Are you a newbie in crypto? Let’s start at the beginning by answering some of the most common first questions. Namely, what is a bear market? What is a bull market? What is HoDL?

Bull and bear markets — where the animals come from

The first thing to know is that a bull market is when (generally speaking) most prices are going up. This bull market can be seen in various asset markets, including stocks, bonds, commodities and cryptocurrencies.

A bear market, on the other hand, is when prices are falling (generally speaking).

The terms “bull market” and “bear market” refer to longer periods of either upward or downward movement, rather than just days, weeks or even months. It is a sustained “mood”.

The term “bull market” in a financial context can be traced back hundreds of years. No one is quite sure of why these animals were chosen, but there are a few good theories.

One involves bull-baiting and bear-baiting, which were cruel sports that were popular in England during the mediaeval and early modern periods. In these blood sports, bears and bulls were pitted against dogs or each other for entertainment.

When a bull attacks, it thrusts its horns upward, symbolising the rising prices. When a bear attacks, it swipes its claws downward, representing the falling prices and negative sentiment during a bear market. But not everyone is convinced that is the true origin of the words.

Bear market and bull market — other possible origins

According to the Merriam-Webster Dictionary, the origin of “bear market” could come from a well-known phrase used hundreds of years ago. More or less, it was not wise “to sell the bear’s skin before one has caught the bear”.

Middlemen who bought bear skins from trappers and sold them to others were called bear-skin jobbers. Soon these bearskin jobbers worked out that they could sell skins in advance, before the bears were even caught. But sometimes, the price of the bearskin would fall after the middleman paid the trapper in advance, leaving the middleman and his customers in a “bear market”.

One of the earliest literary references to the term “bear” in a financial context comes from Richard Steele in 1709, where he referred to a “bear” as someone who assigns real value to an imaginary object and is said to be “selling a bear”.

“Stockjobbers, who contract for a sale of stock which they do not possess, are called sellers of bearskins; and universally whoever sells what he does not possess was said to sell the bear’s skin, while the bear runs in the woods. You never heard such bellowing about the town of the state of the nation, especially among the sharpers, sellers of bearskins—i.e. stockjobbers…”

Bull market origins

Around the same time, another animal symbol made its debut in the marketplace — the bull. Originally, the term “bull” referred to a speculative purchase in anticipation of rising stock prices, and it was later applied to the individuals making the buys. The bull seemed like a fitting counterpart to the bear, and this animal imagery stuck for good.

Since then, bears and bulls have been an integral part of the stock market’s lexicon, representing the ebb and flow of market trends. Whether it’s a bullish market with rising prices or a bearish market with declining prices, these animal symbols continue to be used.

What is a bull market in crypto?

A bull market in crypto signifies a positive economic environment, where generally, crypto prices are on the rise and investors feel optimistic. To be a true bull market, it needs to be a good stretch of sustained price increases. (Not all crypto prices rise together, but generally speaking, most will rise at the same time, and most follow the trajectory of Bitcoin.) Crypto bull markets tend to be more volatile and fast-paced compared to traditional markets, leading to rapid price surges.

A “bullish” market, therefore, has the expectation that there will be continued price growth. During a crypto bull market, you’ll see cryptocurrencies gaining value, accompanied by favourable economic conditions and enthusiastic investors looking to profit from the rising prices.

How long do crypto bull markets last?

