The historic Bitcoin Halving took place during the weekend, on April 20. For Bitcoin and wider crypto communities, it was their version of the FIFA World Cup, as it occurs once every four years. So, celebrations took place across different enthusiast groups around the world, some of which were sponsored by crypto companies.

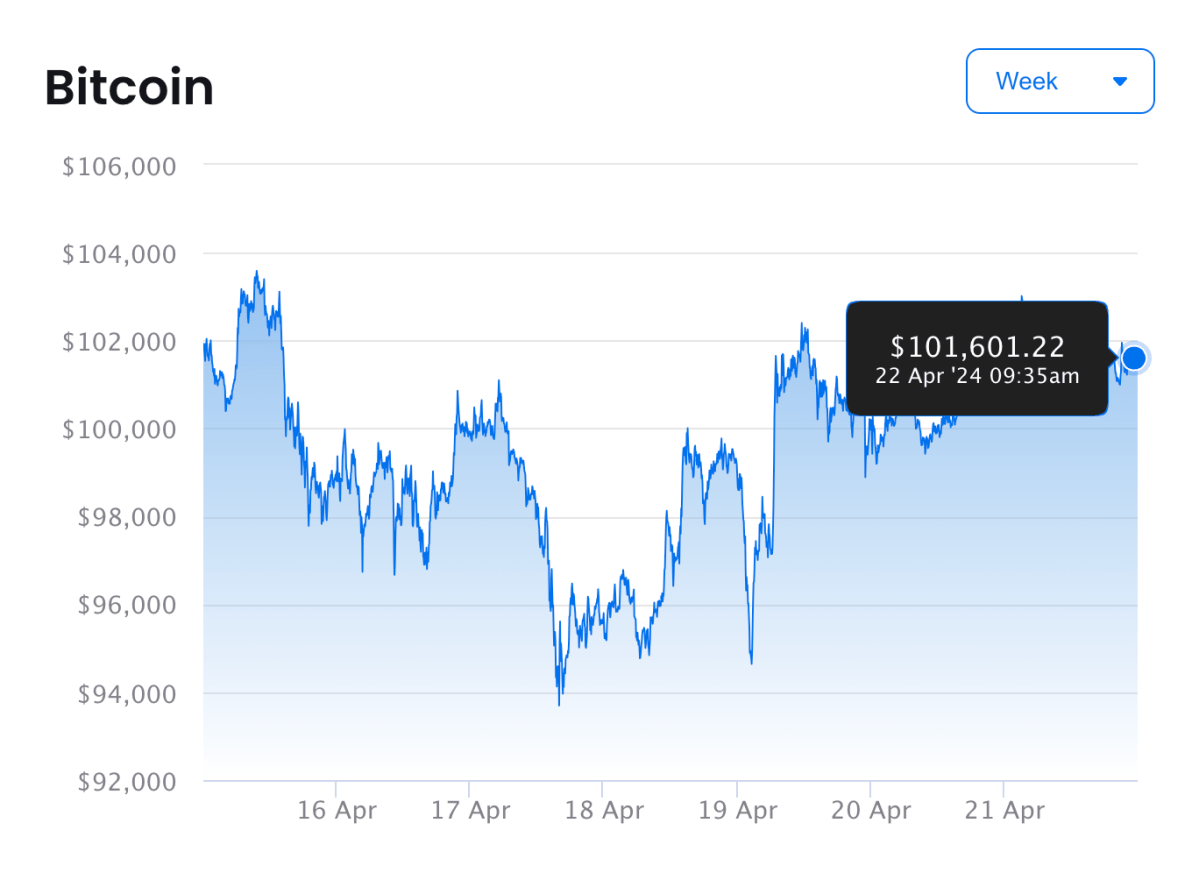

A day before the halving, Bitcoin saw a price surge that sent the cryptocurrency from AU$94,950 to a high of AU$102,000, per Swyftx. However, on Bitcoin Halving day, Bitcoin’s price dropped to AU$99,600 and hovered around that price before slowly crawling back to AU$101,000 the next day.

Bitcoin was trading for AU$101,500 a pop at the time of writing.

After previous halvings Bitcoin’s price experienced a dramatic surge weeks or months after the event. After the halving in 2020, Bitcoin tripled in value, from US$8,480 (AU$13,100) in mid-May to US$25,600 (AU$39,780) in mid-December.

Bitcoin price after halving

John Hawkins, Senior Professor of Economics at the University of Canberra, tells The Chainsaw that the 2024 Bitcoin Halving has been “ridiculously hyped”.

“Bitcoin pays no interest or dividend,” he said. “The only way a punter can profit from Bitcoin is by selling it at a higher price than they paid. So there is no shortage of people with a vested interest in trying to latch onto any argument, no matter how specious, to talk up the price.”

Professor Hawkins noted that Bitcoin had dropped around 10% from its record high.

“So again Bitcoin is failing to live up to the hype about ‘digital gold’. Gold has industrial uses which puts a floor under its price. And it is a unique mineral with distinct properties; whereas there are thousands of other cryptos with the same properties as Bitcoin. Bitcoin itself has forked into Bitcoin Cash, Bitcoin SV etc. So, even the limited supply narrative is contentious.”

However, some experts aren’t too concerned about Bitcoin’s short-term price performance post-halving. Josh Gilbert, crypto market analyst at eToro, tells The Chainsaw that Bitcoin’s “slightly muted” reaction post-halving was “expected”.

“The performance of Bitcoin around halving events speaks for itself, but when we add in the introduction of the institutional interest we have in 2024, this halving makes for one of the most exciting we’ve had yet,” Gilbert said. “Bitcoin’s supply is being cut at a time when institutions are buying the asset by the bucket load.

“If we continue to see the interest in the ETFs we have since the start of the year, there is an evident supply [and] demand imbalance. So, although we will likely see reaction muted in the short term, particularly as geopolitical tensions persist, the closer we move to rate cuts coupled with the recent halving, Bitcoin could be eyeing six figures in this next cycle.”

Image: Yaroslav Kushta via Getty Images