The world’s largest stablecoin, Tether (USDT) has been one of the biggest driving forces behind the insane amount of money that has flowed into the cryptocurrency industry.

Tether has provided investors with enormous liquidity by providing them with a safe haven for their cash. Instead of using a cryptocurrency like Bitcoin or Ethereum to purchase other cryptocurrencies, investors can utilise Tether to quickly purchase cryptocurrencies without ever having to withdraw their money into fiat dollars.

This cuts out a lot of unnecessary exchange fees and clears up a number of tax issues that arise from using native cryptocurrencies like Bitcoin or Ethereum to purchase other digital assets.

While Tether enjoys a reputation as one of the most ‘useful’ assets in the world of crypto today, it has a long and sinister backstory, pockmarked by fraud, conspiracy and all flavours of criminal activity.

Tether and its sibling company Bitfinex — a partnership that its founding members have tried diligently to obscure — have long been surrounded by a murky haze of fear, uncertainty and doubt (what crypto investors call ‘FUD’). However, as an industry, we can no longer just hand wave away their misdeeds as just another thing to ‘not be worried about’, especially following the sudden and terrifying collapse of FTX.

If crypto is truly going to be ‘the future of finance’ then the cryptocurrency sector needs to be clear of bad actors. It must be transparent and trustworthy to the public. Nefarious actors need to be picked from the herd, or at the very least, have their history put out on display in public so that the market can see exactly who they’re getting into business with.

So, without further delay , let’s dig into what Tether is, how it’s supposed to work and where everything went wrong.

Hint: it starts very early on.

Tether 101

Tether is marketed as a stablecoin, meaning that its value is inextricably linked to an underlying asset at all times. Stablecoins can be linked to any asset and are useful for a whole host of reasons — you can keep cash on foreign crypto exchanges, and you can get around regulation easier.

Tether (USDT) is pegged to the US Dollar.

Put simply: 1 US Dollar = 1 Tether (1 USDT)

It works the following way:

All crypto users are exposed to Tether

Now, you might be thinking:

“I don’t use or hold any Tether, so who cares?”

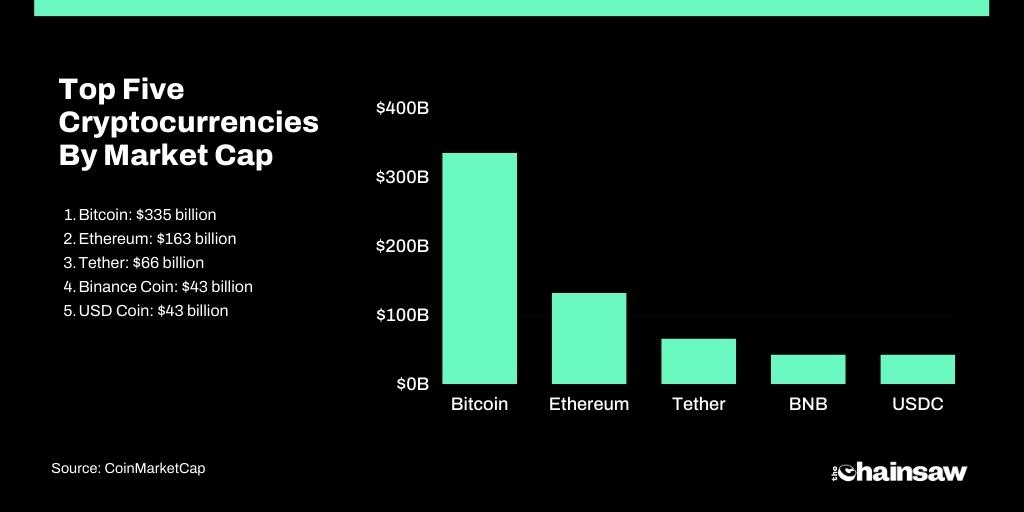

Even if you’re not invested in Tether, or you’ve never used it, you’re still exposed to the fallout of a Tether implosion. This is because it’s quite literally the central nervous system of liquidity in crypto markets. It is the ultimate intermediary in which all crypto trades can be made through and it’s also the largest cryptocurrency asset by trading volume, even when compared to Bitcoin.

At the time of writing, the 24-hour trading volume of Tether was US$23 billion, which is 48% higher than the total daily trading volume of Bitcoin. If this asset were to suddenly ‘de-peg’ or disappear, the entire crypto market could fall to pieces in the blink of an eye.

While many market participants may critique my claim here as being outlandish or overblown, just look at what happened when the Terra Money (LUNA & UST) ecosystem collapsed. UST was by no means a market-dominating stablecoin, and yet its unexpected collapse unleashed a cascade of liquidations and bankruptcies that toppled some of the biggest names in the industry. The collapse of Terra money sent the entire crypto market on a downward spiral that is it yet to make any sort of serious recovery from.

