NFT ownership: Owning IP rights is one thing, but what those rights entail is another.

One of the core promises of NFTs has been underlying incentives such as ongoing royalties for future sales and – perhaps more intriguingly – the ability to license an NFT that you hold into content and branding opportunities and partnerships. This utility has been variously promised or withheld by projects depending on their ultimate end goal, and it can often be a muddy proposition.

IP ownership is a minefield, with differing legal requirements by sector and location. The notion of what one can IP license in the world of NFTs is only beginning to be understood, let alone codified. In many cases, the promised IP rights amount to little in real-world legal protection, as they are not clearly defined and well-understood by the general public.

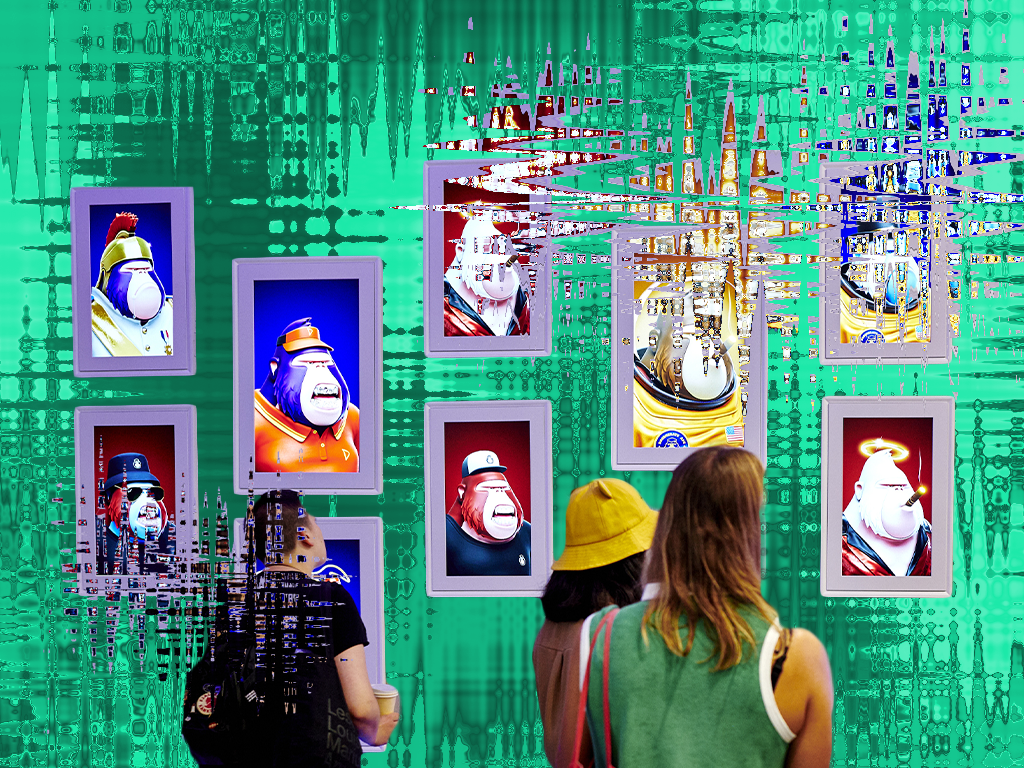

NFT ownership and BAYC

Bored Ape Yacht Club is the most obvious example of IP ownership through NFTs, but there are misconceptions about what that IP entails. The ownership of an NFT vs. the right of the brand that gives that NFT value is not always clear. For example, BAYC states that “when you buy an NFT, you acquire full control over the underlying Bored Ape,” However, Yuga Labs retains copyright ownership and intellectual property over the Bored Apes as a franchise.

Legally speaking, holders can do little more than slap their Ape on a beer can and call it a day. Yuga Labs are actively searching for brand collaborations that could legally trump any branding activities their holders undertake. These branding agreements could leave investors at odds with the umbrella project if they attempt to ink deals that do not align with Yuga’s goals.

In other projects, the ambiguity is far more apparent. Moonbirds, which launched with a promise of IP ownership for holders, turned the tables by announcing that the art for the entire collection of NFTs would transition to the public domain through a creative commons license. This move effectively strips IP rights away from holders and lampoons the basic idea of IP ownership.

NFTs and brands

Going further into the wild west of IP, the recent NFTiff drop by Tiffany & Co carried a set of terms and conditions that seemingly granted the company the rights to use NFTiff holders’ Cryptopunks in marketing and content activities without additional permissions. The reaction to this was swift and harsh, with many criticizing the move as a cynical ploy to exploit the hype around NFTs while giving nothing in return.

In the pantheon of NFT startups, the drop that seems most explicit on IP rights is Doodles, who have stipulated a limit on the amount of money that may be made from derivative works and licensing agreements, and prohibited the ability to alter the original artwork.

Although Twitter has mocked Doodles for its rules, the project has at least given its holders a solid foundation to build branding agreements and monetize their assets. This kind of clarity is needed.

Without these clearly defined rails, IP ownership is a dangerous offering and one that is easy to misunderstand. It’s important to remember that while an NFT may be yours, the IP contained therein may not be unless expressly stated or defined by the project’s creators.

The takeaway

So what’s the takeaway? For now, it seems that collectors should take anyone promising IP ownership as an incentive with a grain of salt. The space is still too new to clarify what those rights entail. In most cases, the only people who can genuinely capitalize on IP are the projects themselves. Codifying IP rights into the metadata and the contract of an NFT seems to be the most streamlined way of achieving clarity for holders.

It’s a solution that more projects should consider as they move forward. Holding regular IP town hall meetings and enabling holders to discuss their licensing plans with the team itself would signal to the market that a project is serious about IP and would give holders some much-needed power in the process.

The NFT market crash has tested the power of utility, with many of the promises made in the bull market being insufficient to sustain community engagement or hype. The benefits of IP ownership remain one of the few vital utility functions available to projects and holders, and both founders and investors should take it seriously. If done correctly, IP could boost the NFT ecosystem and act as a critical differentiator in an increasingly competitive market.