A shitcoin is a colloquial term for a cryptocurrency that investors deem to have little to no value or purpose. While the term is broadly used for tokens that serve no real function in the broader market, it’s a term that gets thrown around by crypto investors when describing a token they don’t like.

Shitcoins usually follow a very similar pattern. They start off with an extremely low value. Next an influencer or big personality comes along and drums up interest in the project through expensive marketing campaigns. These figures usually own a good portion of the circulating supply of the shitcoin. After they’ve driven up the price of the token, they sell their holdings for a huge profit and tank the price of the shitcoin.

To avoid getting caught up in something like this, here’s a brief guide on how to spot shitcoins.

How to identify shitcoins

It’s actually not to hard to spot a shitcoin, simply because the signs are often extremely obvious, especially if you know where to look.

1) Shitcoins usually have very low value

Shitcoins often have a very low market capitalisation (total value), meaning that its easy for big investors to manipulate the price of the token. When a token has a low value, it makes it easy for influencers, celebrities and grifters to create hype around the token, artificially ‘pumping’ up its price before selling and ‘dumping’ on the unfortunate buyers of the shitcoin.

That’s why these tokens are the perfect way for scammers to conduct ‘pump and dump’ style schemes.

2) Shitcoins lack function: always check the white paper

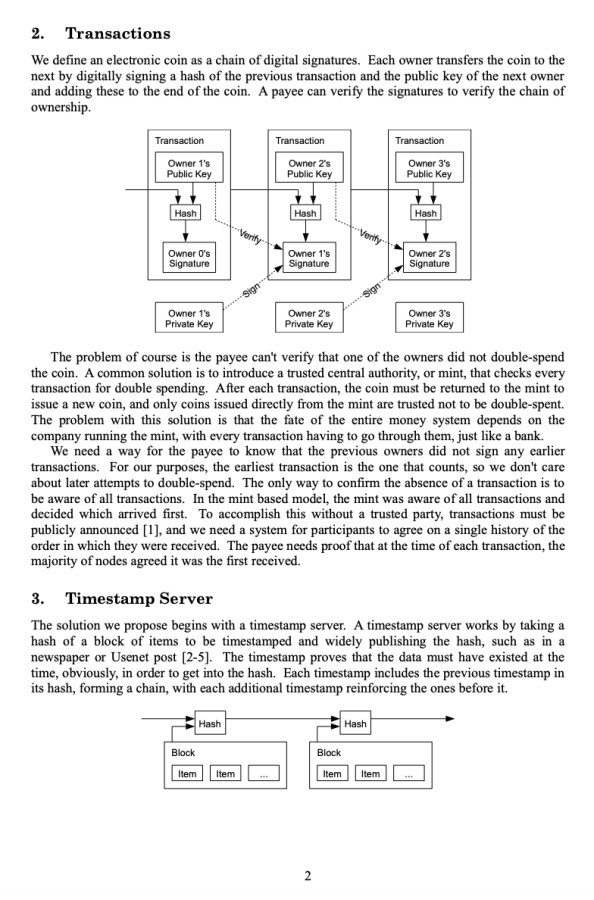

The next thing on the checklist for separating shitcoins from legitcoins is looking at the what function the token serves. Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) both have well-defined use cases and a plenty of resources for learning about what they do.

Bitcoin was built as a peer-to-peer payment network, while Ethereum was constructed as a blockchain network for building decentralised applications, smart contracts and decentralised finance (DeFi) protocols. Shitcoins simply do not have any clearly-defined purpose.

You can easily check whether or not you’re researching an actual cryptocurrency or a shitcoin by looking at the ‘white paper‘ of the token in question. A white paper is a document that tells investors what the token aims to do. If you come across a white paper that has spelling mistakes, or you simply can’t figure out what it actually does, then chances are, you’re looking at a shitcoin.

To better identify bad white papers, it’s good practice to familiarise yourself with good ones. Examples of high quality white papers include those of Bitcoin (BTC), Ethereum (ETH) and Cardano (ADA). When you read through these white papers you’ll find a list of key factors that are crucial to the determining the legitimacy of a given cryptocurrency:

- A clear outline of the problem the cryptocurrency is looking to solve.

- How the cryptocurrency will go about resolving these issues.

