Cryptocurrency is one of the most volatile and unpredictable markets in the world. Even the largest and most reputable crypto assets such as Bitcoin (BTC) and Ethereum (ETH) routinely witness 5-10% daily movements in price. So, how can investors learn to better understand why the crypto market goes down and what causes a crypto crash?

Like all markets, the day-to-day price movement of any cryptocurrency is governed by the most basic of principles; supply and demand. When supply is low demand is high, people are willing to pay more for a certain asset which drives the price up. When supply is high and demand drops, so too does the price.

Much like traditional markets, there are many events that can cause a widespread sell off and tank the value of certain cryptocurrencies. However, unlike the world of ‘regular’ finance, there are a number of uniquely crypto-related events that can cause a crash.

Here’s a breakdown of all the events and causal factors that can potentially cause a crypto major market crash.

What causes a crypto crash?

1) Major economic events in the ‘real’ world

Unsurprisingly, ‘bad’ news about the wider economic state of the world is one of the biggest movers of crypto value. In 2021, crypto markets surged to new all time highs, with Bitcoin reaching an incredible price of US$69,000 on November 11 the same year. But as frenzied crypto investors looked to the world around them they saw an economic landscape that was pockmarked with all the signs of rampant inflation that needed to be reigned in.

Inflation goes up, crypto goes down

This high inflation, and the subsequent interest rate hikes made by the US Federal Reserve to combat it, saw money flee from crypto markets for over a year. Bitcoin fell to reach a new multi-year low of US$15,742 on November 10 last year, just as the collapse of FTX began to wreak havoc on the wider crypto industry.

In short, every time the US Federal Reserve increases the interest rate, investors have less incentive to hold their money in risky assets like crypto. As a result, an expectation of continued rate hikes tends to create downward pressure on markets, which typically sees the price of crypto assets like Bitcoin and Ethereum dip lower.

Crypto is correlated to the stock market

While many still view cryptocurrency as a ‘Wild West’ that remains distinct from any other sector of assets, the crypto market actually has an extremely high correlated to the broader stock market, particularly to ‘growth’ and tech stocks.

This means that when stocks like Tesla, Shopify, Spotify and others crash, so too does crypto. Typically price action in the stock market is a ‘leading indicator’ for cryptocurrencies, meaning that crypto markets tend to follow the downward moves of growth stocks.

2) Regulation

As cryptocurrency is a new industry, government bodies and financial authorities from around the world are still figuring out how best to approach regulating the sector. Typically, new regulation means that crypto companies and firms that deal with digital assets have to obey new rules, adopt new practices and pay higher fees or taxes somewhere along the line.

As a result, new regulation is often seen as a bad thing for short-term price movements, as it creates uncertainty in the market. There are however, many crypto advocates that say that despite these short-term collapses, regulation is a good thing for the industry in the long-term and will help create a solid foundation for industry players to do businesses and create value.

Senior fellow in Economic Studies at the Brookings Institution, Aaron Klein, told International Finance that new regulation has the potential to protect investors, prevent fraudulent activity, and provide clear guidance that allows companies to innovate more efficiently in the crypto industry.

“Even if regulation doesn’t bring more people in, it may change people’s current behaviour. Enthusiasts claim there are a lot of benefits cryptocurrency has over fiat currency and other asset classes, but those benefits can only come to full fruition if an appropriate regulatory framework is put into place,” Klein said.

3) Hacks

The next biggest negative driver of crypto prices is hacks. Unlike traditional finance, cryptocurrencies are entirely digital, which makes them vulnerable to cyber attacks. Despite almost all cryptocurrencies and the blockchain technology they are built upon being highly secure, developers often build complex infrastructure to help transfer, move and transact cryptocurrencies in different ways. This is where the problem begins.

