Australian crypto survey: The results are in from the fourth edition of the Independent Reserve Cryptocurrency Index (IRCI). And according to the Australian exchange crypto survey, Aussies didn’t get the memo that the market is down, with over 50% committing to buying even more crypto in the coming 12 months.

The IRCI is a cross-sectional survey of over 2000 Australians measuring four key elements of attitudes towards crypto:

- Awareness;

- Adoption;

- Trust; and

- Confidence.

The index spits out a rating out of 100 and last year during the peak of the bull market, it came out at 54. This year, amid what some have described as a bear market of historic proportions, the rating has come out at 45. This may suggest that while sentiment is undoubtedly diminished, it’s arguably far higher than it would otherwise have been relative to years gone by.

Australian crypto survey – BTC is the undisputed king

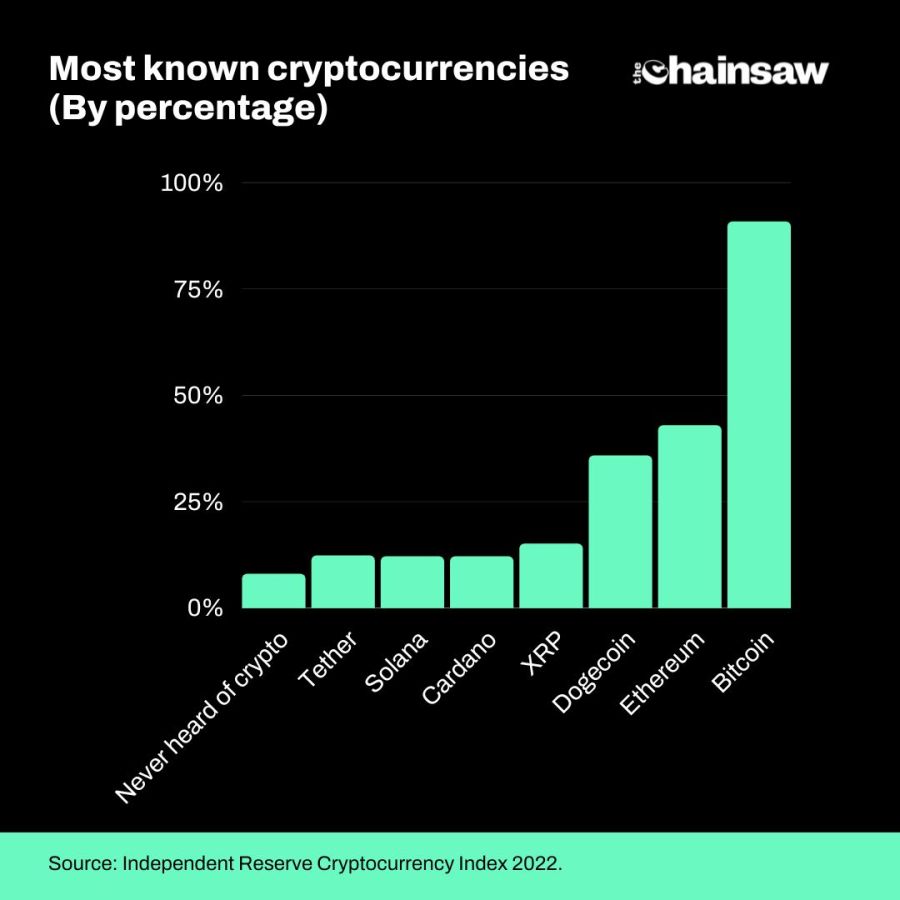

Unsurprisingly, Bitcoin was found to be the favourite across all genders, ages and geolocations with 63% of crypto holders declaring a position. In addition, it was also the most well-known of all with over 90% of respondents saying that they had heard of it, just 2% shy of the 92% who had heard of the term ‘cryptocurrencies’.

Ethereum ranked a distant second in terms of ownership at 38% with Ripple taking third place at 19%.

