Gen Z cryptocurrency traders are leading the way when it comes to social trading, according to a latest research report by Bitget.

In Bitget’s 2023 Copy Trading Report, the crypto exchange looked into the trading habits of a pool of active crypto traders on its platform of 20 million users. They found out that Gen Z users “increasingly turn to social media for financial information over traditional media”, resulting in what is known as ‘social trading’.

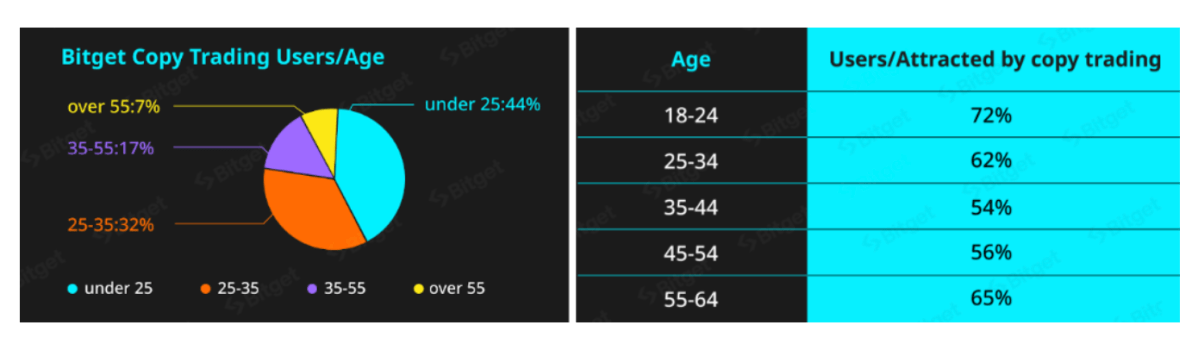

But hand-in-hand with social trading is the adoption of a strategy called copy trading, in which Gen Z traders below the age of 25 account for 44% of all crypto traders on Bitget.

What is copy trading?

Watch and learn from the pros – that’s essentially what copy trading is about. It is when traders mimic or copy the trading strategies of professional traders in hopes of making profit. In other words, whatever the pro traders buy, you buy.

Copy trading is considered a subset of social trading, according to personal finance website CreditDonkey. This is because traders get together in a group on the internet, and exchange tips and tricks.

According to Bitget’s report, 32% of crypto traders on their platform who are aged 25–35 use copy trading as a trading strategy. 17% of those between 35–55 also turn to copy trading. Finally, those above 55 deploy the strategy the least, at 7%.

Why social trading? Why copy trading?

With Gen Z being “digital natives” born into a world where technology is at its most advanced, it is not surprising that they are most comfortable with social trading, especially when it comes to crypto.

The crypto market doesn’t sleep, and prices are highly volatile. The nature of such a market thus naturally finds thriving communities on social media platforms like Reddit and Twitter.

Think about the GameStop saga in 2021, and the role that r/wallstreetbets played. Think about how crypto bros are single-handedly keeping Twitter Spaces afloat – heck, even the platform’s overlord Elon Musk is a known dogecoin supporter.

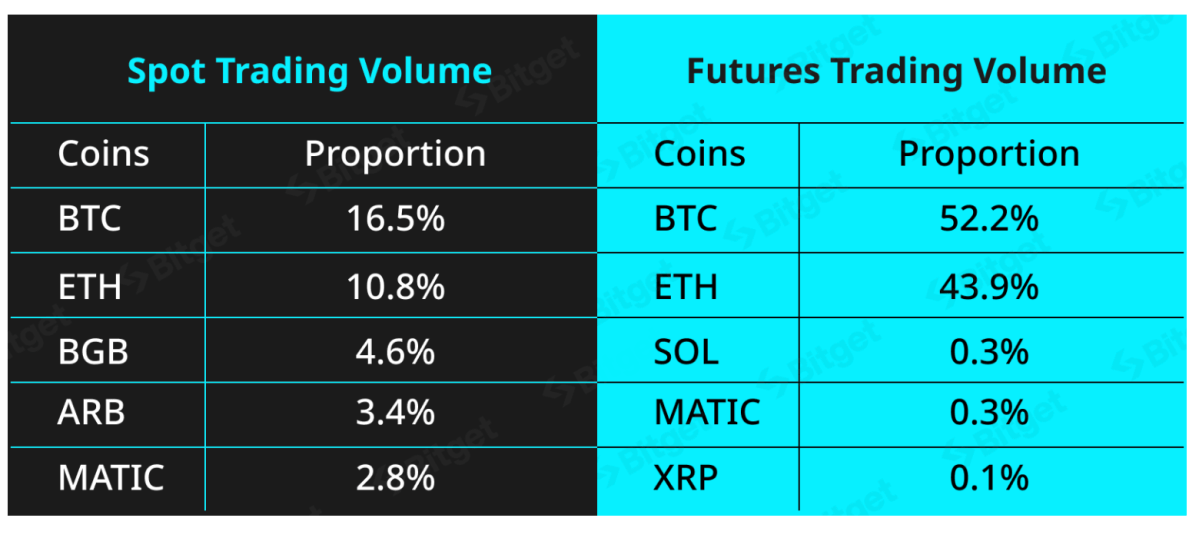

Of all crypto copy trading activity in the first half of 2023, Bitget’s report finds that Bitcoin was the most common asset to be traded, accounting for 52%. This is followed by Ethereum at 44%.

A total of US$74 million (AU$113 million) in cumulative profits in USDT were made from such activity, claims the report.

Financial advice and “FinTok”

With TikTok dethroning apps like Instagram and Facebook to become the go-to social media platform for Gen Z, it is hard to not discuss the rise of communities like “FinTok” and “Cryptok”.

Short for “finance TikTok” and “crypto TikTok” respectively, these communities are flooded with influencers giving unlicensed financial advice on various financial products. On “cryptok”, Australian creators like ‘thisiscryptohodl’ amass up to tens of thousands of views giving out tips, tricks, and investment signals – most of which are not verified.

“Providing financial advice without a licence is illegal in Australia. At the same time, because the financial advice industry is heavily regulated, minimal financial advice can cost thousands of dollars… this, as a result, creates a demand for social media-based finance communities,” Professor Jason Potts of RMIT’s Blockchain Innovation Hub tells The Chainsaw.

“It’s a sign of regulatory failure,” he notes.

Dr. Potts also added that Australia’s Digital Assets (Market Regulation) Bill that’s currently in development does not contain provisions pertaining to crypto financial advice.

“Hopefully one day, the finance industry will catch up – but at the moment, it’s a long way off,” he adds.

Do your own research!

Gracy Chen, Managing Director of Bitget, also tells The Chainsaw that most crypto information shared in social or copy trading communities is considered “sharing personal opinions and information updates, rather than providing formal financial advice and the audience should be aware of the differences between the two.”

She says that for one to be recognised as a financial advisor, they must possess relevant industry experience, knowledge and training, recognised credentials, and legal compliance, among other criteria. Most of the time, social and copy trading ‘gurus’ do not hold such qualifications.