If you’ve had even a passing interest in the crypto world over the past decade, the question of what crypto mining is would have been important to you at some point.

However, unlike the mining you might be familiar with, it has very little to do with grabbing a pickaxe and going to town on a vein of silver ore on the side of a mountain. (Unfortunately!) It’s a little more complex than that — and has led to whole new industries and questions about environmental impact.

In this article, we’ll explore what crypto mining is, how it works and what crypto miners do.

What is crypto mining?

Put simply, crypto mining is the process that generates new crypto tokens or coins on a particular blockchain, as with Bitcoin or Ethereum. We call it ‘mining’ because it’s roughly analogous to the process of mining physical resources like gold or iron — even if the similarities basically end there.

On a more technical level, mining is the work that is done to open up new blocks on particular blockchains by validating transactions. This can take different forms depending on what blockchain we’re talking about, but in general, it is essential to the function of the chain, and miners are rewarded for their work with coins and tokens.

For the purposes of this article, we’ll mostly be discussing crypto mining in the context of Proof-of-Work blockchains like Bitcoin.

How does crypto mining work?

Crypto mining works by validating cryptocurrency transactions and adding them to the central ledger of a blockchain.

In the traditional financial system, when you send some money from one bank account to another, your account is debited and the other is credited. That sounds simple, but the infrastructure required to ensure this works on a system-wide level is immensely complex, requiring cooperation by everyone from banks and payment platforms to governments. They all work to make sure your money goes where it needs to go and that you can’t spend money you don’t have.

Crypto mining does similar work of securing the network in a trustless, decentralised system. Miners validate the transactions and add new blocks — essentially a bundle of transactions — to the blockchain ledger.

To do this, they must solve very complex mathematical equations named cryptographic hashes, which require an immense amount of computing power to break. The first miner to crack the code obtains the right to validate and add the next block to the ledger, and they are rewarded in the chain’s native cryptocurrency for their work.

Why does crypto need to be mined?

Crypto needs to be mined as part of the process to keep the network secure. Because cryptocurrencies are entirely digital, there is an inherent risk that bad actors and attackers could exploit the network through double spending and counterfeiting.

Crypto mining, first executed with the Bitcoin blockchain, solves this problem in two ways. Miners are basically auditors, using their computing power to ensure every transaction is valid and that no individual coin is being spent twice, which would undermine the entire network.

The second part is the reward. By offering cryptocurrency as a prize in exchange for the miner’s computer power and doing the work, it incentivises people to work together and secure the network without a central authority to guide the process.

How to mine crypto

Mining crypto requires only three things: hardware, software and a crypto wallet. Two of those are easy to obtain — there are many crypto wallets to choose from, and the software for crypto mining is usually free and open source.

The hardware is a different question and will inevitably be the most expensive part of any crypto mining setup. Any computer can mine crypto, but it won’t be worthwhile to do so in most cases unless you have a decently powerful hardware setup.

Different methods of mining cryptocurrencies

The different methods of mining cryptocurrencies mostly come down to the type of miner you are using. They are:

- ASIC mining: an application-specific integrated circuit (ASIC) is a device specifically built on a hardware level to complete a certain software task. Devices built specifically to mine crypto are the most expensive, but achieve the best results.

- GPU mining: a computer’s graphics card is well-suited to the cryptographic tasks required to mine crypto. It’s well known that high-end graphics cards often become in very high demand when crypto prices are high.

- CPU mining: applications that use your central processing unit are not the best way to mine crypto, but it is the most accessible for those who don’t have access to a dedicated rig. But don’t expect great results.

What are mining pools?