Crypto adoption dropped

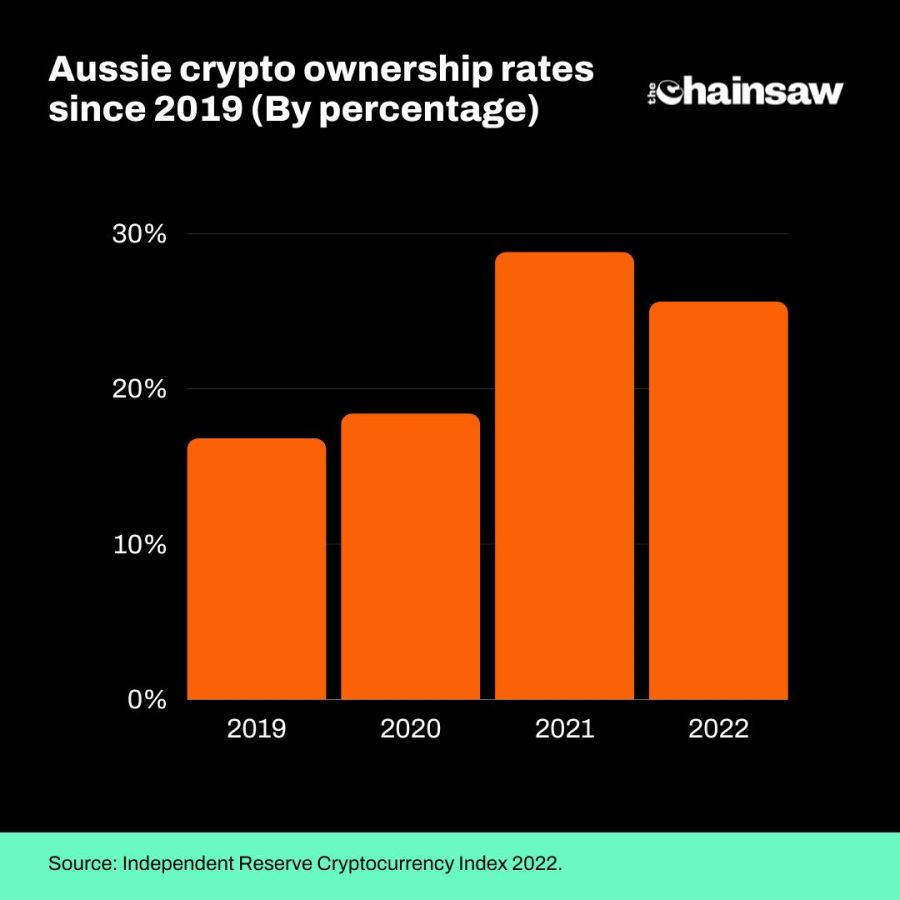

Given the current bear market, seemingly exacerbated by the FTX implosion, it’s little surprise that crypto ownership rates have declined from last year’s historic high of 28.8%.

In the 2022 Australian crypto survey, that figure has declined to 25.6%. While it’s clear that some investors have fled the volatile crypto market in search of safety, it’s revealing that in a year of one deleveraging event after another (Luna, Voyager, Celsius, FTX), ownership rates have only declined by a relatively small amount.

Interestingly, crypto ownership is more or less spread evenly across the country. Notably however, New South Wales and Victoria were up from 29.3% to 32.5% and 26% to 29%, respectively over the past year.

