A crypto company’s annual expenses report has exposed the firm’s Sam Bankman-Fried levels of marketing — we’re so back, boys!

Polkadot, a blockchain platform with a market cap of US$8 billion (AU$11.9 billion), has had its Treasury report for the first half of 2024 released by the platform’s community members.

Who are these vigilant community members, you ask? Polkadot owns a crypto token called $DOT. Those who hold $DOT have “governance power”. This means they have the right to vote on proposals put forward by other holders of $DOT.

Granting holders of a certain cryptocurrency voting rights and other privileges is a fairly common practice in the crypto space. So, Polkadot is one of many platforms that does this.

Polkadot loves a good “outreach”

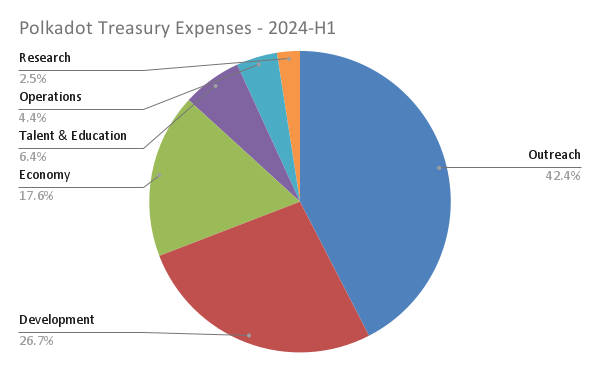

Anyway, back to the story. Polkadot’s community members revealed expenditure details on the company’s forum. For starters, Polkadot’s Treasury spent US$87 million (AU$129 million) in the first half of 2024 alone.

Of the US$87 million (AU$129 million) spent, US$37 million (AU$55 million) was placed in a category called “Outreach”. What does “Outreach” mean? Well, according to Polkadot, it means paying key opinion leaders (KOLs) to promote the company and branding its logo in different places. These KOLs consisted of crypto influencers on YouTube and X.

According to community members, the influencer marketing strategy “appeared successful” at first glance, with 15 million total video views and 570,000 total likes. But a deeper analysis suggested the influencers “were engaging in deceptive practices”, one of Polkadot’s members wrote on the forum on behalf of the community.

“Many KOLs inflated follower numbers, promotion content, and responses, resulting in excessively high costs,” the member added. Some KOLs even straight up posted repetitive AI-generated tweets. Yikes! It’s giving the Kardashian-Jenner clan’s fake bot followers scandal. But who is surprised?

For perspective, that sum would be enough to cover a AU$150 ten-course fine dining meal in Hobart for myself, every day, for 2,356 years of my life. I’d be long dead by then so my children and grandchildren would be able to enjoy it, too.

A logo with a $710,000 price tag

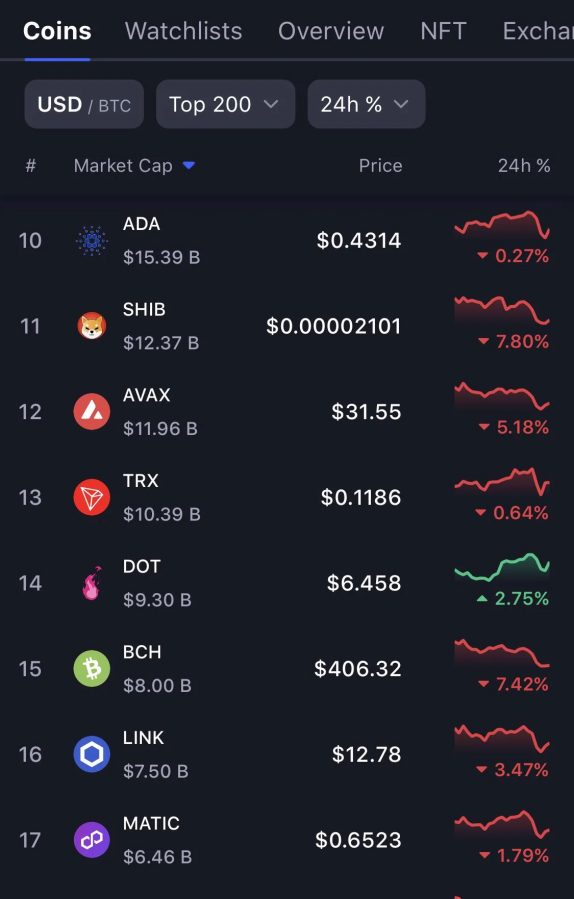

A further breakdown of Polkadot’s “Outreach” costs showed it paid US$418,000 (AU$711,000) to crypto price tracker CoinMarketCap to display the company’s animated logo on CoinMarketCap’s website. Here’s what it looked like:

A deep, moving piece of art that’s well worth the money, if you ask me. The expensive animated logo is the “first ever implementation of its kind” according to Polkadot’s balance sheet, so it’s groundbreaking stuff.

By comparison, a content deal Polkadot made with crypto publication The Block during the same period cost significantly less. For research reports, sponsored posts, newsletters and data insights, the bill came to US$138,600 (AU$206,000).

Crypto bro maths 🧠

Polkadot’s private jet ‘branding’

Perhaps the most outrageous splurge by Polkadot’s people in charge was the US$180,000 (AU$268,000) spent putting the company’s logo on a fleet of European-based private jets. An invoice issued to Polkadot read: “An entire fleet of Europe-based private jets will be branded with the Polkadot logo on the fuselage for six months. In addition to generating awareness among an elite target group, we anticipate social media shares from various celebrities using the fleet.”

… wait. That’s still way less than the animated logo!

“Hopefully the CMO reached the mile high club with this community contribution,” wrote a crypto user on X.

What now?

At the time of writing, the price of the $DOT token had plummeted 8.3 percent from US$6.59 (AU$9.80) to US$5.86 (AU$8.70) over two days. Polkadot doesn’t seem fazed by the online criticism. Amid the controversy, the company cheekily shared a post that read: “gm to all marketers and KOLs ☀️,” seemingly referencing public backlash against Polkadot’s decision to pay KOLs.

A full breakdown of Polkadot’s balance sheet, including crypto transactions, is publicly available on a Google Spreadsheet here. VC money is so back. We love crypto governance.