OpenSea royalties: The debate around NFT royalties is one of the most consequential discussions in the world of Web3 today. Royalties are considered by many to be one of the founding pillars of Web3, as royalties have allowed artists to earn income and sustain their creative work in a way that simply didn’t exist in the world of traditional art.

However, the growing prominence of royalty-free NFT marketplaces has caused a significant shift in the industry, with many of the large exchanges choosing to alter their approach to royalties in response to a shrinking market share.

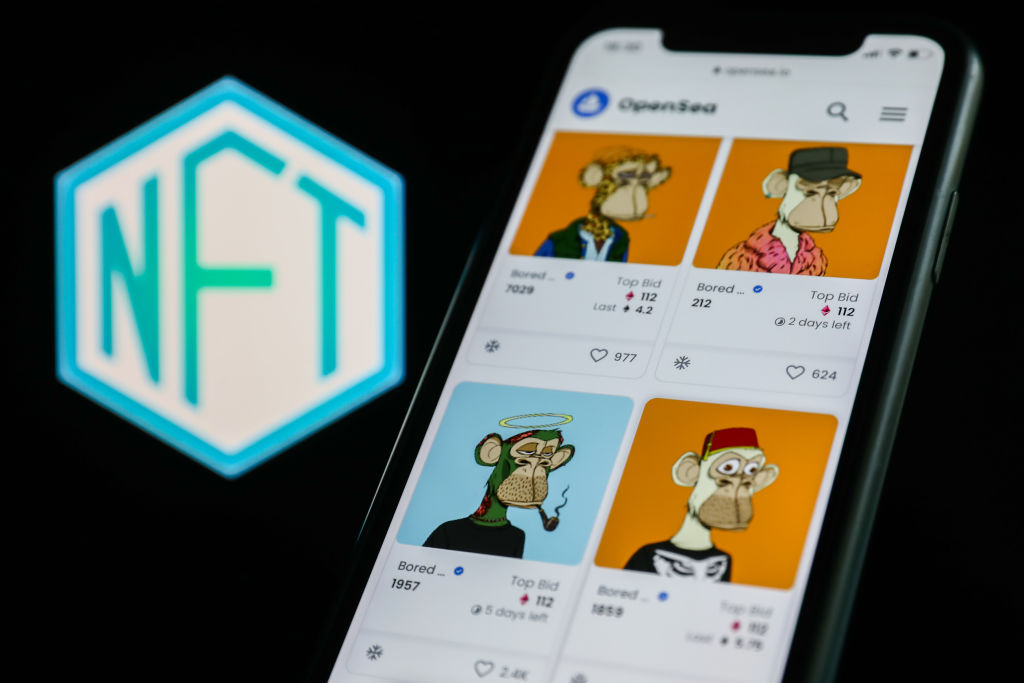

Royalty-free marketplaces are more attractive to traders looking to buy and sell NFTs quickly, as paying royalties on multiple trades per day is seen as an expensive add-on. The general shift towards “flipping” NFTs has seen royalty-free marketplaces like Blur and X2Y2 grow rapidly in popularity. In response to this competitor growth, major exchanges like OpenSea have made a sharp turn to introduce optional royalties, in an attempt to entice more trading on its platform.

On November 6, OpenSea announced on Twitter that it would introduce a tool for new collections to enforce royalties on its platform. The announcement triggered an explosion of responses from practically every major creator in the world of NFTs. While many praised OpenSea for supporting artists and new collections with the introduction of the new tool, the bulk of the community was enraged that OpenSea had essentially thrown existing collections to the wayside.

OpenSea royalties

In response to the industry-wide backlash, OpenSea quickly moved to assure the community that royalties for creators would continue to be enforced for existing collections.

Recently, OpenSea reignited the discussion by revealing a number of changes to its enforcement of NFT royalties. In a Twitter thread, the world’s leading NFT platform announced the creation of the Creator Ownership Research Institute (CORI) which will select which Ethereum-based marketplaces are to be blocked by the platform’s new Operational Filter tool.

CORI will see OpenSea, alongside a number of other prominent NFT marketplaces and Web3 developers including SuperRare, Zora, Manifold, Nifty Gateway and Foundation, work together to dictate the future of royalty policies. Essentially, the establishment of CORI means that the firms will use a multi-signature wallet to make changes to the Operator Filter Registry, a list of all the soon-to-be-blocked Ethereum-based NFT marketplaces.

In response to previous backlash, OpenSea also lengthened the time frame for NFT creators to launch projects without the Optional Filter enabled, pushing the opt-in date back from November 8 all the way to January 2.

