What is a memecoin? Here is the explainer about what memecoins are and what to do with them. Memecoins are a type of cryptocurrency supported by enthusiastic followers, although the crypto may hold little intrinsic value.

What is a memecoin?

A memecoin is a type of cryptocurrency that is created around a popular meme. These cryptos are marketed as a fun alternative to mainstream cryptos like Bitcoin or Ethereum.

The term “meme” is a picture or a joke that spreads rapidly through the internet, through social media platforms like Twitter, Reddit, and TikTok.

Dogecoin and Shiba Inu memecoins are based on a dog meme. The memes usually featured a Shiba Inu dog, accompanied by multicolored words in Comic Sans, displaying an anxious internal monologue, written in ‘dog talk’. The cryptocurrency Dogecoin was a spin-off of this meme series. Despite its origins as a joke, Dogecoin is a hugely popular cryptocurrency with a dedicated following.

Memecoin developers have taken inspiration from all sorts of popular cultural trends. These coins have catchy names and logos that appeal to those that like the famous memes.

Shiba Inu (SHIB) was created in 2020 and is also based on the popular “Doge” meme. More recently, the Pepe Coin has hit the news. “Pump the frog!” is the call to arms of people who like this new memecoin. Named after a cartoon frog popularised by memes (many of which were appropriated and perpetuated by the far right and white nationalist movements), the coin soared to a market cap of over $1.6 billion, before falling slightly.

What are the best memecoins?

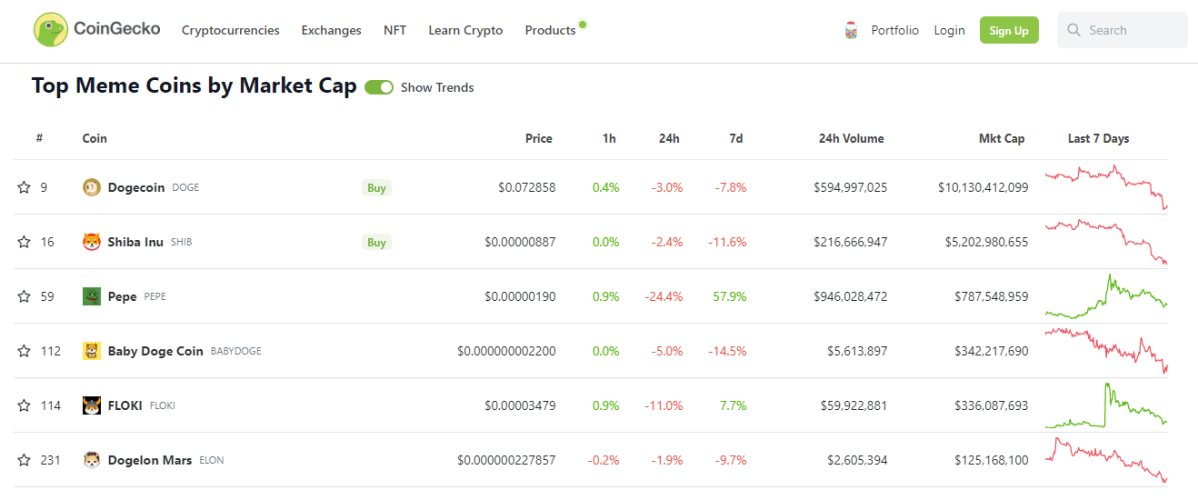

It’s hard to say what are the “best” memecoins, but there are ways to see which are the most popular. There are sites on the internet which show the most commonly-traded memecoins, which are in their own category. At the time of writing, the usual suspects are at the top of the charts, Dogecoin (DOGE) and Shiba Inu (SHIB). New contender Pepe is now in third place, which has been somewhat of a meteoric rise.

Memecoins can be fun and entertaining, but like any of the cryptocurrencies or even mainstream investments, they can also be highly speculative and risky as an investment. Memecoins can have little use in the world, other than that they might rise in price and make the buyer a profit (though they are just as likely to fall in price as well).

Understanding memecoins

Memecoins work like other cryptocurrencies, using blockchain technology to make transactions and maintain a ledger of coin transfers.

When a memecoin is first created, it is usually released into the market through an initial coin offering (ICO). This allows investors to buy the new coins with other crypto like Bitcoin. The price of the new memecoin is usually determined by market demand and supply. Early investors usually buy in, hoping that it will become really popular, and they can sell later at a profit.

