Ooki DAO: In September, the Commodity Futures Trading Commission (CFTC) launched proceedings against Ooki DAO, including holders of its governance token, for illegally offering leveraged lending and margin retail commodity transactions. Now, a US federal judge in the Northern District of California has rubber stamped the CFTC’s decision to issue legal summons through the DAO’s chat box and online forum. And not everyone is happy about it. For DeFi degens it appears as if the dream that DAOs could somehow escape the omnipresent regulatory limelight has been well and truly shattered.

CFTC goes after Ooki DAO

Last month the CFTC pursued a US$250,000 penalty against bZeroX and its founders, Kyle Kistner and Tom Bean, who developed bZx – a decentralised protocol for lending. The protocol was embroiled in controversy in 2020 when an exploit saw an estimated 2,388 ETH stolen. At the time, this was worth around US$650,000 but it is currently valued at close to US$3,24 million. But bZx claimed in a now deleted port-mortem that the figure was only 1,193 ETH.

In the CFTC’s complaint, it alleged that Ooki DAO had used its structure to evade regulatory oversight.

“A key bZeroX objective in transferring control of the bZx Protocol (now the Ooki Protocol) to the bZx DAO (now the Ooki DAO) was to attempt to render the bZx DAO, by its decentralised nature, enforcement-proof. Put simply, the bZx founders believed they had identified a way to violate the Act and Regulations, as well as other laws, without consequence.”

“DAOs are not immune from enforcement and may not violate the law with impunity”, the agency said. Of course given the nature of DAOs, the CFTC had to grapple with the question of who would be liable. In its suit, it identified Ooki DAO as “an unincorporated association comprised of holders of Ooki Tokens”.

The agency believed that the DAO ought to have been registered with the commission and further, it argued that through various governance decisions made by token holders, Kistner, Bean and bZeroX had “unlawfully engaged in activities” that required registration through existing commodities laws.

Notably, a lone commissioner issued a dissenting opinion on the matter, questioning the grounds for holding all token holders liable, rather than just the founders and original owners of bZeroX.

CFTC: hmmm…how do we do this?

The obvious issue facing the CFTC at the time was how to effectively issue legal summons, the documents associated with initiating a lawsuit. The key part there is effectively – if you are the plaintiff, you need to make sure that the defendant actually receives the summons. Failing to do so could result in your claim being dismissed from the outset.