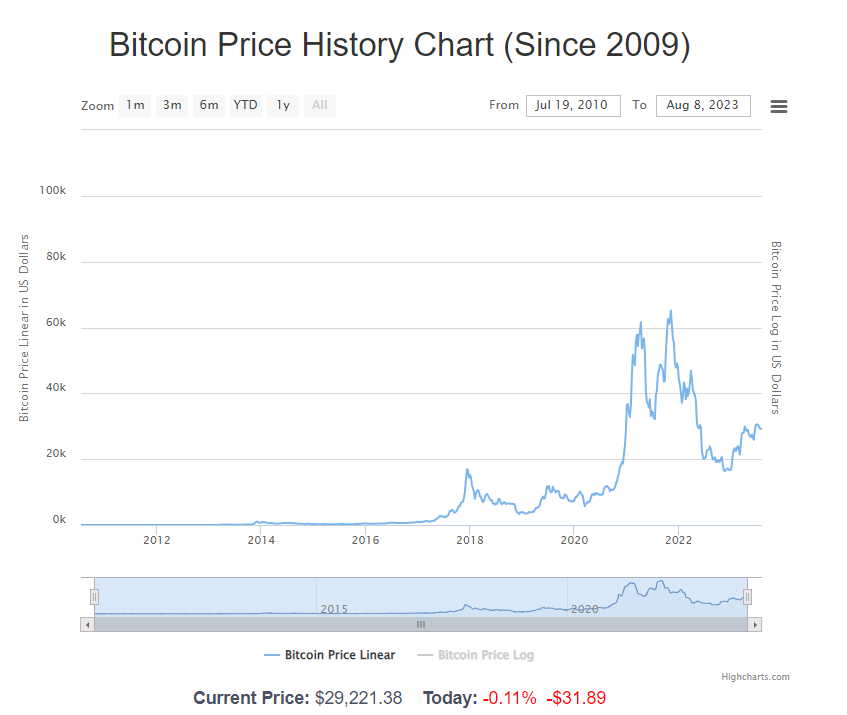

Crypto bull markets have occurred at various times in the history of cryptocurrencies. Because the crypto market is so young, it can be hard to work out a pattern. However, roughly speaking, bull markets can occur at any time based on market dynamics, technological advancements, regulatory changes and other factors.

The duration of a crypto bull market can vary widely. Historically, bull markets in cryptocurrencies have lasted anywhere from several months to over a year. For instance, the bull market in 2017 lasted for approximately a year, while other bull markets might have lasted a few months.

Here are some examples:

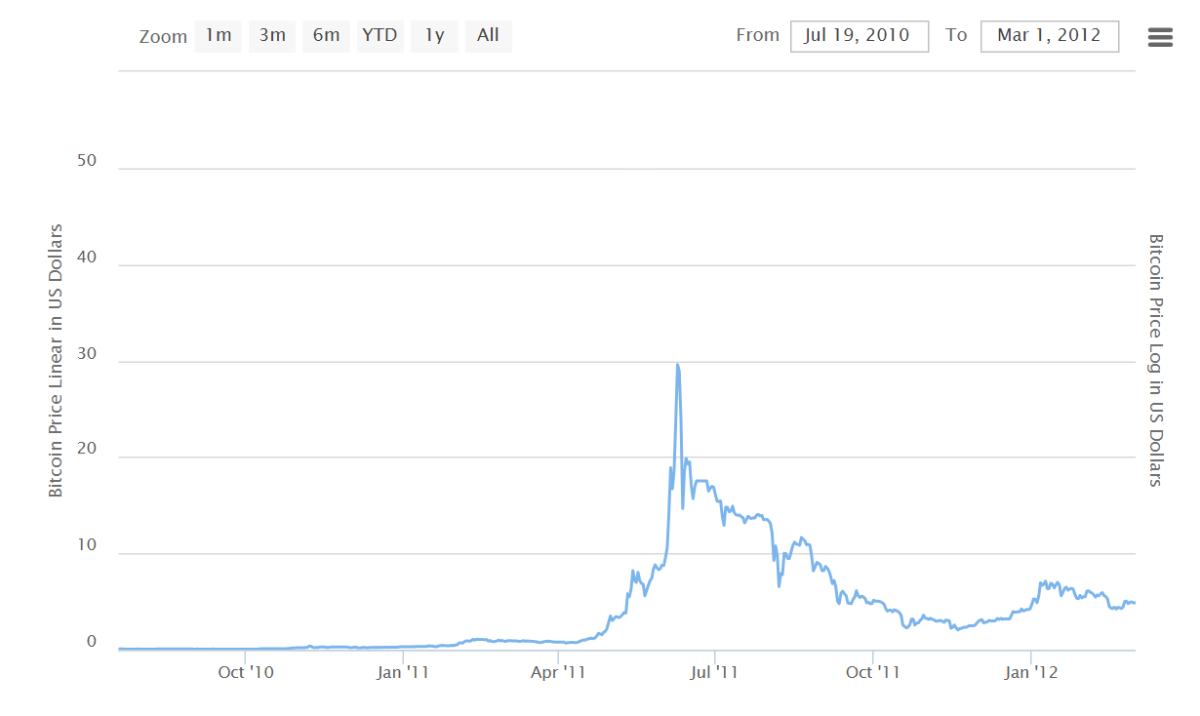

2011 Bull Market: Bitcoin experienced its first significant price increase in 2011, going from a few cents to over US$30 before retreating.

2013 Bull Market: Bitcoin saw a big surge in 2013, reaching a peak of over US$1,100 in November, but then experienced a sharp correction.

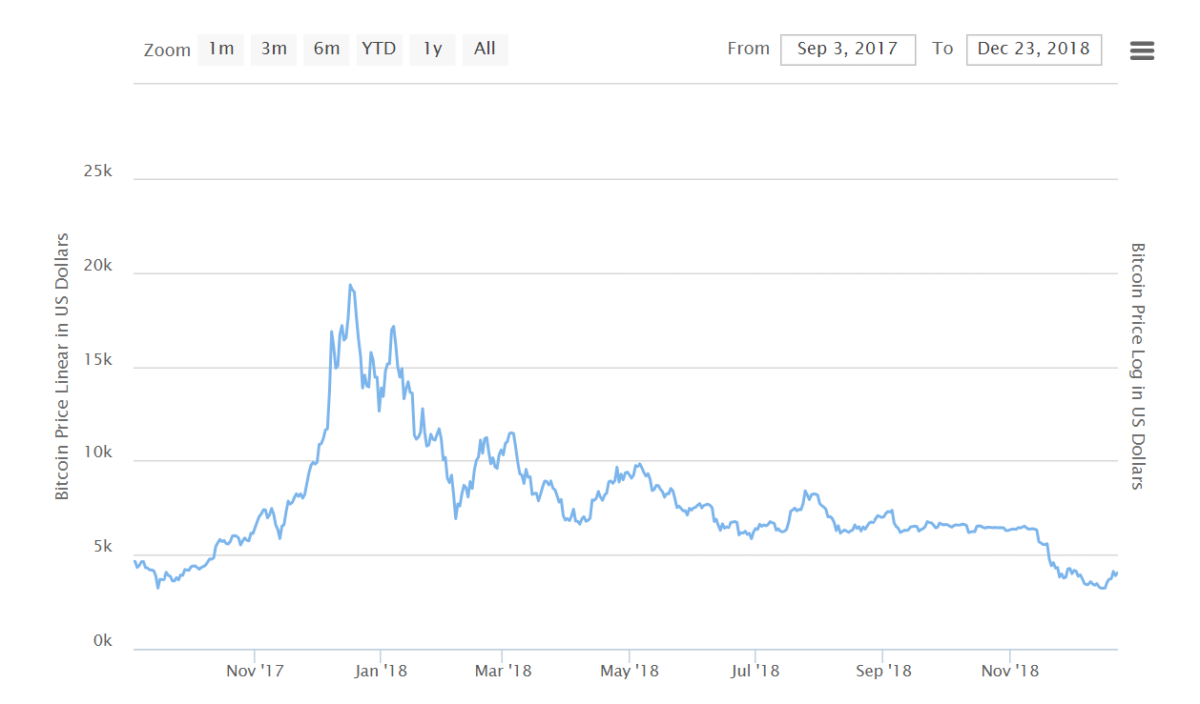

2017 Bull Market: This was a rather dramatic bull market in the history of cryptocurrencies. Bitcoin and many altcoins witnessed a rally, with Bitcoin reaching an all-time high of nearly US$20,000 in December 2017.

