports of him fleeing to Dubai and even Serbia.

Crypto supervillains: Su Zhu and Kyle Davies

Next up in the crypto supervillain list, we have a two-for-one special, the former founders of hedge fund Three Arrows Capital (3AC), Su Zhu and Kyle Davies.

Zhu and Davies launched 3AC in 2012, initially focused on forex trading. They then switched strategies in 2018, and honed in on crypto. Within no time, they developed a stellar reputation amongst crypto bros, most notably when Zhu called the bottom of the crypto bear market in 2018.

Years later, Zhu and Davies were celebrated crypto entrepreneurs, and as recently as March 2022, 3AC managed about US$10 billion in assets, making it one of the most prominent crypto hedge funds in the world. And then it went into bankruptcy after making one bad bet after another. They essentially gambled all their investors’ money away.

3AC’s strategy was to borrow money from almost anyone in the industry, and then invest that into fledgling crypto companies. Since the firm had been around for a decade and the founders hosted their own podcast, they were given billions with few questions asked. They were credible after all, and they wouldn’t do anything silly like get involved in Ponzi schemes would they?

Unfortunately they did, as crypto winter took hold following the Terra collapse, with over US$1 trillion in market capitalisation erased. And with that, 3AC’s investments fell off a cliff at which point lenders started calling for their money. It was a double whammy where the company was selling assets that were declining by the day to pay off the billions it had in debt.

Aside from being exposed to bad investments such as the UST/LUNA ecosystem, which ended up costing it over US$200 million, it turns out they had taken loans from just about anyone in crypto town including Blockchain.com (US$270 million), Voyager Digital (US$670 million) and others including Genesis, BlockFi and even FTX (all bankrupt).

Speaking to CNBC, Nik Bhatia, a professor of finance and business economics at the University of Southern California said, “3AC was supposed to be the adult in the room”.

Only problem was that the hedge fund founders turned crypto villains failed to do their due diligence on a number of highly risky investments, which when they collapsed, brought down the firm and their reputations in the process.

You’d imagine there would be a sense of guilt and self-reflection after watching US$10 billion worth of investor funds evaporate. Instead, they’re launching a new crypto exchange as one founder enjoys his time away surfing and digging into spirituality. Seriously.

Alex Mashinsky

Our next crypto supervillain is Alex Mashinsky, the former CEO of Celsius, a lending firm that froze customer withdrawals due to “extreme market conditions” in June last year.

“Extreme market conditions” was viewed by the market as a red flag that this ship was sinking, which it did within a matter of weeks. In the process bankruptcy proceedings revealed that US$4.7 billion in user deposits were frozen by the company and that liabilities exceeded assets by some US$1.3 billion.

In the end, Celsius proved to be another one of the companies impacted by the downfall of Terra and 3AC, and it seems as if Alex Mashinsky was the man behind it all.

Celsius was a company that took aim at the banks, saying “banks aren’t your friend”. He often went on Twitter criticising traditional finance institutions for the “paltry” return on cash when his platform could offer up to double that.

He also famously clashed with Bitcoiners who advocated self-custody of digital assets, saying that they were responsible for millions of Bitcoins being lost.

Of course, Mashinsky wanted users to deposit their crypto on his platform. In turn, he would take those funds and invest (or gamble) in the crypto sector in order to generate the promised returns on the platform. In addition, he relied on new investors depositing their crypto on the platform to pay existing ones. Ponzi anyone?

With news emerging that Alex Mashinsky withdrew US$10 million in the lead up to Celcius’ bankruptcy and his alleged flight out of the US, it’s fair to say that he is a deserved candidate for crypto supervillain list.

Avraham Eisenberg

Last but not least, we have Avraham Eisenberg. He calls himself a “lawful evil” operator and “applied game theorist”, but most people would call him a thief or a devious crypto supervillain.

Last October, Eisenberg skyrocketed to prominence when he openly announced that he was responsible for the US$110 million exploit on a decentralised finance (DeFi) protocol called Mango Markets. He has since been charged.

What he did was pretty complicated, but in short, he was able to manipulate the value of a token called MNGO through an error in the smart contract code. Then after raising its price, he borrowed real money against MNGO, leaving the DeFi protocol with a monster US$110 million “bad debt” owed to users of the protocol.

He got all philosophical, saying “code is law” and that he merely engaged in “a highly profitable trading strategy.” Of course, this created a far bit of outrage aimed in his direction and there is a ton of suspicion that he is behind several other high profile exploits.

That rounds out the top five crypto supervillains whose actions may have caused crypto winter.

Crypto supervillains responsible for crypto winter?

There’s little doubt that the supervillains contributed towards ushering in crypto winter.

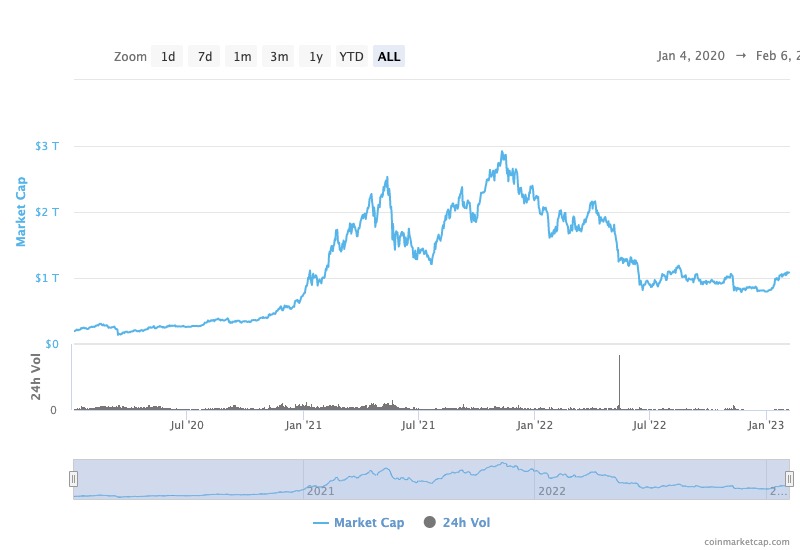

The real question however whether things were already on the decline or if the supervillains are all collectively responsible for turning market sentiment negative, and in the process, erasing over US$1 trillion in market capitalisation?

It’s evident from the graph above that crypto peaked in late 2021, and gradually was on the decline before everything went to hell in a handbag. It’s only in May 2022 when Terra collapsed that things went further South at a rapid clip.

While it is impossible to know exactly how much harm was called by the crypto supervillains, once thing is for sure, they certainly weren’t a positive influence.