After the initial release, memecoins can be bought and sold on crypto exchanges. Because memecoins are usually connected with hype, their value can be volatile. Mentions by celebrities can make the prices spike. However they can fall sharply after.

Something that memecoins have in their favour is that they tend to have very active and loyal communities around them. This keeps interest in the cryptocurrencies high.

These communities can also develop unique cultures and traditions around the coin, such as creating memes, merchandise, and even charitable donations.

Memecoins can be entertaining for investors, but they are somewhat riskier than more mainstream currencies that can be used to buy things and pay for everyday items.

Common memecoin characteristics

Memecoins have some common features.

Catchy name and logo: Memecoins usually have catchy names and logos that appeal to a broad audience. The name and logo are based on a popular meme or culture trend.

Community-driven: Memecoins often have passionate online communities that plug the coins with social media activity that keep the coins in the spotlight and increase its value.

High volatility: The value of memecoins can be highly volatile, often fluctuating in response to trends or celebrity comment.

Low market capitalisation: Memecoins don’t have as many people buying them as the more mainstream cryptos, so they have a smaller market capitalisation.

Little or no working uses: Memecoins often have no use beyond their cultural appeal. They are largely driven by speculation.

Initial coin offerings (ICOs): Memecoins are usually released through an ICO, so investors can buy them with other crypto like Bitcoin or Ethereum.

Limited adoption: Memecoins may not be accepted as payment by most businesses.

Pros and Cons of Memecoins

Pros of Memecoins:

Potential for High Returns: Memecoins MAY generate high returns for investors, especially if they buy in early and sell at a higher price during periods of high demand.

Community-Driven: Memecoins often have passionate and active online communities. So there can be a lot of connection and fun that is involved in owning the memecoins.

Accessible to Retail Investors: Memecoins are often accessible to retail investors, meaning that everyday people can buy them. This means that any one can have a play in the cryptocurrency market with relatively low investment amounts.

Cons of Memecoins:

High Risk: Memecoins come with high risk because their value can be highly volatile, often fluctuating rapidly in response to events on social media. Investors can be hit with significant losses if they are unable to sell their coins at a profit.

Lack of Regulation: Memecoins, like other crypto products, are largely unregulated, so investors don’t tend to have the same level of protection as they do with traditional investments.

Limited Adoption: Memecoins usually have limited adoption and are not usually accepted as payment by businesses, which tends to limit their value.

No Real-World Uses: Memecoins often have little use beyond their cultural appeal. This means that their value can be driven by hype.

Can you make memecoins?

Yes, you can make your own memecoin, but it does require technical and marketing expertise. And you have to choose a meme that is popular enough to build a decent interest. Although you may be able to let AI do the hard work for you if you’re cluey enough.

To create a memecoin:

Choose a name and symbol: Choose a unique name and symbol that reflects a meme or cultural phenomenon.

Choose a blockchain: Decide which blockchain you want to build your memecoin on. Many are built on the Ethereum blockchain, which allows for the creation of custom tokens.

Create your coin: Use a token creation tool or smart contract. Define parameters such as the total supply, decimals, and initial distribution.

Market your coin: Once your coin is created, market it to investors, and be sure to build a community around it. Ideas to do this include social media campaigns, and other advertising.

List your coin on an exchange: You may need to pay listing fees and meet certain requirements set by the exchange.

Manage your coin: Once your coin is listed, it will need managing, which means ongoing marketing and community-building efforts. Also time will need to be spent on security measures to prevent hacks.

Memecoins to invest in

Firstly, be cautious when investing in memecoins, as they are highly risky. You should conduct thorough research before investing in any cryptocurrency, including memecoins.

Here are some popular memecoins that you could consider buying as a beginner:

Dogecoin (DOGE)

Dogecoin is one of the oldest and most well-known memecoins. It was created in 2013 as a joke based on the popular “Doge” internet meme. Despite its origins as a joke, Dogecoin has gained significant popularity and has been embraced by some high-profile investors and celebrities.

Shiba Inu (SHIB)

Shiba Inu is another memecoin that is based on the “Doge” meme. It was created in 2020 and has gained significant attention due to its low price and high volatility.

There is even a Shiba Wings cafe at the Gold Coast in Australia, where you can use your SHIB to buy food and drinks.

