Crypto buying behaviour just got interesting. Investing in cryptocurrencies can be quite the adventure. But which cryptocurrency you buy might simply be a matter of personality.

This is according to a new survey that analysed more than 1,000 cryptocurrency investors and examined how differing personality traits impacted the crypto they bought. Personality traits were assessed through a set of questions and then scored depending on their personality type. According to the survey, your personality could also determine how much profit you make too.

Extroverts and crypto choices

Extroverts are social creatures and are known for their love of excitement and novelty. These investing beasts are 28% more likely to invest in cryptocurrencies compared to stocks.

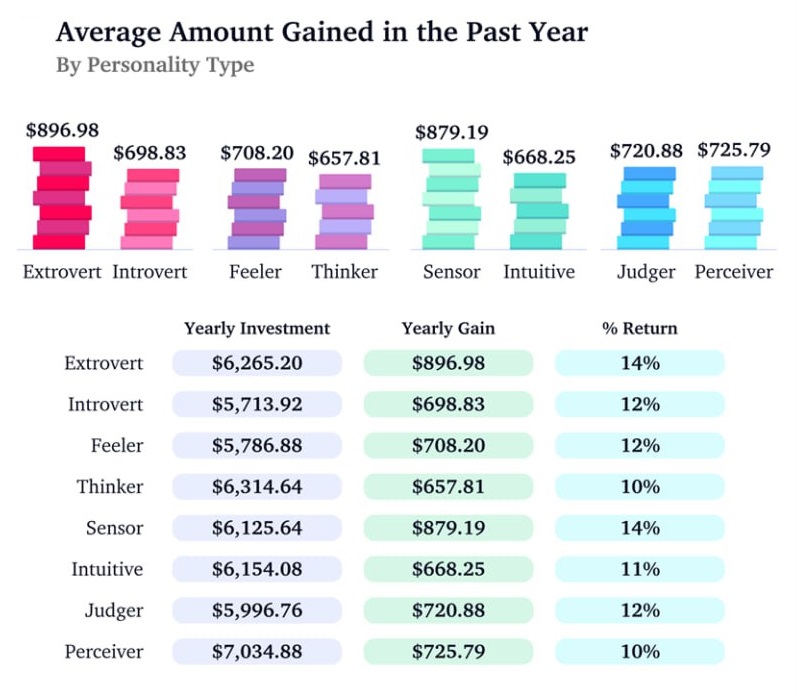

Extroverts are the investors that sink the largest portion of their income (over US$6,200 per year) into their crypto bets. It is paying off, too, as they have seen a 14% return on average. These thrill-seekers are most likely to invest in the biggest and most famous cryptocurrency, Bitcoin.

Introverts and cryptocurrency investments

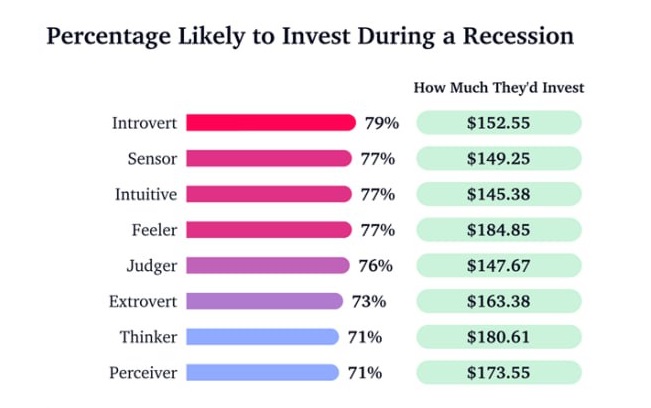

Crypto buying behaviour can also be affected by how shy you are. Introverts are known for their reserved nature and thoughtful contemplation. Strangely, these quiet investing machines are more likely to invest during a recession (79%). They are tight on the money front though. According to the survey, they invest an average of US$152.55 during an economic downturn, a lower amount compared to their extrovert counterparts.

Thinkers and their investing strategies

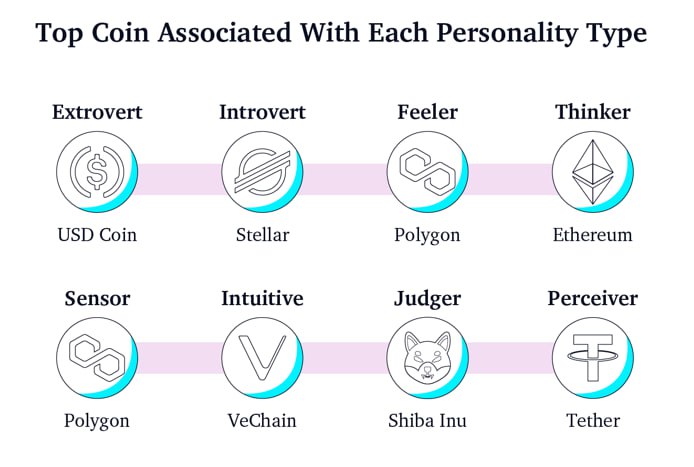

Thinkers, who make their decisions based on logic, are 45% more likely to invest in crypto than stocks. They seem to love a slow burn, favouring Ethereum (ETH) when it comes to buying cryptos.

Feelers, intuitives and cryptocurrency

Feelers are people who follow their emotions. This type of personality are 15% more likely to become addicted to crypto trading compared to Thinkers.

Intuitives are people who are imaginative and abstract. These types of personalities were found to be the most likely to become addicted (79%) to the cryptocurrency rollercoaster.

That said, Intuitives are imaginative and have the ability to think beyond the surface level, diving into the abstract to uncover deeper meaning.

Sensors and Judgers

Sensors are considered more practical and love using data to help make their decisions, with 86% being likely to invest during a bear market.

Judgers value structure and stability, and more than half of those surveyed (56%) claimed to be conservative investors, while Perceivers have flexible approach, embracing the unexpected and taking calculated risks, investing more on average than Judgers.

Crypto buying behaviour: What personality type profits most?

Crypto buying behaviour does have an effect on how swamped in profits investors are. Perceivers invested $86.51 more per month compared to Judgers, but had the lowest return rate at just 10%.

When it comes to investing during a recession, Sensors, Feelers, and Intuitives were more likely to invest, and Thinkers and Perceivers were the least likely to shell out.