On Friday morning millions of dollars worth of Arbitrum’s ‘ARB’ token was airdropped to crypto investors. The ARB token briefly traded at a price of nearly US$11 (AU$16.56) before the recipients of the ARB airdrop rushed to sell their brand new holdings.

This rush triggered a selling frenzy that saw the price of ARB plummet nearly 90%, trading at roughly US$1.26 (AU$2.21) at the time of writing. With the price of ARB down significantly, is now a good time to buy ARB? Or is there still room for the token to sink deeper into the red in the coming days and weeks.

What is Arbitrum?

Arbitrum is a Layer-2 scaling solution for the Ethereum (ETH) blockchain. In plain English, Arbitrum helps the Ethereum network process transactions and solves some of the problems that come with heightened levels of activity on the network such as gas fees and slower transaction times.

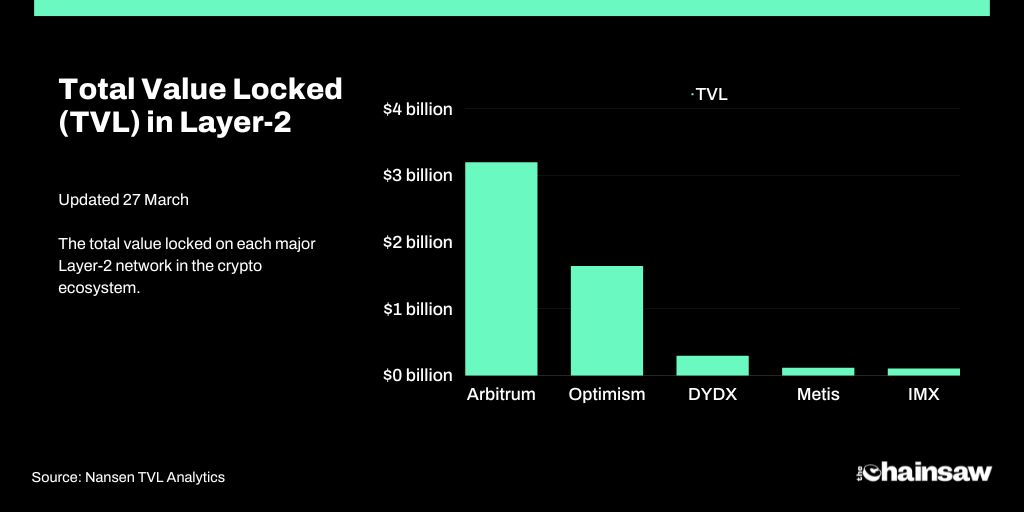

There are a number of other Layer-2 networks in the crypto industry, including the likes of Optimism (OP) and Polygon (MATIC) but Arbitrum is the clear leader in the space. As of March 2023, Arbitrum commands a whopping 55% market share of all Layer-2 value and a total transaction count that topped Ethereum on two consecutive days in February.

According to a combination of data from blockchain analytics firms, Nansen and L2 Beat, Arbitrum has a total value of US$3.2 billion ‘locked up’ on its network, which is a significantly larger sum than many of its other Layer-2 competitors.

The Total Value Locked (TVL) number is important for investors because it showed how much capital is stored on each chain, which symbolises how much use the network is seeing. While it’s not a perfect rule, the higher the TVL, the higher the price stands to rise in the future.

Arbitrum economics

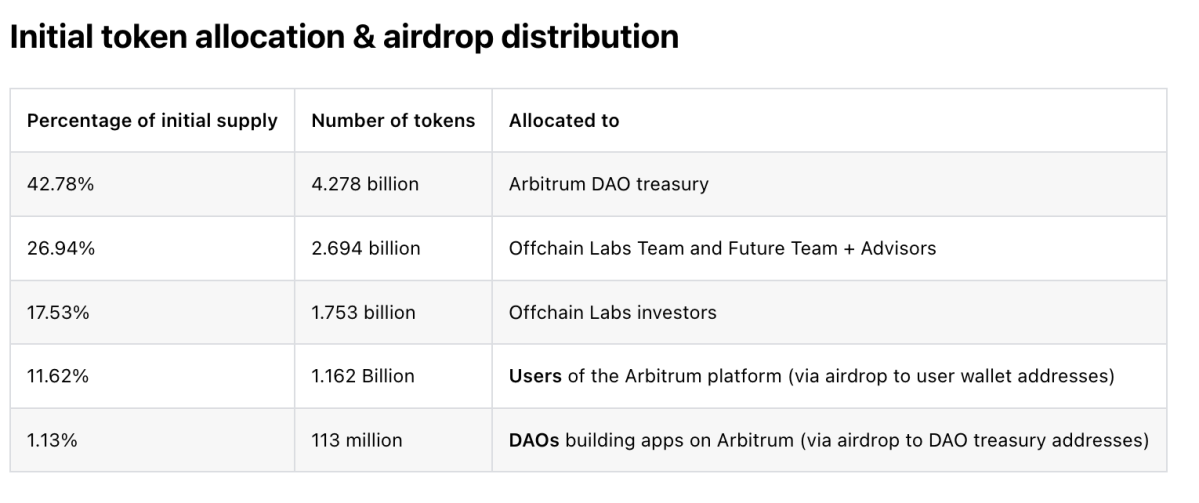

For those weighing up Arbitrum as an investment decision, it’s important to have a good understanding of how many tokens are circulating in the crypto economy and who holds them. According to Arbitrum’s white paper, a little more than 42% of all ARB tokens will go to Arbitrum treasury — they decide which projects to fund and how to spend the tokens.

27% of ARB will go to the team and future team members. 17% will go to private investors and 11% will go to the public — with much of this supply being delivered by the recent ARB airdrop. As is the case with most public blockchains, insiders and developers will own the vast majority of the tokens.

Is now a good time to buy Arbitrum?

So, with the recently airdropped-ARB trading down nearly 90% from its all-time-high, is now a good to time to pick up Arbitrum at a discount or should investors wait for more downward price movement?

According to the analysts from popular technical analysis firm FX Street, the price action of Arbitrum is anyone’s guess. Still, the best way to gauge the future movements of Arbitrum’s ARB token is to look at how other, similarly-airdropped tokens have performed in the past.

FXStreet looks at the airdrops of Optimism (OP) and Aptos (APT) as the main point of reference. In both cases, the OP and APT tokens experienced massive declines in price in the weeks following their airdrops and subsequent listings on major exchanges like Coinbase, Binance and Crypto.com — before rallying significantly after the selling frenzy waned.

“The ideal move is to wait and let the initial excitement subside. This will be a time when airdrop farmers and retail investors that panic-bought, will have sold their holdings and the market as a whole will have calmed down.”

FXStreet

“Beyond that, the next price action for Arbitrum would hinge completely on the general landscape of the crypto market,” wrote FXStreet editor Lockridge Okoth.

If we take a quick peak at the analysis from automated analytics firm CoinCodex, the signs remain blurry, although the analysts here are taking a far more bullish stance on the near-term future of ARB.

According to a wide ranging analysis of different technical factors, the price of Arbitrum is “currently overvalued”, meaning that today’s price of US$1.26 could see some more downside. However, the experts seem to agree that based on multiple technical and quantitative indicators, “the overall forecast for Arbitrum in moving into 2023 is bullish.”