Pepe (PEPE)

Pepe was inspired by the internet meme called “Pepe the Frog.” Its creators wanted to compete with other popular memecoins like Dogecoin and Shiba Inu. Pepe is built on the Ethereum blockchain, and people who hold onto the coin get a little bit of money each time someone buys or sells it. This is meant to incentivise people to hold onto their coins for longer.

If you want to buy Pepe Coin, you have to create a MetaMask Wallet and get some Ethereum first. Then you can go to Uniswap to swap your Ethereum for Pepe Coins.

Hoge Finance (HOGE)

Hoge Finance is a memecoin that is based on the “Hoge” meme. It is designed to be a deflationary currency, with a portion of each transaction burned to reduce the total supply.

SafeMoon (SAFEMOON)

SafeMoon is designed to incentivise long-term holding by charging a 10% fee on transactions, with half of the fee distributed to existing holders and the other half burned to reduce the total supply.

What are the top 5 trending memecoins?

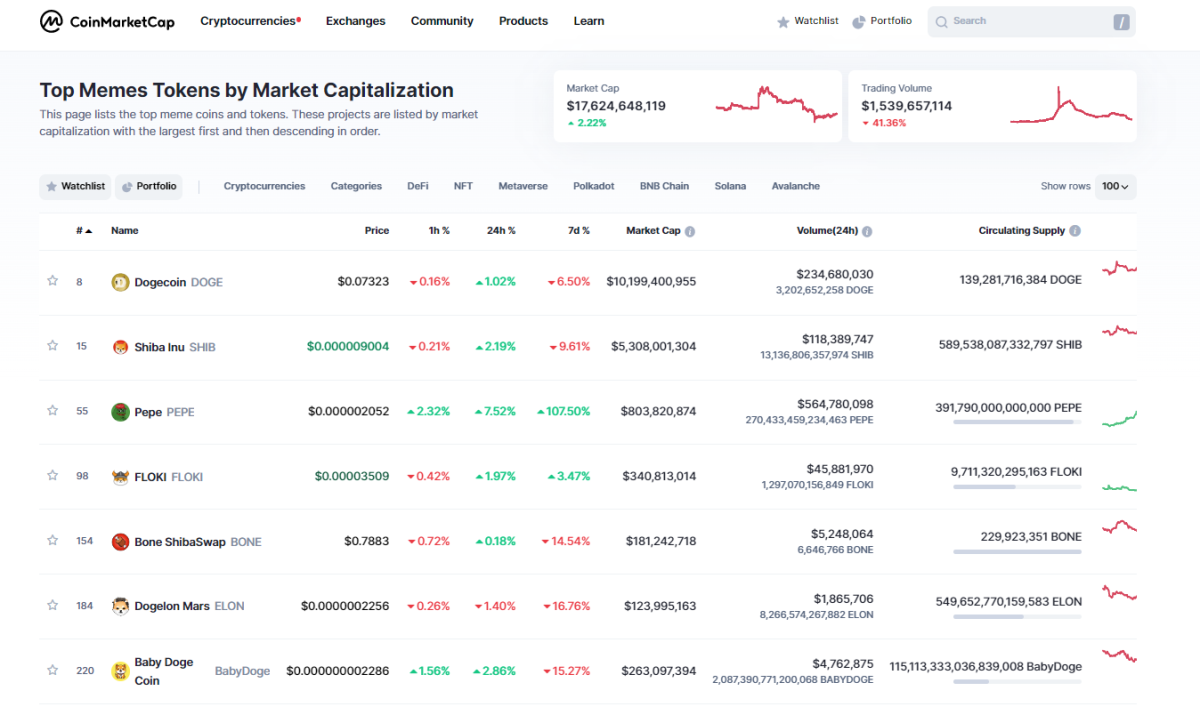

According to Coin Market Cap, here are the top trending memecoins at the time of writing.

Conclusion

Memecoins are a type of cryptocurrency that are based on internet memes or cultural phenomena. They are typically highly speculative and come with high risks, but can also offer the potential for high returns for investors.

Memecoins are created and managed using blockchain technology, which allows for decentralised and transparent transactions. They can be bought and sold on cryptocurrency exchanges, and their value is determined by supply and demand in the market.

Some common characteristics of memecoins include a low market capitalisation, high volatility, and a strong community of supporters.

While memecoins can offer the potential for significant gains, they also come with significant risks and should only be invested in with caution and after conducting thorough research.