What is XRP? Everybody in crypto is watching Ripple Labs and their token called XRP. But what is it? And why are they in the news? Here is the explainer.

The problem

Banks need to send money to each other for a variety of reasons. One of the main reasons is to carry out cross-border payments – transactions that involve the transfer of money between banks in different countries.

For example, I am in Australia. I pay my employee in the Philippines every month. The money leaves my Australian account in Australian dollars. The Australian bank then has to scrounge around to find some Philippine peso. Once the currency is located, Australian dollars are exchanged for it, and it is sent to the account of my employee in the Bank of the Philippines.

This takes around 3 days, except when there is a typhoon and everything breaks. Then it can take up to a week. There are also high fees to do this.

This example shows how individuals conduct international payments. But banks also need to send money internationally to each other for a variety of reasons.

This all can take a lot of time using current methods.

Ripple Labs

What Ripple Labs are offering is for that process to be done in a matter of seconds. They do this by offering XRP in a central ‘pool’.

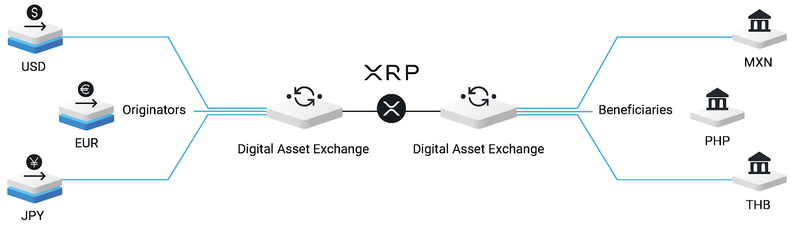

As CEO of Ripple, Brad Garlinghouse explains, Ripple Labs offers a system that allows for quick and efficient payments between banks using different currencies. This is made possible through the use of a central “pool” of the Ripple cryptocurrency, known as XRP.

When a bank using the Ripple system wants to make a payment to another bank, it simply converts the currency it has into XRP. The Ripple system then uses this XRP to make the payment to the recipient bank, who can then convert the XRP back into their own currency. This eliminates the need for the banks to exchange currencies themselves and wait for the transaction to clear, allowing for faster and more efficient payments.

What is RippleNet?

RippleNet is a platform that is made up of all the banks using the network. It is owned by Ripple Labs. XRP is the bridge currency to enable fast and efficient cross-border payments.

Ripple so far has partnered with many banks around the world.

Some examples of these partners include the Commonwealth Bank, ANZ, NAB, Morgan Stanley, Bank of America, Santander, American Express, MoneyGram, and PNC Bank. In addition, a number of other companies are using XRP for various purposes, such as payment processing and settlement of financial transactions.

Things to know about XRP

As with any digital currency or financial technology, XRP has faced its share of criticisms and controversies. Some of the main criticisms of XRP include concerns about centralisation.

As a comparison, Bitcoin (BTC) is decentralised. This means that no one controls it, so no government can mess around with it to get a desired outcome. Person A can send BTC to Person B directly without having to use a bank or without government interference.

XRP on the other hand is a centralised cryptocurrency, meaning that one person or entity controls it. Individual users have less control over what happens to it. However, that is why there are two systems in crypto — sometimes a decentralised system is needed, and at other times, a centralised system is a better solution.

Some people believe that the centralisation of XRP makes it less secure and less resistant to censorship than decentralised cryptocurrencies. However, others argue that the centralisation of XRP allows for faster and more efficient transactions, and makes it more suitable for use in certain types of financial applications.

Why would investors buy XRP?

XRP has a fixed supply, which means that its value is not subject to the same inflationary pressures as other cryptocurrencies that are mined. Some investors may be attracted to the potential for XRP to be used by a growing number of financial institutions and companies around the world.

As a digital currency, XRP can also be used to buy a wide range of goods and services, just like regular money. However, the availability of XRP as a form of payment can vary depending on where you are and whom you are trying to buy from.

Some online retailers and merchants may accept XRP as payment, so you can use it to buy things like clothes, electronics, and other goods. In addition, some physical stores and businesses may also accept XRP as payment, although this is less common.

It is worth noting however that Coinbase has dropped XRP from trading on their platform. They say this is because of the pending SEC case against Ripple Labs, which we will now explain.

Why is XRP in the news all the damn time?

Good question. Ripple, the company behind the XRP cryptocurrency, is being sued by the US Securities and Exchange Commission (SEC).

The SEC claims that Ripple raised US$1.3 billion through an “unregistered digital asset securities offering”, which is against the law.

Ripple Labs say that XRP is not a security. The SEC says it is.

The Securities and Exchange Commission (SEC) is a US government agency that was set up to protect investors by making sure they get important information about securities before they buy them. It also makes sure that companies follow the rules when they sell securities, which are things like stocks, bonds, and other investments.

What is the Howey Test?

The SEC uses something called the Howey Test to decide whether something is a security or not. This is a set of four questions that, if they are all true, then the thing being tested is a security and should be regulated as one.

XRP is being sued by the SEC because it thinks XRP is a security and Ripple did not follow the rules when it sold it.

Ripple Labs say that XRP fails the Howey Test, and therefore it is not a security.

If XRP is ruled a security then Ripple says that their business would not be affected that much. If it was going to be a problem, they would just move offshore.

Garlinghouse, the CEO of Ripple said, “Frankly, most of our customers are non-US customers by a long shot today and so we could absolutely continue to build the business and grow. It’s just we would no longer be a US taxpayer where we paid probably order magnitude of a couple hundred million dollars in taxes here in the United States and I just think that it doesn’t serve the US agenda to drive us offshore.”

In the end….

XRP is a digital currency that is used for fast and secure transactions. It is the native currency of the Ripple network, which is a payment protocol that enables quick and low-cost transactions between different currencies. XRP is gaining popularity as a tool for facilitating cross-border payments and has been adopted by a growing number of financial institutions.

However, if Ripple Labs loses the SEC case, that could prove to be a major spanner in the works, and the price of XRP could plunge. This would be bad news in an already icy crypto winter.

We will keep you posted.