Crypto decentralisation: As we approach the end of 2022, it is now painfully evident that pseudo-decentralisation in the crypto industry has been a profound mistake. Catastrophes like the rise and fall of FTX and Luna have exposed the vulnerability of systems that lack true crypto decentralisation. And that poses an existential risk for the entire industry.

Pseudo-decentralisation masquerades as a benign force, claiming to create decentralisation without needing a formal governance structure. But in reality, this false kind of decentralisation allows centralised entities to exert control and influence, leaving the platforms vulnerable to censorship, corruption and predatory abuse.

The absence of a decentralised governance model and monitoring protocols in FTX and Luna meant that the platforms were open to exploitation and manipulation by their founders. With weak infrastructure and no protection, these platforms eventually gave way and left users exposed and vulnerable.

The events of May-November 2022 have caused shockwaves throughout the industry, casting a harsh light on opaque and unreliable systems. People everywhere are grappling with the implications of this catastrophic wake-up call, realising that absolute freedom lies only in the path of decentralisation.

As Christmas approaches, the true meaning of the holiday comes into focus – true crypto decentralisation is the future.

Crypto decentralisation has a problem

Disillusionment has truly taken hold in crypto investors who believed in these failed projects, only to witness their aspirations for financial freedom dissipate. For the crypto ecosystem, the fall of FTX and Luna serves as a bitter reminder of the risks of pseudo-decentralisation.

During the previous bull run, the notion of true DeFi felt far removed and not very realistic. Despite the euphoria, it was easy to predict the dangerous level of risk and instability that would come with the lack of genuine decentralisation combined with an unstructured, macro-connected market.

As the shady deals of some actors clouded the promise of a new financial world, the industry has started to take a closer look at their practices. Some have pointed to FTX as a reason for stricter regulations to prevent similar events occurring again. Governments and global institutions have started calling for increased crypto market regulations to prevent malicious behaviour and provide consumer protection. The calls for consumer protection and a regulatory framework have become louder.

In response, we’ve seen industry-wide collaborations between exchanges, developers and users to build community trust while providing more transparency and accountability across platforms. The focus is on decentralising the entire system, ensuring that no one actor can control the platform or game the market.

The perils of pseudo-decentralisation are clearer in 2022 than ever before; it has undermined the ethos of decentralised networks and led to a massive crash, only made worse by the dangerous macro scenarios.

Crypto decentralisation should guarantee autonomy and freedom for users, ensuring privacy and preventing single entities from having the power to dictate or censor the network. Pseudo-decentralisation granted authority to a central body, leaving many crypto adopters no better off than those tied to an antiquated centralised system, vulnerable to manipulation and exploitation.

2023 and beyond, true decentralisation can be realised

2023 is the year true decentralisation will take over. With more users abandoning the traditional centralised exchanges and pseudo-decentralised platforms, they are turning towards truly decentralised networks, where no single entity controls the network or its users.

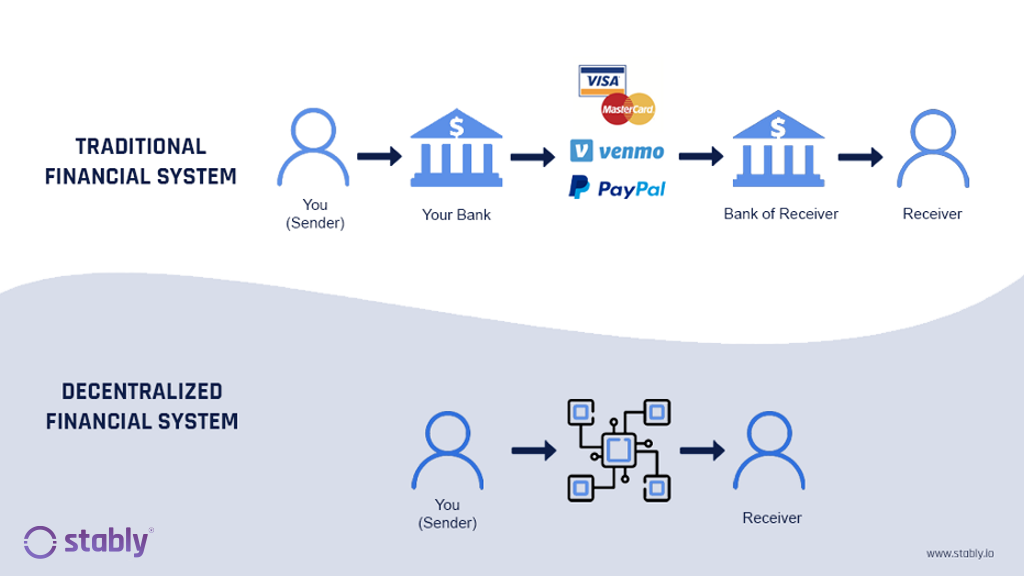

The advantages of the ecosystem embracing fully decentralised networks are clear. Firstly, users have complete autonomy over their funds and transactions. A centralised authority or middleman does not bind them, so they can carry out whatever transactions they choose without external interference. This also means that their funds are safeguarded against thefts, hacks, or scams since the control lies entirely in their own hands.

Furthermore, these networks are protected from market manipulation or censorship since no single entity controls them. Because of this, they can provide a haven for investors and traders looking to safely conduct their business without worrying about malpractice or unfair practices.

Lastly, fees on decentralised networks are much lower than those on traditional exchanges, as there is no need to pay additional costs for third-party services. This makes these networks much more attractive for traders and investors who want to access the benefits of decentralisation without paying high fees.

As more people realise the potential of true decentralisation, demand for these networks continues to grow exponentially. 2023 is set to be a year full of possibilities. As blockchain technology reaches its tipping point — with more participants joining every day —it will soon become the financial system of choice for millions around the world.

The crypto winter of 2023 will be a time of reckoning for centralised exchanges and pseudo-decentralised platforms. As users abandon these models in favour of true decentralisation, the growth and adoption of DeFi will accelerate. Ethereum and Cardano become essential tools in this transformation, leading to a new financial system that is open, transparent, and secure — a positive future that shatters the constraints of our past.