It’s been like a car crash in slow motion, with cryptocurrency lender Genesis Global Capital first warning of potential bankruptcy as early as November last year following FTX’s implosion. And now its official, with the company having formally filed for Chapter 11 bankruptcy after owing its top 50 creditors more than US$3.5 billion.

Who is (or was) Genesis?

Genesis was founded in 2013 as a crypto trading, lending and asset custody platform that focused largely on institutional clients and high-net-worth individuals (HNWI). It clients include the likes of Circle (the company behind USDC stablecoin) and it is owned by the Digital Currency Group (DCG) who itself is currently embroiled in all sorts of controversy — including a tiff with the Winklevoss twins.

Part of the drama relates to intercompany dealings with Genesis midway through last year, after DCG allegedly took on hundreds of millions of dollars of Genesis’ debt after the latter was exposed to bankrupt crypto hedge fund Three Arrows Capital (3AC).

Genesis bankruptcy, largely inevitable

Later in November 2022, Genesis revealed that it had US$2.8 billion in outstanding loans and earlier this month, the Securities and Exchange Commission (SRC) charged it with the unregistered offer and sale of securities to retail investors through Gemini Trust Company’s Gemini Earn crypto asset lending program. The company then unsuccessfully tried to raise additional capital and cut 30% of its staff in early January.

Now, on January 19, Genesis has filed for Chapter 11 bankruptcy protection to reorganise three of its holding companies, all of which are involved in the crypto lending industry. The company has listed over 100,000 creditors with aggregate liabilities in the range of US$1.2 – US$11 billion, as reported by Bloomberg.

Who has been affected most?

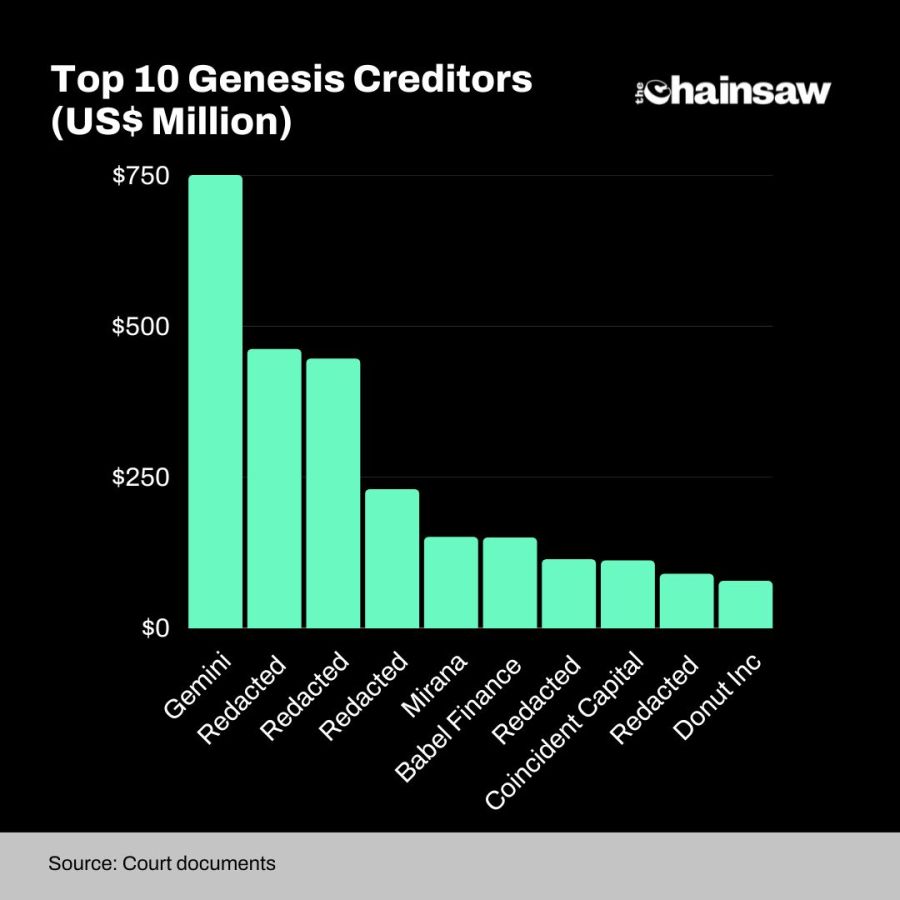

According to a court document which has since become unavailable online, Genesis’ top 50 creditors are said to be owed more than US$3.5 billion. Several notable names appeared in the list, many of which were however redacted.

Some of the more notable inclusions were Gemini Trust (US$766 million), Miranda Corp (US$151 million) and Babel Finance (US$150 million).

Could you be impacted by the Genesis bankruptcy?

The bankruptcy filing will predominantly affect institutional clients and HNWI exposed to the named creditors.

While ordinary users most impacted are undoubtedly those whose funds remain locked in Gemini’s Earn product. Gemini had worked with DCG and Genesis to offer its reported 334,000 Gemini Earn clients a yield on their crypto earnings. The total amount owed is said to be around US$900 million, of which US$775 million is locked up with Genesis.

Most investors in the Gemini Earn product probably didn’t take the time to go through all of the legalese which revealed that Gemini was in fact acting not as a custodian, but as an agent. Instead, the funds were lent by users to Genesis who in turn would lend those on to its clients including the now defunct crypto hedge fund 3AC. Messy and confusing isn’t it? Below is a great summary of the mechanics at play.

Gemini has repeatedly claimed that it is not at fault for creating the situation, however others have taken a less charitable view, condemning their actions in their entirely, saying:

“The Winklevosses are trying to claim that they acted ethically when they created Gemini earn, a loan program dressed up to look like an interest-bearing account, and then invested it with a company (Genesis) that was clearly cooked for months before they shut withdrawals. Scum.”

Ed Zitron

With all this bad news circulating, it has been argued that if the SEC is successful in claiming Gemini’s Earn product was illegal, users may be able to recover a substantial portion of their claims from Genesis. This however remains unclear.

Whichever way you look at it, it’s once again a timely reminder that when it comes to yield products, there is inherently counterparty risk. And unlike banks which are insured by the government, crypto platforms aren’t.

If anything, the ongoing saga with Gemini Earn customers is yet another indication that there is no such thing as a free lunch, particularly when crypto yields are concerned. And if you are wondering where the yield comes from, it may just be you.