It’s only Tuesday and yet regulators from around the world have majorly stepped up their game in cracking down on some of the biggest names in the cryptosphere.

Yesterday, the Australian Securities and Investment Commission (ASIC) Australian slapped crypto-focused asset manager Holon with some stop orders.

Consequently, Holon is blocked from offering three crypto-related investment products — the Bitcoin, Ethereum and Filecoin funds — to retail investors Down Under. All three funds list US crypto exchange Gemini as their custodian.

According to a statement from the financial watchdog, the stop orders were issued because the funds don’t meet ASIC’s relatively strict Target Market Determinations (TMDs), which provide guidelines on how funds market their investment products to retail investors.

ASIC says that Holon hasn’t “appropriately considered” the risks associated with their wide target market, including investors who intend to use the fund as a standalone fund (75-100%) or as a satellite component (up to 25%).

ASIC went on to say that if Holon can’t get its act together, and “take immediate steps to ensure compliance”, the funds in question will be hit with final stop orders leading to furtherregulatory discomfort and penalties.

SBF & FTX to be probed by Texas

It wasn’t just in Australia where regulators fired off shots.

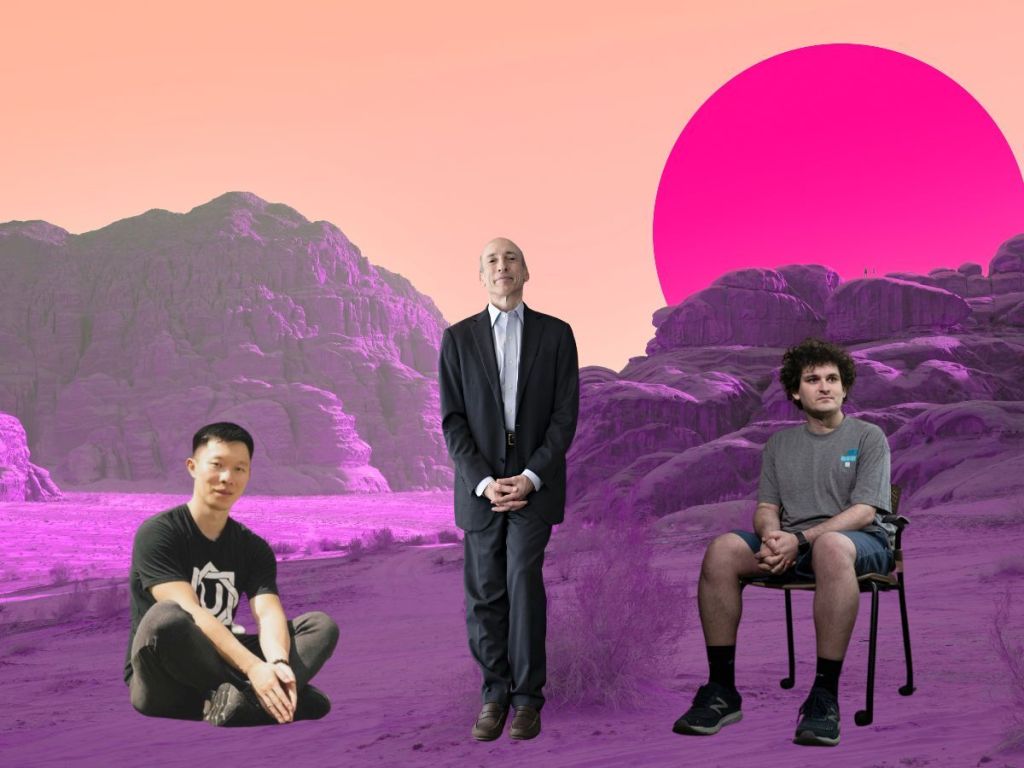

Over in the US, regulators from Texas launched an investigation into the American arm of the Bahamas-based crypto exchange FTX and its CEO Sam Bankman-Fried (SBF). Regulators from the Texas State Securities Board (TSSB) went sniffing through FTX US’s US$1.4 billion plan to acquire the now-bankrupt crypto lender Voyager Digital and found that the company may be violating state law by offering yield-bearing products to US customers.

According to court documents, the crypto exchange’s yield-bearing crypto accounts may actually constitute unregistered securities offering. As a result the American division of FTX cannot move forward with its plan to acquire Voyager until the investigation is concluded.

If SBF’s behaviour on Twitter is anything to gauge by, he seems mostly unphased by the regulatory activity, uploading a screenshot of a buy order for FTX’s native token FTT with the blasé caption “not investment advice etc.”

Three Arrows Capital: the legal gift that keeps on giving

The crew at Singapore-based Three Arrows Capital just keep on getting hit with a stream of bad news. According to a new report from Bloomberg, two major US regulatory agencies are digging into the nitty gritty of how best to prosecute the co-founders of 3AC, Su Zhu and Kyle Davies.

Incredibly, the whereabouts of both founders remains unknown. As a result, the liquidators from advisory firm Teneo are trying to get permission from a US judge to serve the absentee 3AC founders with subpoenas via Twitter. According to reports, Zhu’s and Davies’ lawyers both refuse to accept papers on their behalf.

Sources that reported the matter said that regulatory agencies are currently looking into whether or not 3AC violated rules by misleading investors about the strength of its balance sheet and by not registering with any official agencies. All parties involved in the matter declined Bloomberg’s request for comment.

By some estimates, at its peak 3AC had between US$10-18 billion under management, granting it some significant weight in the crypto world. During the Terra (LUNA) collapse, the fund turned out to be massively overexposed to the tune of roughly US$200 million after chasing a “risk free” 20% yield.