The now defunct crypto exchange FTX once had an option that allowed its users to trade synthetic, tokenised stocks on the platform. Interestingly, it turns out that the synthetic stocks may have been used by hedge funds looking for a ‘back door’ into trading derivatives off the books. Analysts are now claiming that these synthetic tokens may have significantly impacted the real world price of shares in companies like GameStop and Tesla.

As a reminder, tokenised stocks are digital assets that mimic the price action of publicly traded stocks.

A tweet from Chartered Financial Analyst, Peter R Hann levelled criticism at the synthetic FTX tokens, suggesting that the underlying assets may not be findable by brokers.

“When you borrow shares to short, your broker has to claim they can locate. If some stupid crypto exchange says they have 400M AMC shares, then maybe the broker claims they can easily find,” wrote Hann.

FTX Gamestop

Another Twitter user Sanjeev Kale points out that hedge funds were actively using synthetic stocks to bring down the prices of major companies that were seeing large amounts of short-side activity.

“FTX tokens were in fact an important avenue for shorts/lenders to create/use unlimited synthetics to bring down AMC and [GameStop],” Kale wrote in a tweet.

“This is how they stopped the MOASS (Mother Of All Short Squeezes) in 2021. Now with FTX bankrupt this avenue is shut. As AMC/[GameStop] recover, squeeze potential could be higher,” Kale added.

How does synthetic trading impact the price of the underlying?

In further correspondence with The Chainsaw, Kale explained how the trading of synthetic tokens may have played a significant role in manipulating the price of the underlying GameStop assets.

“Tokens are derivatives but not in the traditional way of a call or put option where there is a market maker that takes the other side of the trade with an exposure to the equity position, either long or short,” Kale wrote.

“Tokens are off the shelf contracts that don’t impact the underlying but could have impacted the underlying. It’s one of those tail wagging the dog situations,” he added.

When derivatives are traded, the stock broker charger something called a ‘stock borrow fee’ which is charged to lend shares to short sellers to bet against the stock, which is called the ‘cost to borrow’. The higher the cost to borrow fee, the harder it becomes to borrow the stock.

Essentially, these tokenised stocks on FTX allowed hedge funds to say, “look there’s 10 million tokenised shares over here that could be redeemed for real ones” which reduces the cost to borrow because there’s peace of mind that the shares can and will be located.

FTX Gamestop: FTX knowingly lied to customers. Again.

The contract for the synthetic GameStop (GME) tokens on Etherscan shows that there are 10,000,000 synthetic GME tokens circulating on the Ethereum blockchain. This means that there should be an equal amount of GME owned by FTX sitting on the books somewhere, but statements from the official FTX Terms of Services documents suggest otherwise.

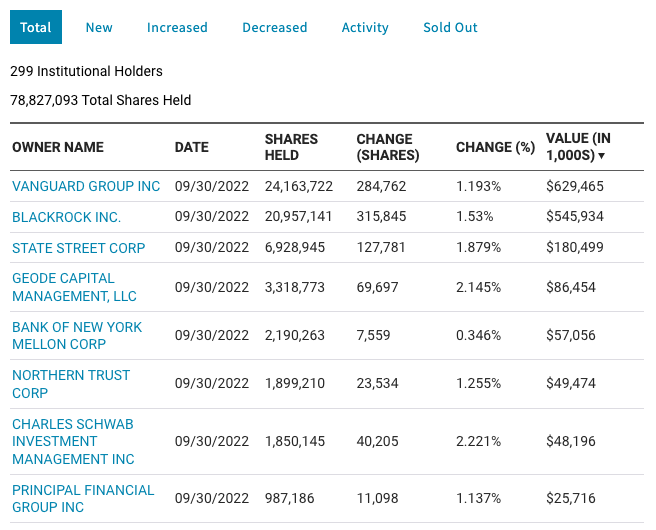

Per the FTX website, all tokenised stocks were allegedly held in custody by FTX Switzerland. Naturally, If FTX’s tokenised stocks were actually backed one to one — like the official statement claims, using Tesla as an example — then the institutional holdings of these shares would be publicly displayed on documents by the SEC.

“These spot tokens are backed by shares of Tesla stock custodied by FTX Switzerland. They can be redeemed with FTX Switzerland for the underlying shares if desired,” reads the disclaimer.

There is however no such listing of FTX Switzerland as being an institutional holder of the 10,000,000 GME tokens on the official NASDAQ website, where companies are required by law to list their holdings. This means that 10 million GameStop “shares” were printed out of thin air.

A deeper look beyond the generic claims on the FTX website and into FTX’s own terms of service on tokenised stocks and Key Information Document state: “buyers of the Fractional Stocks have neither a claim to delivery of the underlying.”

This ultimately means that FTX knowingly lied and misled customers on the website, going directly against its own terms of service.

Was FTX Being Used As a Backdoor to Short Tesla Stocks too?

The unsavoury manipulation of GameStop prices combined with shoddy brokerage practices from FTX in this instance could also be a significant reason why Tesla CEO Elon Musk is hitting out so strongly against Sam Bankman-Fried on Twitter.

There is a strong possibility that if institutions were using tokenised synthetic stocks to short companies like GameStop, then they most likely would be using them to short companies like Tesla as well.

Musk famously hates shorts as an investment vehicle, going as far as calling out Bill Gates for shorting Tesla stock.

The FTX Gamestop mess and collateral damage just keeps on piling up.