How can we know if a crypto exchange is legit? The utter implosion of the FTX exchange showed that the crypto industry places too much trust on the people that run exchanges. So how can we weed out these dodgy actors?

In case you were living under a rock, FTX was a popular crypto exchange that went bankrupt in November 2022 after its founder, Sam Bankman-Fried (SBF), was arrested for money laundering and fraud.

SBF stole the funds of his crypto customers to invest in his hedge fund, Alameda Research, which then lost billions in poorly-executed trades. SBF then had no way to pay back his crypto customers whose money he stole.

When word got out that the ship was sinking, many customers of FTX with crypto on the exchange tried to withdraw their funds from FTX. But FTX did not have enough cash to pay them back, so it stopped withdrawals and filed for bankruptcy.

This caused a panic in the crypto market and led to a crash in the prices of many cryptocurrencies. It also led to contagion, and other crypto businesses collapsed alongside FTX.

The dodgy crypto exchange: Lessons learned

The utter mess that was FTX has taught us all some very harsh lessons. Firstly, just because someone appears trustworthy doesn’t mean we can trust them. And secondly, we need an honest way to be able to determine if a crypto exchange has the cryptocurrency and other assets that it claims to have. And, to keep an eye on what they are doing with those reserves.

Researchers at the Complexity Science Hub (CSH), along with the Financial Market Authority (FMA) and the Austrian National Bank (OeNB) have got together to suggest a new approach to the situation.

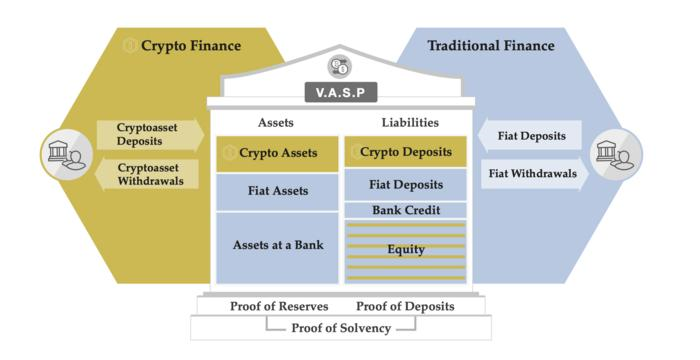

These organisations have produced a report suggesting digital asset businesses should reveal their wallet addresses. All wallets. Fess up, crypto exchanges.

The report also says digital asset businesses should report how much money they have in crypto and in regular currencies. Yep, that’s right, come clean, digital asset peeps.

This way, anyone can check if digital asset businesses actually have enough money to pay their customers and if they are doing anything sus.

© Complexity Science Hub

Something isn’t matching up

The researchers tested their idea on 24 crypto exchanges that are registered in Austria. They compared the wallet addresses, the reports generated by the crypto exchanges themselves, and the information from the authorities. They found out these records did not match very well. Yikes!

Complexity Science Hub’s Bernhard Haslhofer said, “Events like the FTX insolvency demonstrate the need for new solvency assessment methods for cryptocurrency exchanges.”

Normal banks and financial companies have clear rules on how to check if they have enough money to pay their customers and debts. But crypto companies don’t do this, partly because they keep their digital assets in hidden wallets on different networks and don’t show how much they have in their reports.

Haslhofer continues, “However, transactions that occur on blockchains like Bitcoin and Ethereum are publicly viewable, opening up potential new opportunities for improving and automating current solvency analysis and evaluation procedures.”

The researchers say not only should crypto companies show their wallet addresses, they should also give more information about what they use these wallets for.

This way, outside experts could check if the crypto companies have the money they claim to have on the networks.

Fiat too

The researchers also say crypto companies should split their reports into two parts: one for crypto and one for non-crypto assets. And, they should update these reports regularly.

Haslhofer said, “When comparing the known crypto asset holdings with the balance data, we found that they were only partially consistent.”

Haslhofer continued, “FTX has clearly shown that crypto companies can slide into insolvency, potentially resulting in substantial losses for customers. We hope that this study will help improve the analysis and evaluation of virtual asset service providers’ solvency in the future.”