A lot has happened this year, and much of it wasn’t great. From the collapses of Luna and Three Arrows Capital to SBF’s downfall in the whole FTX debacle. However these challenges provide an opportunity to reflect on what we learnt in 2022, and perhaps the biggest takeaway of all is that once again, “not your keys, not your crypto” applies. Arguably as much today as ever.

Not Your Keys Not Your Crypto: 2022 in review

In 2022, Ethereum went through the Merge – a transition to Proof-of-Stake that was on the network’s roadmap since its creation seven years ago. The Merge, along with a series of other significant improvements to the Ethereum code, made ETH deflationary, dramatically reduced the chain’s environmental impact, and marked a significant step forward for the entire crypto industry.

As decentralised blockchains like Ethereum made tremendous progress in usability and security, we also saw many lenders and centralised crypto exchanges lose liquidity and suffer bankruptcies, leaving users unable to withdraw funds.

While these events expose the crypto space to a lot of external criticism and scrutiny, the news coverage tends to gloss over an important detail, namely that centralised crypto exchanges take control away from users by design. Many users are simply not aware that there is a better way to hold crypto that gives them full control of their assets – self-custody which lies at the core of the ‘not your keys, not your crypto’ ethos.

Centralised exchanges like FTX don’t represent all crypto

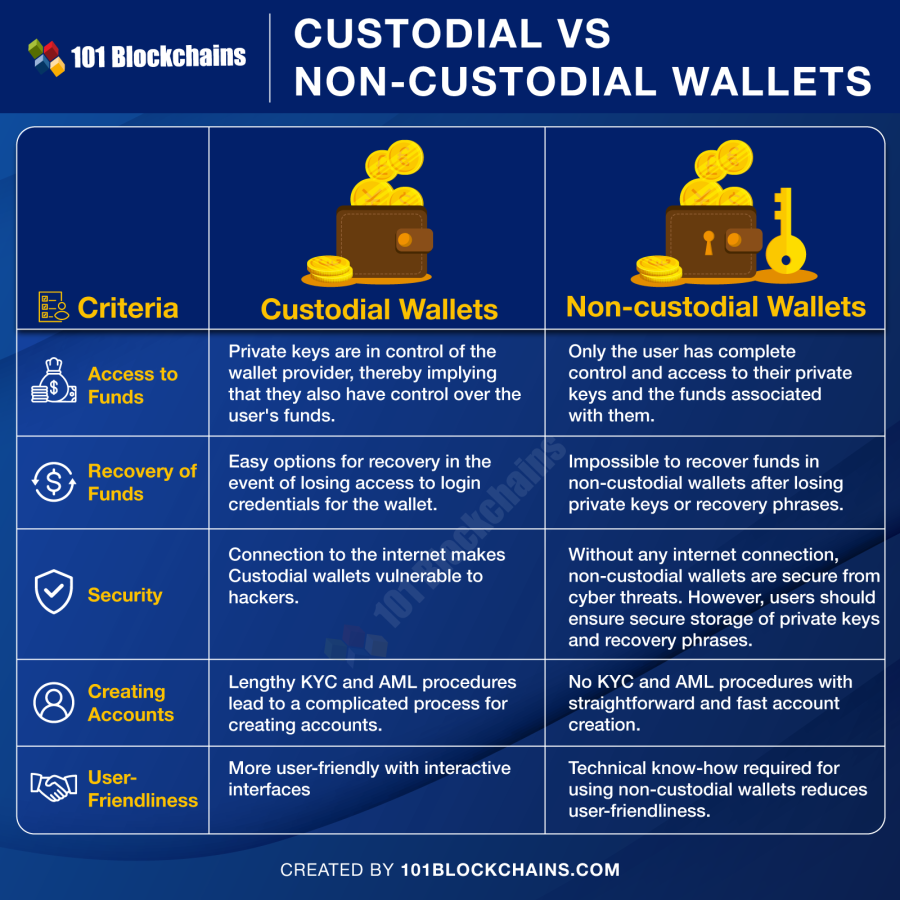

The more people that enter crypto, the more essential it is to highlight the differences between centralised custodial services and non-custodial wallets. Centralised exchanges may be necessary for some things, like buying cryptocurrency with credit cards, but they shouldn’t be used as your main crypto wallet. As we have seen, there is no transparency about the way these companies handle user funds, and the balance in their accounts is just an IOU that can disappear at any time.

Utilising a non-custodial crypto wallet is the only way to ensure full control over funds and avoid exposure to the risk of events like the FTX collapse. MyEtherWallet is one such example that is also open-source, allowing users to interact with a wide variety of decentralised financial services (the ones that don’t take custody of user funds), while having the confidence of full ownership of their crypto. However, providing the right tools is only one part of creating a safe user experience. User education about non-custodial, privacy-focused wallet options is just as important.

To fully understand the differences between custodial and non-custodial wallets, have a look at this useful comparison:

Not Your Keys Not Your Crypto: Owning your keys is the best protection from bad actors and black swan events

Non-custodial wallets are very different from centralised exchanges because if a wallet company fails, users will still have access to funds with their wallet keys. Nobody would be able to prevent them from moving their crypto, or use their funds without their knowledge.

The self-custody of crypto doesn’t only protect user from crypto exchange bankruptcies. It is also a safeguard in case of bank runs, regulation and overreach of popular financial services, as well as catastrophic global events like the war in Ukraine. When traditional banking is interrupted, non-custodial wallets are still accessible. These kinds of events may seem extremely unlikely, but it’s also true that when the unexpected happens, it may be too late.

Not your keys, not your crypto – Self-custody, decentralisation and data privacy in crypto and web3

Decentralisation and self-custody are the core principles of crypto. Blockchains like Ethereum and non-custodial wallets were specifically designed to give users control over their funds and remove the risk of single-point failures like we saw with FTX.

Many (though not all) non-custodial wallets are also committed to preserving user privacy. Unfortunately, few users are familiar with the breadth of crypto wallet options out there. There is a lot of variation in terms of how much control they will have over their funds and how much of their personal data will be collected by a wallet.

That’s why user education, by the wallets themselves and in the general media, is essential for keeping crypto safer for everyone in the aftermath of FTX and in the long run.

So for those in the back, one last time: remember, not your keys, not your crypto.