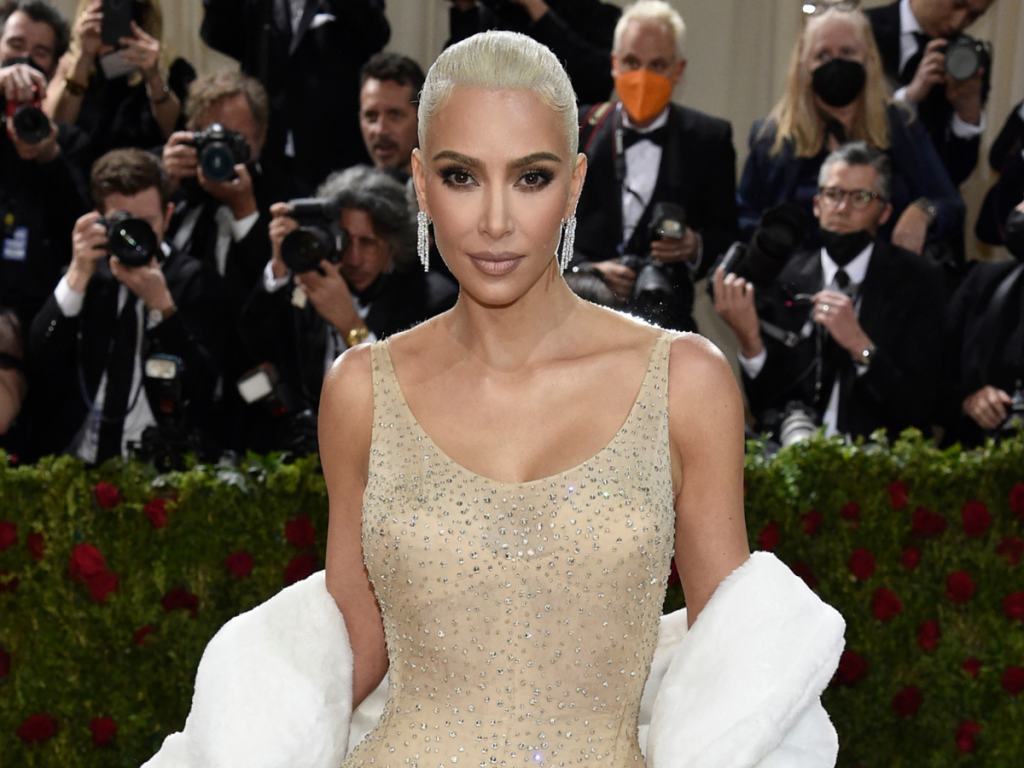

Kim Kardashian is in the news again. The announcement this week that reality TV celebrity Kim Kardashian would be stung with a US$1.26 million fine for her promotion in 2021 came as a surprise to no one in the crypto space.

The real surprise was the fact that Gary Gensler, the chairman of the United States Securities and Exchange Commission (SEC), had actually done something about an undisclosed crypto shill. The SEC was finally walking the walk after talking the talk.

Kim Kardashian and her blunder

Kim Kardashian’s blunder demonstrates the lack of awareness (and clarity) that influencers and retail investors have over the regulation of cryptocurrencies and digital assets.

Kardashian shared an Instagram story to over 300 million of her followers, leading with: “ARE YOU GUYS INTO CRYPTO????” and “THIS IS NOT FINANCIAL ADVICE BUT…”. What followed could only be described as “shilling” Ethereum Max, a virtually unknown token with negligible liquidity.

So why does any of this matter? Who is Gary Gensler? What the hell is the SEC, and what’s happening Down Under when it comes to protecting Australians from crypto scams, shills and rug-pulls?

It’s Gensler’s world — you’re just living in it

Gary Gensler, the chairman of the SEC, fired a warning shot by fining Kardashian. In a move likely to frighten other #finfluencers. Gensler illustrated what may be coming for other influencers who don’t disclose promotions, especially when it comes to crypto assets.