Pure finance aside, these concerns can’t even begin to take into consideration the fallout associated with the ill-sentiment towards a failure of this magnitude being played out right under the noses of all the world’s investors, especially in the wake of the profound failings perpetuated by FTX and Alameda Research.

Tether: A case study of dishonesty

Tether’s issues can be traced back to day one, starting with its founding team.

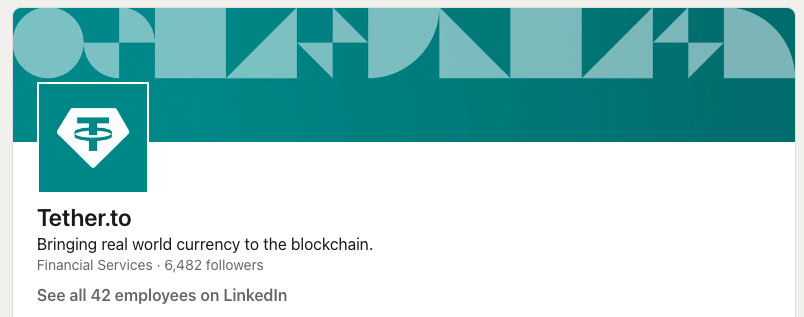

Its small team of consistently dishonest founders can only be described as sketchy —to say the very least. Tether also has the largest employee ownership ratio of any company in the world today, with an approximate ratio of US$1.6 billion in assets per employee.

It’s quite literally a 66-billion-dollar company with only 42 employees.

Even if this bootleg crew of 42 Tetherites were the most trustworthy people in existence, that money to employee ratio should be enough to raise even the most optimistic of eyebrows. Unfortunately for all of us in crypto, the Tether crew is demonstrably far from trustworthy.

Their small, tight-knit team of early state founders is comprised almost entirely of disgraced Wall St bankers, ex-Ponzi scheme artists and former online gambling ringleaders.

Don’t, worry we’ll be digging into all of this a lot more in just a bit.

First, we need to take a look at Tether’s history of ‘transparency’.

Tether and ‘transparency’

Tether have remained completely opaque about the way in which they link the value of their alleged stablecoin to its primary asset: the US Dollar.

In order for Tether to function they need a 1:1 ratio of Tether to dollars at all times. If they were to be minting new Tethers without the exact same number of real dollars in their reserves, they would instantaneously destroy the “stability” of their coin.