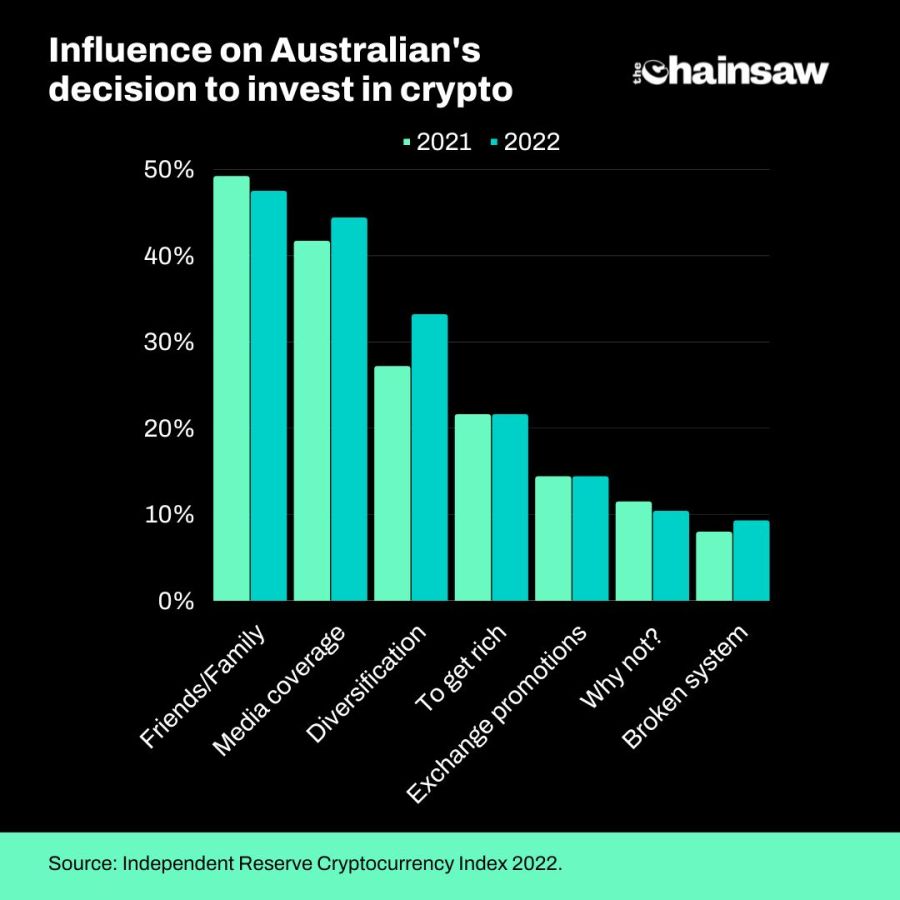

In evaluating what prompted investors to get into crypto, the IRCI found that “family and friends” was the single biggest influence with 49.2% citing them as being responsible for getting them initially invested. Curiously, 59.5% of women were likely to listen to the advice and experiences of friends and family, compared to only 41.1% of men.

The second largest factor driving adoption was “curiosity after seeing it in the media”, cited by 41.7% of those surveyed, followed by “to diversify my portfolio”, which ranked third at 27.2%.

Where is the growth happening?

One of the interesting findings from the IRCI was that Australians aged over 35 demonstrated the largest growth relative to other age groups. The biggest growth in ownership came from respondents 35-44 years of age, up from 38% in 2021 to 45.5% in 2022.

Ownership among 45-54-year-olds grew from 25.3% to 27%, and for 55-64-year-olds, ownership grew from 9.7% to 11.4%. Just 5.1% of respondents over the age of 65 claim to own crypto, but this is up from 3.9%. Evidently the older generations are getting in on the act.

The largest drop in crypto ownership came from 18-24-year-olds, dropping from 55.7% in 2021 to 30.7% in 2022. Of the 23.4% of 18-24-year-olds that didn’t invest in crypto, the inability to do so due to finances was cited as the reason.

Australian crypto survey: Buying the dip

Despite an overall drop in crypto ownership, those who do own are capturing the opportunity to ‘buy the dip’ at an increasing clip. This year, people investing $500 or more per month in crypto rose from 10.3% to 17.3% But these increases are not just limited to higher earners. Even those dabbling in the $1-$100 range have doubled from 11.6% to 26.5% in 2022.

Overall, the survey reflects the fact that despite challenging market conditions, Aussies appear to remain bullish for the most part. Now If this is how they respond to an intense bear market, one wonders what on earth they will do when the money printer goes brrrrr and crypto shifts back in the green. Chances are that adoption rates will skyrocket.