Grayscale: As the FTX fallout continues with more casualties surfacing by the day, it’s become more critical now than ever for crypto firms to preserve market confidence. One suggestion has been proof of reserves, however in the midst of a crisis of confidence, the largest institutional Bitcoin fund has declined to so, citing “security concerns”.

Grayscale Bitcoin Trust, the largest Bitcoin fund isn’t so sure about transparency

During the bull run of 2020/21, the Grayscale Bitcoin Trust (GBTC) was the only game in town for institutional investors to gain exposure to the price of Bitcoin without the associated complexities of physically holding the asset itself. It’s easy for individuals to buy Bitcoin on an exchange and withdraw to a mobile wallet, not so with institutions who would far prefer something regulated and liquid.

As crypto markets soared in 2020 and 2021, investors were forced to pay a premium relative to the spot (or trading) price of Bitcoin. However, since the market turned negative, it started trading at a discount to net asset value. The reasons in both instances are complex, but it ultimately comes down to supply and demand. When trading at a premium, it reflects strong demand, compared to trading at a discount, which is indicative of investors wanting a discount for locking in their capital.

In short this meant that in principle, if the trust actually held all the Bitcoin it claimed to have on its books, investors would be able to get exposure at a juicy discount. But not so fast – there was of course a number of downsides, most pertinently an ongoing 2% management fee and the fact that it was a ‘closed-end trust’ meaning you couldn’t redeem your investment for the underlying assets.

So there you have the GBTC, trading at a 30-40% discount to net asset value for most of 2022 until the FTX drama strikes. And now the discount has widened close to 50% on fears of it being exposed (albeit indirectly) to the FTX unwind. This has brought demand for GBTC to a grinding to a halt.

How is Grayscale impacted by FTX?

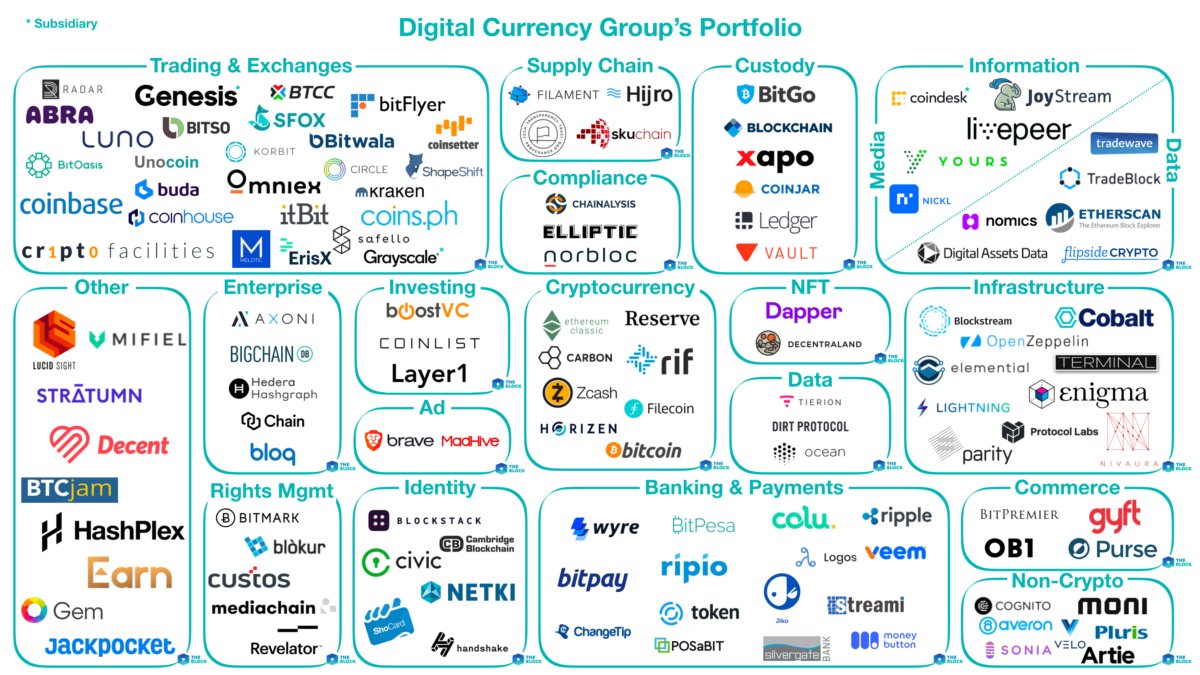

Grayscale, the company behind the GBTC unit trust, is owned by Digital Currency group (DCG). DCG’s tentacles spread far and wide in crypto, including crypto lender Genesis, who was rumoured to be seeking US$1 billion in emergency funding over the weekend.

Grayscale has had its back against the wall this year as investors have all but abandoned the former darling of the institutional Bitcoin investment space.

Now with rumours circulating that its parent company DCG is experiencing a major liquidity crunch in search of US$1 billion to keep things afloat, the pressure has mounted on Grayscale to prove that it actually holds the Bitcoin that it claims.

Won’t publish proof of reserves

In a blog post, Grayscale sought to reassure holders that all digital assets were securely stored with Coinbase.

Furthermore, in an attempt to allay investor fear of contagion, it noted that each of its products was set up as a “separate legal entity”, saying:

“The laws, regulations, and documents that define Grayscale’s digital asset products prohibit the digital assets underlying the products from being lent, borrowed, or otherwise encumbered.”

When pressed for information on proof of reserves, it said:

“Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

While the company acknowledged that some would be “disappointed” by its decision, it argued, “panic sparked by others is not a good enough reason to circumvent complex security arrangements that have kept our investors’ assets safe for years”.

It’s unclear whether Grayscale’s reluctance to publish proof of reserves is due to legitimate business reasons or motivated by something else. Irrespective, it’s not a great look, particularly at a time when greater transparency is being heralded as the solution to avoiding an FTX-like collapse.