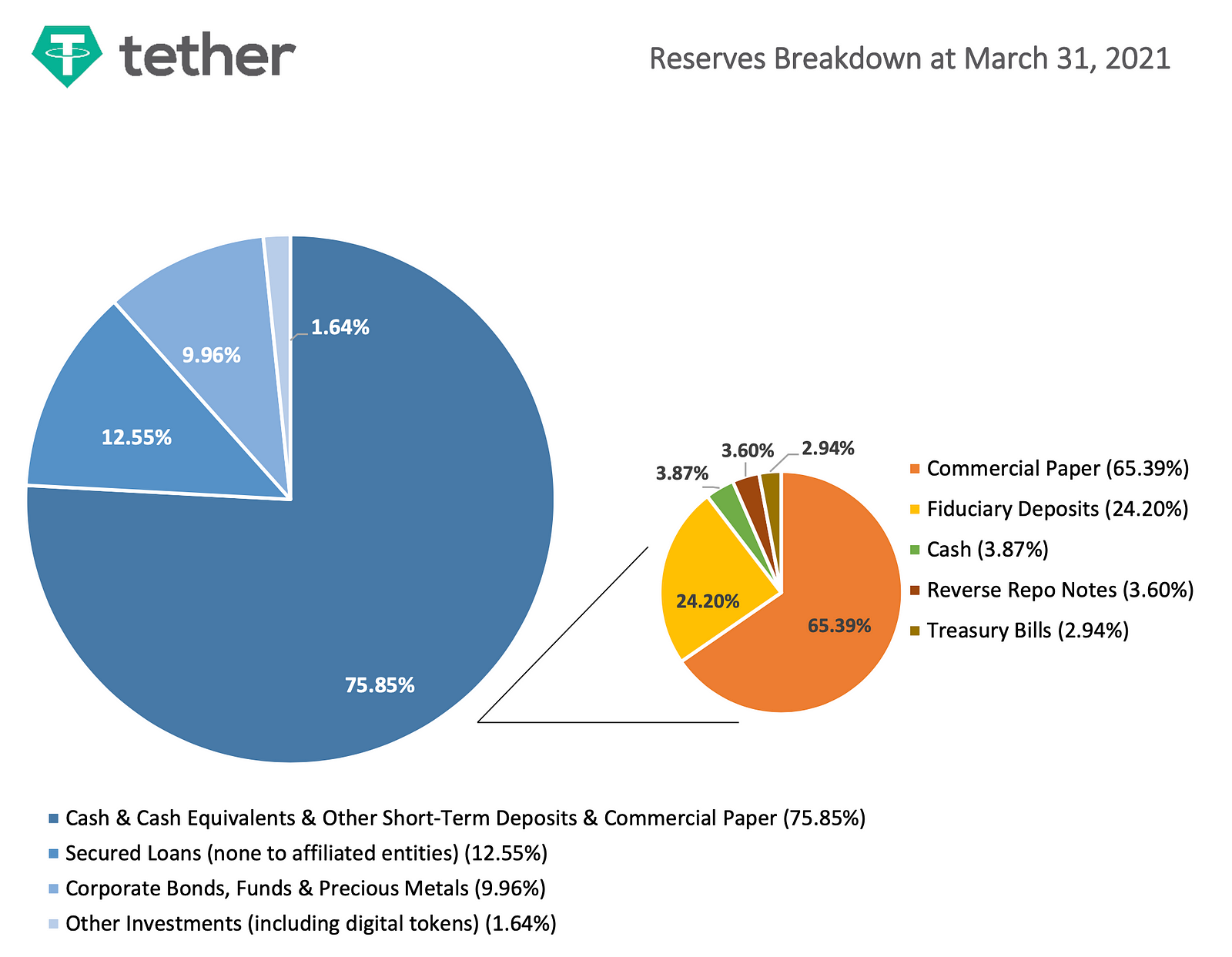

Historically they have remained adamant that Tether is and always was backed 1:1 to real dollars, but recently they’ve muddied the waters on this position by adding in a whole swathe of new assets that they claim keep the coin backed by dollars. So, you ask, what do Tether’s reserves look like now?

From looking at this pie chart we can see that Tether was once so far from being 1:1 on real dollars that it’s almost laughable. Of the 75% chunk of the pie chart labelled ‘cash & cash equivalents’ only 3.87% of that is actually real dollars, which amounts to a grand total of 2% cash.

The largest holding of ‘cash equivalents’ they hold is something called commercial paper which, in case you were wondering is: “an unsecured, short term debt instrument”. These sorts of assets are primarily used as a quick cash substitute to help balance books and are usually only utilised by corporations such as Apple, Facebook and Amazon, who typically have massive amounts of free cashflow.

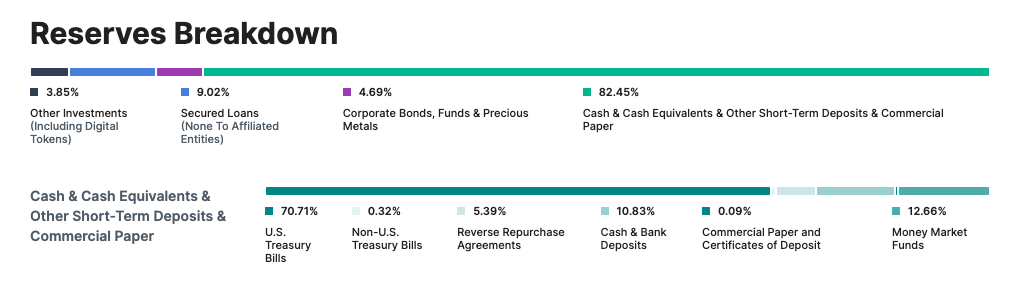

Tether have since updated their reserve statement with the following, which shows a much smaller (0.09%) amount of commercial paper, however, as you’ll soon learn, the legitimacy of these reserve breakdowns should be called into constant scrutiny until a professional audit is undertaken.

This means is that Tether was relying on commercial paper to make up nearly 50% of their total reserve. This is fundamentally absurd.