In 2021, many cryptocurrencies reached an all-time high, with Bitcoin peaking at US$68,789 in November. Since then, there has been a correction in price, however, many people in the industry feel that a bull market could be coming again soon.

Of course, past performance does not guarantee future results, and the crypto market is highly speculative and subject to rapid changes. It is challenging to predict the exact timing and duration of bull markets. Keep in mind that people like crypto traders can spend their lives trying to work out when the next bull market (or bull run) will be, and they can still lose money.

What causes a bull market in crypto?

Investors play a significant role in initiating a bull market by buying cryptocurrencies when they expect prices to rise for an extended period. Many other things can trigger a bull run. These can include strong GDP growth, low unemployment rates, mainstream support, institutional investments and positive news in the crypto space. The overall sentiment of confidence and optimism among investors further fuels the upward trend.

Characteristics of a crypto bull market

-Investors have confidence in the market’s potential for steady returns

-Celebrities, media and influencers talk positively about cryptocurrencies

– Mainstream finance expresses interest in the crypto space

-Positive news leads to significant price spikes

-Prices might experience minor dips even during a bull market, but they quickly recover

-Prices rise consistently over a sustained period

-High demand for cryptocurrencies.

What is a bear market in crypto?

On the other hand, a bear market in crypto signifies a decline in cryptocurrency prices by at least 20% and an ongoing downward trend. Bear markets are characterised by a surplus of supply over demand, leading to falling prices.

During a bear market, investors are generally cautious and may choose to sell their holdings due to uncertainties and negative sentiment.

What causes a bear market in crypto?

A bear market in crypto can be triggered by factors such as economic recession, geopolitical crises, poor economic policies and negative news in the crypto industry. Low investor confidence and fear of further price drops lead to a self-perpetuating cycle of selling, driving prices even lower.

Characteristics of a Crypto Bear Market:

-Minimal or negative coverage of cryptocurrencies in the media

-Experts and traditional finance express scepticism about cryptocurrencies

-Good news leads to only minor price rebounds

-Prices decline consistently over an extended period

-Higher supply of cryptocurrencies compared to demand

-Investors lack confidence in the market’s potential for growth

Prices might experience temporary upward swings, but the overall trend remains downward.

How bull and bear market in crypto differ:

-Bull markets have strong demand and weak supply, while bear markets have high supply and lower demand.

-Bull markets accompany a strong economy with rising GDP, while bear markets often coincide with economic slowdowns.

-Also, bull markets signify economic strength and increased consumer spending, while bear markets are associated with weaker economic conditions and declining profits.

-Bull markets boost investor confidence, while bear markets lead to negative sentiment and caution among investors.

-Bull markets lead to rising asset prices, while bear markets result in declining asset prices.

Is it better to buy in a bull or bear market?

Both bull and bear markets offer unique opportunities for investors. During a bear market, prices are lower, making it an attractive time to buy cryptocurrencies. Investors hope to capitalise on lower prices and sell later during the next bull market for potential higher returns.

On the other hand, buying during a bull market can also lead to profits as prices continue to rise. However, investors need to be cautious as bull markets can be shorter-lived, and they may face losses if they buy at the peak of the trend.

How to invest in a bull market in crypto

-Identify the trend early and buy early to take advantage of rising prices.

-Be prepared to sell when you think the market has reached its peak.

-Bull markets tend to last longer, so potential losses might be temporary.

How to invest in a bear market in crypto

-Purchase cryptocurrencies at lower price points during a bear market.

-Be cautious and stay updated on market trends, as bear markets can be unpredictable in duration.

As with any investment, there are risks involved. Don’t invest any money you can’t afford to lose.

