UK crypto regulation: The UK Treasury department has finalised its plans to introduce a series of wide-ranging regulations for the crypto industry.

According to a new report from the Financial Times, the new regulations will grant the UK’s Financial Conduct Authority (FCA) greater oversight of the crypto sector, allowing it to supervise how crypto firms conduct business and advertise their products to British consumers and businesses, sources familiar with the matter said.

UK crypto regulation: Overview

Many of the provisions set out in the new bill remain far-reaching. So, here’s a quick breakdown of what looks to be included in the UK’s new crypto regulation package:

- New limits on foreign companies offering products relating to digital assets in the UK.

- Fresh provisions for dealing with the collapse of insolvent crypto companies including guidelines on how to ‘wind down’ failed firms.

- Further restrictions on advertising and marketing of financial products and services offered by crypto companies.

- Grant the FCA additional powers to protect consumers from mis-selling, fraud and false advertising.

“The UK is committed to creating a regulatory environment in which firms can innovate, while crucially maintaining financial stability and regulatory standards so that people and businesses can use new technologies both reliably and safely,” a Treasury spokesman told the Financial Times.

“The government has already taken steps to bring certain crypto asset activities into the scope of UK regulation — and will consult on proposals for a broader regulatory regime,” they added.

The new crypto-focused regulations will be rolled out as an amendment to the Financial Services and Markets Bill, which begun as an effort to regulate stablecoins, but has grown to include further aspects of crypto “wild west”.

The move to widen the regulator lens to crypto advertising comes following the launch of a class action lawsuit against a long list of athletes and celebrities including Tom Brady and Shaquille O’Neal for ‘deceptively’ promoting the sale of financial products from the now-defunct crypto exchange FTX.

UK’s ‘crypto hub’ aspirations remain unchanged

The new regulation package throws the UK government’s aspiration to become a global crypto hub into question, as the currently beleaguered crypto industry continues to be embroiled in a series of existential crises.

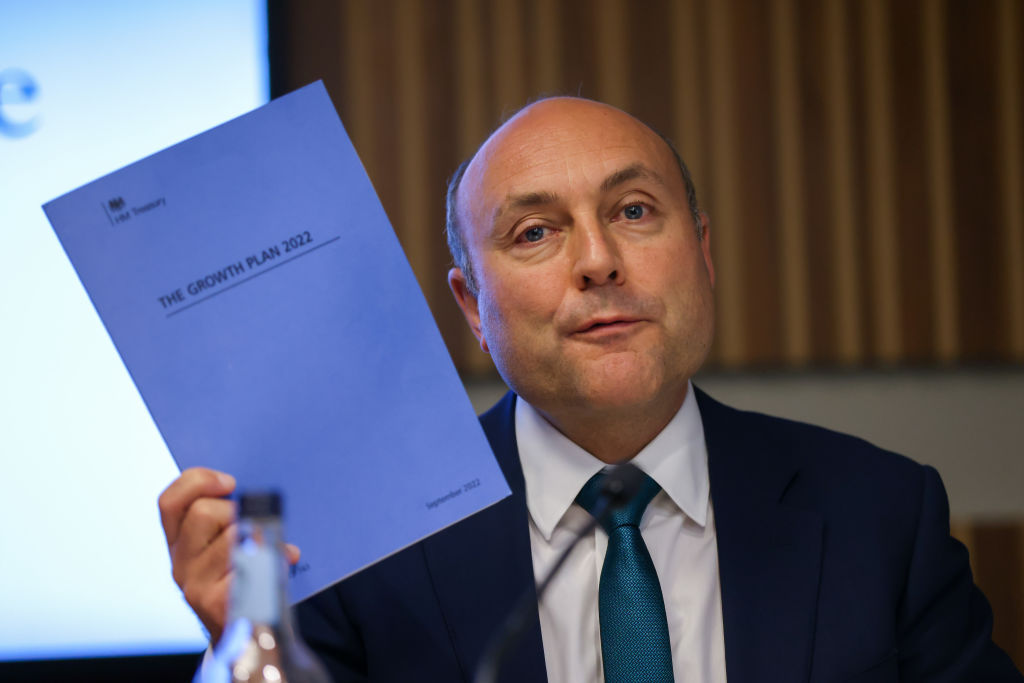

Still, the UK’s Economic Secretary Andrew Griffith says that the country’s commitment to become a global crypto hub remains unchanged.

“We’re driving forward this agenda, and I continue to chair the crypto-engagement group to hear from industry and share progress,” Griffith said at TheCityUK’s National Conference in Edinburgh on Thursday.

“Yes, there are questions about the future of crypto, but we’d be foolish to ignore the potential of the underlying technology.”

Andrew Griffith

Prime Minister support

It also helps that the UK’s new Prime Minister Rishi Sunak is a firm believer in crypto technology, going as far as showing his preference for Bored Ape Yacht Club NFTs.

In his previous role as the Chancellor of the Exchequer (the UK’s chief finance minister) under Boris Johnson, Sunak made a number of crypto moves. In April of 2021, Sunak suggested that the Bank of England put together a task force to explore the idea of a central bank digital currency (CBDC).

More recently, Sunak requested that the nation’s 1136 year-old coin maker, The Royal Mint, get a Web3 update, which saw the institution introduce an NFT project.

A Treasury committee looking into the influence of cryptocurrency in the UK is midway through its inquiry and is set to enter the next phase of investigation this Wednesday. The committee will questions leaders from the FCA and the Bank of England on a wide range of crypto topics, including the overall risk profile of the sector and some pros and cons of a potential UK Pound CBDC.