Tether’s claims of being backed 1:1 are provably false

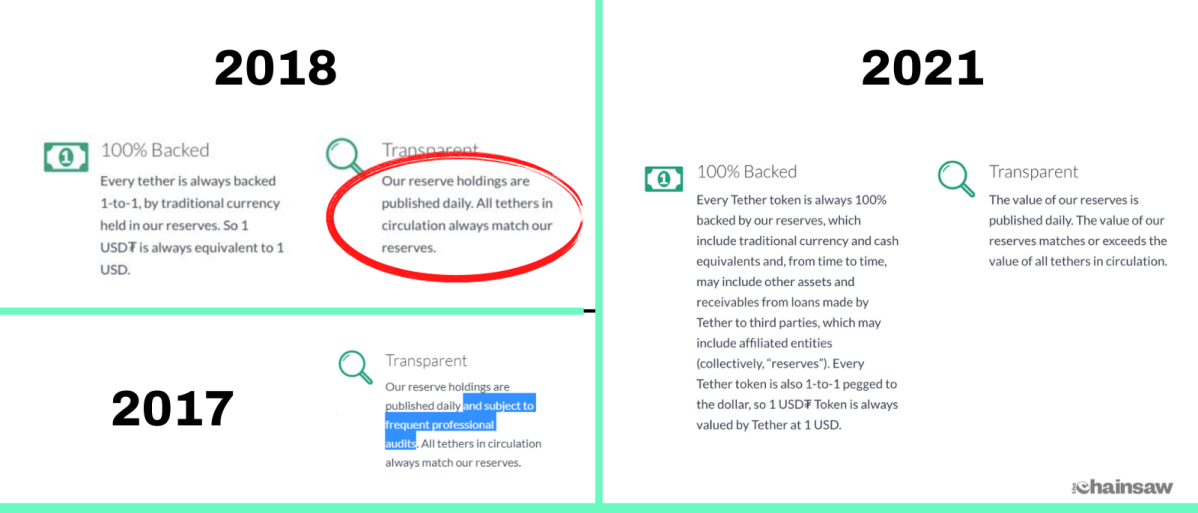

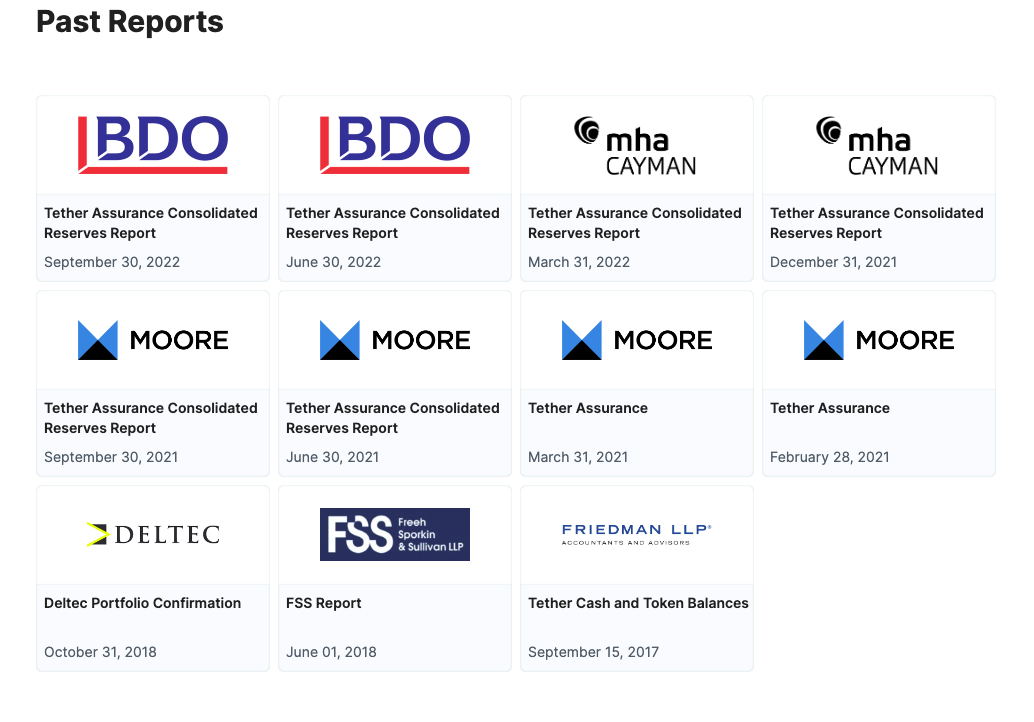

Adding to the concern for the legitimacy of Tether, is that they have also previously claimed all the way up until 2018 that their reserves were subject to frequent professional audits. This is patently false. There had not been a single independent audit conducted on Tether’s reserves up until 2020, which was conducted by a less than legitimate agency housed in the Cayman Islands.

Phil Potter, the co-founder and former Chief Strategy Officer of Tether publicly stated that the reason no one would conduct an audit on Tether was because they couldn’t find an agency willing to go through with one.

On a recorded phone call, Potter stated the following:

“No one wanted to touch it [Tether]… because of the negativity and uncertainty [surrounding crypto].”

When pressed for further details about the legitimacy of Tether’s reserves Potter instead gave his “word” incredulously saying: “I can assure you, the dollars are all there” in place of a professional audit. Also, the above statement simply doesn’t make sense. Why would an auditor not want to “touch” Tether because of the uncertainty around cryptocurrency. An independent auditor doesn’t care about supposed negativity that effects an industry, they’re just paid to go through the books in painstaking detail.

However, if you were to spend a little over 10 seconds Googling this statement, you can find that Potter’s claim that he couldn’t find anyone willing to conduct an audit is a pale-faced lie. Tether did, in fact, have an agency called Friedman LLP who were willing to conduct an audit back in 2018.

So what happened to the auditors? Well, Tether refused to continue cooperating with Friedman due to the:

“Excruciatingly detailed procedures Friedman were undertaking”

You read that correctly. Tether fired their own auditor on the grounds that they were being too thorough and were asking for too much information. In essence: Friedman LLP were fired for doing their job.

Since March 2021, Tether have hired a number of agencies to conduct “consolidated reserves reports”, which only shows the more face-value details of the financial status of a company like Tether. To be extremely clear, a consolidated reserves report is not an audit.