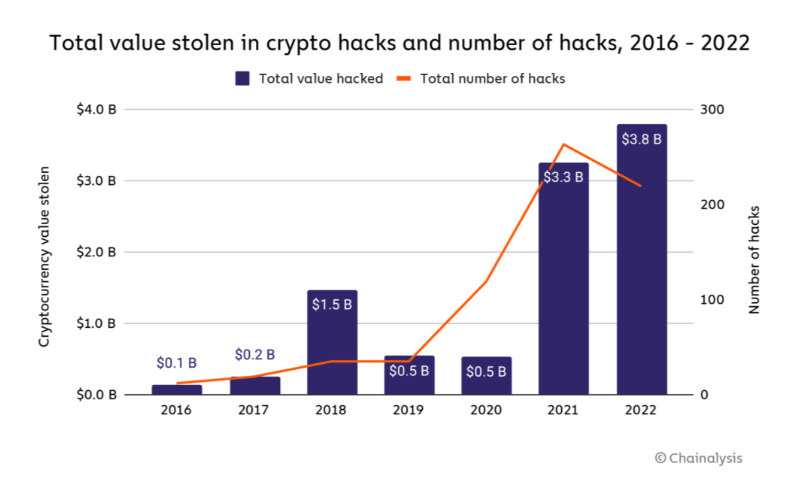

In 2022, crypto saw the largest number of hacks in its history. According to research from the blockchain analytics firm Chainalysis, these hacks saw more than US$3.8 billion disappear from the blockchain industry altogether. The number one target for hackers has been an advanced piece of blockchain infrastructure called a cross-chain bridge, which is a mechanism that sends tokens from one major blockchain network to another

Last year, hackers found a whole range of unique vulnerabilities in cross-chain bridges, rendering these ‘bridges’ one of the most critical flaws in crypto technology today.

The worst cross-chain bridge attack on record was the Ronin Network exploit, where a group of hackers managed to steal roughly US$620 million dollars worth of Ethereum (ETH) and the US-Dollar stablecoin USDC from the bridge that supported the once wildly popular play-to-earn game Axie Infinity.

US authorities later tied the attack to the ominous-sounding ‘Lazarus Group’, a consortium of hackers sponsored by North Korea. Despite the security team at Binance managing to recover nearly US$6 million of the stolen funds, the hackers managed to successfully take off with the rest.

If you’re interested in learning more about the most brutal hacks that the crypto industry has suffered through, you can read all about the nine largest hacks in crypto history here.

4) Collapsing crypto firms

This should come as no surprise, but one of the most significant causes of major sell offs is when a crypto company or institution declares bankruptcy or signals that they are in serious financial trouble. Even though the wider crypto market was already in free fall for most of 2022, a number of high profile collapses of major crypto firms accelerated the decline in price. Here’s the largest collapses of 2022 and the impact they had on prices.

Voyager Digital & Celsius bankruptices

In early-to-mid-July last year, two major crypto brokerage institutions called Voyager Digital and Celsius Network both filed for bankruptcy. Incredibly, crypto markets actually rallied immediately following the announcement, largely due to a host of other reasons.

Still, their Chapter 11 bankruptcy filings and the revelations that were surfaced in court as investigators picked through rubble of the two firms, added further to the sell pressure on cryptocurrencies in latter days of 2022.

Terra Money and Three Arrows Capital collapse

In May of 2022, a cryptocurrency ecosystem called Terra Money, which was comprised of two main tokens, a US Dollar-pegged stablecoin called ‘UST’ and its sister token dubbed ‘LUNA’ death spiralled, driving the price of both tokens to near-zero.

This collapse occurred for a whole host of reasons, but the end result was roughly US$50 billion was wiped from the face of the earth as a result.

The situation was made even worse, when a prominent crypto hedge fund called Three Arrows Capital (3AC) revealed that they had made massive, multi-billion-dollar bets on the success of the Terra Money ecosystem. This saw an additional US$10 billion disappear as a result.

The resulting sell off caused by the combined collapse of both Terra Money and 3AC saw investors withdraw more than US$400 billion from the crypto market over the next month, crashing the price of Bitcoin from roughly $35,000 to just US$21,000 inside 30 days.

FTX meltdown

The most recent, and arguably one of the worst crypto crashes in history came when FTX, once the fourth-largest crypto exchange in the world suddenly collapsed in on itself, leaving roughly US$10 billion of investor money trapped on the exchange.

Not only did the rapid meltdown of FTX wreak immediate havoc on crypto prices — sending the price of Bitcoin plummeting to a new yearly low of approximately US$15,000 — it also damaged the credibility of the entire industry.

The exchange’s former-CEO, Sam Bankman-Fried (SBF), was once a leading figure in the crypto industry. For many, the curly-haired 30-year-old wasn’t just the head of his exchange FTX, he was the benevolent face of the crypto industry itself.

So, when it was revealed that he had most likely gambled away more than US$4.5 billion worth of client funds, the industry was stripped of its poster child and the entire ethos of the space was thrown into question.

That’s what causes a crypto crash

As you can see there are a large number of factors that can cause a crypto market crash. Many of the main causes depend on the movements of the real world economy and are influenced by outside actors. However, as you’ve just learned that are many price drivers that are unique to the crypto industry. Unfortunately, no one can perfectly predict market moves, so its best just to approach investing in a risky asset class like cryptocurrency with a healthy dose of caution, especially if you’re new to the space.