ETHW: While you’re probably sick of seeing yet another Ethereum Proof-of-Stake (PoS) article, I can guarantee you there’s someone out there far more fed up with the news of Ethereum’s upcoming upgrade.

That someone (or someones) are the current miners of the Ethereum network, who, following a successful merge to PoS in mid-September, will be completely out of a job. They’ll be left sitting on millions of dollars’ worth of advanced mining hardware that will have seen its productive output brutally slashed. So, in an attempt to try and prevent losses to the mining community, prominent Ethereum miner and PoW-purist Chandler Guo is telling the Ethereum foundation to go fork itself.

Following on from the increasing signs that the Merge would be going ahead, Guo has been doubling down on pushing for a ‘hard fork’ of the Ethereum network to continue the PoW chain post-Merge.

Back in late-July, Guo tweeted, “I fork Ethereum once, I will fork it again!”, referring to his support for the creation of Ethereum Classic (ETC) after the infamous DAO Hack — one of the most monumental hard forks in Ethereum’s history.

The Ethereum foundation is “making a big mistake”

In an interview with The Chainsaw, Chandler laid bare his plans for continuing the PoW version of Ethereum, which he says will go by the name ETHW.

“I think the Ethereum foundation is making a big mistake,” he said.

“If they change to PoS we will have a lot of people changing back to PoW. There will be a lot of whales in Europe and the West who don’t want PoS because of security reasons.”

Here, Guo is referring to the fact that PoS blockchains are often criticised for being less secure and less anonymity-focused than PoW chains.

Guo went on to clarify what he identifies as the fundamental differences between the ETHW network and the new PoS Ethereum.

“I am totally, 100% a Proof-of-Work believer,” he said, “A PoW Ethereum is and will remain totally decentralised. There’s no leader, no central team. It’s run by the miners and volunteers on GitHub. Proof-of-Stake is like a centralised company.”

While Guo told Blockworks last month that there was a 90% chance his ETHW fork would fail, he seemed to have a more renewed sense of optimism.

Proof-of-Work Ethereum will survive

“This blockchain will survive,” he said.

“Nothing changes, just the teams keep doing their jobs. We will keep mining. There are lots of teams from China, India and Korea, mostly Asian — teams that still want to work on PoW Ethereum.”

Guo also claimed to have the support of Tether, which, following a successful hard fork, would create a USDT stablecoin on ETHW to allow people to access their native assets. Even if the Tether deal were to fail, Guo said the network’s gas fees and dedicated users would keep the fork afloat.

“Dogecoin doesn’t have ERC-20 and it doesn’t have NFTs — all it has is a big user base… so, even if the ETHW chain doesn’t have smart contracts, it will still be worth more than Doge,” he said.

Because the ETHW fork will be, to use Guo’s words, “much, much harder” than forking ETC, it will require a serious investment of capital and effort.

“For now, there are around 600 miners on ETHW and waiting for the next testnet,” he said.

“No developers say, ‘I don’t like PoW,’ they just say, ‘I follow the updates and I got to PoS.’ There’s still a lot of interest on the PoW. There are a lot of teams committing to seeing dApps and NFTs getting forked to ETHW,” Guo added.

Is ETHW really necessary?

Despite Guo’s dedication to the continuation of a PoW Ethereum through ETHW, there’s one giant question that hangs heavy in the air: is ETHW even a good idea?

It’s super important to note that when hard forks are genuinely a good idea — and not just a slow motion rug pull —there would be an entire ecosystem of miners and developers willing to see it through and maintain the ecosystem following a successful fork.

Apart from benefiting the miners who make their livelihoods from securing the network, there simply doesn’t seem to be another good reason to continue the ETHW fork. On the contrary, there’s a host of factors that suggest the ETHW network simply wouldn’t have the organic demand to survive in the long term.

Then there’s the possibility the ETHW chain could likely be damaged beyond repair, leaving anyone still clinging on to ETHW assets out of stubbornness to be dragged down to new lows.