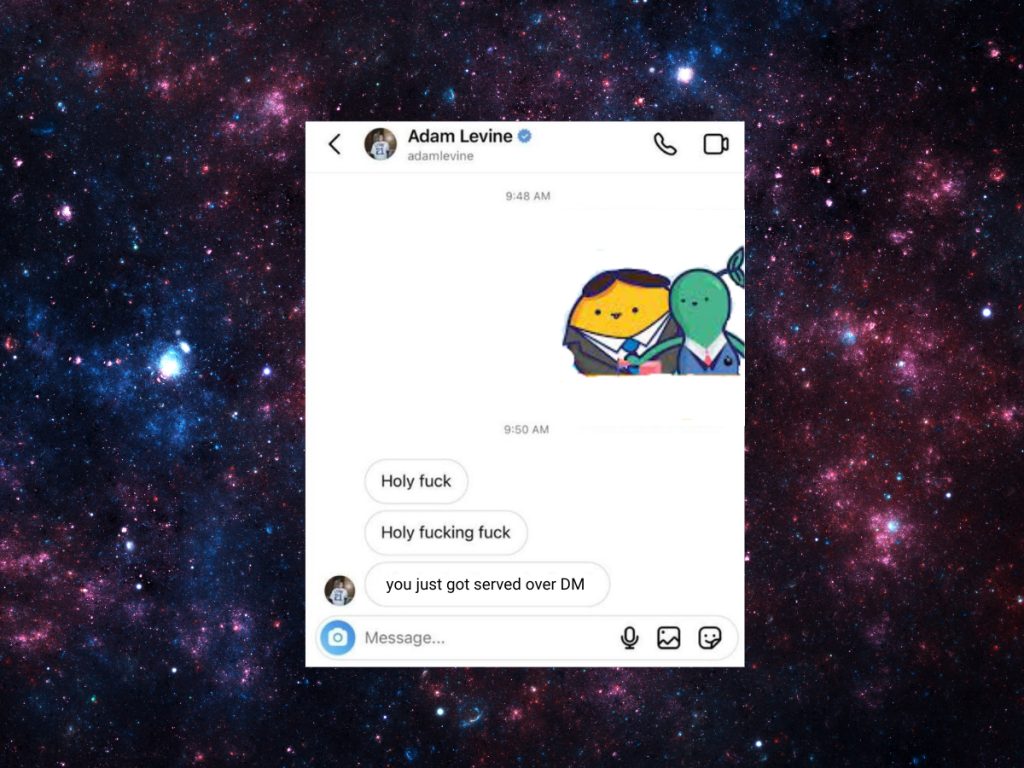

With that in mind, the CTFC issued legal proceedings through the DAO’s website help chat box and an affiliated online forum. Subsequently, it launched a motion in court to confirm the legality of the novel mode of issuing summons, which has since been granted by US District Judge William Orrick.

“Because the Commission provided the documents in this manner on September 22, 2022, the Court holds that the Commission effectively served the Ooki DAO on that date,” read the order.

Ooki DAO fights back

The result has struck a nerve across the DAO community, most acutely within Ooki DAO members who are currently mulling over whether to raise funds or allocate a portion of its treasury to fight the decision.

There are several options on the table including the idea of gathering support from the broader DeFi and crypto community. “Insofar as all DAOs have a stake in the outcome, broad community support of Ooki DAO’s legal defense is critical,” the forum post stated. NFTs are another potential avenue, with some discussing how they could be used to raise funds to mount a legal defence.

In general, the community appears motivated to fight back and it is likely that a vote is on the horizon as to how the DAO will proceed. And it’s not just the Ooki community who are looking to take action. A group by the name of LeXpunK Army, who claim to be “lawyers at the intersection between law and decentralised technologies” have filed a suit to challenge the ruling.

Twitter was ablaze with commentary on both sides of the issue. Most of it however was distinctly outraged and concerned about the precedent it would set for DAOs going forward. In and amongst the noise was a poignant Twitter thread that broke down the situation and the potential ramifications for DAOs and token holders going forward.

TL;DR: Cope highlighted an argument made by Will Papper, co-founder of SyndicateDAO, saying, “Under this more pessimistic view, if the DAO did something that it could be liable for, everyone involved could be held liable”.

Others however had little sympathy for the founders saying they could have easily avoided the problem by “spending US$100 and forming an LLC”.

Australian law remains sketchy on DAOs

According to McPherson Kelley solicitors, Australian corporate law does not presently recognise DAOs as having legal personality. If you have legal personality under Australian law, you have the same rights as a natural person and can incur debt, sue and be sued.

The firm however notes in a blog post that entities which aren’t recognised as having legal personality are “at risk of having insufficient standing to enforce the entity’s rights”. This could make it challenging to bring proceedings against DAOs given their unrecognised legal status.

To illustrate, the firm highlights a number of potential risks and questions facing both DAO founders and token holders:

- Can a DAO’s leadership team be held liable for the debts of the DAO or are the DAO’s founders afforded some form of limited liability (similar to, for instance, a company)?

- If the smart contracts which govern how certain decisions of the DAO are made are flawed, what recourse or protections are available to members of the DAO that are negatively affected?

- What sanctions can be imposed on nefarious DAO leadership teams, which may reside in Australia and/or overseas who run off with investor funds or DAO treasuries?

When Australia’s long-awaited crypto reforms come into effect, will DAOs have similar legal status to companies (where shareholders are individually insulated from risk) or will they be treated as partnerships where all members could be held jointly and severally liable. If you’re an Australian DAO, you are undoubtedly hoping for the former.