This morning, the crypto world awoke to the biggest news of 2024 yet — that the US Securities and Exchange Commission (SEC) approved spot Bitcoin ETFs, allowing people to track the price of Bitcoin without owning it directly. But the news was soon confirmed by the SEC itself to be false, triggering a AU$448 million loss in market cap for Bitcoin.

It all started with an X post by the SEC:

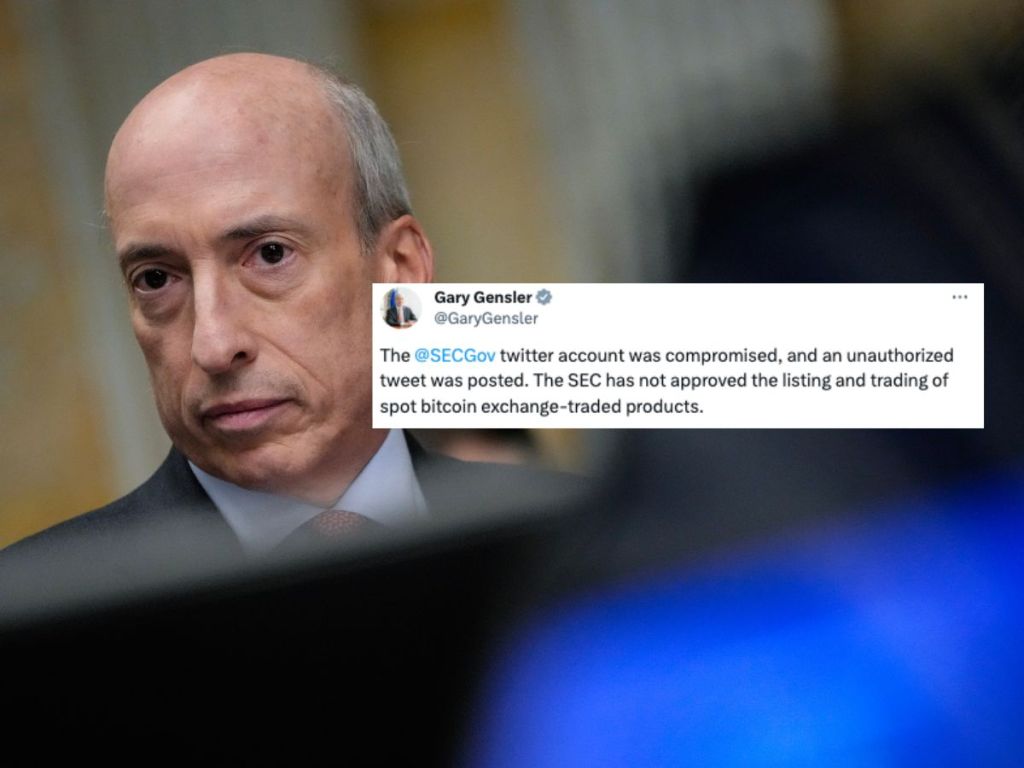

However, several minutes later, Gary Gensler, Chairman of the SEC, shared this on X:

That’s right, the SEC’s X account was hacked, and the Commission has not yet approved any spot Bitcoin ETFs. To paraphrase DJ Khaled, we played ourselves.

Moments after the hack was confirmed, Bitcoin’s price plunged over 3 percent from a high of US$47,680 (AU$71,300), and recovered to US$45,700 (AU$68,300) at the time of writing.

Bitcoin was also estimated to have lost US$300 million (AU$448 million) in market cap after the false news. In an X post, Fox Business Senior Correspondent Charles Gasparino said that the SEC will now have to investigate itself for market manipulation after the saga.

False SEC Bitcoin post: What now?

SEC has also confirmed that it will be working with US law enforcement to investigate the hack.

X commander-in-chief Elon Musk also said that the platform will investigate the cause of the SEC hack.

Josh Gilbert, market analyst at eToro, tells The Chainsaw: “[Bitcoin’s] volatility will likely continue in the days ahead, with a ruling on the ETF’s approval due in the next 24 hours regardless. This event may see some investors go risk-off, and we could see a ‘sell the news’ event – but in my view, this would be short-term.”

“The other possibility is that there may be a widespread buying with retail looking to front-run future inflows that these ETFs will likely facilitate once approved, but today’s moves may show that there is a top to the rally for now,” he adds.

“It seems increasingly likely that we’re going to see ETF approval from the SEC, especially with all the amendments to the initial registration form currently happening around fees as applicants look to compete with one another to attract investors,” Gilbert says.

This is a developing story.