This ‘damage’ on ETHW would emerge from the fact that most assets, protocols and oracles (the things that keep smart contracts up to date with real-world stuff) would be dead in the water the second the Merge goes through.

Stablecoins, DeFi protocols and digital assets still on the PoW chain could vanish in a puff of smoke because everyone else has agreed to transfer their resources and computing power to the new chain.

ETHW: Miners

Even though Guo says he’s mobilised nearly 600 miners, this will most likely not be enough to actually execute a proper hard fork. Even if the fork is initially successful, Guo would have to arrange a substantial team of Ethereum developers to ensure the functionality of protocols, oracles and assets. Without this, ETHW will likely fail.

Even then, there’s the ever-looming problem of the ‘difficulty bomb’, which is scheduled to effectively make the old chain impossibly difficult to mine after the Merge, slowing transactions to a crawl.

For Guo to overcome all these obstacles, it would require a serious investment of both financial and coding resources. However, due to the major lack of legitimately skilled Ethereum developers, finding these resources, especially to work on a chain that might be a hedge against PoS instability, could prove to be extremely difficult.

PoW Ethereum already exists

The next problem facing those rallying behind an ETHW hard fork is the blunt reality that a PoW Ethereum chain already exists. It’s called Ethereum Classic (ETC).

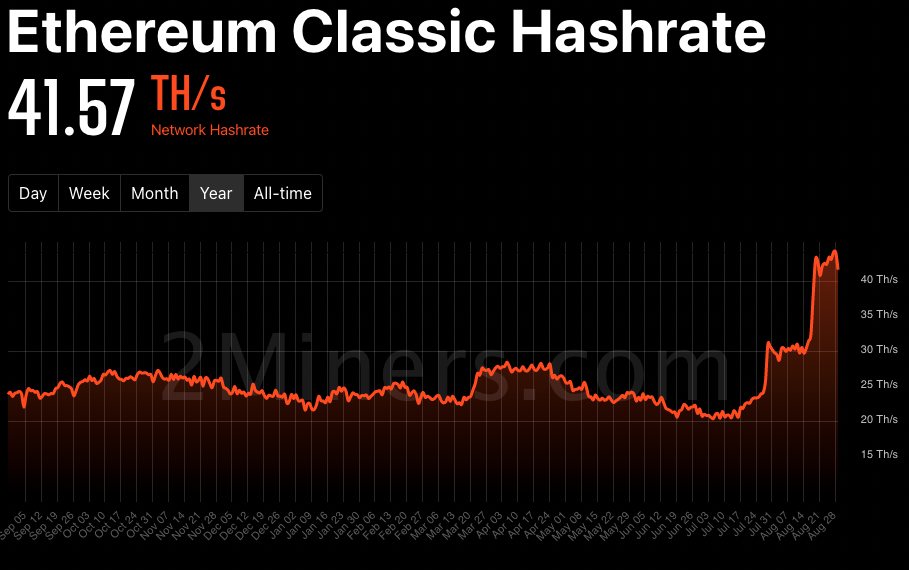

ETC miners have already been realising the benefits, with thousands of cheap, second-hand mining rigs from the less-dedicated ETH miners flooding the market. As a result, ETC witnessed a near 50% increase in its hashrate over the last month and its price doubled in the same time.

A recent report from JPMorgan also outlined ETC as the best “hedge against any potential disruptions in the Ethereum blockchain during the shift from PoW to PoS”.

At least it’s a hedge, right?

While the likelihood of an outright failure of the Ethereum Merge upgrade is extremely low, if something were to go wrong, ETHW would most likely see a mega-migration of users, apps and assets back to the original chain as developers and network actors scramble to re-secure their assets.

It’s worth noting that, following on from the continued successful merging of multiple testnets, the chance of something going wrong with PoS Ethereum — or just ‘Ethereum’ — is exceptionally small.

Regardless, it will be insanely interesting to keep a close eye on ETHW and see what the future holds for Guo and the undeniably persistent ETHW community.