This means that from January 2, NFT projects that choose to launch without the Operator Filter tool switched on, will be able to set a royalty fee that will be “optional for collectors to comply with”. This day will mark the first time that OpenSea has made royalties optional for traders.

While OpenSea argues that the tweaks were made in response to artist feedback, not everyone in the world of NFTs is thrilled with the move to optional royalties.

Greg Oakford says it feels messy

The co-founder of NFT Fest Australia, Greg Oakford told The Chainsaw that the whole royalty situation is undeniably tricky, and that unfortunately for NFT enthusiasts, there simply doesn’t seem to be a silver bullet.

“My initial reaction to OpenSea’s latest move with the centralised CORI governing mechanism is that it goes against decentralisation and feels messy. But on the flip side, this is becoming more and more of a short term political battle amongst the marketplaces and OpenSea is making a stronger bet on the narrative of royalties being enforced winning out,” he said,” Oakford said.

“Don’t get me wrong, I’m pro royalties as I think it’s a massive selling point of the new creator economy and something that piqued my interest in early 2021 when I got involved in NFTs.

I’m just not sure that playing ‘whack-a-mole’ with all the new marketplaces that pop up that don’t want to honour royalties is the long term solution,” he added.

Roo Troop’s Morgan Stone isn’t too bothered

When asked about the move to a more centralised governing body, Morgan Stone the founder of Roo Troop said he didn’t mind too much, saying that OpenSea’s move to optional royalties still holds up.

“I’m not a decentralisation maxi by any means, and on the flip side, I’m definitely a profit maxi. So I don’t really care if it goes against some decentralisation ethos, they’re a centralised business making a decision that positively impacts them and gives me, as a creator, the option to make my own decision that positively impacts me and my business,” he said.

Stone added that the only “fix” to the current problem with royalties would be to take things back to the way they were before OpenSea changed its enforcement policy.

“Nobody was complaining about royalties or not trading due to royalties. Marketplaces only got rid of them after the first domino fell. Snowball effect, now everyone’s fucking with them,” Stone said.

At the end of the day, Stone says that NFT projects who were revenue-stream focused from the outset shouldn’t feel too much of a hit from the decision.

“Those of us who always have focused there have kept building. Debating about royalties is just a noisy distraction,” he concluded.

Web3 entrepreneur Joan Westenberg weighs in

Speaking to the most recent announcement from OpenSea, Westenberg held no punches, claiming that the OpenSea should never have moved to backtrack its royalty policy in the first place.

“We’ve been hearing a lot lately about platforms like OpenSea trying to ‘fix’ the way that NFT royalties are handled. But here’s the thing: NFT royalties weren’t broken to begin with,” she said.

“The only reason platforms are caught up in this discourse is because they made hasty decisions powered by greed and an insensitivity to the needs of the creators who give their products value.”

“Instead of taking the time to understand the needs of creators and build a fair and sustainable system for royalties, they rushed to fill revenue holes created by the bear market, and began a race to the bottom that favoured degenerate gamblers over actual value adding artists,” concluded Joan.

‘Boot’ steps on the scene

Speaking more broadly to the concept of royalty payments overall, pseudonymous NFT figure ‘Boot’ who is also the Head of Launch at West Coast NFTs, said that while he supports the idea of royalties overall, projects should be looking for ways to diversify their income.

“I think royalty-dependent projects should spend their money a little more carefully, and start finding other revenue streams,” he said.

“Too often these projects are larping on Twitter as supporters of artists when, in reality, they see their poorly structured business model challenged by the other side of the royalty debate,” Boot concluded.

‘Gami’, the founder of Gnars DAO, a subsidiary project of the wildly successful ‘Nouns’ NFT collection, echoed Boot’s sentiment, saying that there were fundamentally more creative ways to go about looking at royalties in the NFT space.

“To be honest, I think there are way more crypto-native and innovative ways to think about NFT revenue than just taxes.” he said.

“I would love to see artists being more willing to explore those options. Especially when as an artist myself, I am doing just that, and consider art as an exercise in feeling out boundaries pushing them,” Gami explained.

OpenSea royalties

The overarching attack on blanket creator royalties doesn’t seem to be winding down any time soon, and OpenSea isn’t alone in its move to make royalties optional. Last month the Solana-based NFT marketplace Magic Eden also announced their move to optional royalties as well, but not after being slammed by the community for it.

The NFT royalty saga rages on and clearly, there is still more to come.