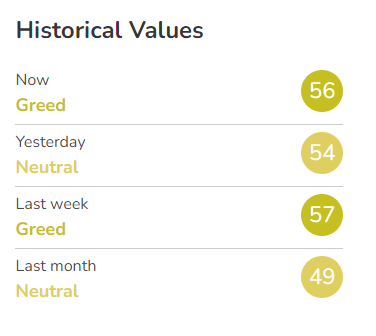

The Bitcoin Fear and Greed Index changed from its neutral position yesterday to a “greed” signal today.

The Bitcoin Fear and Greed Index is a tool used to gauge the sentiment of the Bitcoin (BTC) market. It claims to measure the emotions and psychological state of Bitcoin traders and investors. The index ranges from 0 to 100 and is based on various data.

Some traders consider that it might provide insights into market cycles, potential buying or selling opportunities, and extremes in investor sentiment.

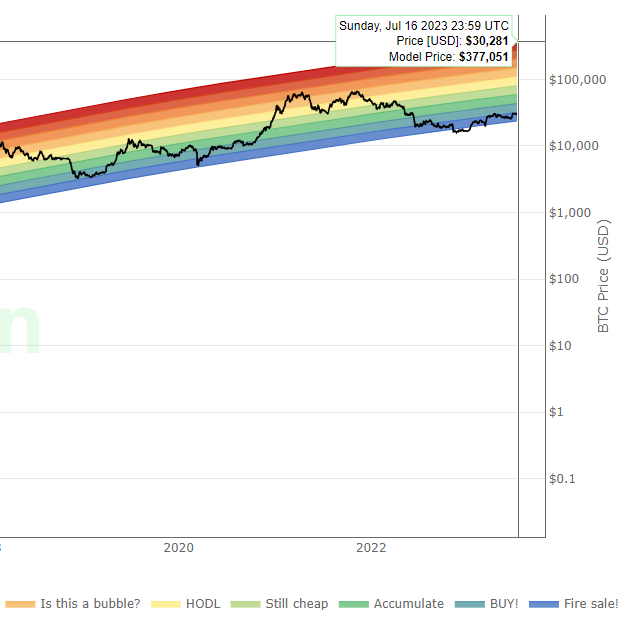

However, let’s be real here. It is just one tool among many at the crypto enthusiasts’ disposal, when trying to work out when to buy or sell BTC. It should not be solely relied upon to make investment decisions. But loosely speaking, like the Rainbow Chart, some consider it helpful in gauging overall feeling about Bitcoin. (By the way, the Bitcoin Rainbow Chart is wobbling between “It’s time to buy” and “It’s a fire sale!”)

Fear and Greed Index

The Fear and Greed Index claims to take into account several indicators, including market volatility, trading volume, social media sentiment, surveys, and price trends, and other factors that can affect price movement. These indicators are analysed and combined to generate a single numerical value that represents the level of fear or greed in the market.

When the index is low, it suggests that there is a high level of fear prevailing in the Bitcoin market. This fear could be due to negative news, uncertainty, or a downward price trend. It indicates that investors may be more cautious and hesitant to buy BTC.

When the index is high, it indicates that there is a significant level of greed among market participants. Greed suggests that investors are optimistic, confident, and may be eager to buy BTC. It could be driven by positive news, upward price momentum, or the fear of missing out on potential gains.

It is currently sitting at 56, which means it is in greed mode.

What happens in greed mode

When the Bitcoin Fear and Greed Index turns to “Greed,” it supposedly means that the overall sentiment of people who buy and sell Bitcoin trading are probably leaning towards being greedy or overly optimistic. The expectation is that its price will rise further.

When the index shows greed, it claims to show that people may tend to buy more Bitcoin, on the hope that the price will continue to increase, so they want to take advantage of the upward trend and potentially make a profit. This increased buying pressure can potentially drive the price of BTC even higher.

It’s also claimed that Greed mode can also create a “Fear of Missing Out” (FOMO) effect. When people see others making money and the price of Bitcoin rising, they get whacked with the FOMO stick and buy Bitcoin as well. By the time FOMO kicks in, however, it might be at the tail-end of price rises.

During periods of greed, the market can become overheated. The buying frenzy and high demand for Bitcoin can push the Bitcoin price to levels that might not be sustainable in the long term.

What goes up…

After a period of greed, a price correction or a market downturn can occur, as Bitcoin enthusiasts who bought during the greed phase sell their Bitcoin for a profit, leading to a decrease in demand. This correction can then send the needle back to the fear zone.

But if you are a believer in the Bitcoin Fear and Greed Index, and the Rainbow Chart,you might want to start researching how it all works and read up on Bitcoin.