This information alone should be plenty to make anyone extremely sceptical about the financial activities that go down at Tether, but the horrible reality is, it’s only just getting started. To make matters, much, much worse, it turns out that the founders of Tether aren’t just fully associated with a major crypto exchange called Bitfinex, they’ve also been lying about their relationship for years.

Getting Bitfinex’ed

So what’s the big issue with Tether and Bitfinex being in cahoots?

As first exposed by an anonymous Twitter user called Bitfinex’ed: Bitfinex is a crypto exchange just like Binance or Coinbase and they were the main exchange that used Tether before it became massively popular in the broader market.

Now, because Tether is completely controlled by the same guys that run a massive crypto exchange it essentially means that this crew of questionable characters (which we’ll read more about in a second) can create new Tethers (which are always worth a dollar) out of thin air and funnel them directly onto their exchange, without any scrutiny or regulation from a third party.

They can then use said Tethers (worth US$1 each despite being oftentimes unbacked) to buy real cryptocurrencies like Bitcoin and Ethereum. After purchasing actual cryptocurrency — they can use new holdings of real crypto to mint even more new Tethers. This creates an enormous amount of real cash out of absolutely nowhere.

In plain English , by controlling the supply of Tether, this gang of anti-Robin Hoods basically gained access to their own personal money printer. They can indefinitely print money and then use that fake money to buy real cryptocurrency. They then sell this cryptocurrency and use that money to back more of their Tethers…

Beginning to see how this could death spiral?

This may sound a lot like a conspiracy theory but there’s very good reason to believe that all of this is entirely true. Here’s why.

Once again, Tether co-founder Phil Potter was caught red-handed, deliberately obscuring the relationship between Tether and Bitfinex.

He initially stated that Tether and Bitfinex aren’t owned by the same people or have any real relationship together, offering instead that:

“We bank with the same banks…”

Phil Potter

It was revealed in the Paradise Papers leak of 2017 that Tether and Bitfinex weren’t just working together, rather, they are in fact owned by the same people, namely: Phil Potter & Giancarlo Devasini (Tether and Bitfinex’s Chief Financial Officer).

So, if these guys co-own both Bitfinex; a massive crypto exchange, and Tether; the most highly traded asset in the cryptocurrency market, how trustworthy are they really?

This is where, professional fraud investigator Bennett Tomlin who appeared on a Youtube Video by fraud-buster Coffeezilla comes in handy. He’s currently writing a book on Tether’s unsavoury origin story and provides unique and damning insight into their founding members.

The founding fathers of Bitfinex & Tether

Let’s start with Bitfinex.

Bitfinex was founded in 2013 by Raphael Nicole. He was a help-desk technician before founding Bitfinex and spent the majority of his time scouring BitcoinTalk, a popular bitcoin forum, for fraudulent crypto schemes to participate in.

Raphael lost a good deal of his Bitcoin in the Trendon Shavers Ponzi scheme which was brought down by the US Department of Justice (DoJ). After this he attempted to start his own “high yield lending program” where other crypto holders would lend him their Bitcoin and he would use “arbitrage” to earn these holders 2% a week.

After he received little to no interest in this program because it was quite obviously a Ponzi scheme, he then decided to start Bitfinex.

He was then quickly joined at Bitfinex by Giancarlo Devasini, now the Chief Financial Officer at both Bitfinex and Tether. In 1996, Devasini, also a former plastic surgeon, was busted for selling pirated Microsoft software and was ordered to pay US$65,000 in fines.

Next to join Bitfinex was Phil G Potter the former Chief Security Officer of both Tether & Bitfinex, who was publicly humiliated when fired from Morgan Stanley after bragging about wearing expensive custom suits, a US$3,500 Rolex, and spending thousands of dollars on lavish dinners in a New York Times article.

Now, let’s turn our attention to the very strange crew that founded Tether.

Tether was originally founded as ‘RealCoin’ in 2014 by Brock Pierce, Craig Sellars and Reeve Collins. Brock Pierce was a child actor, known notably for his role in Mighty Ducks. He’s now more well-known for fleeing to Spain with convicted pedophile Marc Collins Rector where both of them were tracked down by authorities and arrested in what Interpol says was “a house filled with guns, machetes and child pornography.”

RealCoin was bought out by Bitfinex in 2014 and was renamed Tether. Both companies then shared the same executive team, a fact that was diligently covered up by all of its members.

The Tether and Bitfinex team was then joined by Paolo Ardoino in 2015 who now serves as the Chief Technology Officer at Bitfinex. He was employed as a Fintech developer, however it was later discovered that Paolo was previously a director of Delchain, a crypto-oriented branch of Deltec Bank, the same bank that now services Bitfinex & Tether.

Moving further down the ladder of questionable characters: the Bitfinex and Tether team were later joined by now General Counsel, Stuart Hoegner.

Hoegner was formerly the director of compliance for the parent company of Ultimate Bet, an online poker company that was rocked by a scandal in which it allowed some players (obviously those affiliated with Ultimate Bet) to see the cards of other players, effectively rendering it impossible for them to lose. Hoegner left the company shortly after this was exposed.