- Technical details on the implementation and proliferation of the cryptocurrency.

- A clear, legible roadmap that outlines when big developments are planned.

- A good deal of information about the cryptocurrency’s function and tokenomics (a crypto-specific term for economics).

Again, if you come across spelling mistakes, obvious grammatical errors and bad photoshopping in a cryptocurrencies’ white paper, it’s probably safe to conclude that it may very well be a shitcoin.

3) Shitcoins rely on marketing and promotional material

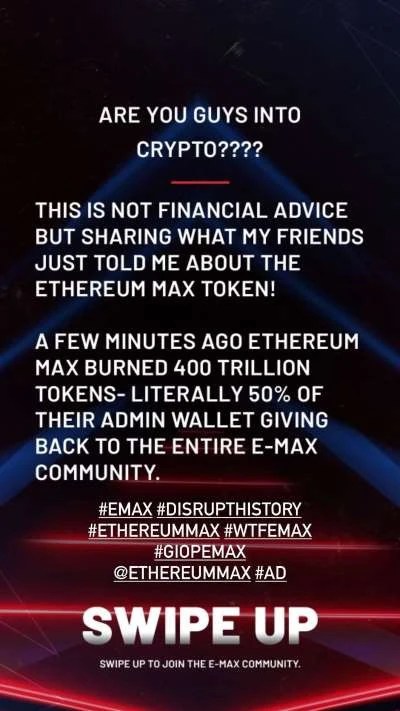

In the past, a number of celebrities have been involved in advertising for shitcoins. This is another way of discerning whether the token your looking at is legit or not.

Midway through 2021, Kim Kardashian posted a carefully worded Instagram story, saying that her “friends” had just told her about a hot new cryptocurrency called EthereumMax (EMAX). That same day the price of EMAX surged nearly 800% in response.. Unsurprisingly in the weeks that followed, it did exactly what all shitcoins inevitably end up doing; its price cratered over 98% and stayed there.

It turns out Kardashian was paid US$250,000 to promote the token by an advertising agency. She was later fined US$1.26 million by the US Securities and Exchange Commission (SEC) for failing to disclose that she was paid to run the ad.

The lesson here is: if you’re only seeing a cryptocurrency because its appeared on the story of an influencer or celebrity who’s never before expressed an interest in crypto, it’s typically a shitcoin of some form. Cryptocurrencies that provide real value and serve a legitimate purpose in the industry don’t spend their money getting celebrities to run promotions, because they don’t need to.

Ggool: the one true shitcoin

While there are thousands, if not tens of thousands of entirely useless shitcoins, there’s one project that stands above all the rest. In South Korea, scientists and students worked together to create a literal shitcoin, where people are paid in a cryptocurrency called ‘Ggool‘ every time they take a dump.

Professor Cho Jae-weon, an academic from the Ulsan National Institute of Science and Technology in South Korea designed an energy-extracting toilet called ‘BeeVi’. He incentivises students to use the energy-creating toilet by paying them in cryptocurrency.

This super-powered toilet is connected to a lab that then uses the excrement of students at the university to produce biogas and other forms of energy from the poop. This biogas is the utilised to power devices like gas stoves and boilers in the buildings on campus.

Every time a student drops their pants to help contribute to the project, they are paid ten of the Ggool token. Ggool (or Kkul) literally translates to ‘honey’ in Korean. Students can the use their hard-earned Ggool tokens to purchase a number of different goods on the university campus.

Are shitcoins a good investment?

It should go without saying, but shitcoins generally make for really bad investments.

They involve a massive amount of risk on behalf of a regular investor and very rarely does anyone see any real return from investing in a shitcoin, even if they were to get involved early on in the process.

The majority of shitcoins that fall victim to pump and dump schemes are internally manipulated by a very small group of insiders who all collaborate on when to sell their holdings, a move which instantly drives down the price. Because shitcoins offer little in the way of ‘real value’, after a pump and dump scheme is executed, there’s very little hope that the token will ever recover in price.

This isn’t to say that very small, low market cap altcoins can’t be fantastic investments, you just need to be extremely wary before investing in cryptocurrencies of this genre. As cryptocurrency remains largely unregulated, there’s very little in the way of protection — or compensation — if you end up falling victim to a pump and dump scheme.