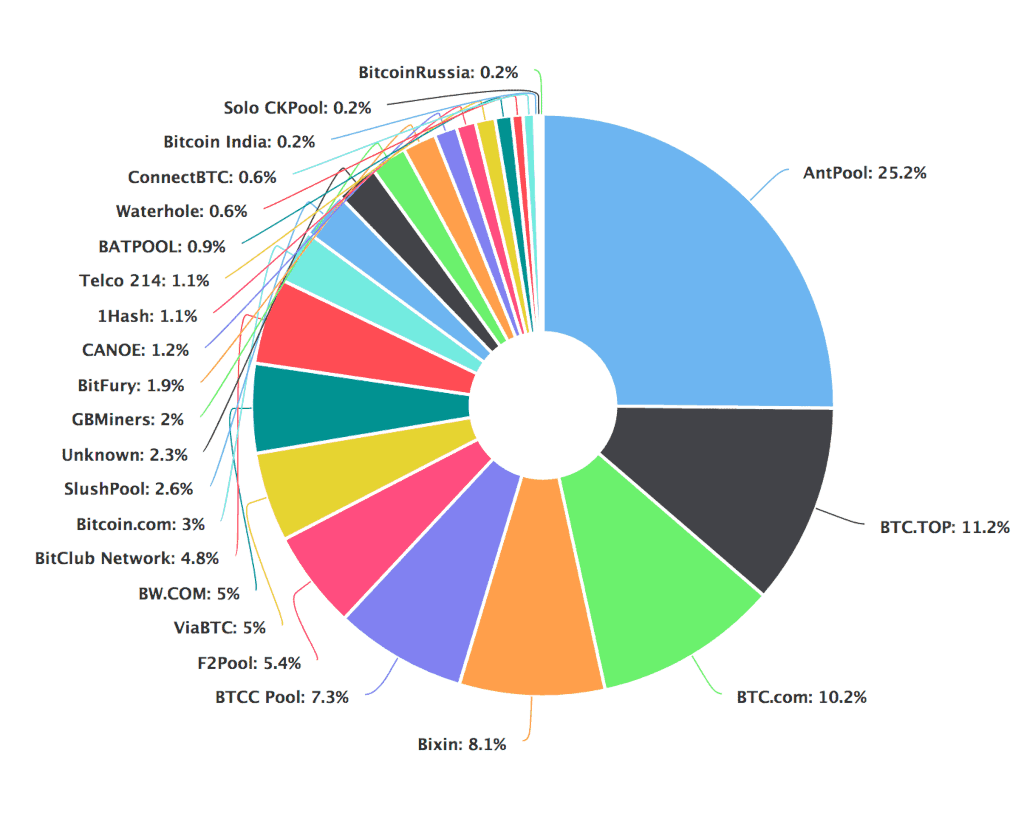

A mining pool is the pooling of resources by crypto miners, who share the processing power of their various mining rigs with the goal of also sharing the rewards if they are successful in creating a new block.

By bringing together their computing power, the individual miners are increasing their chances of being part of the creation of a new block, and they’re willing to share the spoils for that improved shot at the prize.

As the rewards for mining shrink and the process becomes more difficult and demanding — as is the case with popular cryptocurrencies like Bitcoin — mining pools become more widespread.

Is crypto mining worth it?

The short answer to the question of whether crypto mining is worth it is probably not. The long answer? It’s complicated.

When it comes to the two most popular blockchains, Bitcoin and Ethereum, the answer is pretty clear. As an individual, it’s unlikely going to be worth it for you to start crypto mining now.

There are a few reasons for this. Firstly, the competition on these blockchains is fierce. Bitcoin mining is no longer something a small group of hobbyists are doing for kicks on their home computers. It’s now heavily concentrated and the biggest miners are commercial operations with warehouses full of equipment, often working with sophisticated electricity usage deals with their local power providers.

Additionally, the rewards for Bitcoin are shrinking as the number of coins gets closer to the hard coded limit of 21 million. After every 210,000 blocks mined — or roughly once every four years — the coin reward is halved. This is to ensure the purchasing power of Bitcoin can increase over time.

There are other coins, like Monero, which can also be mined. It’s worth doing your research on what the current requirements and rewards are for those coins before making the decision to enter the mining world.

Even if crypto mining isn’t worth it for you on an individual basis, it might be as part of a mining pool.

The tax implications of crypto mining

There are tax implications for crypto mining in Australia.

If you mine crypto as a hobby — which generally means you are doing it on a small scale without much by way of specialist equipment — then the cryptocurrency you accumulate is treated as a capital acquisition and as part of the capital gains tax system.

If you mine crypto as a business, it is taxed according to trading stock rules and treated as business income.

Either way, you should keep records and speak to a tax accountant about your obligations.

Is crypto mining legal?

Crypto mining is usually legal, depending on where you live. In Australia and most U.S. states, crypto mining is legal.

However, some jurisdictions have cracked down on crypto mining. For example, China officially banned crypto mining in 2021, shaking the local industry.

Always check local laws before you decide to get into crypto mining.

Can you mine crypto on your phone?

It is technically possible to mine crypto on your phone. Your smartphone likely has both a CPU and a graphics unit, meaning it can mine cryptocurrency.

But it’s not a great idea. Firstly, your phone has a fraction of the processing power of a genuinely effective crypto mining rig, meaning you’re unlikely to achieve returns that would make it worth your while.

Secondly, the process of mining is intense. You’re likely to significantly shorten the lifespan of your phone if you put it through the paces of crypto mining.

Both Apple and Google have banned crypto mining applications from their respective App Stores. It is possible to sideload crypto mining software onto an Android smartphone or jailbroken iPhone, but again, it’s worth considering whether it is worth it.

Several cryptocurrencies, like Pi and AntCoin, have at times launched promising phone-based mining. Do your research before engaging with those kinds of projects.

Why does mining use so much electricity?

As anyone with even passing familiarity with cryptocurrencies like Bitcoin will tell you, crypto mining uses a lot of electricity.

It’s estimated that Bitcoin alone consumes electricity at an annualised rate of 127 terawatt-hours (TWh) — or roughly the yearly energy usage of the whole country of Norway. Much of that power consumption is used by miners.

Bitcoin’s consensus mechanism is particularly rough for power consumption. As miners race to solve the cryptographic hash and gain the right to write the next block, they are all expending energy on the complex mathematical puzzle. Even though only one of them will eventually ‘win’, there are millions of machines competing to do so. That adds up.

The sustainability of crypto mining

There are two things that can happen to help improve the sustainability of crypto mining.

The first is to move away from it altogether. Crypto mining is always going to be power-hungry by its very nature, so one solution is to migrate to less intensive blockchain systems. Most new blockchains launched these days do not use Proof-of-Work, largely because of its computing and environmental effects.

The second option is to move to sustainable, renewable and greener energy for crypto mining. This can be a highly complicated undertaking that is tied to the rest of the economy’s take-up of green power and can fall down easily if crypto miners think they can get a cheaper deal with fossil fuel-generated electricity. But some of the world’s major Bitcoin farms like Bitfarms utilise hydropower, for example.

In short: crypto mining isn’t a particularly sustainable activity. But there is evidence the crypto space has dramatically shifted towards the use of more sustainable energy sources.