All of these people that we have just learned about are the core constituents that holds together the largest provider of liquidity and purchasing in the entire crypto market. They hold the keys to this and the staggering 66 billion dollars of capital associated with it.

All of this is more than enough information to be resolutely concerned with the legitimacy of Tether and the underlying stability of liquidity throughout the entire crypto market. Well, unluckily for crypto investors, there’s more.

Tether’s not-so-Noble bank

All of this following information first exposed by an pseudonymous source named Bitfinex’ed who told internet detective Coffeezilla that he noticed something was fishy in March 2017, after sifting through a lawsuit between Tether and Wells Fargo.

In the proceedings it was revealed that Tether & Bitfinex actually didn’t have any official banking services at all, despite this they continued issuing tens of millions of dollars of Tether despite being unable to take transfers.

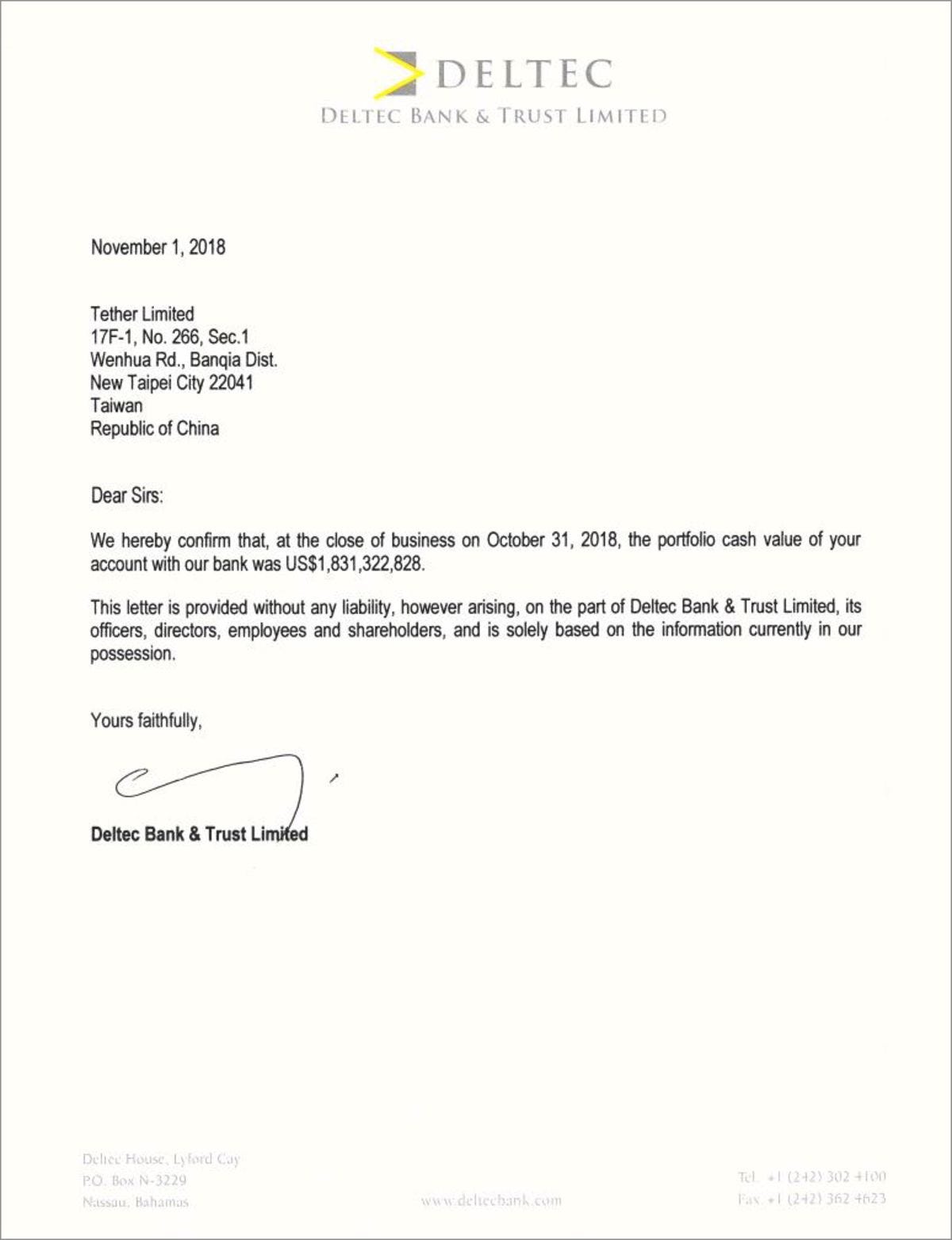

In response to pressure applied by Bitfinex’ed they applied for a financial ‘attestation’, which looks a lot like an audit but is actually just an incredibly quick glance at a bank account by a third party to verify the number of dollars in said account.

This is where things surpass the realm of shady and step into the realm of downright criminal.