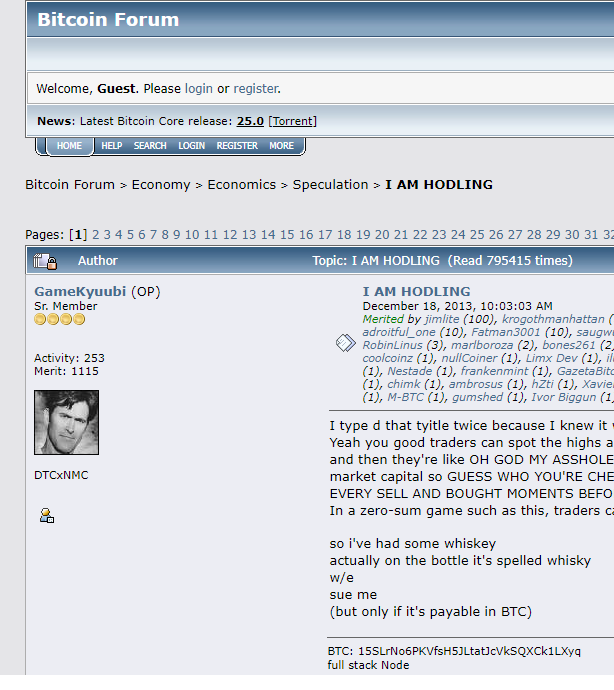

What does HoDL mean?

It’s a heavily-googled term … “HodL meaning”. In the world of cryptocurrency, “HoDL” is a term that originated from a misspelling of the word hold. It has become a widely used slang term among cryptocurrency enthusiasts and traders. The term gained popularity in a Bitcoin forum post in 2013 when a user misspelt “hold” as “HODL” in a drunken rant about not selling their Bitcoin despite market fluctuations.

HoDL has since become an acronym for “Hold On for Dear Life”, which emphasises the idea of holding onto your cryptocurrency investments for the longer term, regardless of short-term price fluctuations or market volatility. The term has become a meme and is often used humorously or as a rallying cry for the importance of not panicking and selling during periods of market downturns.

In essence “HoDL encourages investors to have a long-term perspective and to resist the temptation to make impulsive decisions based on short-term market movements.

It’s about believing in the potential of a particular cryptocurrency and staying committed to the investment despite the ups and downs of the market.

The “HoDL” strategy can be considered beneficial for several reasons.

Long-term growth

Holding onto your cryptocurrency assets over the long term allows you to ride out short-term market fluctuations and volatility. Cryptocurrency markets can be highly volatile, and attempting to time the market perfectly to maximise gains can be challenging and risky. By adopting a HoDL strategy, you are less exposed to the day-to-day price swings and can potentially benefit from the overall growth of the market over time.

Reduces emotional trading

Emotional decision-making can lead to poor investment choices. Many traders fall victim to fear and greed, buying when prices are high (FOMO or fear of missing out) and selling when prices are low (FUD or fear, uncertainty, and doubt). HoDLing encourages discipline and reduces the temptation to make impulsive trades based on emotions.

Lower transaction costs

Frequent buying and selling of cryptocurrencies can lead to higher transaction fees, especially on certain exchanges. By holding onto your assets, you can avoid these fees and potentially save money in the long run.

Capitalises on growth potential

Cryptocurrencies have shown significant growth over the years, and long-term holding of certain assets can be more profitable than short-term trading. By holding strong and promising cryptocurrencies, you have the opportunity to participate in potential price appreciation over time.

Diversification and risk management

HoDLing can be a part of a diversified investment strategy. By holding multiple cryptocurrencies with strong fundamentals and potential, you spread your risk across various assets.

While HoDLing can be a viable strategy, it is not without risks. Cryptocurrency markets are inherently unpredictable, and not all projects will succeed. Some coins may become obsolete, suffer significant price declines or be affected by regulatory changes.

Remember, do your own research and don’t throw anything into the crypto market that you can’t afford to lose.