With the valuations of crypto assets and crypto companies scraping the barrel following the disastrous collapse of FTX, financial services firm Goldman Sachs is gearing up to invest “tens of millions” in the industry while things are still cheap.

In a recent interview with Reuters, Goldman Sachs Head of Digital Assets Mathew McDermott, said that big banks are seeing opportunities in the space as the FTX collapse highlighted a need for more regulation within the industry.

In some much-needed bullish sentiment for the struggling crypto industry, McDermott said that while FTX was the “poster child” for much of the crypto ecosystem, it’s important to remember that its collapse doesn’t spell the end for crypto, with “the underlying technology” continuing to perform as expected.

While the total dollar amount Goldman is looking to invest isn’t the largest conceivable sum of money – especially considering that the financial services titan raked in US$21.6 billion in 2021 – its willingness to keep investing in crypto in the midst of everything that’s happened shows that traditional institutions still see a wealth of opportunity.

Nearly one month ago on November 11, FTX — once the world’s fourth largest crypto exchange — revealed that it was insolvent and filed for Chapter 11 bankruptcy protection in the United States. The fallout from this has seen a number of other major crypto firms like BlockFi file for bankruptcy as a result. The financial contagion has also spread across the market to companies like Genesis Global Capital and its parent company Digital Currency Group, which owns some of the biggest names in the business including asset manager Grayscale and news outlet CoinDesk.

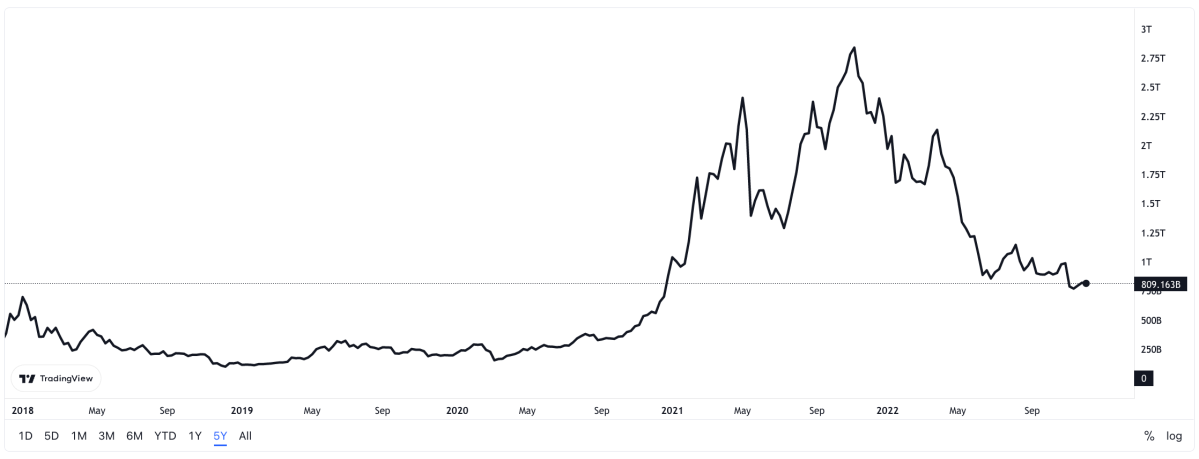

The global cryptocurrency market peaked at a total valuation of nearly US$3 trillion in November last year, according to data from TradingView, but has since shaved off more than US$2 trillion over the course of this year as central banks tightened monetary policy and a number of large crypto firms went under.

The total crypto market cap is currently hovering at roughly US$809 billion at the time of writing.

Interestingly, the sudden implosion of FTX was a win for Goldman Sachs, which saw its trading volumes spike as institutional and retail investors alike flocked to better regulated services.

“What’s increased is the number of financial institutions wanting to trade with us,” he said. “I suspect a number of them traded with FTX, but I can’t say that with cast iron certainty.”

Overall McDermott said that the recent market turmoil presents a really interesting opportunity for some more “sensibly priced” acquisitions. Goldman sees the recent downturn as an event that will increase the trustworthiness of the space as negligent actors continue to get cleared out.