It was discovered further down the line by Letitia James, the New York State Attorney General for the that Tether had convinced Friedman LLP, the third party that conducted the attestation to look into their account at ‘Noble Bank’ on an extremely specific day at an extremely specific time: 8pm on the 15th of September 2015.

On the 14th of September 2015, quite literally the day before, Tether didn’t even have an account with Noble Bank. On the morning of September 15, 2015, they opened an account with Noble Bank. Just moments later on the very same morning, Bitfinex transferred US$382 million into the Noble Bank account from their own private holdings.

The attestation was conducted at 8 o’clock that evening. No one from Friedman knew that both the bank account and the resultant funds had only been summoned into existence that same morning.

Adding fuel to the suspicion fire, the price of Bitcoin fell by over 40% in the two weeks leading up to the date of the attestation, suggesting that insiders at Bitfinex were selling boat loads of Bitcoin to provide the US$380 million they needed to prove that Tether was in fact ‘backed’.

Just hours after the attestation was released, the largest four hours of buying in the history of Bitcoin occurred, alluding to the fact that the Bitfinex team were busy buying back all of their Bitcoin now that they had proved to their customers that Tether was ‘legitimate’.

Bitfinex goes gangbusters

The next scandal occurred in the months following the attestation.

It’s safe to say that Bitfinex had issues with their banking model. They were getting too large to remain financially unserviced and desperately needed an actual institution to bank with.

In the world of crypto it can be hard for exchanges and companies to find banks that will deal with cryptocurrency because of valid fears of money laundering within crypto exchanges. Couple that with the fact that the boys from Bitfinex also have a history plagued by shady misdealing and you’ve got yourself a case of: ‘hard to find a bank that will trust you’.

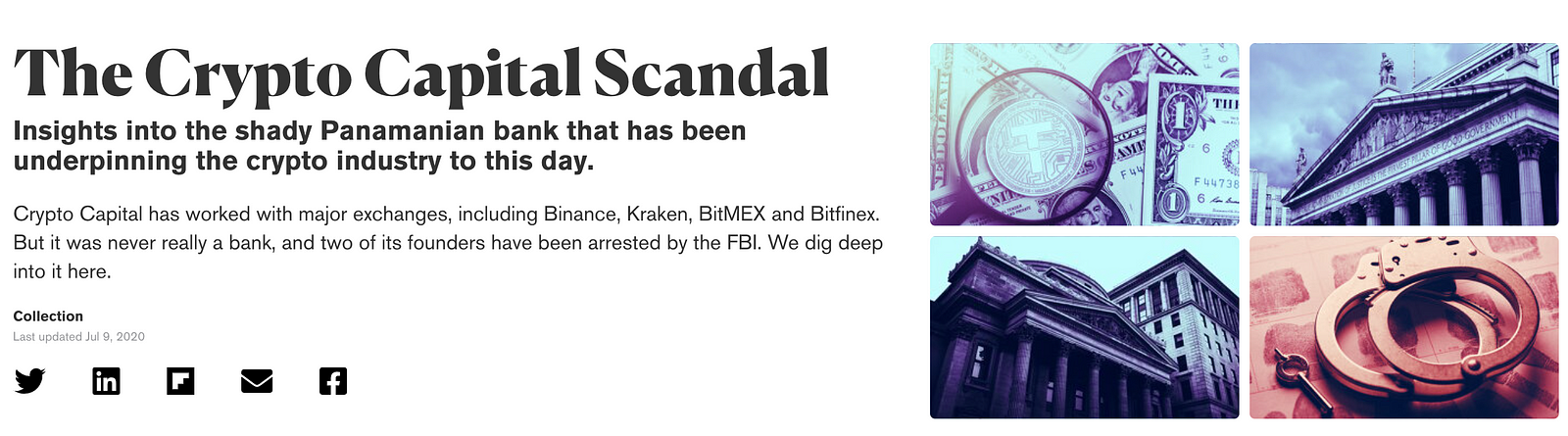

So, they decide to bank with Crypto Capital, an off-shore Panamanian ‘bank’ that dealt exclusively with cryptocurrency and had plenty of ties to some major players in the world of organised crime, namely: international drug cartels.

Anyways, Bitfinex and Crypto Capital began working together.

Bitfinex used Crypto Capital to bank approximately US$850 million in client funds. Crypto Capital were later, unsurprisingly, busted for their involvement in an illegal escort website called Backpage along with a long list of other very unsavoury cartel-adjacent clientele.

Long story short, the Feds came in and froze the entirety of Crypto Capital’s assets, immediately separating Bitfinex from 80% of their total funds … This should have spelled the end for the Bitfinex. There’s no way they could have continued their services and undertaken withdrawals for clients with an 800-million-dollar hole in their finances.

Instead of declaring bankruptcy and going bust like any other crypto exchange would have, they had a unique advantage. They weren’t just a lone wolf exchange. Bitfinex had hundreds of millions of dollars of reserves in Tether just sitting there. So, they decided to dip into those reserves: to the tune of US$400 million.