The US$1.26 million Kim Kardashian now owes covers the US$250,000 she received to promote Ethereum Max back in 2021, along with a sizeable US$1 million fine on top.

“This case is a reminder that, when celebrities or influencers endorse investment opportunities, including crypto asset securities, it doesn’t mean that those investment products are right for all investors,” SEC chairman Gary Gensler said in a video addressing the matter.

In the months since Kim Kardashian’s undisclosed shill, and despite the 400 trillion EMAX tokens burned, the price has lost over 99% of its value — will the devs do something?

Kim Kardashian not alone – who else may be in hot water?

Celebrities haven’t only been shilling crypto tokens, they’ve also been promoting other digital assets including NFTs. Truth In Advertising (TINA), a US-based non profit organisation that focuses on fighting false and deceptive marketing, investigated multiple celebrities who had promoted NFTs via their social media accounts. They also found numerous instances where payment hadn’t been disclosed.

Celebs that were sent warning letters in August 2022 include:

- Shaquille O’Neal

- Snoop Dogg

- Paris Hilton

- Tom Brady

- Madonna

- Logan Paul

- Gwyneth Paltrow

- Floyd Mayweather

- Eminem

A full list is available here.

While there may be some celebs in hot water with the SEC, regulators here in Australia are also making moves – and a lot of positive changes are on the horizon.

What’s happening in Australia to keep crypto investors safe?

The Australian equivalent of the SEC is the Australian Securities and Investments Commission (ASIC). They flagged crypto assets as part of their “core strategic projects” for the 2022-2023 financial year – highlighting the need for additional consumer protections.

This comes in the wake of CeFi borrow/lenders Celsius and Voyager both announcing bankruptcy, as well as the collapse of the Terra LUNA ecosystem in mid-2022.

While ASIC is focused on consumer protection, the Albanese government announced a “token mapping” exercise a couple of months ago. The Department of Treasury said they would be conducting a world-first in mapping out all crypto assets held by Australian taxpayers.

They’ll be doing this using distributed ledger technology and publicly available information stored on the blockchain. The token mapping exercise can be seen as the first step before any additional regulations are implemented. This will allow regulators to identify various crypto assets and their respective use cases.

The recent token mapping announcement has come on the back of an ASIC ‘finfluencer’ crackdown, with the regulatory body threatening hefty penalties for those who promote financial products or give unlicensed financial advice.

What about crypto taxes?

While the Department of Treasury is busy checking the chain for your holdings, it’s important to note that the Australian Taxation Office (ATO) has data matching programs with Australian crypto exchanges (in addition to many international providers that offer their platforms to Australian users).

This essentially means there’s no hiding when it comes to your crypto and the ATO. The ATO has sent out hundreds of thousands of letters to Australian investors over the past few financial years, reminding them of their tax obligations when it comes to crypto and digital assets.

With over 1 million Aussies expected to lodge a crypto tax return this financial year, the ATO has been busy updating its crypto guidance on a range of topics.

Most recently, airdrops were the flavour of the month, with the ATO stating that “Initial Allocation Airdrops” would not be taxed on income or capital basis on receipt.

Airdrop probs

Put simply, if you received an airdrop — say A$10,000 of XYZ token, the ATO recognised that A$10,000 as income when received. This meant your airdrop would previously be taxed as income at your marginal tax rate (at 30%, say A$3,000) when you receive the initial airdrop. Further, you may have capital gains obligations if you make a profit on disposal (the difference between the price when you received the airdrop and the price when you sold).

The change is a positive step in clarifying that most airdrops are not taxable when received which was a source of much contention when many airdrops are received on an unsolicited basis — you didn’t ask for it!

More generally, the space is moving quickly with the Government requesting input as to the future tax treatment of digital assets in Australia. Submissions are expected from cryptocurrency exchanges, banks and financial institutions, crypto tax platforms, and retail investors. Findings are due to be released at the end of the year.