Keeping up with the movement of crypto coins is difficult, considering there are hundreds or thousands of tokens out there. However, there is now a handy tool called ‘Altcoin Season Index’ that helps investors analyse when is the best time to buy altcoins… or not.

The Altcoin Season Index is made by Blockchain Center, a site maintained by crypto enthusiast Holger, who is known for creating the infamous Bitcoin Rainbow Chart. The Altcoin Season Index tracks the performance of the top 50 altcoins by market capitalisation over 90 days. It then predicts if it is time to buy altcoins, or whether sticking with Bitcoin is the better bet.

Wait, what is an altcoin?

An altcoin – short for ‘alternative coin’ – refers to any cryptocurrency besides Bitcoin. This pretty much means anything that is not Bitcoin is an altcoin. Yes, even Ethereum, the world’s second-largest cryptocurrency, is considered an altcoin. However, there exists several arguments in the crypto space claiming that Ethereum is no longer an altcoin.

Some crypto investors view altcoins as, well, alternative investment options. Altcoins like Ripple (XRP), Cardano (ADA), Solana (SOL), and Dogecoin (DOGE) rank among the top ten crypto tokens with hundreds of millions in market cap. So, it is not surprising to see investors betting on their performance in hopes to make profit.

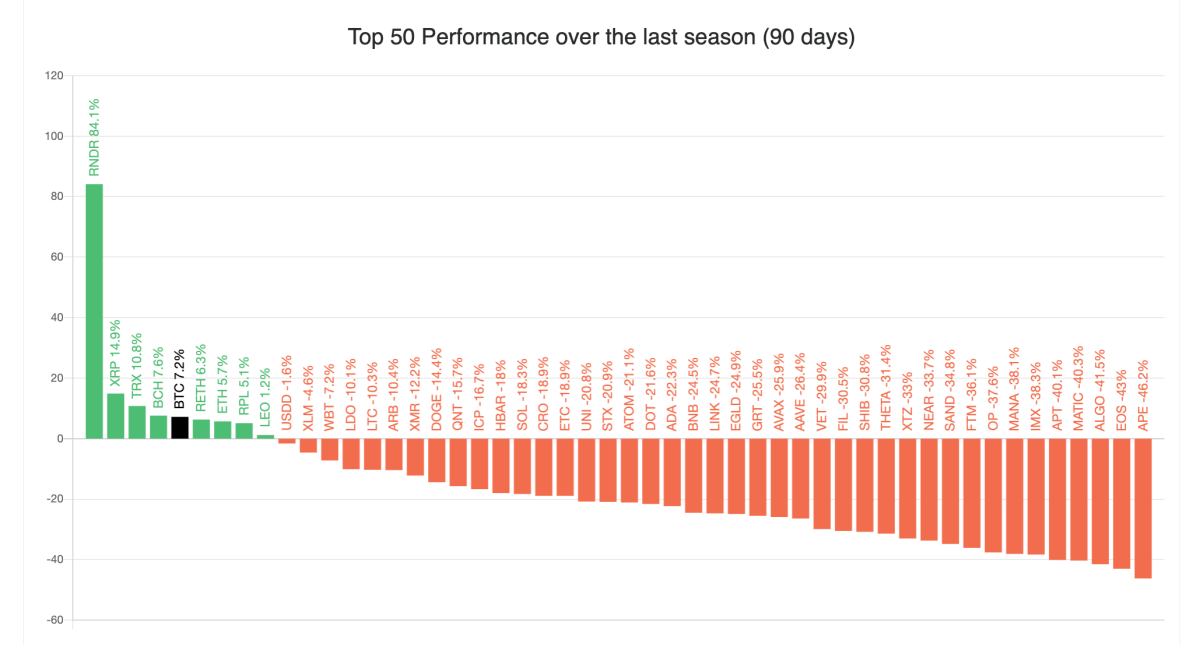

The Altcoin Season Index places Bitcoin’s performance amongst the top 50 altcoins to give an idea of how the world’s largest crypto compares to the rest of the market in the past 90 days. Altcoins that saw returns in the past 90 days are highlighted in green. Those that saw losses during the same period are highlighted in red.

At the time of writing, Bitcoin sits in the green zone with 7.1% returns in the past 90 days. RNDR, an altcoin by decentralised GPU provider Render Network, saw the highest returns at 85% from the past 90 days. APE, a token by the Bored Ape Yacht Club, had the worst losses at 37.5%.

‘Altcoin season’ isn’t anytime soon

So, how does the Index judge whether or not it is ‘altcoin season’?

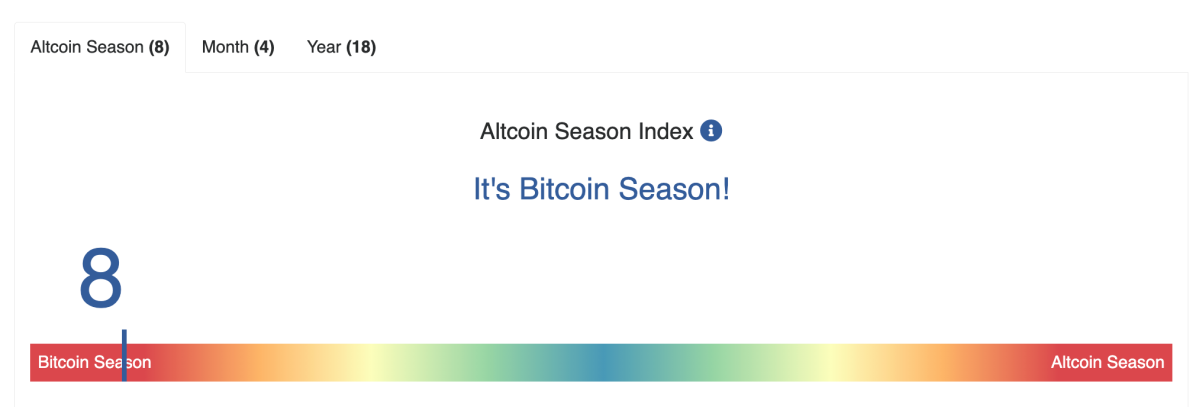

“If 75% of the top 50 altcoins performed better than Bitcoin over the last season (90 days), it is Altcoin Season,” according to the site. This means that at least 38 altcoins have to have higher returns than Bitcoin.

Right now, it is firmly ‘Bitcoin Season’, according to the index. The number 8 on the rainbow bar above indicates that currently, only 8% of altcoins performed better than BTC in the last 90 days. The number needs to be 75% for it to be considered ‘altcoin season’.

Besides an overall projection, the index also provides a monthly and yearly prediction of whether or not it will be altcoin season soon. Sure enough: it will not. Right now, it’s ‘Bitcoin month’ and ‘Bitcoin year’ – sorry, altcoins.