They could now continue servicing clients and conducting business like normal. In the face of vast media criticism, they had to prove that they were in fact “not insolvent”.

This is where they choose to bank with Deltec, which we learned before; founding member Paolo Ardoino was formerly a director. Deltec provides an attestation on November 1, 2018: ‘proving’ that Tether does in fact have the funds necessary to be backed at a ratio of 1:1.

However, immediately after this attestation was made public by an announcement from Deltec, on November 2, 2018, Tether then paid Bitfinex a sum total of US$475 million to help fill the gaps in Bitfinex’s balance sheet. This means that Tether is now once again, completely unbacked.

Obviously, now lacking the requisite funds ($475 million) to be backed 1:1, Tether made a fundamental shift in their public policy about how Tether was to be backed. This was mentioned in the infographic at the beginning of this piece, but I’ll re-share the important part below:

What happened to Bitfinex & Tether?

On the 23rd of February 2021, it ultimately resulted in the Attorney General of the State of New York, following a two-year-long Federal investigation stating the following:

“Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines. Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie. These companies obscured the true risk investors faced and were operated by unlicensed and unregulated entities dealing in the darkest corners of the financial system.”

Letticia James, NYAG

As settlement they were fined US$18.5 million dollars and were banned from practice in New York. One would think that Tether wouldn’t be able to just brush this off and then lie about it in a public statement or anything right?

Wrong.

Tether’s General Counsel, Stuart Hoegner penned a publicly available statement (now slightly altered but the original can still be viewed with the help of Wayback Machine) on Tether’s website which spectacularly stated the following:

“The New York Attorney General’s Office made no negative findings whatsoever that tethers were not fully backed nor were ever issued without backing, or for the purpose of manipulating crypto markets.”

Stuart Hoegner

This isn’t witty PR spin.

This is a lie.

Don’t worry, there’s more.

Tether’s Ties to FTX

The stunning collapse of what was once the world’s fourth largest crypto exchange FTX caught the crypto industry by surprise. In less than a week, Sam Bankman-Fried (SBF) went from benevolent poster-child of the crypto industry to public enemy number one, after it was revealed that he had been funnelling billions of dollars of client funds to prop up hyper-risky (and deeply unprofitable) trades at his provate hedge fund Alameda Research.

As Crypto Twitter frenzied over the daily bombshell developments, like the news that Alameda Research CEO Caroline Ellison had been engaged in a romantic, polyamorous relationship with SBF — bankruptcy filings revealed some more sinister details about FTX’s ties to Tether. The fingerprints of Tether are inescapably everywhere at all times in the world of crypto, especially when something dodgy is being surfaced.

So how was Tether linked to FTX? Was it the international drug trade, cartels or something Jeffrey Epstein-esque? Nope.

It was connected to FTX through a tiny little bank in the rural town of Farmington, US which then showed how a number of chief executives at Tether may have been using FTX’s own shady banking relationships to potentially move large sums of money around the world.

While FTX’s dodgy connections to the fun-sized Farmington bank raised plenty of eyebrows, Another strange coincidence that drew added speculation was the connection between the bank’s parent company ‘FBH Corp’ and Tether.

It turns out that the chairman of FBH Corp is banking executive Jean Chalopin. Chalopin also happens to be the chairman of the Bahamas-based Deltec Bank, which services both Tether and Alameda Research.

After FBH Corp purchased Farmington State Bank in 2020, it applied for approval with the Federal Reserve to facilitate cryptocurrency-related transactions. The bank received federal approval in June 2021. Roughly nine months later, FTX invested in the rural bank which was now Federal Reserve approved.

Many crypto market participants suggest that FTX’s investment in the bank wasn’t just a way of bypassing US banking regulation, it was actually a way of nefariously moving money between Deltec Bank, Tether, Alameda Research and FTX.

Ultimately, it remains a mystery as to how the Bahamas-based FTX, which was subject to ongoing scrutiny from major financial regulators, was able to purchase such a significant stake in a federally-approved bank. It’s murky connections to Deltec Bank and Tether only adds more layers to the opaqueness. As the FTX bankruptcy proceedings continue to unravel, further light will no doubt be shone on the finer details of the ties between FTX and Tether.

What’s the takeaway?

This article wasn’t written to scare people away from crypto, or to “take down” Tether in a self-destructive, market-imploding exposé. In fact, it’s quite the opposite. This article was written so that people can choose to use crypto companies that have a demonstrated history of not being engaged in repeated criminal offences.

Even if Tether and Bitfinex have cleaned up their act and everything is running perfectly over there, a stablecoin provider like Circle (USDC) simple doesn’t have a past riddled with illegal activity, and as such, is a much safer option than Tether.

Following the collapse of FTX, we can no longer allow bad actors to lurk below the surface, and organisations with a past as blotchy as Tether (USDT) should be called out so — at the very least — people know exactly who they’re going into business with.